Another Gold Multi Bagger?

I am about to introduce you to a company whose management discovered billions of dollars’ worth of gold and handed investors hundreds of millions in profits.

It’s not just some exploration gold company looking to strike it big.

And it’s not a gold company attempting to develop a mine—because we know how long and how much money that takes.

I am talking about a company that is on track to produce over US$172 million worth of gold this year alone. And its stock barely prices in a fraction of that gold pot.

Most important, this company holds the secret ingredient to one of the most lucrative calls we’ve made to date. The stock I we introduced you to a few years ago soared 8,000% as a result of this.

Let me explain.

The Multi-Million Buyout Team

There’s a legendary team that has a beyond-belief knack for spotting gold gems. It has collectively founded, managed, and sold mining companies with a combined value of nearly $30 billion.

Their last jackpot exit—and one of the best calls in the past few years of this letter—took place in 2016.

Back then, this group of individuals negotiated an incredible deal to merge $7 billion worth of gold assets into a shell company that had nothing more than the anticipation of a C$25 million bankroll.

At the time, the junior gold market was taking a turn for the worse, and exploration companies were failing. There simply weren’t the exits there used to be for development companies within the mining sector.

And no exits meant no capital.

To even have a chance of success in the gold sector, you needed to be a producer.

After looking at hundreds of assets and spending hundreds of thousands of their own money, this team finally settled on a project.

They found a public company with three 100%-owned operating mines across Australia that collectively were producing more than 200,000 ounces annually.

But these assets had been mismanaged so many times by so many people that no one else was willing to back them or even talk about them.

The assets were outstanding, but a bad barber with the sharpest scissors still won’t give you a good haircut. Such was the case with the Australian company’s management. Besides, 80% of the company was owned by five hedge funds in New York.

In other words, it really wasn’t a public company at all; it operated more like a semi-private entity. As a result, there was no liquidity and very little institutional coverage.

But THIS team saw the diamond in the rough.

They saw a mismanaged world-class gold producer with massive exploration and discovery potential.

And they took advantage of it.

They negotiated a deal to merge the assets into a new Company for a measly $25 million.

And guess what? In less than a year, this team turned that twenty-five-million-dollar acquisition into a sale of the assets just over a year later for over $1 billion.

That Company was Newmarket Gold.

Newmarket Gold Handed Investors 8,800% Gains

We first introduced Newmarket Gold (Newmarket) to readers on July 26, 2015, when it was trading at C$0.82.

In September 2016, Canada’s Kirkland Lake Gold announced that it would acquire Newmarket for roughly C$1 billion—valuing Newmarket at C$5.28 per share.

That’s a gain of more than 540% in barely over a year.

But that’s not all.

The team at Newmarket didn’t look at the deal as an exit—they looked at it as a way to bring even more value to existing shareholders.

And boy, were they right.

Since that transaction, Kirkland Lake Gold has been one of the best performing gold stocks.

Last month, Kirkland Lake was worth over C$50 per share.

If you were a Newmarket shareholder and held on, each one of your shares today could be worth over $23.75 (based on a 0.475 consolidation).

That’s a return of 2,796% from the $0.82 price back when I introduced it. And had you made your exit a little earlier at C$73 in July 2020, you would have raked in a life-changing 8,800%.

Think about it.

A $10,000 investment could have become $880,000.

A $100,000 investment could have become $8,800,000.

Newmarket Gold was one of the most lucrative mining plays of the last decade. And I bet anyone who is reading this now is kicking themselves. Including me because I sold out too early.

But here’s the good news.

This legendary buyout team recently spotted another diamond in the rough …

Calibre Mining Corp.

(TSX: CXB) (OTCQX: CXBMF)

Calibre Mining Corp. (Calibre) is a quickly growing junior miner run by many of the same core individuals that created and sold Newmarket Gold.

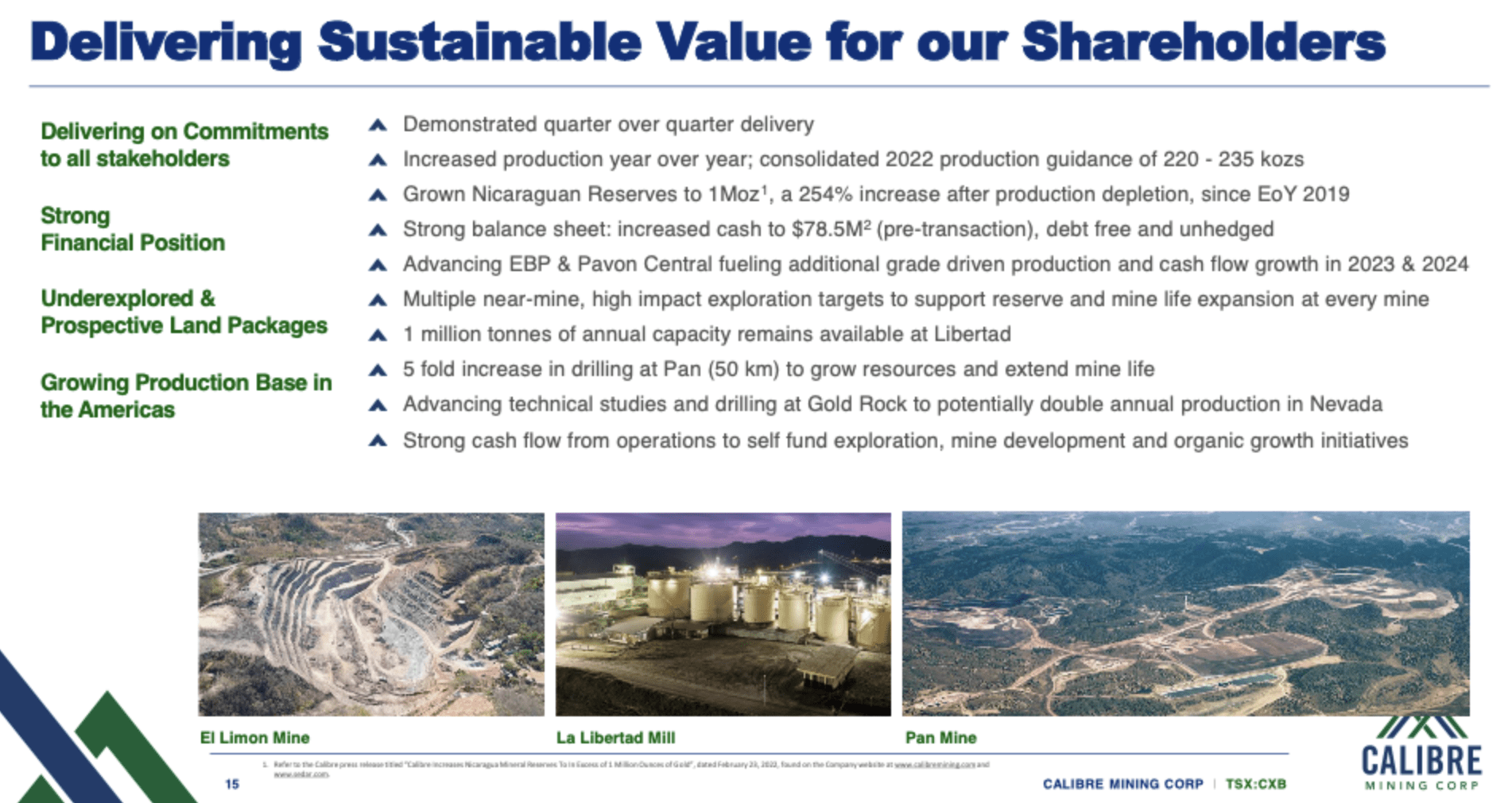

Today Calibre Mining owns 100% of three fully operating gold mines in Nicaragua.

The company’s crown jewel is the duo of the La Libertad and El Limon mines. They are some of the largest gold mines in Nicaragua with a multi-decade track record of producing millions of ounces of gold.

For nearly a decade, the La Libertad and El Limon Mines have been responsible for a big chunk of Nicaragua’s gold exports. In addition, the two mines are collectively the largest individual exporting operations in the country.

Considering that gold is now the third-largest export for Nicaragua, that’s a big deal.

Just how big?

Last year, the two mines dug up 182,800 ounces of gold with All-In Sustaining Costs (AISC) between US$1,125-1,175 per ounce of gold.

With the gold price around US$2,000, these two mines alone will be spitting out around $155 million of operating cash flow a year, with revenues of over $365 million.

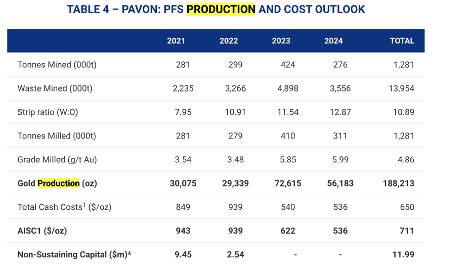

Then in 2019, Calibre Mining expanded another one of its high-potential properties in Nicaragua, Pavon Gold. A largely underexplored property with massive potential.

In short order, Calibre Mining began mining it and just last year, it was able to produce 30,000 ounces of gold from an never-before-tapped resource.

Calibre’s success in Nicaragua is proof Newmarket Gold wasn’t a fluke. It shows just how competent this team is in developing world-class mines and turning around slack operations.

Consider this.

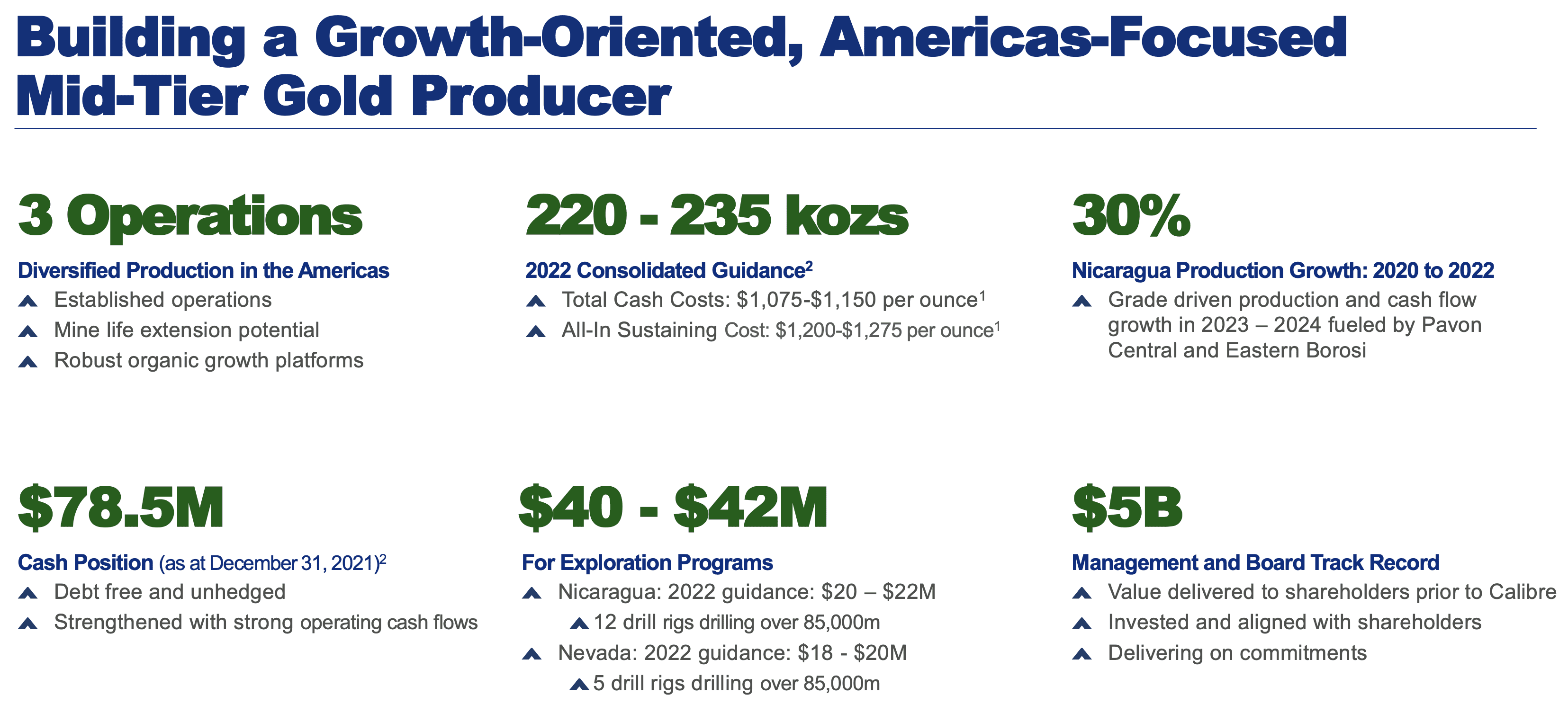

In the past two years, Calibre grew its mineral reserves to the north of 1,000,000 ounces of gold—a 254% increase, and increased its annual gold production by 30%.

Better still, Calibre Mining pulled this impressive growth while fortifying its balance sheet. The miner successfully grew its cash to $78.5M, got rid of all debt, and remained unhedged.

That’s very rare.

Of all the mining operations I’ve seen during my career, I can count on one hand companies that can grow so quickly without piling up a mountain of debt and becoming overleveraged.

I time my calls very carefully – especially when it comes to gold.

We introduced Calibre Mining to readers in 2019. It was in an unusually special situation that let it take advantage of a unique opportunity that many of its peers couldn’t seize.

It was a merger with the owner of a basket of cash-flow producing yet largely underperforming assets with nearly four billion dollars’ worth of gold in the ground. It was about to make one of the most promising deals we’ve seen in a long time.

It seemed like a tall order. What multi-billion dollar asset would want to merge with a junior miner? I knew the team would pull it off because it has done it many times over.

And it did.

Over the next 12 months, the stock grew nearly 4x from C$0.60 to C$2.10

Then we issued another alert back in March 2021. At that time, crashing gold sent miners into a tailspin, and Calibre was caught up in it despite its phenomenal growth in resource and production.

I knew Calibre was just collateral damage. It was a matter of time before it would bounce back.

Indeed, within three months, the stock jumped 64%.

Today Calibre Mining is at Another Inflection Point

The timing of this call is not accidental either.

Today Calibre Mining is at a pivotal point in its growth story, which could launch it into a triple-digit rally as soon as this quarter.

See, for the past few years, the company has been in the exploration/development phase. Its management was testing the waters with newly acquired assets, advancing mines, and fine-tuning operations.

Now they’re shifting this whole operation into overdrive.

For starters, the company is jacking up its exploration scope.

This year, the management signed off on a $40 million budget for further exploration in both Nicaragua and Nevada. The company will have 11 rigs in Nicaragua drilling 100,000m and 5 rigs in Nevada and drill through 60,000m-90,000m of rock.

For perspective, that’s nearly twice as much as it’s dug in Nicaragua to this day. And I can tell you, this exploration ramp-up will dole out a ton of resource updates that could push stock higher.

And the company is starting to reap the fruits from the exploration it’s been sinking money into over the past years – and rather aggressively.

In 2019, when I first told you about Calibre’s Pavon asset, it had a resource of just 78,000 gold ounces, of which only 55,000 of it was in the indicated category. Today, its produced more than 30,000 ounces of gold. And get this, its gold production is estimated to more than double next year with ~30% lower AISC.

Last, Calibre Mining is going to benefit a lot from organic growth in the coming year.

For example, Calibre’s management expects to improve its gold reserve grade in Pavon’s central deposit from 3g/t to 6g/t in 2023. That means this asset can triple its production in the next few years just on grade improvements alone.

But that’s not all.

M&A

If there’s one thing that this management has shown time and time again, aside from increasing shareholder value, is its ability to turn around under-performing assets. Heck, they bought a struggling gold mine in Australia, turned it around, and it became one of the lowest cost producing gold mines in the entire world.

And earlier this year, they made yet another noteworthy acquisition, buying the Pan Gold Mine, located in one of the best gold jurisdictions in the US, Nevada. In addition, this purchase also included the adjacent advanced-stage Gold Rock Project and the past producing Illipah Gold Project in Nevada, as well as the Golden Eagle project in Washington State.

This acquisition not only de-risks Calibre’s international assets, but also increases Calibre’s production profile.

And it’s management team, as always, is already extracting value from those assets with resource expansion already planned for the Pan Gold Mine. Considering what they did with its assets in Nicaragua in such a short time, investors should be excited to see what management can do with a US asset in Nevada – assets which command a very high valuation relative to global peers.

Why 100% Upside Isn’t a Stretch

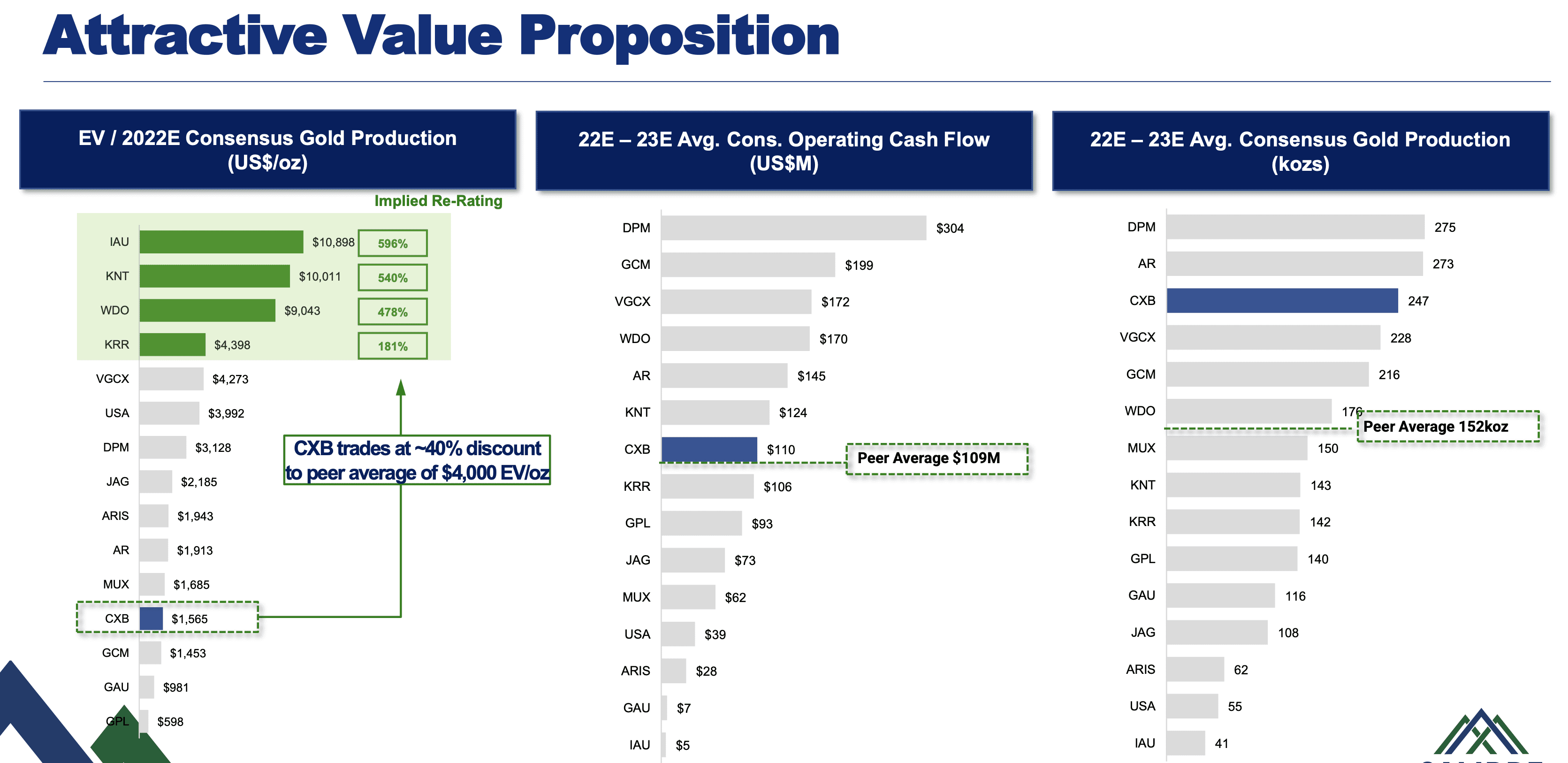

Calibre Mining is quietly transforming itself from a junior into a mid-tier miner that will compete with some of the largest names in the Canadian mining sector.

Yet, this growth story is still largely under the radar.

Just look at its price. The stock is still down 34% from its 2021 highs.

Why?

Because like last time, it was caught up in a broader sell-off that swept up the gold sector. And many investors, failing to see this hidden gem, blindly sold it off with the rest of the gold names.

Yet, it’s clear as day Calibre’s stock price doesn’t correspond with its fundamentals on any level.

So, it’s just a matter of time before investors wake up and pile back into Calibre. As they did so many times in the past few years.

In fact, Calibre Mining is already turning big money heads.

One of the nine institutional banks that is covering Calibre Mining, Haywood securities, recently issued a $3.50 price target. This target implies a quick 100% upside from today’s price.

If that sounds like too much of a stretch, just look at how much investors pay for other miners.

Despite its impressive growth, its stock still trades at a 2.08 EV/EBITDA compared to the peer average of 4.16. And it has one of the most cash-rich balance sheets with no debt.

If Calibre’s stock re-rated to its peer valuations, its price could double or even more. Again, that’s a 100% gain as soon as investors realize this company isn’t “just another junior miner stock.”

That can happen anytime now.

With stocks tumbling and war raging on in Europe, gold is hitting all-time highs—boosting Calibre’s earnings even more.

– Carlisle Kane

Disclosure:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Calibre Minning Corp (CXB) because the Company is an advertiser on www.equedia.com. We currently own shares of CXB and have been granted options by CXB. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in CXB or trading in CXB securities. CXB and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from CXB, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

If we are fortunate to have some money to invest in gold, what percentage of my estate would you recommend putting into gold? How diverse can one be and how do you decide where to allocate all investment amounts, I have? You can only protect a percentage of your wealth with diverse investing. Should we look to Annuities to keep up with inflation?