Back on November 15, 2009, we released a report titled, “A New Standard in Silver.” In it, we featured a relatively unknown silver junior that was trading at $0.32.

The story went something like this…

Many years ago, a small Canadian exploration company went and purchased a group of abandoned silver mines. Like many companies hoping to strike the big one, their hopes relied on succeeding where all previous owners had failed. Just like the story of Goldcorp in our past newsletter, “The Gold Super Hero.“

Over the last 14 years before the Canadian junior snatched up this piece of property, it hadn’t produced a single ounce. But as the drills turned, so did the fortunes of this company and its investors. They uncovered over 195 million ounces of silver reserves! If at first you don’t succeed…

Over the last ten years, (this) silver stock has outperformed every major indices. It crushed the NASDAQ by 11,500%. It destroyed the Dow by over 12,000%. And it obliterated the S & P 500 by a whopping 18,000%.

To put in short, a measly $1000 investment into this company would have netted you $76,000. A $14,000 investment would have made you a millionaire raking in just over $1 Million!

This company is Silver Standard Resources (TSX:SSO)(NYSE:SSRI)

Because of their discovery, Silver Standard gave its investors over 850% profits, year after year, for nine straight years!

But guess what? We’re not here to talk about Silver Standard.

We’re here to talk about Silvermex Resources Ltd. (TSX-V: SMR)

Here’s why.

We caught wind of a news release that peaked our immediate attention and caused us to change our schedule, yet again. Silvermex Resources Ltd. (TSX-V: SMR) put out a press release stating that they have elected a few new directors:

Silvermex Resources Ltd. (TSX-V: SMR) announces that on November 4, 2009 it held its Annual and Special Meeting wherein the following directors were elected to the board: Arturo Bonillas, Bruce Bragagnolo, Duane Nelson, Joseph J. Ovsenek, Kenneth C. McNaughton and Michael H. Callahan.

Doesn’t sound interesting at first glance, I know. But take a closer look.

Both Bruce and Arturo are the founders and CEO and President, respectively, of Timmins Gold Corp. Timmins gold is focused solely on Mexico, where Silvermex operations reside. These two have taken Timmins’ from their 52-week low of CDN$0.20 to over a $1 dollar this past Friday. That’s a 500% increase.

Duane A. Nelson: Over 25 years of private and public sector experience with a focus on early-stage projects.

Michael H. Callahan: Vice President, Corporate Development of Hecla Mining Co., from 2002 to 2006. He served as President of Minera Hecla Venezolana, a subsidiary of Hecla Mining Co and also as Vice President of Hecla Mining Co. from 2006 to January 2009.

Hecla Mining currently has a market cap of $1.27 billion.

But that’s not the only thing that struck us.

Take a look at the other names.

Joe Ovsenek: Senior Vice President, Corporate Development of Silver Standard Resources Inc.

Kenneth C. McNaughton: Vice President, Exploration for Silver Standard Resources Inc since 1991.

With the new team in place, Silvermex Resources (TSX-V: SMR) certainly has our attention.

Here is the full news release: Click Here

It looks like we’re not the only ones. Over the past week since the announcement of their new directors, Silvermex has quietly crept up from just over CDN $0.26 to a close of $0.32 this past Friday.

Oh, and lets not forget that Silver Standard and insiders currently own a large chunk of shares in Silvermex. More than 20%…

That’s an excerpt from our past newsletter, “A New Standard in Silver.”

Of course, since that report Silvermex Resources Ltd. (TSX-V: SMR) has been pushing forward with significant corporate developments including both the addition of it’s new Chairman Arthur Brown (the man who built Hecla Mining, a company worth close to $1.5 billion) and completing the acquisition of the Rosario project.

At Friday’s close, their shares traded at $0.53

Whenever we select a featured company, we take into account many factors including strong asset holdings, near-term production potential, and the ability for management to excecute. All of this needs to be combined with a story that is relatively “under the radar” and thus, more likely to be trading at a discount when compared to their industry peers.

We knew the Silvermex story wouldn’t remain a secret for very long.

Since our newsletter, take a look at what other professionals in the industry had to say about Silvermex Resources (TSX-V: SMR):

Morgan Report/Silver Investor (11/30/09)

“Silvermex offers good value on both a market capitalization per oz and enterprise value per oz basis. It is also one of the lowest market capitalizations and enterprise values of its peer group. Additionally, this company has high leverage to an increase in resource estimates.

The market is currently giving little to no value for the infrastructure or production potential in place at the San Marcial/Rosario Project and very little if any value to the bulk-mineable portion of the deposits held.”

Bob Moriarty, 321gold (08/19/09)

“I went to Mexico three weeks ago to see some silver projects. Anyone who wants to believe there is some sort of shortage of silver has obviously never been to Mexico. There is a lot of silver yet to be mined in Mexico, far more than has been mined to date.

My first visit was to Silvermex (SMR-V). Silvermex has about 40 million ounces of 43-101 silver resource in addition to some gold, lead and zinc resources. It works out to about an ounce of silver per share. That should put some kind of floor under the share price. As it works out right now, investors are buying ounces of silver for less than $.20 an ounce. With near term production potential, that’s pretty cheap.

All of the properties belonging to Silvermex were past producers. They went out of production due to silver prices, not any lack of resources. For anyone who believes the price of silver is going up, Silvermex offers a low price way to buy silver ounces. The company believes they can be in production within 24 months at a capital cost of under $15 million. This is one of the most highly leveraged silver plays in the world.”

Lawrence Raulston – Resource Opportunities (12/1/09)

“Silvermex is a silver exploration and development company focused on near term production in Mexico. The company recently acquired a past producing mine and associated infrastructure, which is located close to one of its advanced-stage deposits. The company is investigating the feasibility of using the recently acquired facilities to treat ore from its deposit. The company’s flagship past producing San Marcial silver mine hosts 22 million ounces of silver in the measured, indicated and inferred categories, plus substantial lead and zinc values. The deposit is open in all directions. Silvermex plans to conduct expansion drilling of the deposit, but only after commercial production is achieved.

Silvermex now has a total of 42 million ounces of silver at its various projects giving it a favorable value per ounce compared to its peers.  <br

<br

style=”color: #000000;” />

More important than the ounces now in hand is the potential to greatly expand the resources, as well as the prospects for near-term production. The recently expanded management team provides a basis for confidence that the company will achieve its objectives.”

David Smith, The Morgan Report (12/17/09)

“In an interview on King World News, ‘Mr. Gold’ Jim Sinclair, spoke of the mortal danger that ‘onerous underwriters’ pose to a mining exploration company. Since exploration is capital-intensive, a lot of money goes into the ground before any gold/silver comes out. The management has to exchange shares for a loan-generally the only money coming into the explorer – which the underwriter then sells into the marketplace, depressing share price.

Sinclair says, ‘The whole play for the companies is to get out of exploration alone, into production in which they can make more money than the day to day expenses, and avoid Wall Street financing.’

. . .It would appear that Silvermex Resources, via its Rosario silver/gold/lead/zinc mine and surrounding past-producing properties, along with indications of a significant near-surface ore body, has been handed the opportunity and is developing the strategy by which to fulfill Jim Sinclair’s dictum of ‘graduating’ from an externally financed exploration company, to an internally financed (through production) mid-tier silver producer. And if their near-term strategy, supported by a well-conceived business model is successful, they shouldn’t have to ‘use a shovel’ to get themselves onto the profit side of the ledger.

Sinclair concludes: ‘Any junior which has this opportunity, should stop looking towards markets and go for that opportunity…if you have to use a shovel!’

. . .The existing Rosario Mill Site is the linchpin in the Silvermex plan to turn itself into a near-term silver producer.

Having in its possession a previously-permitted mill site, which can be reconstructed and put back into production in a relatively short time, is a major reason why management could be able to jump-start its efforts toward moving into the producer league. . .significantly cutting down the time AND dollars necessary to do so.”

Arthur Brown – Ex CEO and Chairman, Hecla Mining Company (11/18/09)

“After reviewing the technical data and visiting Silvermex’s core projects, I am quite confident that Silvermex has a real opportunity to become a significant mining company in relatively short time. The existing resources are high grade and near surface, in very wide structures, and these are generally amenable to development with a low amount of capital cost. The projects offer tremendous opportunity for resource growth.

I am excited to join Silvermex and help to guide this dynamic team which is committed to delivering shareholder value through a strategy of production at its projects and growth thru exploration on its significant land position. The ability for a young exploration company to attract such a talented Board of Directors, speaks highly of the company’s projects, management and future prospects.”

David Bond – silverminers.com – (12/15/09)

“One of the first companies out of the chute in what promises to be a robust December bull market for precious metals is Silvermex Resources, Ltd. or as we might now call it, Hecla Down South. In addition to a star-studded board of directors that now includes former Hecla Exploration Veep Mike Callahan, Silvermex has rearranged itself as a premier mining explorer and near-term producer of precious metals in the Rosario District of Mexico, of Sinaloa State.  Rosario is one of those properties you bump into in a lifetime that is too good to be true, except that it is. With the wide, high grade structures at San Marcial, San Juan and Plomosas and a trend of over 6 km’s this could be heap of at least 100 million ounces of silver, on the surface, not stepped out.

Rosario is one of those properties you bump into in a lifetime that is too good to be true, except that it is. With the wide, high grade structures at San Marcial, San Juan and Plomosas and a trend of over 6 km’s this could be heap of at least 100 million ounces of silver, on the surface, not stepped out.

Mike Callahan will keep this project honest.

David Morgan jumped on this prospect over the turkey-day weekend. We are a day late. But investing in Silvermex, we will not be a dollar short.”

Peter Grandich (02/2/09)

“Silvermex Resources Ltd. Was formed in 2005 and taken public in August of 2006 on the TSX Venture Exchange (TSXV: SMR). The company’s largest shareholder is Silver Standard Resources Inc. (NASDAQ: SSRI).

Silvermex’s primary objective is to increase shareholder value through the acquisition and development of near-surface, advanced-stage silver deposits in Mexico. The company holds an impressive 85,000 acres of mineral claims located in Mexico’s most prolific mining production regions.

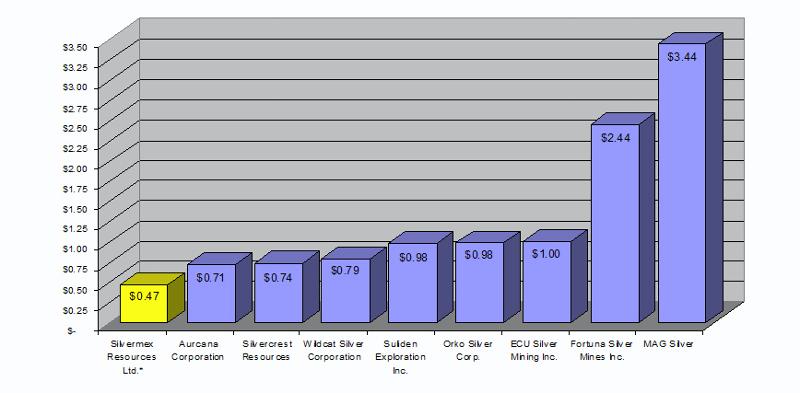

Bottom Line: 42.4 million Oz silver resources (NI 43-101), 240 million lbs of lead and zinc (NI 43-101), 1.42 Oz silver resources per share, 443% resource growth in last 24 months, High resource return on money raised, The lowest market cap within its peer group, Low MCAP Value per OZ ($0.13 per Oz), Near-surface, bulk-mineable projects, Proven management in Canada and Mexico.

Investors looking for undervalued situations which offer low MCAP valuations on established, in-ground silver resources with superior leveraged exposure to increased resources and silver prices, should consider this company carefully.”

Trey Wasser: More Stars in the Mexican Precious Metals Universe (Part II) Interview (01/11/10)

“Silvermex is a new management story. CEO Duane Nelson has just brought on Mike Callahan and Art Brown to help him manage the company. These are retired Hecla executives who could make this a very exciting story in 2010. Duane also added two new board members, Joe Ovsenek and Ken McNaughton. They both work for Silver Standard (TSX: SSO; Nasdaq: SSRI) and have been involved in many significant discoveries and mine developments. This quality of people doesn’t get involved in a junior compan

y unless they really see something they like.

Silvermex has an option on the San Marcial property, a near-surface deposit of over 20 million ounces of high- grade silver in Sinaloa State. They also just bought the old Rosario Mine from Aurcana Corporation. This is a mine that was operated by Grupo Mexico in the 1990s and was shut down due to labor issues and low metal prices. The infrastructure at Rosario will allow Silvermex to fast-track San Marcial into production. There is also a couple of years’ worth of production left behind by Grupo at Rosario that is very economical. There is significant exploration potential at the old mine, at San Marcial and within the district. Either of these projects on their own may not have been developable without a lot more exploration, but together they make a very powerful story and a near-term silver producer.”

Need we say more?

To sum it all up, here are some strong points that the above gentlemen have pointed out regarding Silvermex Resources (TSX-V:SMR):

- One of the most highly leveraged silver plays in the world

- Near-term silver producer

- Near-surface high grade deposits

- Bulk-mineable projects

- Superior leveraged exposure to increased resources and silver prices

- Lowest market-cap value per ounce of silver compared to its peers

- Projects offer tremendous opportunity for resource growth

- Market is currently giving little to no value for the infrastructure or production potential in place at the San Marcial/Rosario Project and very little if any value to the bulk-mineable portion of the deposits held

- High leverage to an increase in resource estimates

- Phenomenal management team including executives who are more accustomed to running billion-dollar companies (they must really like Silvermex’s potential by jumping on board to a company worth less than $30 million in MCAP)

Silvermex Resources (TSX-V: SMR) is the real deal. It’s not everyday you run into a junior company that has generated this kind of buzz and positive accolades from leading industry professionals.

If you haven’t already taken a look at their most recent presentation, take a look below:

Silvermex Resources (TSX-V: SMR) Presentation Jan 11 2010

A picture is worth a thousand words and the presentation will surely give you a much better understanding regarding the sheer size and potential of what Silvermex Resources (TSX-V: SMR) has to offer.

If Silvermex Resources (TSX-V: SMR) is good enough to bring a CEO who built a $1.5 billion company out from retirement, it’s good enough for us…

Until next week,

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

The full interactive version of this report can be found by following this link:

http://archive.constantcontact.com/fs005/1102243211822/archive/1102946624567.html

Forward-Looking Statements

This Newsletter and report contains forward-looking statements. Forward looking statements are statements which relate to future events. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans, “anticipates”, believes”, “estimates”, “predicts”, “potential”, or “continue or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect out current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggests herein. Except as required by applicable law the companies in this report do not intend to update any forward-looking statements to conform these statements to actual results.

Disclaimer and Disclosure

Regarding Historical Data: All resource estimates presented in this report for Silvermex other than their San Marcial project are historical and were prepared before the introduction of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Historical resource estimates may not be relied upon until they are confirmed using methods and standards that comply with those required by NI 43-101. The potential for the exploration target to replicate the historical resource, or to reach the indicated range of tonnages, is conceptual and is based on historical reports, which cite approximately lengths, widths, depths, grades and projections of the historical resource. Readers are cautioned that a qualified person has not completed sufficient exploration, test work or examination of past work to define a resource that is currently compliant with NI 43-101 for historical resource estimates in the Silvermex Reports. We further caution that there is a risk that exploration and test work will not result in the delineation of such a currently compliant resource. Neither Silvermex nor its personnel treat the historical resource estimate or the historical data as defining a current mineral resource, as defined under NI 43-101, nor do they rely upon the estimate or the data for evaluation purposes; however, these data are considered relevant and will be used to guide exploration as the Company develops new data to support a current mineral/resource estimate in accordance with the requirements of NI 43-101.

For more information on Silvermex Resources, investors should review the Company’s registered filings that are available at www,sedar.com.

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Equedia.com has been compensated to perform research on specific companies and therefore information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/termsr. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. Equedia Network Corporation., owner of Equedia.com has been paid $8,000 Canadian dollars plus gst per month for 2 months of advertisement coverage on Silvermex Resource Ltd. We have been paid by the company. These services includes but is not limited to the creation and distribution of reports such as this one written by Equedia.com. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation is a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.