Every few years, a new technology transforms the way we interact with our world; letters replaced by emails; tubes replaced by flat screens; computers replaced by mobile phones.

This week, the world saw the next big change.

For those of you who thought Microsoft (NYSE: MSFT) was no longer relevant, I suggest you think again.

What I am about to show you – if you haven’t already seen it – is absolutely incredible. It is THE next technological revolution.

Describing it won’t do it any justice, so here you are. DO NOT read the rest of this Letter without first watching the following videos:

[youtube height=”326″ width=”580″]https://www.youtube.com/watch?v=aThCr0PsyuA[/youtube] [youtube height=”326″ width=”580″]https://www.youtube.com/watch?v=aAKfdeOX3-o[/youtube] [youtube height=”326″ width=”580″]https://www.youtube.com/watch?v=b6sL_5Wgvrg[/youtube]

The first two videos are promotional, while the last video shows an actual demonstration of the technology in action – transforming a hologram into real life via a 3D printer. See it for yourself, it’s amazing.

For years, the world has been flirting with virtual reality; from flight simulators that teach pilots how to fly, to 5-D movie theatres where the audience is immersed through sight, sound, touch, and even smells.

Then the world began experimenting with augmented reality: an integration of technology in a real-world environment whose elements are augmented (or supplemented) by computer-generated sensory input such as sound, video, graphics and other data.

Some of these include ski goggles that show us slopes and jumps, or video games that integrate visuals to our surrounding environment such as PlayStation 4’s Playroom.

Then Google took it one step further with Google Glass: a small glasses-like headset that essentially projects a floating image in front of your eyes, that is to be worn everywhere you go.

While the technology was cool, the world may not yet be ready for millions of people walking around with a nerdy device on their head. That’s why last week Google announced that it was going back to the drawing board on Google Glass.

And Microsoft attacked.

The Future of Interaction: Microsoft HoloLens

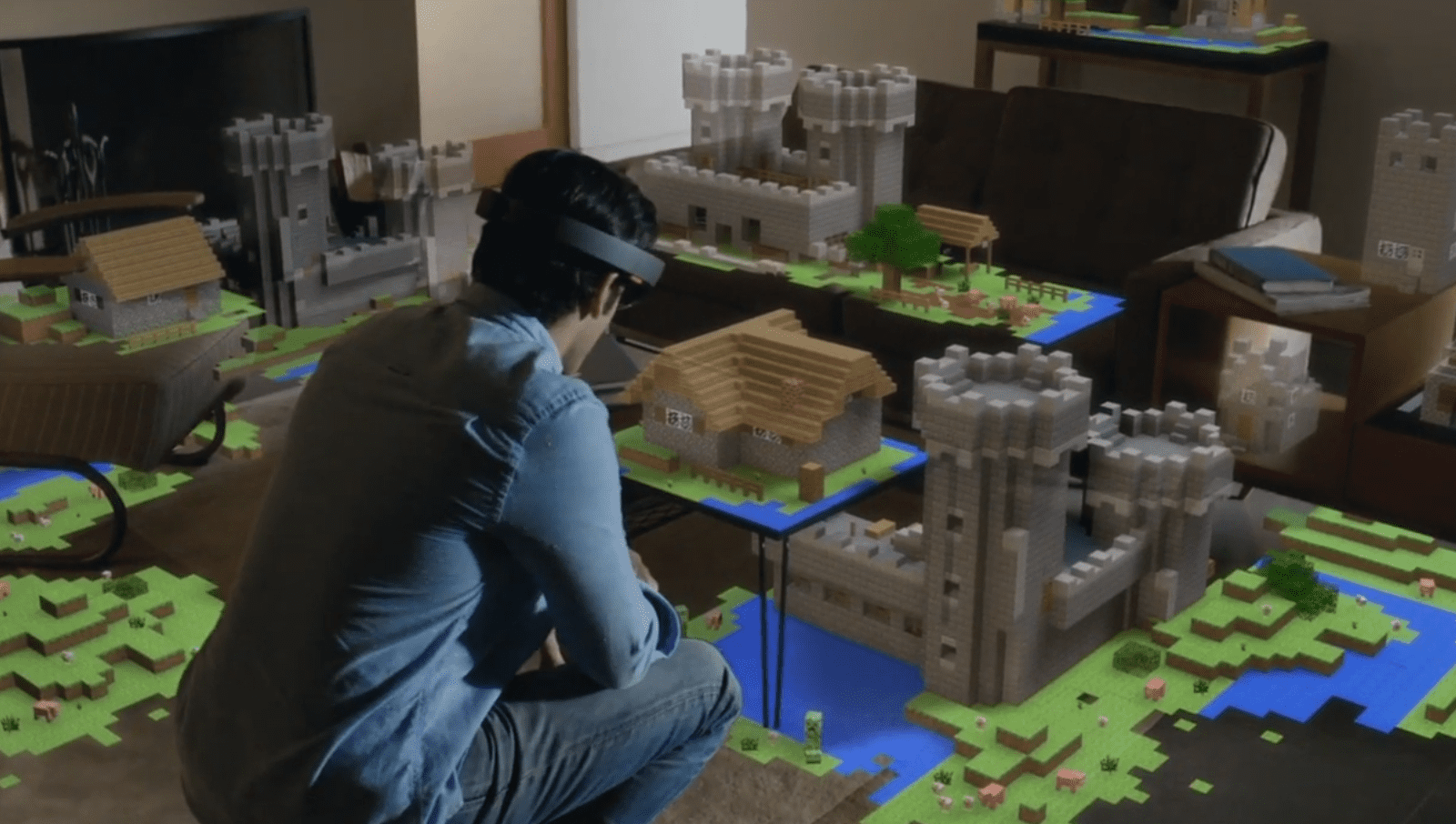

Microsoft stunned the world this week at its Windows 10 event by unveiling HoloLens, the company’s augmented-reality headset.

Of course, the comparisons between Google Glass and HoloLens have already started. Both are weird and dorky looking headsets you wear on your head. But there is a stark difference: the HoloLens is better.

Not only does HoloLens directly integrate with your environment, it also allows for both voice and hand gestures – a la Microsoft Kinect – making the entire augmentation immersive.

Will all of the apps for Microsoft’s HoloLens work as smooth and seamless as the promotional video? Probably not right away. But the video shows us exactly what this type of technology is capable of.

And it shows us what the near future holds.

Microsoft has found a way to blend holograms with reality, and this innovation will change the world. Just watch.

What do you think of this tech?

CLICK HERE to Share Your Thoughts

Moving on.

An Important Market Update

Just as expected, and notably on cue, the European Central Bank (ECB) came out with a massive €1.1 trillion over 16 months of ECB Quantitative Easing (QE) this past week.

This immediately sent shares of euro stocks flying; and the euro itself plummeting. If you haven’t already learned from my past letters, front-running the Fed – or any other central bank – almost always nets you a cool and easy short-term profit.

Here’s a look at Europe’s leading blue-chip index for the Eurozone:

Here’s a look at euro-dollar exchange rate:

And here’s a look at what the euro looks like when stacked against gold:

It’s obvious that the latest round of stimulus by the ECB sent the euro sharply lower against other currencies; devaluation is what happens in a currency war.

The ECB has once again effectively made exports from Europe – the single largest economic block in the world – cheaper. Japan’s central bank has done the same.

I won’t be getting into the details regarding the ramifications of the latest ECB QE, but the punch line is very simple: How will the U.S. compete with such a strong dollar?

Keep your eye on the impact of the rising dollar on U.S. economic growth.

While experts continue to talk of an imminent rate hike, don’t be surprised if it doesn’t happen soon. You wouldn’t believe how many debates I have had with “experts,” where they tried to convince me that Canada was about to raise rates; yet, just this week, the Bank of Canada did the opposite and cut its benchmark interest rate to 0.75%.

Will the Fed raise rates if the U.S. economy slows as a result of a stronger dollar? I don’t think so…but then again, who knows what the Fed is really up to.

Will Gold Hold Up?

Gold held strong this week with the help of the ECB QE.

Last week, I said there were a staggering number of gold companies experiencing a bearish-to-bullish reversal in their charts:

“While the last few years have been dead for the gold mining sector, it may be about to change.”

This week, in a flurry of big money transactions, the sector showed exactly that: Romarco Minerals Inc., Detour Gold Corp., Osisko Gold Royalties Ltd., Primero Mining Corp., Asanko Gold Inc., and Richmont Mines Corp., collectively raised a whopping $789.8 million.

On the M&A front, Goldcorp agreed on a C$526 million (US$440 million) all-shares offer to buy Probe Mines Ltd.

There are really only two scenarios as to why this much money flowed into gold stocks this past week:

1. Bankers are rushing to get their commissions, while money still exists in this space

or

2. The negative aura surrounding gold stocks is finally turning positive

I’ve been bearish for the most part of the last year on gold stocks, but there really does seem to be a glimmer of hope in this space as we approach spring.

Historically, gold stocks often do well leading up to the PDAC Convention in March, before correcting after. But this year, there’s a feeling that the momentum for gold stocks – although small – may last beyond the PDAC.

Why?

Switzerland Exposes China’s Secret Gold Data

There are many things forcing countries around the world into a gold grab.

Last year, I talked about how China has been initiating currency swaps with many countries around the world, including the euro:

“…The euro will become the sixth major currency to be exchangeable directly for Yuan in Shanghai, joining the U.S., Australian and New Zealand dollars, the British pound and the Japanese yen.”

Then last week, I talked about how the Swiss screwed the ECB by removing its currency peg, and that more was to follow:

“It was only a matter of time before one of the world’s most stable currencies decided it had enough of tying itself down to Fed dollars.

Last week, Switzerland and its central bank decided to end its three-year currency peg to the weakening euro. The result was nothing short of stunning: the franc appreciated a whopping 21 percent against the euro this week in New York, jumping as high as 41 percent – the strongest jump since the euro’s debut in 1999.

This marks the first major economy to leave the battle of our current international currency war.”

This week, shortly after removing the franc-dollar peg, Switzerland’s central bank signed an agreement with China to make Zurich the newest hub for trading the renminbi currency (RMB).

Now consider this: Switzerland’s biggest export is gold, accounting for nearly a third of all foreign trade. It is also is one of the world’s biggest centers for refining gold.

Why is this important?

If the Swiss is one of the biggest gold refiners in the world, surely they would have a lot of information on where gold is leaving, and where its going.

Last year, for the first time since 1981, the Swiss let us in on a little secret: Gold is leaving the West, and almost all of it is heading East.

Via Swiss Info:

“Switzerland exports its gold mainly to Asian countries, according to data on precious metal trade released Thursday by the Federal Customs Administration. Exports were broken down by country for the first time in 30 years.

The Asian market, including countries such as Hong Kong, India and Singapore, was the primary purchaser of Swiss gold and silver bullion and coins in January 2014, according to the customs administration.

The top five purchasers were all countries in Asia, and made up more than 80% of the total worth of CHF6.9 billion ($7.8 billion).

… Gold trade is of great importance to Switzerland – it accounts for about a third of total foreign trade. Up until now, little was known about Switzerland’s trading partners. In response to a request by parliamentarian Cédric Wermuth of the Social Democratic Party, the customs administration released details on its gold trade for the first time since 1981.”

A few months ago, this data was finally released. Yet, not one media outlet has talked about it.

So let me be the first to break it down for you:

According to the Swiss Customs Administration, from Jan-Nov 2014, the Swiss exported (net) 188,125.62 kg, or 188 tonnes, of gold to China, and exported (net) 324,902 kg, or 324 tonnes, to Hong Kong.

And since, as I mentioned last week, gold imports from Hong Kong to China continue to reach new highs, one can only imagine how much gold China is actually accumulating.

Furthermore, neighbouring countries with close ties to China, such as Singapore and Malaysia, continue to be net importers of gold from the Swiss.

Australia has also sent record amounts of gold to China over the past few years, with China accumulating 66% of Australia’s 2013 gold mine production.

Let’s also not forget that in November, UK gold export to China was 30 tonnes, up 186 % month-over-month, an all time record. Aggregated net gold export (January 2014 – November 2014) to China was 105 tonnes, according to Eurostat.

The West, on the other hand, was a net exporter of gold to the Swiss in 2014. Between Jan-Nov 2014, the U.S. exported (net) 190,050 kg, or 190 tonnes of gold to Switzerland, while the UK exported (net) 578,378 kg, or 578 tonnes.

Imagine if the Swiss were to publish everything prior to 2014? While we may never find out, it’s clear that the Swiss’ knowledge of gold inflows and outflows was instrumental in making the decision to remove itself from the euro peg, and create a Zurich-based trading hub for China’s currency.

There’s going to come a time when China will announce its central bank gold reserves to the world. And – unlike the Fed – won’t hesitate to show it to the world.

Looking Forward

With that being said, I am looking to slowly add new junior gold stocks to my portfolio. If you feel there is a stock that I should be covering, let me know.

CLICK HERE to Submit Your Entry

I am looking for companies who have:

- a great asset in a stable jurisdiction

- money in the bank, or the ability to raise it

- a great management team who knows how to both operate and promote

The last bullet point is key: It doesn’t matter how great an asset is, if it’s not promoted, it’s worthless – especially in this market. As an experienced and successful friend of mine once told me: “God doesn’t make stocks go up, people do.”

Gold may be boring, but its rise could reinvigorate Canadian stocks and bring back some desperately needed excitement to our investment community.

There’s a glimmer of hope. Let the treasure hunt begin.

The Equedia Letter

excuse my lack of grammer and punctuation…….this has got to be a megaleap in its influence on life in the 21 century….the porn industry will jump at this technology….the porn business drove vhs growth pc growth and people like Netflix

if Microsoft can successfully launch windows 10 and at the same time hololens then I can see the porn industry with the help of independent developers propel the acceptance of the technology….. one should be a buyer of Microsoft ……the cash flow has got to be affected….and the dividend maintained…..but what do I know I thought google and Netflix were novelties and how could they possibly generate cashflow I did not buy.

This is a major leap. The problem is the practically of its uses. Looks incredible, but will there be a real world use for it?

If the app makers think of something useful, this will be the next big thing

great piece! from a purely selfish standpoint, i love the fact that there is hardly ever anyone walking or biking over the bridge – makes it much easier to run across than the bk or williamsburg bridges. also – that’s an interesting point about the debate btwn eye bar chains and steel wire. didn’t know that

Over the past year I have been an avid reader of your newsletter. I am very impressed of your data collection and analysis of the data. Also, your comments on and connection to world events is outstanding.

My only negative observation of your great work is that you fell for the Microsoft Hololens hoopla. While I believe that it may be an assistance to 3-D design and visualization, that quad-copter was never 3-D printed with motors, batteries, electrical wiring and control system, including software. Microsoft just wants to create a buzz. They had to do something, their share price has been languishing for eight of the past ten years.

Keep up the great work!

Nick Wagner

Microsoft’s new ‘toy’; so very interesting!

I forsee healing applications with this technology. Dr. Norman Doidge documents neuroplastic treatments in his new book and I believe this could be a future tool in these endeavours.

Thank you! Your articles are always a joy to read even if the realities they illuminate, may be frightening.

Hi Ivan

I look forward to your column each week. Lately I have been following companies near Srewart, in northwestern BC.

I put some money on one, IDM Mining which I have some hope for even though I am in a loss at the moment,.quite usual these days.

The reasons I bought the story were the people first, the history next, the area, and lastly,their ability to raise at least enough to get started on something that could prove up a substantial resource without doing a lot of expensive work based on work, equipment, and data abandoned by Lac minerals some time ago.

The company has very good engineering contacts, and good insider holdings together with a low share count. As well as close to town.

Hey visitors!!!