Dear Readers,

While every financial expert tells you every asset class is overvalued, I am going to show you why they may be completely wrong.

In fact, my theory on this subject is many years in the making and it’s playing out precisely as I expected it to.

And now that Donald Trump has been elected the next President of the United States, I am even more confident in what is about to happen next.

So before I reveal my next big bet, let’s talk about what has happened recently because it ties directly into what comes next.

A Streak of Predictions

When the financial crisis hit in 2008, I told my readers to load up on stocks, both in the U.S. market and in the Canadian Resource sector; a difficult call as many had predicted that the financial system and the stock market would not recover.

Both markets soared shortly after.

Then, early in 2012, I called for the S&P to rise passed 1500 and the Dow to surpass 14000; this was during a time when analysts called for Doom and Gloom.

Today, the stock market is still near all-time highs.

On the political front, I said that Mitt Romney would run against President Obama in the 2012 elections, but that he would lose.

I also predicted the fiscal cliff that every analyst said would have a big effect on the market was a non-issue and told you to ignore the drama.

And in recent years, readers of this Letter know that I’ve had a pretty accurate track record on timing Fed policies and Canadian politics.

I even recently made startling predictions about the launch of Basic Income tests for Canada and Japan just weeks before they happened.

Yet, when I wrote back in March that Donald Trump had a strong chance of becoming the next President of the United States, my opinion – even given my track record – was met with much criticism.

If you’re new to this Letter, I strongly suggest you go back and read it to understand why I said what I said.

“Why the People are Voting Donald Trump.”

Despite supporting my prediction with evidence, and despite my run of research-backed predictions, many readers told me I was crazy – that there was no way Trump could become President.

Despite supporting my prediction with evidence, and despite my run of research-backed predictions, many readers told me I was crazy – that there was no way Trump could become President.

In fact, many of my friends and associates within the financial community said that my hot streak of predictions was finally coming to an end – that I was insane to make that prediction publicly.

Fast-forward to the present and Donald Trump will be the next President of the United States.

And what was my prediction if he became President?

“For all we know, Trump, the master of the deal, may have already struck a deal with the bankers and politicians.

But as we know right now, Trump is anti-establishment and anti-globalization.

If Trump is elected under that presumption, we’re going to see the building blocks of the Establishment and globalization come under attack, and they won’t like it.

They will fight back, leading to major conflicts including riots, protests, and potentially even war and assassination attempts. It is quite possible that the Establishment might even be allowing Trump to succeed in order to cause chaos to show the People that the Establishment is a necessity once all hell breaks loose.”

And we’re already seeing the beginning of riots spew all across the United States. Some say they’re being funded by rich oligarchs of the Establishment…like George Soros.

[cbc_video id=”56791″ volume=”50″ width=”700″ aspect_ratio=”16×9″ autoplay=”0″ controls=”1″]

It’s gotten so bad that there are even people burning the American flag. I don’t need to tell you that cheering at the sight of a burning American flag is completely unacceptable.

I am sure most of you share the same sentiment – regardless of your political views.

The United States is a democracy, after all.

But my Letter today isn’t to tell you that I was right while others were wrong. And I most certainly am not happy about the prediction of riots coming true.

I am writing to hopefully inspire you to understand that just because something is controversial, or conspiracy-like, doesn’t make it wrong.

More importantly, I am writing to share with you how I put my expectations of world events to use when it comes to investing.

This is an investment newsletter, after all.

Blood on the Streets

If you ask almost every successful investor, the best bets are made when nobody else wants to make them.

Baron Rothschild said, “buy when there is blood on the streets.”

Warren Buffett said he wants to be greedy when others are fearful.

And billionaire David Tepper says the worse things are, the better they get: “when things are bad, they go up.”

Right now, stocks are great – almost too great. This makes them overvalued. And while it’s not my job to tell the market what is fair value, I would much rather buy something that is undervalued – like I did in 2008 when everyone thought the stock market was finished.

So while everyone is focused on stocks, there is one sector that has been quietly breaking out.

In fact, the prices of some of these asset classes are up over 50% this year – and no one has even batted an eye.

But I think it’s just the beginning…

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

A Bet on Commodities

Base metals have been very quiet over the past years.

But in last year, they have enjoyed an under-the-radar breakout.

Aluminum is up 24% from its lows last November, and nickel is up over 50% after hitting multi-year lows in February.

Tin is up over 60% from its January lows, while zinc is up over 73% from its 52-week lows.

Even Dr. Copper has climbed 14 days in a row now – the longest winning streak on record in at least 28 years.

And while these are spectacular gains, current market prices still pale in comparison to the highs set leading up to 2008.

Nickel, for example, traded above US$22/lb, but now sits just above US$5.31/lb despite the recent run.

Now there are many reasons why I expect commodities to climb in the coming years; the most obvious being the massive infrastructure plans announced by the governments of the world’s largest economies.

China has announced a whopping 4.7 trillion yuan (US$724 billion) in transport infrastructure projects over the next three years.

Canada has promised $125 billion in infrastructure spending over the next 10 years – the largest in Canadian history.

And with Donald Trump taking over as the President of the United States, we should expect hundreds of billions in infrastructure spending from the global driver of growth. He did promise US$1 trillion in infrastructure spending, after all.

But there are more granular scenarios as to why commodities should continue to climb – stuff you will never hear in mainstream media.

Fed to Regulate Commodities?

Liquidity is the key to ensuring a stable market; remove it and the increased cost effects trickle down the chain.

One of the biggest liquidity roadblocks is regulation.

In almost every instance, regulation increases the cost of doing business.

When the Dodd-Frank Act was signed in, it was meant to protect investors. However, it has had many unintended consequences that caused liquidity to decline in certain markets.

One of these was the commodities market.

Since the Dodd-Frank Act regime began, most of the largest traders in commodity derivatives have exited the physical trading businesses.

This exit has unleashed a supply of metals onto the physical market forcing the price of base metals lower as banks unwind their physical holdings.

This didn’t just happen in the US, but in China as well.

I explained this in my Letter from June 2014, “How Non-Existent Metals are Used to Borrow Money“:

“As with most financially derived products, the paper market value is generally much larger than the actual value in relative terms than the physical market. As such, physical inventory is much smaller than the open interest in the futures market.

That means the impact of purchasing the physical commodity on the physical market has a much stronger effect than the impact of selling the commodity futures on the futures market.

These Chinese commodity-financing deals take supply from the physical market and thus places upward pressure on the physical price – giving the illusion of stronger demand.

If these Chinese commodity-financing deals begin to unwind as a result of the investigations, those who have claims to the underlying commodity would likely sell their ownership in physical inventory, while those with hedges against it would buy it back in the futures market.

And since the physical market has a stronger effect on prices, it would likely send the price of the underlying commodity lower.

As Reuters recently reported, those involved are beginning to question the legitimacy of their collateralized financing deals and it would appear that an unknown number of deals have already begun to unwind.

That is likely why we’re beginning to see lower commodity prices.”

And just as predicted in that Letter, base metals continued to drop before bottoming out late last year and early this year.

Now I am not saying that the unwind of metals manipulation by the banks was the only cause of lower commodity prices, but the coincidence cannot be overlooked.

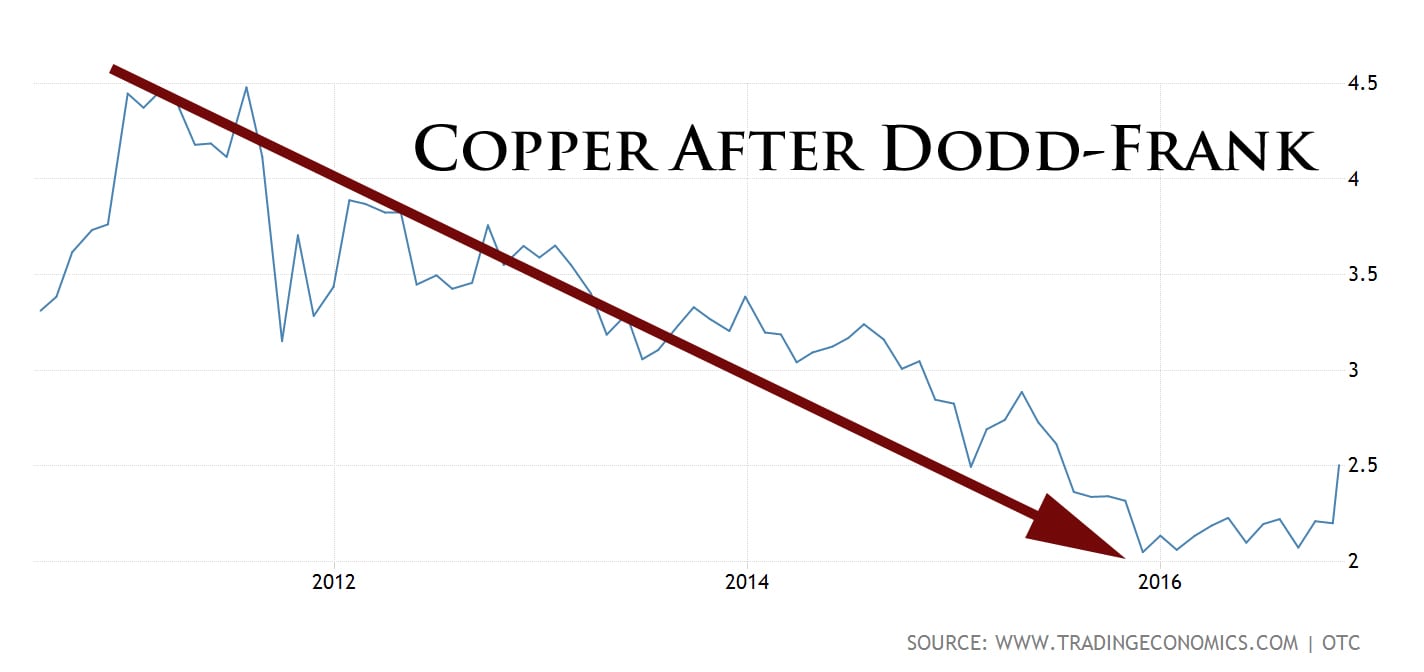

That includes copper, whereby shortly after the Dodd-Frank act was signed into law, we witnessed copper taking a long gradual dive in prices in the following years.

A Sudden Shock

The commodity trading market is a three-tiered structure made up of producers, commodity traders (including intermediaries such as banks) and consumers.

The Dodd-Frank Act has made it harder for companies to structure hedges. With fewer counterparties to do business with, the costs of hedging and doing business also increases, thus causing the market to become less liquid.

This directly and indirectly affects commodities firms, which in turn means additional costs are passed down the chain.

As a result, it has become more costly for miners to mine, and more costly for energy companies to produce energy. The bright side is that it has forced companies to become more effective by reining in their production, exploration, and expansion, but it also means the pipeline for new projects has dwindled.

Efficiency is not a bad thing, but what happens if we were to experience a sudden boom in demand? Say, a sudden boom as a result of government infrastructure policies…

Well, there may not be enough supply – or anticipated supply – to fuel that demand, which would lead to a potential supply crunch that could force prices higher. Especially when you

combine that with what appears to be the bottoming of the “metals unwind” by the banks.

So while regulation was intended to avoid a financial catastrophe and discourage speculative trading that could drive up consumer prices, it may have had the opposite effect.

But the Dodd-Frank Act was just the beginning.

More Regulation?

Earlier this year, Fed Chairwoman Janet Yellen announced that she would attempt to put in place even more regulation regarding commodities exposure by the banks.

And just a couple of months ago, she formally announced the proposed rule to aggressively limit Wall Street’s commodity holdings.

“The Federal Reserve on Friday released a proposed rule governing Wall Street’s involvement in physical commodities that would stiffen capital requirements, tighten limits on trading activity, remove banks from the business of running power plants and restrict their activities in the copper market. Banks that remain in the market despite the new restrictions would have to report their commodities holdings to the public…”

But that’s not all.

Just weeks before that, the Fed and other banking regulators released several recommendations about further restricting how the industry invests its own money.

Via Bloomberg:

“The Fed’s section called for Congress to ban merchant banking, the practice of investing in companies instead of lending them money, in which Goldman Sachs has been a leader. The agency also said the original grandfathering of the two banks should be erased.

.. Friday’s proposed rule — open for public comments for 90 days — also limits banks’ holdings of copper by no longer considering it a precious metal, joining an earlier proposal from the Office of the Comptroller of the Currency.”

If these regulations come through, it could lead to higher commodity prices if the infrastructure plans of Donald Trump come to fruition.

But it would be unwise not to look at the other side of the story under Trump’s reign.

Trump Deregulation

Trump has vowed to deregulate and one of his goals is the removal of the Dodd-Frank Act.

If he does, banks would once again be allowed to not only engage in prop trading (which includes commodities trading) but to invest directly in hedge funds.

More importantly, as it relates to this Letter, it could mean the end of heavy oversight of commodities trading by the CFTC, who was given even more power under the Dodd-Frank Act.

What does this mean?

I have already explained how commodity prices are now rising due to a potential supply crunch as the result of what’s happened over the last few years.

Many mines have shut down and exploration for economic resources have stalled as a result of lower prices.

But if deregulation were to occur under Trump, it could allow the banks to once again participate heavily in the sector. That, in turn, will fuel investment demand and a potential spur back into owning the physical commodity itself – an event that would most certainly drive up prices.

If this happens, banks could once again control the underlying commodity and use the supply crunch to induce a price spike, but only after they have accumulated and invested enough money into the sector.

In other words, they could buy low now, induce an even bigger supply crunch, and then sell for even higher prices.

We already witnessed how capable the banks were at driving up prices prior to the Dodd-Frank Act.

But this time, things are completely different.

There is not only more money available to the banks via monetary policy, but we’re now witnessing an unleashing of fiscal policy as well.

The combination of both monetary and fiscal policies, combined with deregulation, could unleash a whole new world of price discovery the world has never seen.

And I plan on taking advantage of this trend before the masses do.

Stay tuned.

So what are we looking at? Global base metals? Include oil in the mix? I’ve been tracking the DCB etf and others too afraid to pull the trigger.

Just a note to update you that…………………………..

After further review, Trump will NOT eliminate the Dodd-Frank law.

However he will modify it.

Knowing how bankers supported the Communist Democrat party and EVIL Hillary,

odds are that the banks will NOT get much of anything. Maybe even less

Stocks are safer as etf,is my experience

Anyway i heard he would work on Dod Frank

Surtenly worth to follow up on that one

Gabriel