You have probably witnessed a number of lithium stocks skyrocket in share price over the past year.

You probably asked yourself:

“Is it too late to jump into the fuel of the future?”

Many lithium stocks have exploded in value – right alongside a perfect storm of rising lithium prices and media hype.

But what if there’s a Company that hasn’t even scratched the surface?

What if there is a Company that very few people know about, yet has the potential to become a big player in the lithium space?

Today, I am going to introduce you to such a play.

It’s one you probably never heard of.

And that’s the best part because it means the opportunity has likely just begun.

In fact, it really did just begin.

Just this past Friday, the Company finally made the announcement I was waiting for.

But before I tell you about this undervalued opportunity and this very specific announcement, a little background is in order.

Equedia Special Report:

How to Invest in Lithium

Lithium is the world’s lightest metal and has a magical range of applications.

It not only powers almost every mobile device including laptops and mobile phones, but it’s even used to build nuclear weapons.

It’s no wonder why some analysts call it the “new gold.”

Others, like Goldman Sachs, call it the “new oil.”

That’s because Lithium is the key component used to fuel our next generation of transportation.

And unless you’ve been living in a bubble, you would know that Japanese, Korean, European, Chinese and American car manufacturers (Tesla, of course, and Chevy’s new Bolt) are all jockeying for a slice of the action.

In fact, Tesla – which announced 400,000 pre-orders (and climbing) for its affordable Model 3 – is not even the biggest consumer.

Tesla is just the tip of the iceberg.

Tesla is just the tip of the iceberg.

Chinese automotive manufacturer BYD is already making more than 100,000 electric cars a year and plans to start making other electric autos such as trucks and buses.

Just last week, it launched 51 new single decker electric buses in London, making it the biggest all-electric bus fleet thus far.

In India, Lithium Technologies started off with just 10 electric cabs. Within nine months, the Company has already grown to over 200 vehicles.

This massive boom in electric cars has caused the price of lithium to skyrocket over the last year.

Nothing New, But Getting Big

While lithium and the new generation of lithium ion batteries aren’t new, it’s the sheer amount of lithium required to build an all-electric vehicle that has auto manufacturers scrambling.

Goldman Sachs estimated that just one Tesla Model S battery contains more lithium than 10,000 smartphones.

It’s no wonder why Deutsche Bank expects lithium demand to nearly triple by 2025.

It’s also why the price of lithium has more than tripled in the last year in places like China, where prices of lithium have gone from US$7,000/tonne in September 2015 to over US$20,000/tonne today.

But lithium isn’t a scarce a resource as promoters of the metal will have you believe.

Lithium is actually everywhere.

In fact, our oceans are estimated to hold a whopping 230 billion tonnes of lithium!

The U.S. Geological Survey estimates there are 14 million tons of reserves of lithium globally – that’s more than 400 years of supply based on last year’s production.

And while lithium demand is expected to blow up over the next few years – thanks to Tesla and other global automakers jumping on the electric boom – there is still a lot of lithium available.

So why are prices skyrocketing and why is everyone scrambling for the resource?

The Big Four

As much 90% of today’s lithium market production comes from just four companies: Soc. Quimica & Minera de Chile SA, Albermarle Corp., FMC Corp., and China’s Tianqi Group.

That means they’re the ones setting the price for almost all of the world’s current lithium supply.

So why haven’t others entered the space?

Just because something is abundant, doesn’t mean it’s economic.

The costs of extraction and production of lithium is precisely why many lithium juniors, and others who have tried to enter the space, have failed.

If you want to be a lithium player, you better have economically viable lithium assets.

Cheap Lithium

Under current conditions, outside the rare occurrence of extremely high-grade hard rock operations, truly economic lithium comes mainly from one source: lithium found in salty water.

We call this salty water brine.

Why is brine the most cost effective way to produce lithium?

Because nature does most of the work; you simply drill a well, pump the brine, and let evaporation take its course.

But there’s a problem:

Not only does the brine have to have high enough concentrations of lithium, it also has to have the right chemistry. And even then, it’s still not enough.

You also need the right climate for nature’s evaporation process to take place.

And there is only one place on earth with lots of lithium brine and the right climate…

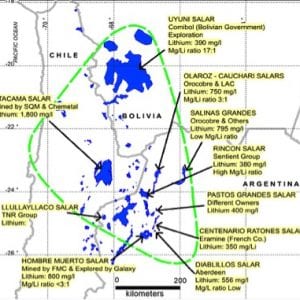

The Lithium Triangle

The most famous accumulation of lithium brine is in the Atacama Desert, in what has been dubbed the “Lithium Triangle” of Bolivia, Argentina, and Chile.

More than 70 per cent of the world’s long-term supplies of lithium is found within this triangle. And being the driest non-polar dessert in the world, it’s also the right climate for evaporation.

There is so much lithium here that people are calling Chile, Bolivia and Argentina, the new Saudi Arabia.

There is so much lithium here that people are calling Chile, Bolivia and Argentina, the new Saudi Arabia.

But don’t think anyone can just jump in and invest.

Bolivia, for example, has been quite hostile towards foreign investment – it wants to control and limit how much lithium is produced every year, and it just suspended lithium mining last year after opposition from local residents around the enormous lithium-containing Salar de Uyuni salt flats.

Meanwhile, Chile is not currently granting any new concessions. And if you’re going to develop lithium in Chile, you’re likely going to do it in partnership with the nationalized mining company Codelco.

Which is why if you want to get into the lithium triangle, you really only have one logical choice…

Argentina

Argentina is well-known for its world soccer elites, like Diego Maradona and Lionel Messi, beautiful landscape, and of course, beautiful women.

It’s also the world’s number three lithium producer.

According to Argentine mining secretary Jorge Mayoral, Argentina sits on resources that may surpass 128 million tonnes of lithium carbonate.

But that’s not all.

Unlike Bolivia and Chile, the new Mauricio Macri Argentine government that took over last year is all about business.

Via Reuters:

“Macri has begun making sweeping changes in a bid to return the country to economic orthodoxy, removing onerous capital controls and sending a message that the country is open for business again after more than a decade of protectionism.”

And one Company stands to benefit big from this opportunity.

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

In fact, they have direct contact with the very highest levels of the Argentine government.

Millennial Lithium:

My Next Lithium Play

Canadian Trading Symbol: TSX-V: ML

US Trading Symbol: OTCQB: MLNLF

Millennial Lithium (TSX-V: ML) is a brand new lithium play that just announced on Friday the closing of its flagship project in one of the most favourable lithium places in the world: Argentina.

Millennial Lithium (TSX-V: ML) is a brand new lithium play that just announced on Friday the closing of its flagship project in one of the most favourable lithium places in the world: Argentina.

Over the last six months, Millennial Lithium has been aggressively acquiring prospective lithium assets in the Argentinean portion of the Lithium Triangle. To date, the Company has completed the acquisitions of three highly prospective projects.

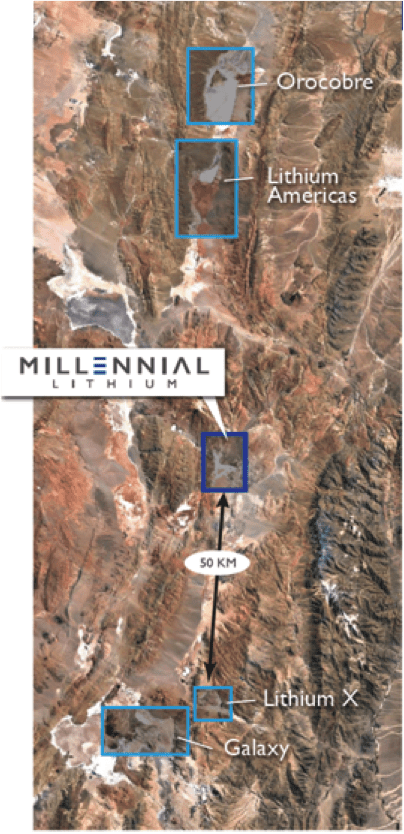

Together, the assets cover roughly 7,500 Hectares, smack in the middle of other lithium properties owned by companies with market caps well above Millennial Lithium’s current value.

The Company’s flagship project is the 100% owned Pastos Grande Project.

The Pastos Grandes Salar is located 231 km from the city of Salta at an elevation of 3800 meters and sits right along the Borate Belt in Argentina, where boron and lithium are the lithophile elements.

In Layman terms, it sits in an area home to a lot of lithium.

In fact, you can literally draw a line from Salar del Hombre Muerto, where FMC (one of the world’s largest producers of lithium) is currently producing, up through a number of lithium projects in development, to the top end were Orocobre is also producing.

In fact, you can literally draw a line from Salar del Hombre Muerto, where FMC (one of the world’s largest producers of lithium) is currently producing, up through a number of lithium projects in development, to the top end were Orocobre is also producing.

Along that trend, you have Millennial Lithium’s Pastos Grandes project, which sits right in the place you’d expect it to.

There are major crustal features that trend northwest-southeast that intersect the borate and lithium trend. And precisely where they intersect, you have these basins that were fed by volcanoes that were spewing out the lithophile elements.

And that’s where you find the lithium brine.

If you’re looking for an elephant, you look in elephant country.

And Millennial is right in elephant country, smack in the middle of a huge trend, with an asset that has all the earmarks of a strong lithium project.

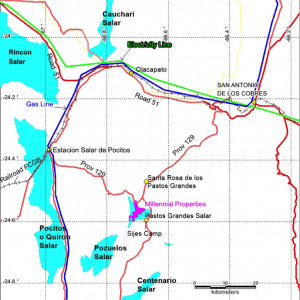

The project is accessible year-round using paved highway and dirt roads from Salta.

Just 12 km north of the properties is the Los Pastos Grandes Village, which is home to 120 inhabitants, and provides basic infrastructure including a domestic water system and diesel-based power generation of 220 volts.

Just 12 km north of the properties is the Los Pastos Grandes Village, which is home to 120 inhabitants, and provides basic infrastructure including a domestic water system and diesel-based power generation of 220 volts.

A 600MW, 375kVolt power line between Salta and Mejillones in Chile passes 53 km to the north of the project, with a natural gas pipeline passing through San Antonio de los Cobres to Salar de Pocitos, just 26 km northwest from the Millennial Lithium properties.

Not Everyone is a Winner

While being on trend in elephant country is a great start, it takes more than just that to become a great project.

As I mentioned before, lithium has to be found in high enough concentrations in order to make economic sense.

Today, that magic number for lithium brine is between 300-600 mg/L.

Eramine Sudamerica SA, the previous owners of the Pastos Grandes project, had previously invested over US$4 million over a 2 year period in 2011 and 2012, and conducted extensive development work and exploration studies.

So far, six exploration wells have been drilled to determine geochemistry of the brine/aquifer which included core recovery and pumping tests.

Evaporation tests were carried out in a pilot plant on site.

Three brine samples collected in the southwestern sector of the Pastos Grades properties had values between 602.2 to 665.9 mg/L of lithium and 6342 to 7146 mg/L of potassium.

Overall data from Pastos Grandes shows a range of between 500-600 mg/L.

So far, that certainly checks the grade box.

But there’s more.

Going Deeper

History has proven that as you go deeper, grades generally improve.

In fact, many of the current lithium resources in play came into play as a result of going deeper.

For example, Orocobre – one of the few lithium producers in Argentina – started near surface, with their first campaign no deeper than 50 meters. They designed their process around the brine they found but in the end, they couldn’t really extract that brine very well. So they went and drilled deeper and lo and behold, down at 350 meters, they found very nice brine.

That’s because brine is heavier than water, so it tends to sink. The more junk you have in the fluid, the denser your brine is and the deeper it goes, which is why it’s no surprise to find these things at depth.

Millennial Lithium hasn’t drilled passed 160 metres at Pastos Grandes.

But that’s not all.

Once you get the brine, you put it in a pond and the water evaporates. This process requires a lot of help from mother nature.

Luckily, at Pastos Grandes, the climate evaporates the water at a fantastic rate, so instantly you can increase the grade.

But grade isn’t the only thing that makes a great lithium asset. As I mentioned earlier, you also need the right chemistry.

An Important Metric: Mg to Li

Grade is important but more important than grade is the quality of the brine.

For example, you’ll see some huge resources of lithium like the Salar de Uyuni in Bolivia.

But the problem with it is that it has something in the order of a 25-to-1 magnesium to lithium (Mg to Li) ratio.

This is an important metric because magnesium tends to want to hang around with the lithium, but you have to get it out. The more magnesium there is to lithium, the more reagents and energy it takes to separate the two, which all leads to higher costs.

Now a common industry axiom says that the ratio of Mg to Li in brine needs to be below the range of 9:1 or 10:1 to be economic.

From the data we have so far for Pastos Grandes, the Mg to Li ratio is about the same as at Salar de Atacama, which has some of the lowest Mg to Li ratios in the world at between 6-8 to 1.

Anything around the 5-8 to 1 range, especially at today’s prices, would be considered world class.

And so far, Pastos Grandes is showing it will be in that range.

But how does Millennial stack up with its peers?

Comparables

First of all, let’s take a look at the market cap of some of the comparables. Clearly, Millennial has upside in value when you compare the companies based on market cap alone.

But what about the other numbers?

Take a look:

As you can see, Millennial not only has the lowest market cap, but also the lowest amount of shares outstanding. So from a share structure perspective, it’s one of the best.

But, unlike the others, it also has 100% of the project.

While most other lithium plays are focused on exploration, Millennial’s team wants to be one of the first to actually put their asset into production.

And with Iain Scarr leading the way, they might just be one of the first.

Iain Scarr is Millennial’s VP of Exploration and Development and is well-known in the lithium industry.

He spent 29 years with Rio Tinto, where he was responsible for multiple discoveries in North and South America and Africa, and worked on the commercial justification for the Jadar lithium-borate resource in Serbia.

After Rio Tinto, Iain joined Lithium One Inc., where he was responsible for bringing the Sal de Vida lithium Brine project in Argentina through feasibility with Galaxy Resources.

Following Galaxy, Iain completed the definitive feasibility on the Rincon project with the Enirgi Group.

He is a man who knows his lithium.

And he not only plans on expanding Millennial’s assets through exploration and acquisitions through his connections in Argentina, he plans to fast-track Pastos Grandes to production over the next few years.

Right Place, Right Time

Drilling started at Pastos Grandes on November 15th, The first hole was completed on time and on budget. The size of the brine aquifer and the composition of the sediments exceeded expectations and the density of the brine recovered was very favorable. A second rig was immediately mobilized to drill a production-scale pumping test well.

Millennial is now drilling at a second location and plans are in place to move to a third location, which will give the Company enough data to produce an initial resource estimate.

Assay results from all the holes will be released as we receive them, most likely starting in the third week of January. From our initial analysis, we expect these to meet or exceed our expectations.

But that’s not all.

Millennial also acquired other promising nearby assets.

The second project Millennial acquired was the 100% owned Cauchari East Project.

Cauchari East covers an area of 2,990 hectares on the eastern side of the Cauchari-Olaroz Salar, adjacent to Orocobre’s producing Salar de Olaroz and Lithium Americas Corp.’s advanced-stage Cauchari-Olaroz.

The property displays geological characteristics common with the deeper, buried salar-type mineralization that has been proven for both of those projects.

Gravity and magnetotelluric (MT) survey profiles to the south of the property reported in the Orocobre technical report, and VES (vertical electrical sounding) survey results to the north of the property as reported by Lithium Americas both indicate that the brine-hosting aquifers extend beneath the Cauchari East project.

* The Cauchari East project is adjacent to the ground which Advantage Lithium recently paid Orocobre $36 million US for… and Advantage is only getting 75% of the project!

Millennial plans to drill the Cauchari East Project in second quarter of 2017

That means come late spring, or early summer, we’re going to get even more news that could help bolster Millennial’s share price.

Millennial’s third project is the 100% owned Cruz Project

The 2,500-hectare Cruz property lies at the north end of the Pocitos salar basin in Salta province, Argentina.

The Cruz property is at the junction of a large north-south fault system and the northwest-southeast megastructure along which lies the Rincon volcano, the source of the Rincon salar lithium brine occurrences in the Rincon salar basin immediately north of the Pocitos salar basin.

Historical drilling at the Pocitos Salar have indicated brine containing 400 mg/l lithium occurs at shallow depths. Ady Resources recently released a Definitive Feasibility Study on their Salar del Rincon operation:

Probable reserves 1.2 million tonnes lithium carbonate equivalent (LCE)

Measured and indicated resources 3.5 million tonnes LCE

Inferred resources 4.8 million tonnes LCE

Capital expenditure

Initial net capital expenditure $720.1-million (including 8.62-per-cent contingency)

Project economics

Ungeared after-tax 9% NPV $1.36-billion

Ungeared after-tax IRR 30.80 per cent

Payback period 4.13 years from start of commercial production

Mine production

Life of mine 24.5 years

Average annual production 50,000 tonnes LCE per annum

Total cash operating cost $2,070 per tonne LCE for life of mine

* Millennial’s Cruz property is only separated from the Rincon Salar by the Rincon Volcano, which is the source of the lithium brine. (see attached map)

Millennial will be drill testing the Cruz Property starting in February.

Going forward, Millennial continues to evaluate new projects and is aggressively developing its excising projects with a goal of initial production within 3 years.

Over the next few months, Millennial is going to prove to the market that they’re advancing Pastos Grandes, while advancing and adding a pipeline of other promising projects.

And if all goes as planned, there should be no reason why Millennial doesn’t achieve at least the same value as some of their comparables. If it does, that’s some major upside from here.

Risks

As always, there are risks to everything. It is our job as investors to judge if the reward outweighs the risk.

First and foremost is management’s ability to execute on what seems to be a very promising asset. Millennial has an incredibly valuable asset in Iain Scarr, but it’s also beefing up the help with the addition of Dr. Vijay Mehta, as part of the technical advisory board.

Dr. Mehta has an extensive forty-five years of experience in the field of Ore and Brine-based technology, which is used for the recovery of Lithium, Potash, Magnesium, and Boron. He was also previously responsible for coordination and communications with lithium producers around the world.

In short, he is very well-known in the industry and his addition is sure to spur interest into the Millennial Lithium story.

Then there’s always the risk of the asset itself.

Just like other mining operations, things may not always go as planned. But given the data and Iain’s technical expertise, Millennial’s Pastos Grandes project, along with its pipeline of other assets, look very promising.

Then, of course, there’s a chance that we may find alternatives to Lithium-Ion technologies. But if you do some research, you will see that there really are no other feasible near-term economic alternative power solutions.

Millennial has CDN$5 million in the bank with just over 27.3 million shares issued and outstanding. Even on a fully-diluted bases, there would be only 40 million shares out but nearly CDN$12 million from the exercise of warrants and options.

This solid share structure is far better than any of its comparables, which will most certainly be a plus for when the Company decides to raise more money.

Conclusion

When you consider that pure electric vehicles account for less than 1% of all vehicles on the road, the potential growth for lithium is astonishing.

Elon Musk has already told us that for Tesla to meet its target of 500,000 cars a year, Tesla would basically need to absorb the entire world’s lithium-ion production.

Elon Musk has already told us that for Tesla to meet its target of 500,000 cars a year, Tesla would basically need to absorb the entire world’s lithium-ion production.

Yet, Tesla is just the tip of the iceberg.

China is expected to build twice as much new lithium-ion battery capacity as the U.S. by 2020. And while Tesla’s Gigafactory in Nevada may be the biggest factory being built, it is only one of at least 12 such projects across the world.

In other words, the lithium market is only getting bigger and those who have a piece of the pie now will control it. I expect that as many of the juniors advance their project, the big guys will attempt to buy them in order to maintain this control.

That means investors in these early explorers and developers could reap the rewards – but only if they invest in the right assets.

The lithium boom has only just begun and there aren’t many players.

I believe Millennial Lithium is one of them.

And that’s why it’s my next lithium play.

Millennial Lithium Corp

Canadian Trading Symbol: (TSX-V: ML)

US Trading Symbol: (OTCQB: MLNLF)

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure: We’re biased towards Millennial Lithium Corp. because they are an advertiser. We currently own shares purchased in a private placement announced on July 19, 2016. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Millennial Lithium Corp. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Millennial Lithium Corp. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

I am brand new to equedia but have been referred by friends in financial research who credit you with bringing to light a number of relatively unknown companies.