Dear Readers,

The past weeks have been very important for Canadian investors.

They have given us a glimpse into what could be a very profitable year for those still willing to participate in the commodities-weighted Canadian stock exchanges.

Last week, I wrote:

“For many Canadians, (2014) could be the turning point for their investments. Many of the companies on the TSX, and in particular the TSX Venture, have been beaten down but it truly appears a bottom has formed.”

This week, the TSX climbed to a new 2.5 year high and has advanced in eight of the last nine sessions. The TSX Venture has continued its uptrend since the beginning of this year and is now up over 4.5%.

I believe this year could be very rewarding for Canadian investors.

Subscribers to my premium service investmentdiary.com continue to see big gains with new ideas. The latest idea announced this week is already up 100% and another one from last year is up over 700% in just the last few months – get a small preview by clicking here.

Light at the End of the Tunnel

There’s no doubt that access to capital has been a major roadblock to junior companies in Canada. That, combined with tighter regulations and the high legal costs of running a public company, has folded a lot of TSX Venture prospects.

Last year, I wrote many articles on why the TSX Venture was failing; I wasn’t the only one. Many respected industry professionals felt the same way and wrote about the major problems that were suffocating the growth of capitalism in Canada.

We took the situation into our own hands and collaboratively made an effort to tell “our” side of the story.

I may be saying this a little early, but our noise may be slowly paying off.

A primary frustration for retail investors was their inability to participate in private placement financings that often come with the benefit of a warrant, and sometimes a discounted rate to the secondary market.

These financings have often been restricted to the general retail audience because of the costs and time involved for a Company to file a prospectus.

In short, the current rules mean retail investors are disadvantaged from being able to participate in private placements, while TSX Venture issuers are denied a potential source of capital.

Last November, the Canadian Securities Administrators (CSA) proposed an exemption that would allow TSX Venture issuers to distribute securities to existing security holders, thereby reducing the cost for investors and providing issuers with access to an additional source of financing.

Thus far, it seems all the provincial and territorial regulators, with the major exception of Ontario, like the proposal. And furthermore, it seems the BC Securities Commission and the Alberta securities Commission has been very accommodating to the suggestions of the investment dealers – the key backers of emerging companies in Canada.

The proposed exemption means that retail investors may soon be able to participate in private placement financings without being an accredited investor, and without the Company filing or obtaining a receipt for a prospectus.

Investor participation in private placements shouldn’t be restricted based on his/her net worth. I believe there are many sophisticated Canadian investors and we should all be given equal rights in determining our own investments.

What do you think? Should every Canadian be allowed to participate in private placements?

Share your thoughts by CLICKING HERE

This proposal is a great step forward in bringing equality and revitalization to Canada’s emerging markets.

The deadline for submissions on the proposal is January 20, 2014. If this proposal is accepted, it will be a pivotal turning point for the TSX Venture.

The Outlook for Canadian Stocks

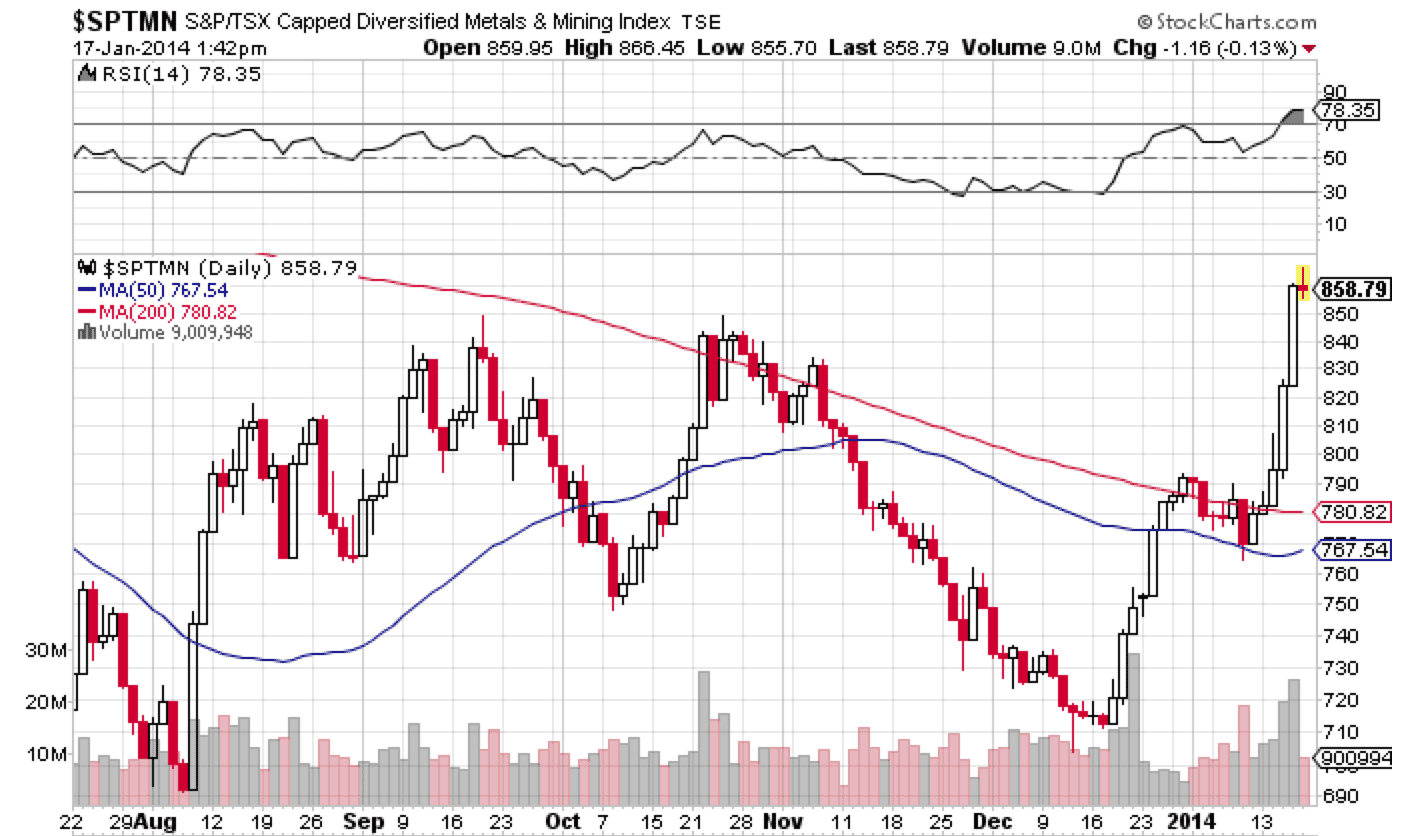

Last week, the TSX Venture crossed above its 200-day moving average for the first time in more than three years.

The Venture is currently attempting to break out of its chart resistance at 975 and it looks like we could be there next week. If we move passed this, it would be wise to accumulate the strong performers within the exchange. In particular, it would be wise to focus on many of the gold juniors which have been leading the charge and significantly outperforming gold itself over the past few month.

Although I didn’t feature a report on a gold company last year, those I featured in 2012 have all climbed significantly over the past two weeks, despite gold remaining relatively unchanged. I will likely be buying many gold stocks this year.

The aphorism “a rising tide lifts all boats” is true for the resource-ridden Canadian stock market.

Stronger Earnings, Improved Conditions

Over the past years, the declines in commodity prices have forced many companies to become more cost-conscience. While prices may not see an aggressive upswing this year, operational efficiencies and cost-cutting measures have now created a scenario whereby any pickup in the pace of resources could lead to stronger earnings by the miners.

Companies have had to significantly reduce capex, which should lead to improved conditions in cash flow.

While structural demand concerns remain in China (liquidity tightening and current shadow banking fiasco), it would be unwise not to see the opportunity at hand. I believe the declines in commodity prices have been fully priced into the market, while the “efficiency” efforts have not.

The FTSE 350 mining index appears to be rebounding and the S&P/TSX Capped Diversified Metals and Mining Index has broken aggressively beyond both its 50 and 200-day moving average.

Its better to be a little early on this rebound call rather than too late as investor sentiment has been at an extreme low but reversing aggressively this week.

Could this be a false breakout? We shall see…

This will be an important month for the mining sector.

Uranium – Getting Front Stage

Uranium will be one of the hottest commodities this year. I have written extensively about this over the last half of 2013.

Last year, I mentioned that leading up to December, the chances of participating in uranium stocks at bargain prices would be coming to an end.

Uranerz (TSX: URZ) (AMEX: URZ) was a prime example of this call. The Company is now up over 60% since November 21, 2013.

But the sector explosion is just starting to heat up, which means the upside for uranium and uranium stocks could be huge.

More Uranium Catalysts

Two major uranium mines recently shutdown in Niger, Africa. These mines were operated by Areva – a French energy multinational – under a 10-year mining license, which expired as of December 31, 2013. Niger wants more royalties, while Areva claims it cannot operate profitably if that happens.

As I mentioned in my uranium report, France gets 75% of its electricity from its 58 nuclear reactors. According to Oxfam, Areva’s two mines in Niger produced more than €3.5bn (£2.9bn) of uranium in 2010. That means uranium from Niger could have been powering close to one in three light bulbs in France.

On the same side of the world, Germany’s No.2 utility RWE is preparing to sue for millions of euros (estimated at 187 million euros ($255 million)) in damages after a federal court confirmed that a state’s decision to shut down the company’s Biblis nuclear plant in 2011 was illegal.

The plant was forced to shut down by the state of Hesse as a precaution following the disaster at Japan’s Fukushima plant. Plants all over Germany were shut down as well.

RWE estimates that dismantling its two reactors at Biblis will cost 1.5 billion euros, excluding storage costs for the nuclear waste.

So what does this mean?

It means that the state of Hesse may have to pay in excess of $1.6 billion euros to stop the power plant operations of RWE.

While Germany’s switch to renewable energy, known as the Energiewende, remains on the media front, this could be a quiet step in turning the nuclear reactors back on in Germany.

Last, and most significant, is the approval of a revival plan for Tokyo Electric Power Co (Tepco) – the utility responsible for the Fukushima nuclear disaster – by Japan’s trade ministry this Wednesday.

The plan hinges on Tepco restarting its Kashiwazaki Kariwa nuclear plant to cut the massive fossil fuel costs for Japan.

The first reactor in expected to go online within the next few months and I expect that many of them will be restarted later this year, as Japan has already made submissions for up to 14 nuclear reactor restarts.

While uranium bears believe that uranium stockpiles have been growing – and thus prices have not been moving – they have been growing because the Japanese have been accumulating in anticipation of the nuclear power plant restarts.

The moment these reactors are back online, the stockpiles will be consumed very quickly. More uranium will be required and prices should go up.

Gold – Down But Not Done

There’s been a lot of talk about where gold prices are headed.

Gold bears tell us that there is no reason why gold should move higher because investment demand is down. Gold bulls tell us that gold production cannot continue with gold below $1200, which would cause a major supply disruption.

The short term trend for gold remains unclear at this point, but it is by no means going to be the forgotten sector in 2014. It’s not sexy, but there’s sex appeal in gold stocks.

We’re already seeing many gold juniors rise aggressively this past week. However, we have seen this action before and it could simply be a rebound from extreme lows. If gold maintains its position above $1200, junior gold stocks could still do very well this year.

I stayed away from gold stocks in 2013, but I am bringing myself back in the game this year.

Precious Metals Manipulation

This week, Germany’s top financial regulator said possible manipulation of currency rates and prices for precious metals is worse than the Libor-rigging scandal, which has already led to fines of about $6 billion.

Via Bloomberg:

“The allegations about the currency and precious metals markets are “particularly serious because such reference values are based — unlike Libor and Euribor — typically on transactions in liquid markets and not on estimates of the banks,” Elke Koenig, the president of Bonn-based Bafin, said in a speech in Frankfurt yesterday.

… Bafin has also interviewed employees of Deutsche Bank AG as part of a probe of potential manipulation of gold and silver prices…”

I’ve written about gold manipulation many times last year. Will the recent investigation by Bafin lead to a major manipulation scheme discovery that will force gold prices to shoot through the roof? Maybe. But I suspect that “the powers that be” will likely try and shut this thing up.

Speaking of the “powers that be”…

The Fed – Still in Control

This week, Fed Chairman Ben Bernanke discussed his response to the financial crisis of 2008 and his reign as Fed Chairman.

%CODE88%

At the beginning of the interview clip, he was asked by the interviewer:

“The playbook you relied on was essentially given by a British economist in the 1860’s, Walter Bagehot, and his dictum was that in a financial crisis, the central bank should lend unlimited amounts to solvent institutions against good collateral, at a penalty rate. How useful in practice was that rule in guiding you?”

“It was excellent advice, used by central banks going back at least to the 1700’s.”

Anyone else notice the big smirk on his face?

The central banks have been controlling the money supply – and the world – since the 1700’s, as Bernanke mentioned. They will constrain the money supply if politics don’t agree with them, and they will increase it when politicians allow them to do whatever they want. Prepare for a bigger government more debt.

Long Robots, Short Humans

Last week, I talked about minimum wage and robots – how America will increase the minimum wage and how robots are replacing humans for work. If you didn’t read it, you should by CLICKING HERE.

This week, BofA Merrill Lynch chief investment strategist Michael Hartnett’s sent a note to his clients, which summarizes everything in one simple chart:

“The rise in the use of industrial robots and the decline in the number of manufacturing jobs for human beings (Chart 1) remind us of the technology theme.”

The chart speaks for itself.

Meanwhile, Obama is apparently looking at raising the minimum wage for Federal workers…go figure.

Until next time,

Ivan Lo

The Equedia Letter

We’re biased towards Uranerz Energy Corporation because they are an advertiser and we own options. We currently own shares at the time of this writing. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including Uranerz Energy Corporation. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Uranerz Energy Corporation and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

I am surprised the regulators are finally making it easier (if they go through with the proposal) for us little guys. None of us should be restricted from private placements! Let us choose our fate!

The problem is that when investors lose money, they complain and regulators react. That’s the problem with society: no one takes responsibility for their losses but take all the responsibility for their wins. When investors lose money, they blame someone else; the company, a newsletter writer, the news, a blog. Its a complete shame. And we wonder why regulators continue to make it harder for every one to invest.

Couldn’t have said it better myself. Hopefully this proposal goes through and gives us a more equal playing field.

any best thoughts on stocks for robots?

I would definitely need that pack of food because even if I had a knife and a bow and arrows, I would likely still starve. I couldn't shoot an arrow to save my life, and I'm not sure I would be able to stab anything with a knife and kill it. Yikes. Survival fail. Oh, and I would want Logan for sure as well. Cute nerd warrior? *dies of happiness*

ALL existing shareholders wherever they are from should have the right to participate before anyone else as there holdings are devalued when they are unable to do so

One of my investments did a private placement recently at a price well below the market and included VERY rich three year warrants as well! It STUNK! This garbage needs to stop as quickly as possible.

More of a reason why every one should be able to participate. companies need money to operate and grow, that’s why they’re public. You are a prime example of someone who shouldn’t invest. You made a bad investment decision and now you’re complaining.

Clearly our economic theories have been archaic and we now know that in hindsight and surely the TSX rulings on private placements were equally archaic and it is time to change. This proposal’s time has arrived and it will pass if these morons begin to think logically.

I hope the manipulation of gold and silver is not swept under the carpet they have stolen money from ordinary investors and should be punished like anybody else.In the past bank robbers robbed banks how times have changed Banksters are robbing ordinary people and dont get the punishment they deserve.The markets are rigged in favour of the rich.

I don’t get it. There already is an exemption for distributions to existing shareholders. It’s called a “Rights Offering”. I assume the real reason that small investors have been left out of privates for small TSXV-listed companies is the paperwork involved in a rights offering as compared to a private placement. The regulators had better get it right, therefore, because if brokers are required to get their retail clients to fill out subscription forms, etc. instead of merely being able to ticket them like any other trade or prospectus-based offering, this will not accomplish what everyone hopes.

A rights offering requires a prospectus. That’s why companies don’t do it because it costs too much.

Not a prospectus (at least, not necessarily), but rather a circular. Still, to Thomas’s point, paperwork. That’s why I say that brokers had better be able to merely ticket their clients. Requiring hundreds of small investors to fill out private-placement subscription forms for small amounts will render this initiative ineffective. I confess I haven’t read the proposal, so it may be dealt with. My comments stem from a career of seeing well-intentioned initiatives such as this go nowhere because of the realities of the business that regulators don’t understand. Anyone remember the Exchange-offering Prospectus?

I am sure they will still hVe to fill out sub forms. It’s a lot less work than a prospectus so it’s still worth it.

My two cents

Terrible idea! Over the past year we have seen lots of angry shareholders who have lost money, lots of money. These novice investors are the bulk of retail investors. It is bad enough that they fall for every promo and sales pitch thrown their way and lose their shirts in the process. I don’t think that the private placement rules should be changed to allow venture companies to prey on ignorant investors. This will just lead to more anger, frustration and losses for the retail investor.

investors shouldn’t invest if they can’t lose. The gold and silver sector were killed, doesn’t mean all companies are bad. That’s like saying when apple fell 50% last summer that apple is a bad company and people shouldn’t invest.

You are one of those people that make it crappy for everyone.

If you can’t take the heat, get out of the kitchen.

We are all at a disadvantage at the starting gate running days after the private placement gun goes off. It’s just another insider trading perk we suffer with !

If I want to earn more money from my investments, I’d use R.F. Culbertson – http://www.equedia.com

The idea proposed really isn’t a new one, it’s been around for years in the form of Shareholder Rights Offerings, but the ability to avoid a lot of the Prospectus “red tape” is a GIANT step in the right direction. If an investor who ALREADY has “skin in the game” by ALREADY being a Shareholder is willing to shoo the moths off their wallet and pony up some more CA$H they should be able to do so, no questions asked.

I’ve been exploring for a little for any high-quality articles or weblog posts in this kind of house .

Exploring in Yahoo I ultimately stumbled upon this site.

Reading this info So i am happy to exhibit that I have an incredibly good uncanny feeling I discovered exactly what I needed.

I such a lot indubitably will make certain to don?t disregard this web site and give it a glance on a constant basis.

Post writing is also a fun, if you be familiar with after that you can write otherwise it is

difficult to write.

Hey just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly.

I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

It’s perfect time to make a few plans for the long run and it’s time

to be happy. I’ve read this put up and if I

could I want to suggest you some fascinating things or suggestions.

Perhaps you can write subsequent articles regarding this article.

I want to learn more issues approximately it!

It’s very straightforward to find out any topic on web as compared

to textbooks, as I found this paragraph at this web site.

Thanks for the guidelines shared on your own blog. One more thing I would like to talk about

is that fat loss is not all about going on a

fad diet and trying to get rid of as much weight

as you’re able in a couple of days. The most effective

way to lose weight naturally is by having it bit by bit and obeying some basic tips which can help you to make the most from your attempt

to lose weight. You may learn and already be following some

tips, nonetheless reinforcing knowledge never damages.

I think that what you typed made a lot of sense.

However, think on this, what if you wrote a catchier title?

I ain’t suggesting your content is not good, however suppose you added something

that makes people desire more? I mean Equedia Investment Research The Outlook for

Canadian Stocks

I’m not sure where you’re getting your info,

but great topic. I needs to spend some time learning much more or understanding more.

Thanks for great info I was looking for this information for

my mission.

I really like it when folks get together and share views.

Great site, keep it up!

Tech – Crunch reports which a “member of Anonymous often known as Anonymous – Own3r is claiming responsibility, and helps it be clear this may not be an Anonymous collective action. The coupon codes can help to accordingly split into weekly plan, monthly plan, a few months plan etc. That’s the level of example you are attempting to show for a teammates and they also follow.

I go to see every day a few web sites and information sites to read posts, however this weblog offers quality based posts.

Amazing issues here. I’m very happy to look your article.

Thank you so much and I am taking a look forward to touch you.

Will you please drop me a e-mail?

Preheat oven to 350 degrees and spoon dressing over the salmon ration and.

You may achieve total remission or suffer daily from the

ups and downs with lupus. What is unusual, however, is that the headache

comes after a arrangement of irregular visual sensations.

I HAVE LOST A LOT OF MONEY IN Canadian STOCKS WHEN THERE has been private placements that I have not been able to participate in thus diluting my holdings

When I originally commented I appear to have clicked on the -Notify me when new

comments are added- checkbox and now every time a comment is added I receive 4 emails with the same comment.

Is there a way you can remove me from that service?

Cheers!

I delight in, result in I found exactly what I was having a

look for. You’ve ended my 4 day long hunt!

God Bless you man. Have a great day. Bye

Powerful post. I am glad you are okay. Even half a world way those images burned their way into my mind and memory. I know where I was, with whom I was. And realised at that time it would change our world. It has.

At times work culture can be so demoralizing; and sometimes the best armor comes in the form of a well conceived wardrobe. Your life is on a much bigger stage than the confines of your day gig. Most jobs rarely reflect our deepest aspirations or talents. Stay strong and keep your shit kicking boots handy!

When someone writes an paragraph he/she keeps the thought of a user in his/her mind

that how a user can understand it. Thus that’s why this piece of writing

is amazing. Thanks!

It’s really very complicated in this busy life to listen news on Television, therefore

I only use web for that purpose, and get the hottest information.

Help, I’ve been informed and I can’t become ignorant.

Nicce post. I learn something totally new and challenging on sites I stumbleupon every day.

It wil always bee helpful to read content from

other writers and use something from other sites.

I visit eachh day a few blogs and websites to read articles, however this

websitte presents quality based posts.

Tremendous issues here. I’m very glad to look your post.

Thank you so much and I am taking a look ahead to contact you.

Will you kindly drop me a mail?

As a private investor with a portfolio of Canadian stocks ,but living overseas , I would welcome the chance to participate as my portfolio is continually diluted by these private placings .

Would this apply to investors like me?

This paragraph presents clear idea in favor of the new viewers of blogging,

that really how to ddo running a blog.

It means that you get total discounts at the time of subscription. One should

keep in mind that communication lines for live

support are kept open for paid accounts, who are given top priority.

There are thousands of web-hosting service providers and all

of them claim to be the best.