Dear Readers,

Our last idea in this sector has climbed nearly 300% since we first brought it to your attention.

Since then, demand for this resource has skyrocketed.

Everything from AI, energy, infrastructure, and even national defense requires it.

It’s why the U.S. government just added it to America’s Critical Minerals list.

And whenever Washington labels a mineral “critical,” it sends shockwaves through the market.

We’re already seeing the effects.

Prices have now surged to an all-time record high.

That’s what happens when a vital resource suddenly becomes a matter of national security.

But that’s not even the full picture.

You see, this resource has been in a supply deficit – meaning consumption has outstripped production – for the last five years.

This isn’t expected to change anytime soon.

In fact, analysts are calling for even higher prices, with the supply deficit expected to continue for at least the next five years.

It’s no wonder this commodity has outperformed the S&P 500, Bitcoin, and even gold this year.

Most importantly, our track record with this commodity—and the stocks we highlight—speaks for itself.

Yes, I am talking about silver.

And today, I am about to introduce you to our next silver play.

One of the Largest Undeveloped Silver Projects

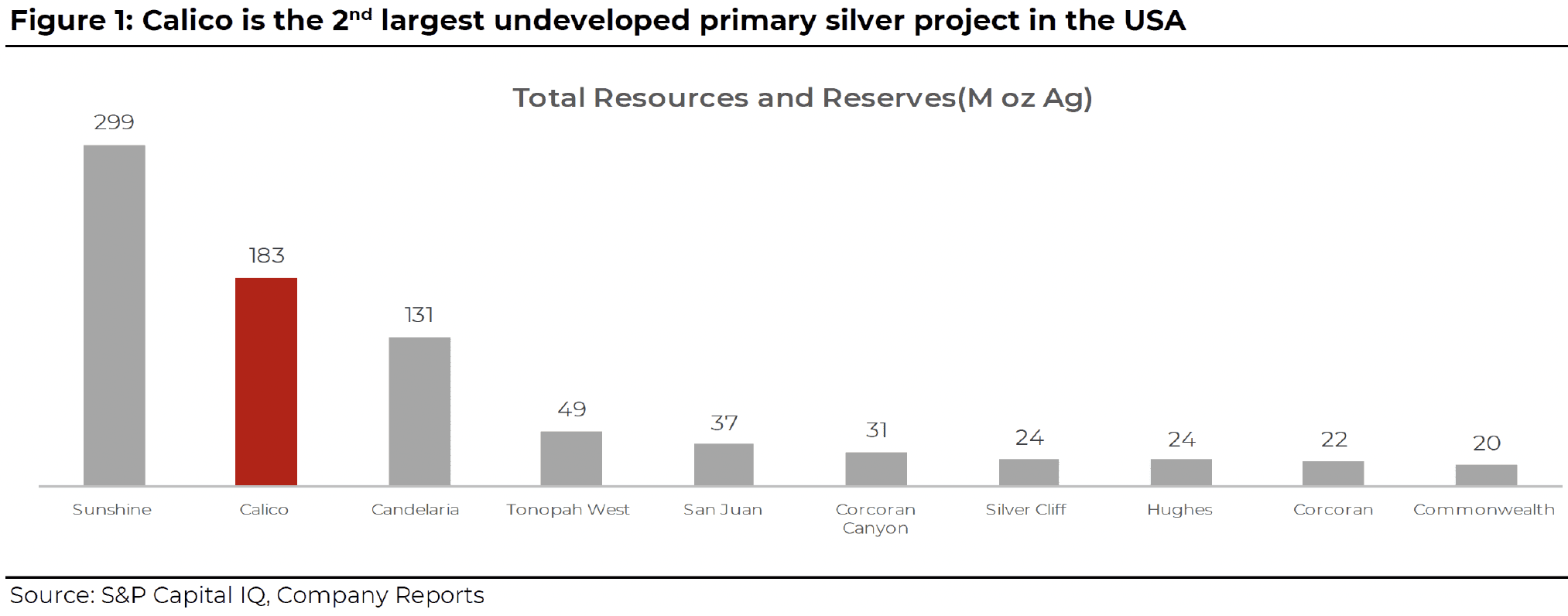

This company has one of the largest undeveloped primary silver assets in the United States, second only to one owned by a private company.

That means it’s the largest undeveloped primary silver asset in the United States retail investors have access to.

But that’s not even the part I’m most excited about.

You see, this company might have something else – something that could perhaps be the biggest of its kind…in the entire world.

In just a bit, I’ll share the evidence so you can judge yourself.

In fact, it is one of my favorite undeveloped silver assets – one we have chased for a very long time.

And now THIS company holds the keys.

If they pull it off—and word is we could know within just a few months—it could explode into one of the biggest stories the silver world has seen in a long time.

In other words, not only does this company own the largest undeveloped primary silver asset among publicly traded companies, but it also holds the keys to one of the biggest deposits of its kind in the world.

So, let’s cut to the chase.

And be sure to read to the end, so you don’t miss the biggest story.

Introducing…

Apollo Silver Corp

(TSX-V: APGO) (OTCQB: APGOF) (Frankfurt: 6ZF)

Disseminated on behalf of Apollo Silver Corp.

Apollo Silver (APGO) is a silver exploration company advancing one of the largest undeveloped primary silver projects in the US.

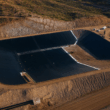

Known as the Calico project, it’s located in the historic Calico Silver Mining District in the Mojave Desert of San Bernardino County, California, and it hosts a large, bulk minable silver deposit with significant barite credits.

*Please see Calico Silver Project MRE Cautionary Notes at the end of this article

Silver is currently trading at ~US$62/ounce. You can do the math.

But there is an important element here: the addition of barite and zinc provides valuable critical-mineral credits—an uncommon advantage among pure silver juniors.

And at a time when the U.S. is scrambling for domestically produced critical minerals, that edge could translate directly into a permitting advantage.

Last month, the U.S. also added silver to its critical minerals list—giving Apollo Silver a triple whammy of critical-mineral exposure the country desperately needs.

A District-Scale Silver Opportunity

The scale of Calico is undeniable.

But this is where things start to get interesting.

The current resource only captures the Waterloo and Langtry areas. Yet the broader system stretches for more than 6,000 metres of mineralized strike along the Calico Fault—the primary structural control on mineralization.

In other words, the district-scale footprint is still wide open.

Large portions of Calico have seen little to no modern exploration. With continued work, Apollo has a clear path to meaningfully expand an already impressive project.

There’s obvious upside below the 2025 MRE, particularly to the north at Waterloo and beneath the overburden at Langtry. And early work near the historic Burcham mine has already delivered surface samples grading up to 211 g/t gold, pointing to genuine new discovery potential.

Even the gold story is far from finished.

Today, Calico hosts a modest 130,000-ounce Inferred gold resource at 0.25 g/t. But historical reports from the Burcham area reference grades as high as 9.7 g/t gold—suggesting that higher-grade zones may still be waiting to be uncovered.

To capitalize on this district-scale opportunity, Apollo recently added the 2,215-hectare Mule property to the east. The area remains largely untested, yet historical sampling has already returned results of up to 654 ppm silver, and the geology is compelling.

Importantly, the Mule property covers sedimentary rocks of the Barstow Formation in contact with volcanic units of the Pickhandle Formation—the same geological contact that has already demonstrated gold potential at Waterloo.

Simply put, this area could hold district-scale potential.

What’s Next?

A drill program is now being planned for Q1 2026 and Q2 2026. The objectives are clear:

- Expand the existing gold resource

- Metallurgical studies to evaluate options to improve upon historic silver recoveries

- Geotechnical analysis to support future mine design work

Given the scale already defined — and the extensive potential upside still untouched — Calico remains one of the most compelling district-scale silver opportunities in the U.S.

Challenge One

One of the biggest questions around Calico has nothing to do with geology.

It has to do with California.

Permitting a commercial mining operation in the state has long been viewed as an uphill battle. The regulatory framework is restrictive, the process can be slow, and many investors simply tune out the moment they hear the jurisdiction.

But here’s where things get better.

Calico’s updated resource now includes barite and zinc—both of which are officially classified by the U.S. government as strategic minerals. And silver, the core of the deposit, was just included last month as a critical mineral.

In today’s political and geopolitical environment, projects containing minerals deemed strategically important often receive a very different level of attention and support.

Furthermore, Calico is located in San Bernardino County—a region with a deep and established mining history. The county is home to more than 90 active mine sites, including the only major rare-earths producer in the United States.

That alone puts to rest the idea that nothing gets permitted in California.

Apollo already holds valid permits, has been active on the ground, and is working primarily on patented land—a major advantage in this state.

And get this: just 165km from Calico and in the same county, lies Equinox Gold’s Castle Mountain project (TSX:EQX).

Equinox Gold is a company we introduced to you in July, when it was trading at around $8.50 per share. Today, it’s trading at over $19.50. But I digress.

In August, Equinox Gold’s Castle Mountain project was accepted into the U.S. FAST-41 program—one of the federal government’s most important tools for streamlining and de-risking the permitting process for major projects.

In other words, if Washington is willing to fast-track a mine in this exact jurisdiction, ask yourself what it might do for a project that contains THREE critical minerals, including the 2nd largest undeveloped silver asset in the United States.

In other words, things at Calico could move quicker than previously thought.

And that bodes extremely well for Apollo Silver.

An Absolute Monster

Calico alone is a company maker.

And with silver prices at all-time highs and the United States focus on silver and critical minerals, advancements to Calico could prove quite attractive.

But for us, the real prize is Challenge Number Two.

Aside from owning the 2nd largest undeveloped silver asset in the United States, Apollo Silver may have struck something that can overshadow Calico.

I am talking about an absolute monster of an asset in the best silver jurisdiction in the entire world: Mexico.

The Largest Silver Producer in the World

Every once in a while, a story comes along that forces us to rethink what we know about geology, mining, and the global supply of critical metals.

Today’s story truly begins deep beneath Mexico—a nation that has quietly become the undisputed heavyweight champion of world silver production.

But the real secret isn’t just the production numbers.

It’s the “why Mexico has so much silver” that’s important.

Because when you understand that “why,” you begin to see that Mexico was designed for silver – and Apollo may reap significant benefits from this.

First, Mexico is the single largest silver-producing country in the world, representing nearly 25% of global annual silver production.

The silver-mining heritage of Mexico spans centuries — from colonial times and pre-colonial eras through to modern large-scale mining.

Over that long history, Mexican silver mines have cumulatively produced a substantial portion of the world’s silver, making Mexico a global silver production powerhouse.

Mexico’s extraordinary silver endowment is not a coincidence — it is the result of a rare combination of geology, tectonics, mineralizing structures, long volcanic history, carbonate host rocks, and 500+ years of mining infrastructure.

To understand Mexico’s dominance, you need to look at the forces that shaped it millions of years ago.

And stretching across the country is one of the most metal-rich volcanic provinces on Earth.

The Sierra Madre Occidental

Layered within the Sierra Madre Occidental is the legendary Mexican Silver Belt—home to silver districts whose names have echoed through mining history for centuries:

- Fresnillo

- Zacatecas

- Guanajuato

- Parral

- Taxco

These districts didn’t appear out of nowhere.

They are the surface expressions of deep, long-lived magmatic systems that spent tens of millions of years pumping silver-rich fluids into the crust.

But that’s only half the story.

The real magic lies where these magmas intersected with something even more important…

The Geological “Perfect Storm”

Mexico contains a combination of geological conditions so rare that you could visit every major mining jurisdiction in the world and never find all of them in one place:

- A massive volcanic heat engine—recharged over and over again

- Deep, long-lived fault structures—perfect conduits for metal-rich fluids

- Thick sequences of reactive carbonate rocks—ideal hosts for large ore bodies

- Multiple waves of mineralization—upgrading earlier deposits again and again

When you put these ingredients together, something extraordinary happens.

You don’t just get silver veins.

You get silver districts.

You get silver belts.

You get billion-ounce systems.

And this brings us to one of the most misunderstood—but incredibly powerful—deposit types in the world.

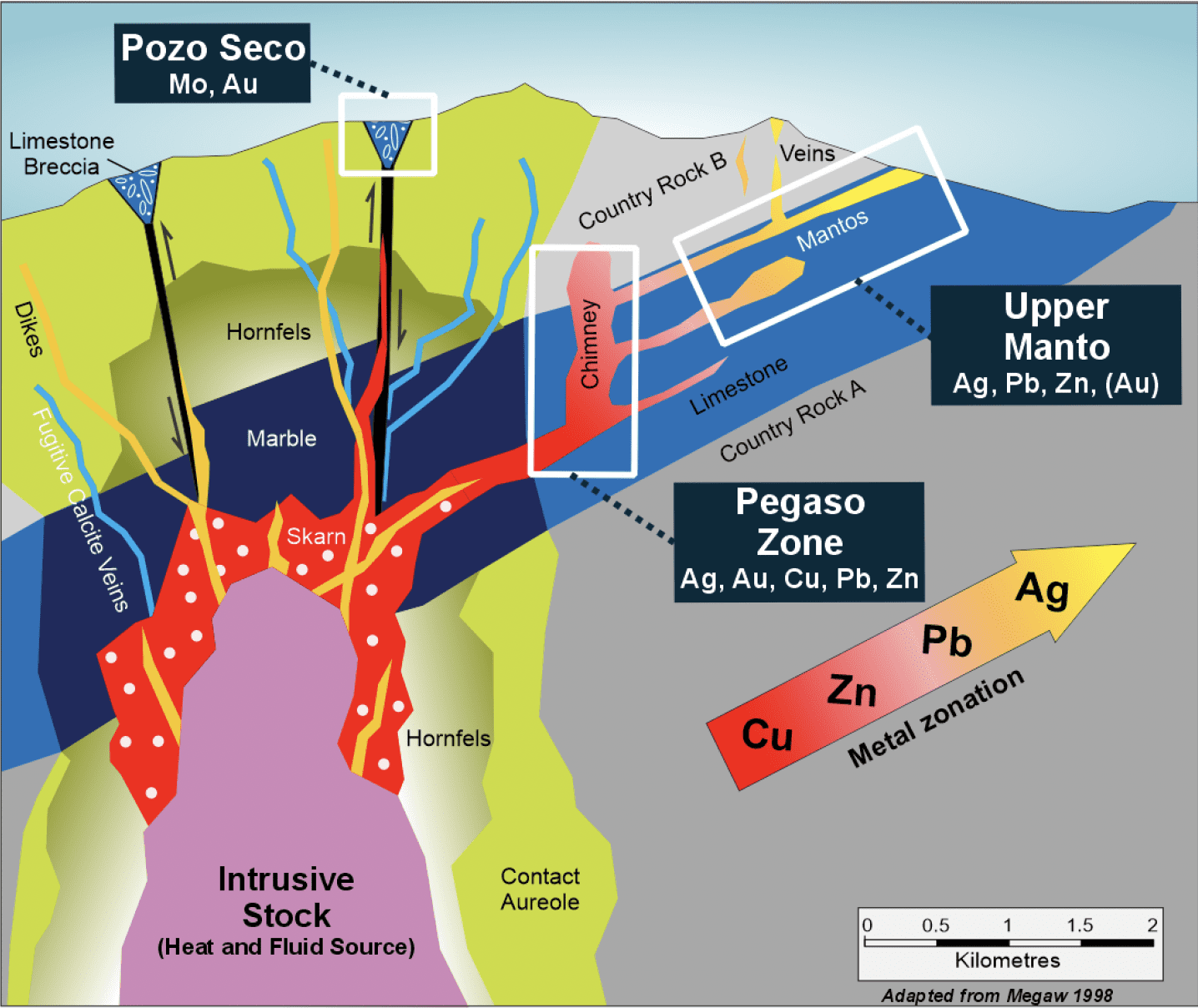

Carbonate Replacement Deposits (CRDs)

Carbonate Replacement Deposits (CRDs) are a major class of mineral deposits—high-grade, high-tonnage, and often extremely valuable.

And Mexico is the global capital of CRDs.

They are characterized by massive to semi-massive silver-lead-zinc sulphide intrusions.

The attractive characteristics of CRDs are simple. They have potential for large tonnage and high grades; potential for substantial base metal credits to the precious metal resource; and sulphide replacement in carbonates (limestone) mitigates oxidation, and is therefore more metallurgically amenable and environmentally benign.

In short, CRDs are cheap to mine and have a minimal environmental footprint.

So why does Mexico have so many of them?

Because Mexico has something most countries don’t: the perfect geological setting for CRD formation.

Massive Carbonate Platforms

Northern and central Mexico are underlain by thick limestones and dolostones—rock layers that dissolve and replace easily when struck by acidic, metal-charged fluids.

These CRDs form when intrusions meet carbonates.

And in Mexico, this happens everywhere.

It’s the geological equivalent of repeatedly hitting the jackpot.

Mexico’s crust is cut by huge structural corridors—true “metal highways” that transported enormous volumes of mineralizing fluids over millions of years.

Most countries get one shot at forming ore, but Mexico got several. And each new pulse upgraded and expanded earlier systems.

That’s why CRDs in Mexico routinely show kilometers of horizontal extent and hundreds to thousands of meters of vertical continuity.

This is why districts like Santa Eulalia, Naica, Parral, Velardeña, and Bismark became world-famous.

In fact, CRDs represented nearly 40% of Mexico’s 10-billion-ounce historic silver production and have been mined for more than 400 years.

In other words, finding a good CRD in Mexico is like hitting the silver jackpot.

But what happens if you find the biggest one?

Well, Apollo might just have a shot.

The Agreement

In 2025, one of our past featured ideas, MAG Silver, was acquired by Pan American Silver for US$2.1 billion.

Prior to that, Apollo Silver struck a deal with MAG for a very important earn-in and option agreement to acquire a 100% interest in a very special project.

This project is called Cinco de Mayo.

Cinco de Mayo

After fighting many battles with other acquirers, Apollo Silver was finally able to secure the rights to acquire the infamous Cinco de Mayo project – more on the infamous part in just a bit.

The Cinco De Mayo Project (Cinco) is located in the north central part of Chihuahua State, Mexico, approximately 190 kilometers northwest of the state capital of Chihuahua City.

It hosts one of the most sought-after undeveloped CRDs on the planet.

In order to understand why, let’s take a look at a CRD exploration model:

As you can see above, CRDs have many parts.

Think of a CRD like an octopus. The stock and skarn are the body of the octopus, and the manto are the tentacles.

So, one could assume: the bigger the tentacles, the bigger the octopus.

And Cinco is home to the Jose Manto – arguably one of the largest mantos ever found in a CRD system.

The Jose Manto/Bridge Zone

Let’s dive into the evidence.

Mantos in CRDs are usually ribbon-like and no more than 150 metres wide at the top end.

The mantos found at Cinco is currently 50 to 450 metres wide in dip length, averages 2 to 100metres thick, and has 2,700 metres long of continual mineralization so far. And it’s still open along strike!

Think about it: 2,700m X 300m X 10m. And there’s multiple zones in there!

That’s a footprint of 113 full-sized FIFA soccer fields and over 1850 basketball courts

That’s a footprint of 113 full-sized FIFA soccer fields and over 1850 basketball courts — big enough to fit 140 Manhattan City blocks!

For context, we can look to one of the biggest chimney manto systems in the world located at Santa Eulalia.

Santa Eulalia is a mining district in Chihuahua that has been mined for over three centuries, producing over half a billion ounces of silver – a staggering output that places it among Mexico’s most important silver-producing regions.

Now, the mantos at Santa Eulalia get up to 4km long and up to 15-20 metres thick, but they’re less than 85 metres wide.

In other words, Apollo’s Jose Manto isn’t just keeping pace with the giants — in key dimensions, it’s already dwarfing the mantos at Santa Eulalia. And there is still lots of room for growth.

Of course, size isn’t the only thing that matters. As we have always said, grade is king.

Previous assays found exceptional silver grades. On average, they were between 150 and 250 g/t Ag, with base metals (Pb+Zn) in the order of 12-15%. Assays as high as 60% lead and 30% zinc have also been found.

These numbers show that the mantos at Cinco are a high-grade base metal, silver-rich discovery that has yet to be developed.

Previous Drilling: Out of this World

Let’s continue with the evidence on why this thing could be an absolute monster.

When you’re drilling to outline a manto, the standard practice is tight spacing — 50 to 100 metres at most.

But the previous operator broke the rules. They were stepping out 250 metres along the axis and 50 metres across it… and still hitting mineralization.

That’s how confident they were in the scale of the system.

And here’s the thing: no one has ever drilled out a manto in a CRD system with step-outs this aggressive — and succeeded.

There are no other examples in the world where the CRD mineralization was as laterally persistent and consistent as the Jose Manto/Bridge Zone to allow the type of drilling that was done at Cinco.

You could look at any of the manto systems in the world and you would have a very hard time defining a drill program because of its snake-like tentacle shape

Even if you knew where the manto was, you’d have a hard time drilling it off as consistently as the previous operators did before.

What Does that Mean?

Normally, manto ore bodies are unpredictable — more like tangled spaghetti than anything uniform.

But at Cinco, the geometry is completely different. It’s layered and consistent…more like lasagna.

It’s unlike anything seen in typical CRD systems.

No one really understands how the previous operator was able to drill Cinco with such massive step-outs and still hit.

The only reasonable conclusion?

They’re onto something of incredible size.

Of the previous 420 holes drilled to date, 390 of them intersected mineralization – all in an area of 12 X 14 km.

That tells you that the size of the system is huge. Everywhere you look, there’s some sort of mineralization.

But that’s not even the best part.

The Mother Lode

Previous drill results indicated that the source of all of the fluids is near, and that source is usually related to a large skarn or large intrusive (body of the octopus), which is all part of the system that was being explored.

Why did they think that?

The proximal area of these CRD deposits often contain strong molybdenum-gold mineralization.

And at Cinco, they’ve already hit exactly that.

The moly-gold signature is there — right within the CRD system.

Except – like the Jose Manto/Bridge zone – it’s unlike anything we have ever seen.

Pozo Seco High Grade Moly

More than 10 years ago, a mineral resource estimate for the Pozo Seco Moly-Gold discovery was released.

That estimate confirmed that Pozo Seco is a significant high grade oxide molybdenum/gold deposit within the CRD system at Cinco which contains an Indicate resource of 29.07 million tonnes at 0.147% molybdenum (94,012,000 pounds moly) and 0.25 grams per tonne gold (230,000 ounces gold) with an Inferred resource of 23.38 million tonnes at 0.103% molybdenum (53,205,000 pounds moly) and 0.17 grams per tonne gold (129,000 ounces gold)*.

*The reader is cautioned not to treat this historical estimate for the Pozo Seco Mo-Au deposit, or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

That’s more than 3 times the average grade of a moly deposit!

The Larger the Tentacles, The Larger the Octopus

Dr. Megaw — the foremost expert on CRD systems — has examined virtually every significant CRD showing across Mexico. He’s seen the same style of mineralization found at Pozo Seco in several major deposits. In fact, at San Martín — the largest skarn deposit in Mexico — he’s identified the biggest zone of that style he’s ever encountered.

That was until the discovery of Pozo Seco.

The moly zone at San Martin is 200-250 meters in diameter, its irregular and it’s about 20 meters thick. The one at Pozo Seco is 2500 meters long, 300 meters wide, and 35-250 metres thick. It completely blows away the similar alteration features found at San Martin.

Given the size of the manto and the size of Pozo Seco, the source of the system could be an absolute monster.

The moly gold zone at Pozo Seco completely blows away the benchmark for anything similar.

Add that to the sheer scale of the Jose Manto, and the message is clear: the part of the system that was not yet found could be an absolute monster — far larger than anything we’ve seen so far.

Now it’s up to Apollo Silver.

Can Cinco be the biggest CRD ever found?

That may very well be the case — but Apollo will now need to drill to confirm it.

Despite that, there are reasons to believe this system could grow into one of the largest ever found.

Consider the biggest known CRD system at Santa Eulalia. It’s produced more than 50 million tonnes, contains six parallel mantos of comparable size, and each of those mantos alone held roughly 8 million tonnes.

And that’s before you even factor in the giant chimneys — some rising 700 metres high and 100 metres across.

CRD systems are defined by these parallel ore bodies. So far, only one has been discovered at Cinco — and it’s already shaping up to be the largest manto ever documented.

Each one of these mantos could potentially be standalone mines.

So, when you consider the tentacles they haven’t found yet — and the massive “body” of the octopus yet to be discovered — the upside becomes enormous.

One of the biggest manto and the biggest moly-gold signature within a CRD system has already been found at Cinco.

That means Apollo may be onto one of the biggest discoveries in Mexico in a very long time and potentially the biggest CRD ever.

Challenge Two

You may be thinking, why would MAG, despite being acquired for its other incredible assets, give up Cinco de Mayo?

Well, Cinco de Mayo has a complicated past.

When MAG Silver began exploration, drilling was going extremely well.

But the partnership between MAG and the local Mexican community has always been challenging. In short, when things go well, people ask for more.

Then, in 2012, two members of the local ejido were murdered.

An ejido is a form of communal land in Mexico where community members have use rights (usufruct) but not ownership. The land itself is owned by the Mexican state, while local members share access for agriculture and related activities.

The deaths were prematurely and incorrectly attributed to MAG, and in response, its council imposed a 100-year moratorium on accessing mining projects across the district. MAG was never able to overturn that decision.

For more than a decade, that moratorium stalled all progress.

But things have changed.

A new ejido executive has recently been elected, and with it comes a noticeable shift that could reduce long-standing opposition to mining.

Apollo is now engaging directly with the new leadership, surrounding communities, and state and federal authorities to secure the access, licensing, and permits required to move Cinco forward.

There are good reasons to believe the ejido may reconsider its position.

Local economic activity has declined sharply over the past 12 years, and many residents now recognize the employment and development opportunities a project like Cinco could bring.

If Apollo succeeds in establishing access, the impact would be game-changing – for both the local ejido and Apollo.

This critical social license is the key to unlocking the potential at Cinco de Mayo.

And with MAG out of the picture, a new team in place, and a new executive of the ejido, things are looking promising.

To satisfy the option agreement with Pan American (previously MAG) and fully acquire Cinco, Apollo must first secure a surface access agreement with the local ejido, along with obtaining the necessary permits to re-commence exploring the project.

Once Apollo has secured the ability to start working, it is then required to complete 20,000 metres of exploration drilling, all before September 2029. Upon completion, Apollo must issue shares equal to 19.9% of its then-outstanding equity to Pan American (who acquired MAG), subject to regulatory approval. Pan American will retain the right to maintain its equity position.

If Apollo secures the social license, it could unlock one of the most compelling mining deals the industry has seen in years.

Conclusion: We Love a Challenge

As many of you know from our past Featured Ideas, we love great mining assets where there are problems that can be solved by sharp management.

Remember when people scoffed at K92 Mining when it was trading at C$1.15, for being in Papua New Guinea?

Well, today, it’s trading at over C$21. That’s a 1,726% gain if you still hold shares.

Remember when people scoffed at Newmarket Gold at C$0.82 per share, when they took over a mismanaged gold mining asset? Just over a year later, Kirkland Lake Gold announced a C$1-billion acquisition valuing Newmarket at C$5.28 — a gain of more than 540%. Kirkland Lake went on to become one of the sector’s top performers, trading above C$65 a few years later.

For investors who held through the merger, Newmarket shares effectively became worth over C$30 (based on the 0.475:1 share exchange), translating to a remarkable 3,558% return from the original C$0.82 entry.

And let’s not forget our most recent silver play – a company who took over a non-profitable production asset when silver prices fell below $18/oz. Fast forward a few years later and that company has turned around for a near 300% gain for our readers, with millions in revenue.

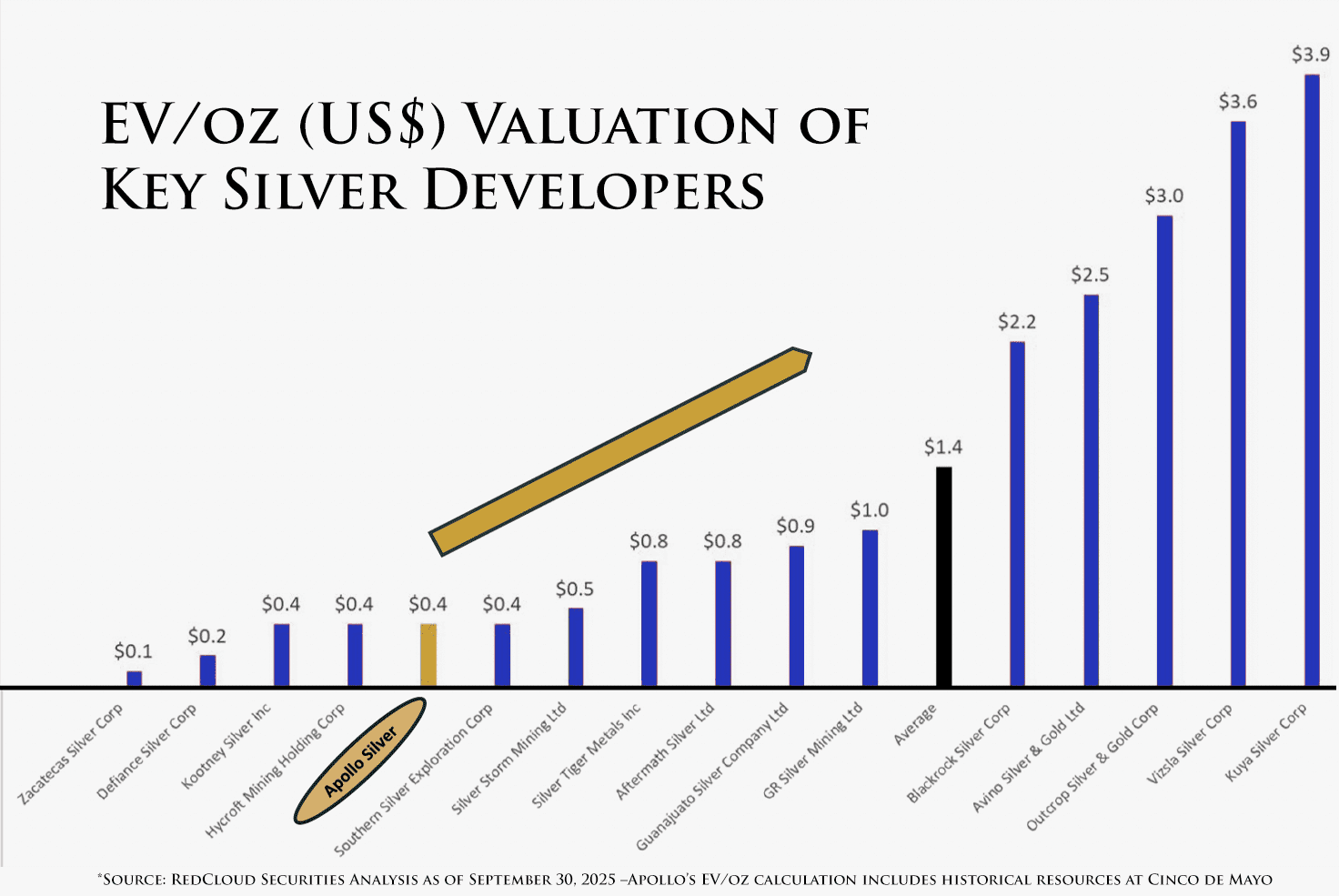

Right now, Apollo trades at a discount when compared to its peers based on EV/Ounce.

More importantly, Apollo has two chances where management execution and progress can lead to big rewards (we’ll dive deeper into management in another letter).

One of those projects is already the biggest undeveloped primary silver asset in the U.S. available to retail investors—right when Washington is calling silver critical to the nation’s success.

And the second project?

Well, it could be the biggest of its kind in the entire world.

That’s a risk we’re willing to take.

Seek the truth and be prepared.

Apollo Silver Corp

CDN Stock Symbol: APGO

(Current price C$4.37)

US Stock Symbol: APGOF

(Current price US$3.15)

Germany Stock Symbol: 6ZF

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Apollo Silver (APGO) because the Company is an advertiser on www.equedia.com. We currently own shares of APGO purchased on the open market and plan on buying more. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in APGO or trading in APGO securities. APGO and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. Please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

This newsletter (this “Newsletter”) is provided by Equedia Network Corporation (“Equedia”, “we” or “us”). Your access to and use of this Newsletter is subject to and governed by this disclaimer and Equedia’s Terms of Use, which is available at http://www.equedia.com/terms-of-use (the “Terms”). Please read this disclaimer and the Terms carefully. This Newsletter is not an offer to sell or a solicitation of an offer to buy any securities or commodities. To the extent that anything contained in this Newsletter may be deemed to be investment advice or a recommendation in connection with a particular company or security, such information is impersonal and is not tailored to the needs of any specific person. In addition to historical information, this Newsletter may contain forward-looking statements, including statements with respect to third parties regarding product plans, future growth, market opportunities, strategic initiatives, industry positioning, customer acquisition, the amount of recurring revenue and revenue growth. In addition, when used in this Newsletter, the words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding a third party’s focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this Newsletter involves risks and uncertainties that may cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those disclosed by the parties referred to in this Newsletter in their public securities filings. You should carefully review the risks described therein. You should not place undue reliance on the forward looking statements in this Newsletter, which speak only as of the date such statement was published. Equedia undertakes no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of their publication, except as required by law. As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. Equedia and its directors own shares of APGO at the time of this writing. In December 2025, Equedia was paid US$350,000 for a three-month advertising contract for APGO, which includes expenses for advertisements on third party sites that we arranged for APGO. These services were paid for by APGO.

Cautionary Notes

The Upper Manto were estimated by RPA with an effective date of September 1, 2012. Mineral Resources are estimated at an NSR cut-off value of US$100 per tonne. NSR values were calculated in US$ using factors of $0.60 per g/t Ag, $12.32 per g/t Au, $18.63 per % Pb and $14.83 per % Zn. These factors are based on metal prices of US$27.00/oz Ag, US$1,500/oz Au, $1.15/lb Pb, and $1.20/lb Zn and estimated recoveries and smelter terms.

The Pozo Seco Historical Mineral Resources estimated by RPA with an effective date of July 12, 2010. The cut-off grade of 0.022% Mo was estimated using a Mo price of US$17/lb and assumed operating costs and recoveries. See MAG Silver press release dated August 4, 2010, for details.

The reader is cautioned not to treat this historical estimate or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

Cautionary Notes on Historical Resource Estimates:

In 2012, MAG Silver reported at an NSR cut-off of US$100/t, an Inferred Mineral Resources for total 12.45 million tonnes of 132 g/t Ag, 0.24 g/t Au, 2.86% Pb, and 6.47% Zn. The total contained metals in the historical resource were 52.7 million ounces of Ag, 785 million pounds of Pb, 1,777 million pounds of Zn, and 96,000 ounces of Au. The Upper Manto Deposit historical mineral resource estimate (2012) was prepared by David Ross, M.Sc., P.Geo., of RPA, an independent Qualified Person from MAG Silver. The 2012 Technical Report had an effective date of September 1, 2012. This Technical Report conformed to NI 43-101 Standards of Disclosure for Mineral Projects. Please see MAG Silver news release dated October 12, 2012, for more information on the 2012 MRE. In addition, the reader is directed to the NI-43-101 that was filed by MAG Silver on SEDAR+.

Pozo Seco Deposit:

In 2010, MAG Silver reported at a cut-off grade of 0.022% Mo, an Indicated Mineral Resource for a total of 29.1 million tonnes grading 0.147% Mo and 0.25 g/t Au and containing 94.0 million pounds Mo and 230,000 ounces of Au. In addition, the Inferred Mineral Resource was estimated at 23.4 million tonnes grading 0.103% Mo and 0.17 g/t Au, containing 53.2 million pounds Mo and 129,000 ounces Au. The Pozo Seco Mineral Resource Estimate (2010) was prepared by David Ross, M.Sc., P.Geo., of RPA, an independent Qualified Person from MAG Silver. The 2010 Technical Report had an effective date of July 12, 2010. This Technical Report conformed to the NI 43-101 Standards of Disclosure for Mineral Projects. Please see MAG Silver news release dated August 4, 2010, for more information on the 2010 MRE. In addition, the reader is directed to the NI-43-101 that was filed by MAG Silver on SEDAR+.

Key assumptions and method used:

Upper Manto Deposit:

For the Cinco de Mayo, Upper Manto Deposit, the 2012 Historical Mineral Resources was estimated at an NSR cut-off value of US$100 per tonne. NSR values were calculated in US dollars using factors: Ag ($0.60 per g/t), Au ($12.32 per g/t), Pb ($18.63 per %) and Zn ($14.83 per %). These factors were based on metal prices of US$27.00/oz Ag, US$1,500/oz Au, $1.15/lb Pb, and $1.20/lb Zn and estimated recoveries and smelter terms. The values were capped to 1,000 g/t Ag, 4 g/t Au, 18% Pb, and 24% Zn. Grade interpolations for Ag, Au, Pb, Zn, and density were made using inverse distance cubed (ID3). The Resources wasreported in-situ.

Pozo Seco Deposit:

For the Pozo Seco Deposit, the 2010 Historical Mineral Resource estimate was estimated at a cut-off grade of 0.022% Mo. The cut-off grade was calculated using the following variables: surface mining operating cost (US$1.60/t), processing costs (US$5.00/t), general and administrative costs (US$1.50/t), Mo price of (US$17/lb), Au price (US$1,050/oz), and metal recoveries (Mo 90%, Au 70%). Grade interpolation of Mo and Au were made using ordinary kriging. The resource was reported within a preliminary open pit shell.

Work needed to bring the Cinco de Mayo Project mineral resources it to current:

In order to bring Cinco de Mayo historical mineral resources current for both the Upper Manto and Pozo Seco Deposits, Apollo would need to conduct a review of the historical database, update the metal prices, recovery and NSR factors, and update the geological and resource models. Apollo has engaged an independent consultant and Qualified Person (“QP”), to complete that work on the Upper Manto Deposit, and in addition, the QP is expected to complete a site visit and an independent resource estimate and technical report. The resource estimate at the Upper Manto Deposit will be prepared in accordance with the requirements of the Canadian Institute of Mining Metallurgy and Petroleum’s (“CIM”) National Instrument 43-101 (NI-43-101).

Cautionary Notes on the Calico Silver Project MRE

The Calico Silver Project 2025 Mineral Resource Estimate (“2025 MRE”) has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd., an independent Qualified Person, in co-operation with Mariea Kartick, P.Geo. (independent Qualified Person for drilling data QA/QC) and Johnny Marke P.G. (independent Qualified Person for resource estimation) in conformance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators National Instrument (“NI”) 43-101. Please see Apollo Silver Corp’s news release dated September 4, 2025, for more information on the 2025 MRE.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve. For all references to the 2025 MRE included herein, please note that: •The MRE is represented by the base-case estimate using 47 g/tA g equivalent and 0.17 g/t Au cut-off grades for Waterloo and 43 g/t Ag for Langtry. • Ounces are reported as troy ounces. • CIM definitions are followed for classification of the mineral resource. • For the Waterloo Property, a AgEQ cut-off grade was calculated using the following variables: surface mining operating costs (US$2.8/st), processing costs plus general and administrative cost (US$26.5/st), silver price (US$28/oz), barite price (US$120/t), zinc price (US$1.22/lb), gold price (US$2,451/oz), and metal recoveries (silver 65%, gold 80%, barite 85%, zinc 80%). For the Waterloo Property gold-only resources the gold cut-of grade was calculated using above gold price, gold recovery and gold-only processing costs plus general and administrative cost (US$8.2/st). • For the Langtry Property, a silver-only equivalent cut-off grade was calculated using above silver price, silver recovery and silver-only processing costs plus general and administrative cost (US$24/st). • Resources are constrained to within a conceptual economic pit shell targeting mineralized blocks within the specified cut of grade limits shown in the table. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). For the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%. • No drilling was completed on the Waterloo Property and Langtry Property since the declaration of the 2023 MRE for Waterloo and 2022 MRE for Langtry. The 2025 MRE update accounts for changes in commodity prices, mining costs since 2022/2023, and barite testing of existing drill samples from the Waterloo Property. • Totals may not represent the sum of the parts due to rounding.

Qualified Person

The scientific and technical data contained in this presentation was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Minerals Projects and is not an independent of the Company.