Dear Readers,

It was a critical week for both the TSX and the TSX Venture.

Last week, I mentioned that January would be a big month for mining stocks; that we really need to watch how it plays out in order to gauge how we invest.

We started the week with a bang. However, thoughts of a renewed market were once again put on hold Friday when the TSX recorded its biggest single-day drop in seven months.

The expectations of the U.S. Federal Reserve scaling back stimulus hit emerging-market assets, and thus, the commodities-weighted Canadian exchanges.

U.S. stocks also dropped, with the S&P 500 having its worst week since June 2012.

Has the U.S. market finally come to a breaking point? Not yet, but the Fed will meet next week to decide its fate.

While the market was battered last Friday, subscribers of Investment Diary continue to reap the benefits, with the latest idea up more than 200% in less than two weeks. CLICK HERE for a sneak preview of my premium entries.

Rise of the Phoenix?

The indecisiveness of the market and economy are helping gold rebound from its recent lows.

2013 was a bad year for gold, falling nearly 28% – its worst decline since 1981, when the precious metal lost 32.8%.

Does that mean gold will rebound?

From a historical standpoint, the simple answer would be no.

When gold fell this sharply in 1981, it rebounded over 12% the next year, but then lost another 32% in the next 2 years. Overall, it took about 25 years to recover its drawdown.

But nothing about the world’s current financial system is the same as it was back in the eighties.

Back in 1981, there were no bitcoins, no subprime mortgages, interest rates were nearly 20% higher, and public debt was 1500 per cent less then it is today.

I can go on, but I have on too many occasions over the past few years.

My point is that no matter how much crap you hear about gold, its best to know the facts before passing judgment.

Fundamentals vs. Manipulation

The more the price of gold is driven down by the Western paper gold market, the higher the demand for physical bullion in Asian markets.

Last year, I talked about how badly gold had been manipulated; how its price would be subdued, and how no one would expose the truth, because every one that wants gold would rather pay a cheaper price anyway.

It’s no wonder why China announced that its gold reserves remained unchanged at the end of 2013, at 33.89 million troy ounces – the same as it has been for the past 5 years.

But we all know that’s not true.

China has become the world’s largest gold producer with total estimated output at 437.3 tonnes, which is more than 9 percent of the global supply last year.

Given that many of China’s gold mines are run by state-owned entities and protected by the “gold police,” or those with connections to the government, it would be ignorant to believe that none of the gold went to China’s reserves.

Besides becoming the biggest gold producer, China has also become the biggest gold consumer by overtaking India. Chinese demand increased 32 percent last year – a fivefold increase since 2003.

India to Lift Import Restrictions?

If the citizens of India had their way, they may still be the world leader in physical gold consumption. But since India has experienced a record current-account deficit, its government decided to force price controls on gold imports hoping that it would fix their problem.But it didn’t.

Instead, India’s restrictions on gold have now created an illegal black market, with citizens finding newer and more creative means of smuggling gold. The situation has become so big that its surpassed the drug smuggling trade.

It’s no wonder why India’s Congress party chief Sonia Gandhi asked the government to review the tough import restrictions on gold last week.

Eventually, I believe India will have to either lift or reduce the import restrictions on gold. This could lead to higher prices as pent up demand from Indian buyers once again floods the global supply.

Where’s My Gold?!?!

Many of the gold vaults in America are being rapidly depleted of gold.

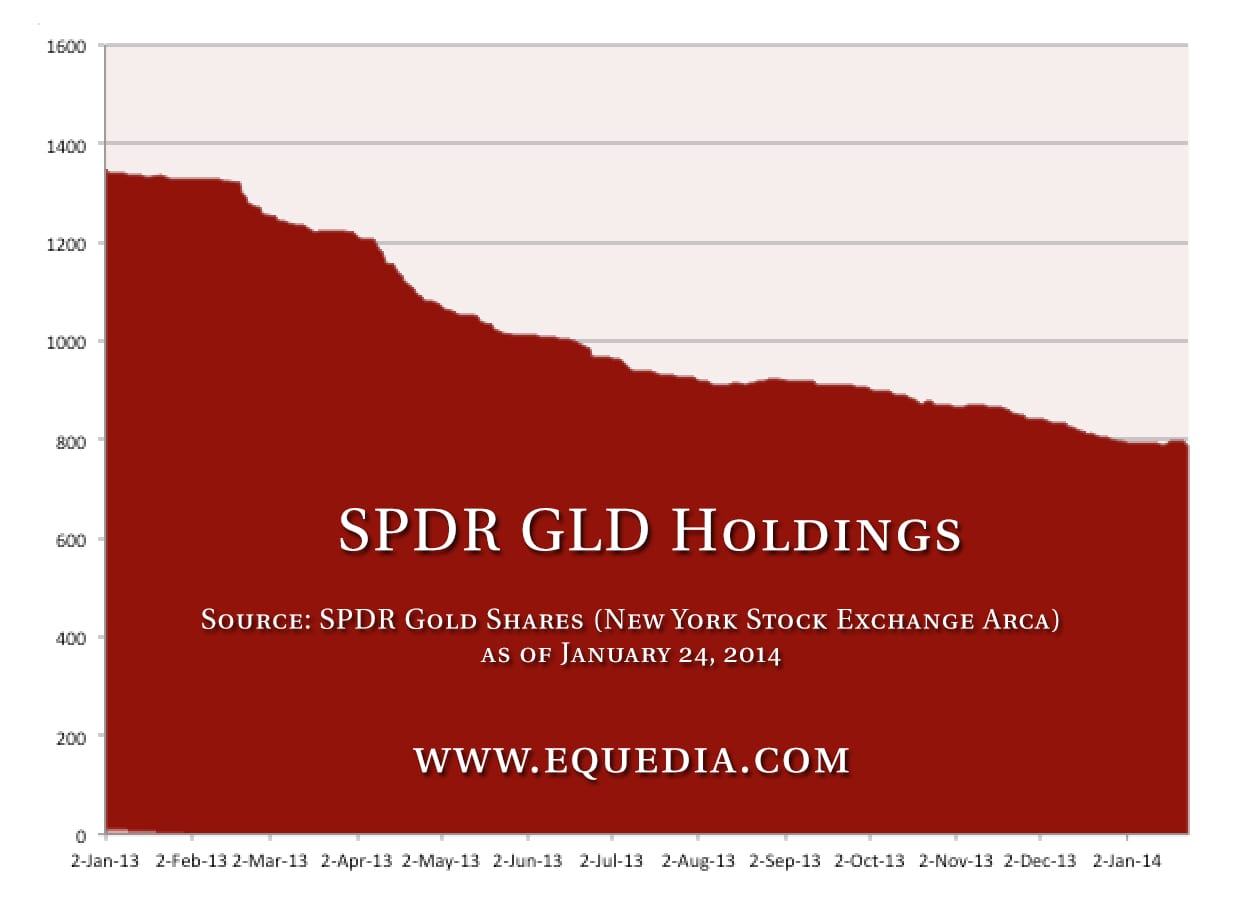

Prior to 2013, the GLD held one of the largest stockpiles of gold in the world. Here’s an up-to-date look at how fast its holdings have been depleted over the last year:

Last year, more than 1,000 tonnes of gold were emptied from various ETFs and bank custodial vaults, including more than 100 tonnes of gold that disappeared from the Comex vaults.

Where am I going with this?

As you may remember from my letter back in October 2012, I mentioned that Germany wanted to repatriate 150 tonnes of gold to test the quality and weight of its gold bars that it had stored over seas, to make sure the gold was still there:

“The watchdog report follows claims by the German civic campaign group “Bring Back our Gold” and its US allies in the Gold Anti-Trust Committee that official data cannot be trusted. They allege central banks have loaned out or “sold short” much of their gold.

The refrain has been picked up by German legislators: “All the gold must come home: it is precisely in this crisis that we need certainty over our gold reserves,” said Heinz-Peter Haustein from the Free Democrats (FDP).”

After the announcement, rumours spread that the Fed had refused Germany’s attempt to look at their gold in American vaults.

Whatever it was that caused Germany to react, Germany decided a few months later they wanted even more of its gold back.

From my Letter, Prepare for a Crisis:

“Germany has 3,396 tonnes of gold, the world’s second-largest holding after the US. However, Nearly all of it was shifted to vaults abroad during the Cold War in case of a Soviet attack.

Roughly 66% is held at the New York Federal Reserve, 21% at the Bank of England, and 8% at the Bank of France.

…It will retrieve all 374 tonnes of the bullion it currently keeps in Paris and 300 tonnes currently stored at the New York Federal Reserve Bank.

The process will take 8 years and bring about 19 percent of Germany’s gold reserves back to the Fatherland. Germany holds 3,400 tonnes of gold reserves – the most of any country, second only to the United States.

When the process is complete, Frankfurt will hold half of Germany’s gold. New York will retain 37 percent, and London will store 13 percent.”

It’s been one year since that announcement, so how is Germany’s gold repatriation going?

Apparently, not so good…

A Disappearing Act

Germany was expecting to receive around 84 tonnes last year. So far, only 37.5 tonnes have been delivered.

Guess how much the US delivered so far?

In one year, the US has managed to ship back only 5 out of the 300 tonnes Germany wants back. The rest came from Paris.

That’s means only 1.6% of what Germany wants back has been delivered by the US; even more shocking, that’s only 0.147% of all the gold Germany stores in US vaults.

Questions once again arise: “Why will it take 8 years to bring less than 9% of Germany’s gold held in US vaults back to its original owner? And why has the US only delivered 1.6% of the gold that Germany wants back?”

We’ve heard many answers: from shipping logistics, to the gold needing to be recast before being returned.

If we can ship deadly chemical weapons from Syria across oceans, certainly we can ship a few thousand pounds of gold?

As for the gold needing to be recast, what incentive would the New York Fed have in going through the process of recasting the gold? Surely Germany did not expect its gold back in the form other than how it was originally delivered to the New York Fed.

If you have an idea, CLICK HERE to share your thoughts

The Biggest American Secret

The only logical explanation is that the New York Fed either doesn’t have the gold, or the gold has been leased so many times over to other banks and funds that it simply cannot be traced.

Regardless of the explanations, they all point to the same conclusion: The German gold that was originally deposited 50 years ago is no longer there.

If you owed someone a large amount of gold and didn’t have it, you would do whatever it takes to replace that gold, and you would try and replace it at the lowest possible price.

If it turns out that America truly doesn’t have Germany’s gold, I would suspect they would be doing their best to replace the gold at the cheapest price possible.

In other words, those who believe that gold is shifting out of America could be very wrong.

America, like China, could secretly be buying up gold and using the paper market to buy it at cheaper prices. Could America be the biggest buyer of gold?

This could be one of America’s biggest secret.

What do you think? Could America be secretly buying gold? Does America have any of Germany’s gold left?

CLICK HERE to share your thoughts

Paper Gold

Gold continues to hover over $1250, showing major strength – despite the extreme bearishness the media inflicted upon it last year.

Bank of America’s head technician, MacNeill Curry, just told us that gold could rise significantly if it breaks through its pivot point of $1,270.How high could it go?

He said that once it crosses $1,270, it will be eyeing resistance between $1,362 and $1,399.

He’s not the only one that thinks gold can climb higher.

RBC’s precious metal strategist George Gero also wrote that, “A close over $1,275 would signal momentum traders to re-enter the long side.”

Watch gold’s action closely and look to trade based upon its movements.

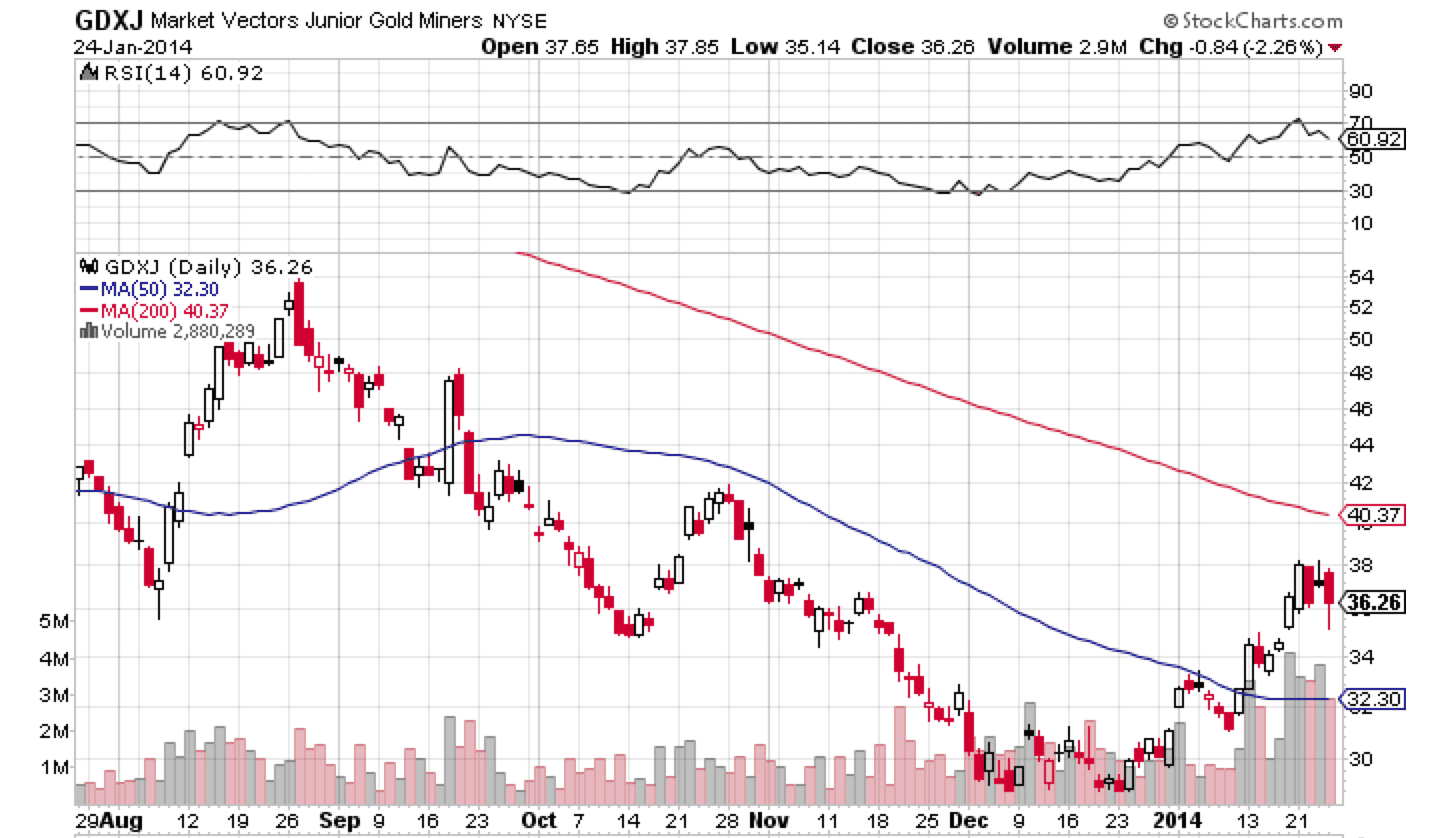

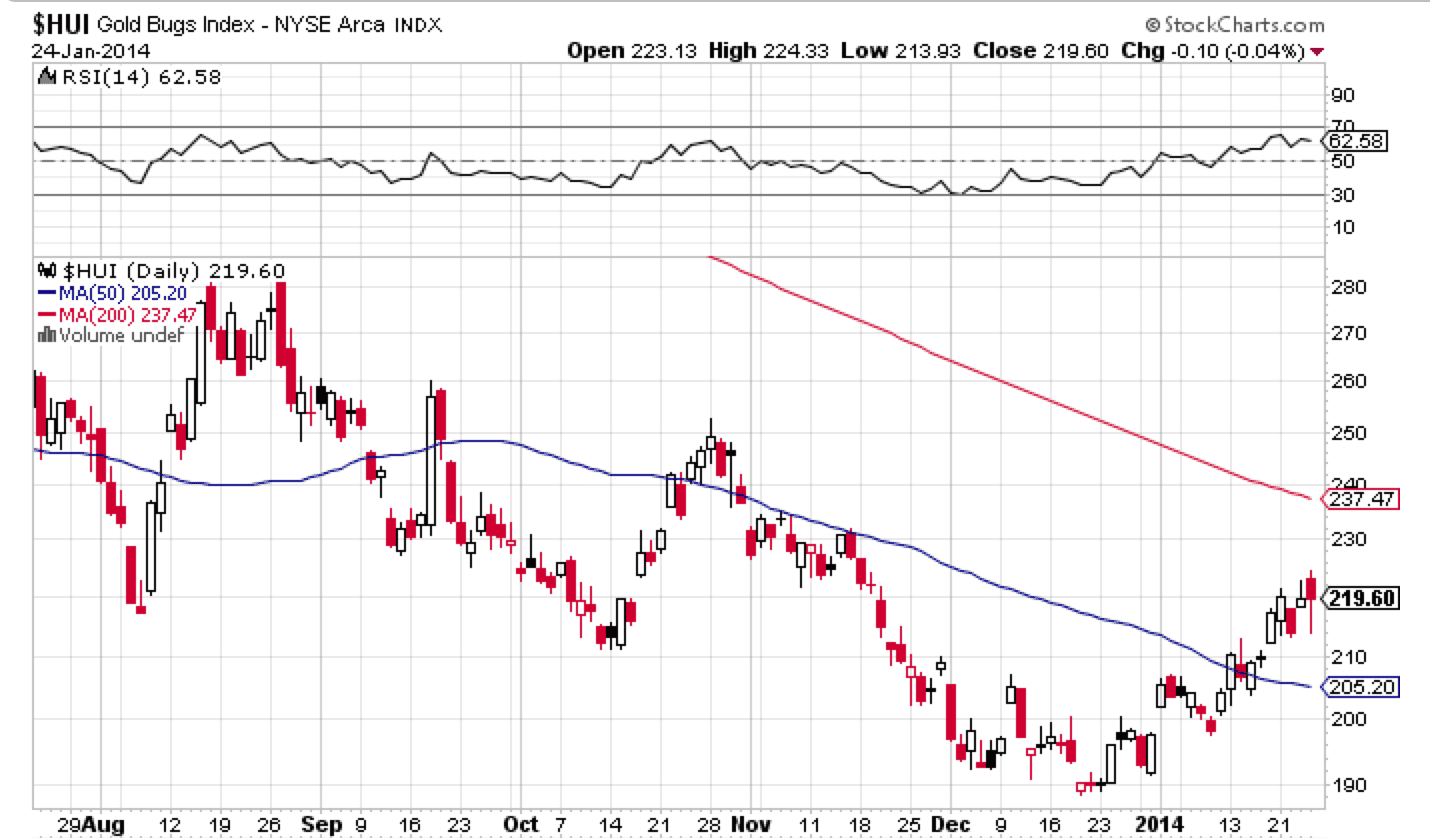

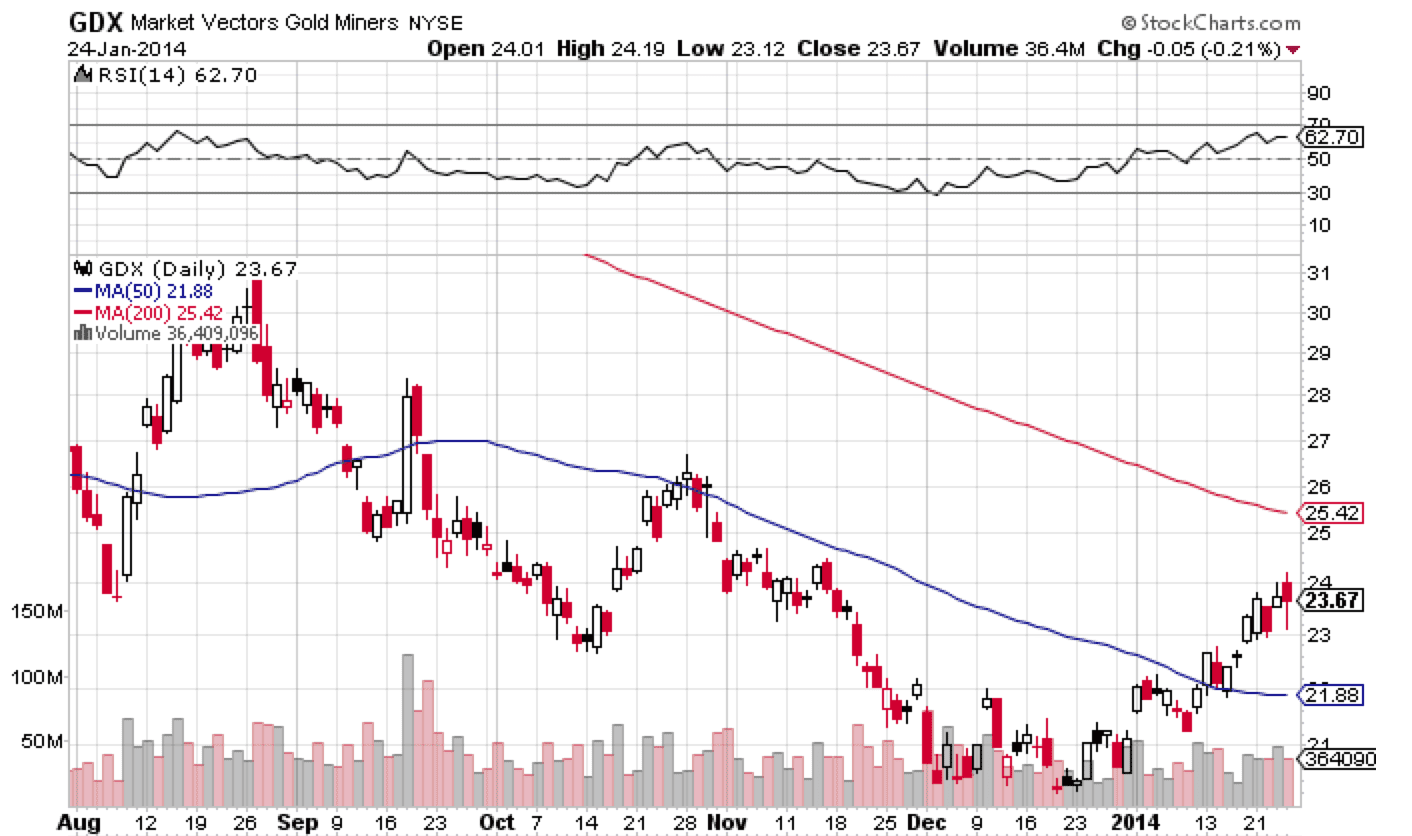

While the overall TSX and TSX Ventures closed down on Friday, many of the gold stocks held relatively steady and are still looking to climb passed their 200-day moving average.

Gold stocks are currently trading between their 50 and 200 day moving averages.

Here’s a look at the HUI, GDX, and GDXJ:

Gold stocks are now a much better leverage on investment dollars than gold – especially producers with a low production cost because their earnings significantly increase as the price of gold goes up.If gold moves higher, look for gold stocks to regain some significant ground.

The Equedia Letter

it’s obvious that America has no gold, or not the gold it claims it has.

Eventually this will be revealed

The gold that Germany refers to was returned back in 1973 when the POTUS Nixon took the U.S> off the gold standard.

Every one talks about how boring gold is but if they knew anything, they would realise that the Fed is trying to take every one away from gold and force paper money in their faces. Its stupid that the general public falls for this.

Humans are idiots that have evolved to allow a few bankers to make us do their chores for pieces of paper.

Your theory about America could well be true as they may be desperately trying to replenish stocks to repay Germany and others. I am curious where you obtained the data from saying China’s reserves did not increase in 2013 . I thought these figures would not be published until the Spring ,if at all.

Thanks Gold Bug. Try this: http://www.pbc.gov.cn/image_public/UserFiles/diaochatongjisi/upload/File/2013年四季度金融统计数据报告附表.pdf

The banks have borrowed all of it and then losing it when they gave it to the ETFs. Now that the Comex and GLD have lost their gold, the US is frantic. There is no reason not to return something other than in its original form.

Why are people so blind?

Obviously, the U.S.A. doesn’t have Germany’s gold in pure form in order to ship it back. They probably used gold plated bullion as collateral for borrowing and must now remake new pure bold bars to return to Germany. If that is not the case then Germany’s gold was commingled with other U.S.A. gold so that bullion reports would show more tonnage for the U.S.A. government. Germany is going to have to wait many years to be given back their gold, or they will be pressured to discontinue the return of their gold from the U.S.A.

With all the lies, lack of transparency, deception, fraud, divisiveness, and corruption, it would seem that Obama moved with the Mafia from Chicago to Washington, DC.