The CEO of the world’s largest and most successful bank just gave us a blunt warning last week.

“We shouldn’t be stockpiling Bitcoin—we should be stockpiling guns, bullets… and rare earths.”

Jamie Dimon’s point was simple: the next conflict won’t be won with memes or digital tokens, but with hard assets and the critical minerals that power weapons, grids, and data centers.

He’s not the only heavyweight waving the flag.

Last week, we told you how world-class players like BHP, BlackRock, and even the Saudis are already moving their chips onto the board—from antimony to uranium, cobalt to scandium, a quiet race is underway to acquire the world’s strategic metals.

But why?

The battle over economic dominance is nearing a tipping point.

America may boast the planet’s deepest pockets and deadliest arsenal, but its fiercest economic rival holds a different ace—one powerful enough to knock the U.S. off the top.

Especially if America ignores it.

I’m talking about the supply of critical minerals.

And the numbers are staggering.

Domination

China now dominates global output, supplying about 70 % of world production of rare earths and graphite, 98 % of gallium, 88 % of magnesium, and more than 80 % of tungsten.

This dominance extends to refining, giving China control over 86 % of the market for key energy-transition minerals in 2024, up from 82 % in 2020.

The importance of those minerals cannot be overlooked.

They are the key to semiconductor production, nuclear energy, batteries, integrated circuits, and military technologies. Without them, there are none of those things.

Want advanced AI? Yup—you need them.

Want advanced military tech? Yup—you need them.

Want new smartphones? Yup—you need them.

You get the point.

And China is using this flex to assert its power.

Via the International Energy Agency:

“In December 2024, China restricted the export of gallium, germanium, and antimony—key minerals for semiconductor production—to the United States. This was followed by further announcements in early 2025, including restrictions on tungsten, tellurium, bismuth, indium, molybdenum, and on seven heavy rare-earth elements.

…Currently, more than half of a broader group of energy-related minerals are subject to some form of export controls. These restrictions are not only increasing in number but also expanding in scope to cover not just raw and refined materials but also processing technologies, such as those for lithium and rare-earth refining.”

So it should come as no surprise that the United States is scrambling to fight back.

In March, President Donald Trump signed an executive order demanding swift action to ramp up domestic mineral production.

Earlier in May, in a groundbreaking move to bolster domestic critical mineral production, the U.S. Department of the Interior greenlit a uranium-and-vanadium mine in Utah—marking the nation’s first project approved under a newly accelerated 14-day environmental review process, initiated in response to the national energy emergency declared by President Donald J. Trump.

And this is just the beginning.

Just ask Perpetua Resources, who earlier in May obtained the final federal approval for its Stibnite gold-antimony project in Idaho after nearly a decade of permitting.

Perpetua’s Stibnite Project contains 4.8 million ounces of gold and 148 million pounds of antimony—and is seen as the only viable U.S. source of antimony production.

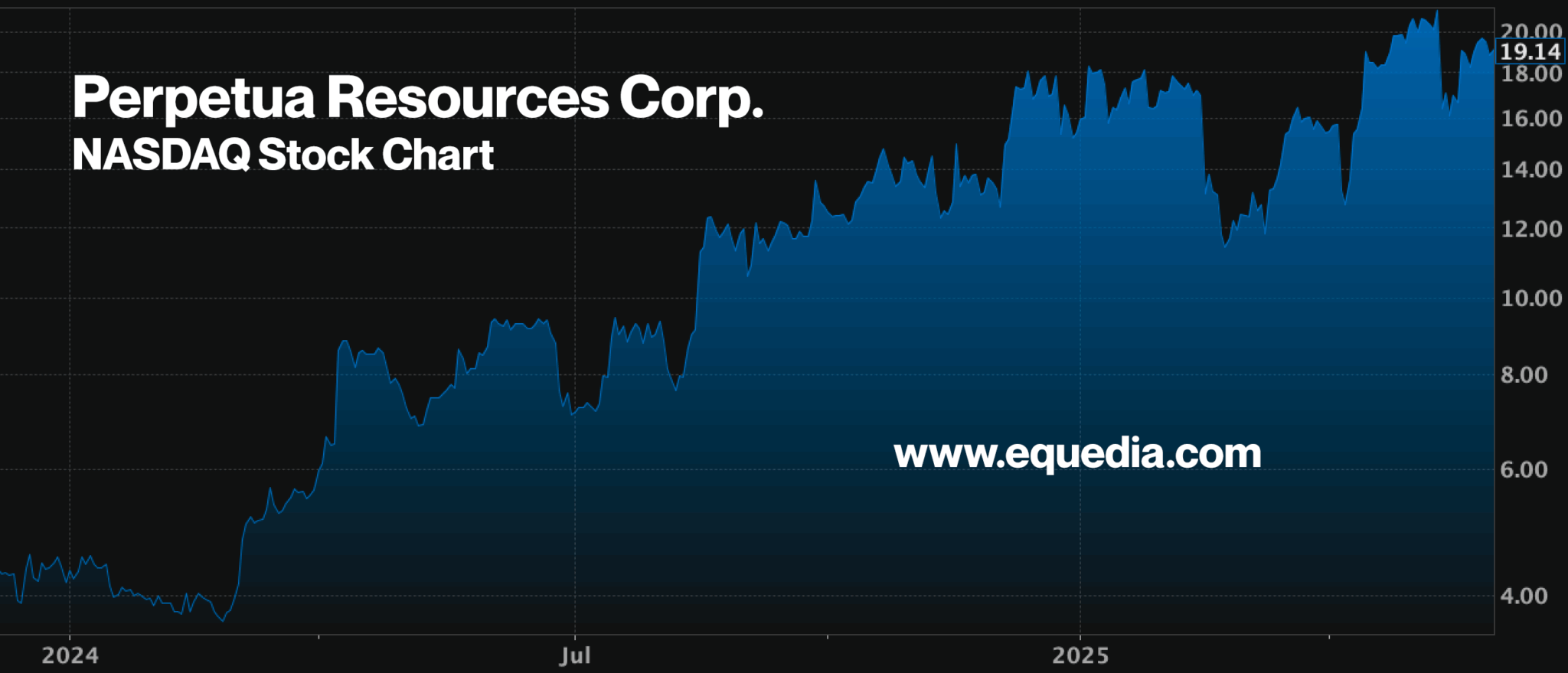

Now take a look at their stock chart.

In just over one year, shares of Perpetua have climbed from less than C$4 per share to over $20—an easy five-bagger.

Now, of course, we’re not here to tell you about a company whose shares have already gone up five-fold in the last year. We’re not a news outlet—we’re an investment newsletter.

We’re here to tell you that bankers and institutions are aggressively looking for key mineral assets in the United States—especially those in the antimony-gold space like Perpetua Resources—in hopes of making the type of gains Perpetua has.

But there’s a problem: there simply aren’t many gold-antimony projects in the United States.

And if you’re looking for the potential of even bigger returns, like those found in the junior-exploration sector, there are even fewer.

But we’ve found one.

In fact, it’s an extremely rare and advanced gold-antimony exploration play that has seen tremendous drill results.

Pay close attention, because this company could be the next big gold-antimony play.

I’m talking about…

NevGold Corp.

(TSXV: NAU) (OTCQX: NAUFF) (Frankfurt: 5E50)

NevGold is an advanced-stage exploration gold junior with rare upside potential.

Recall, we brought this company to your attention before (for a deeper dive, click here). Full disclosure, we not only own shares, but Nevgold is and has been an advertiser.

Today, this letter will be short and sweet—we want to make sure you know about this first before more catalysts arrive.

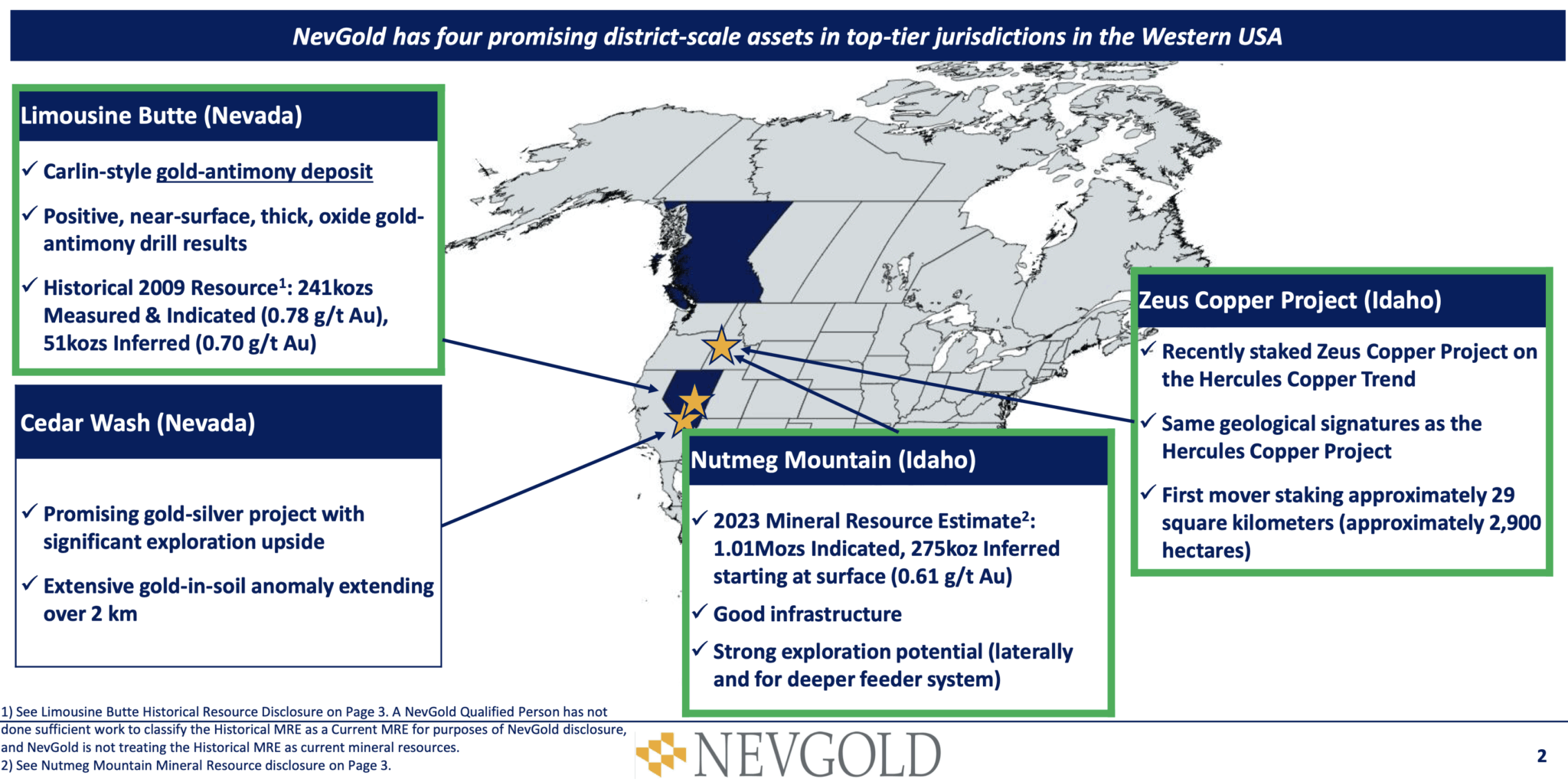

NevGold owns four promising district-scale assets in top-tier jurisdictions in the western USA.

They are:

Limousine Butte Project (LBP), Nevada

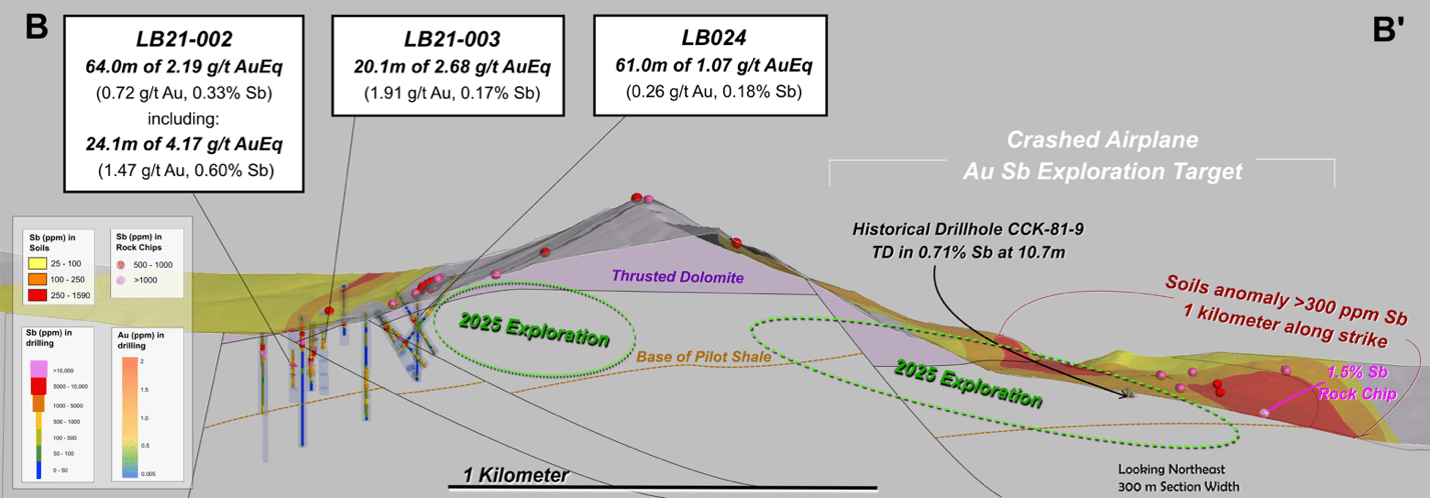

NevGold’s 100 %-owned Limousine Butte Project is a Carlin-style gold-antimony deposit that has consistently delivered positive, near-surface, thick, oxide gold-antimony drill results.

Oxide gold deposits are highly favored in mining due to their economic and operational advantages over sulfide ores. Their free-milling nature allows for cost-effective extraction through simpler methods like heap leaching, which yields high recovery rates of 90–95 % and requires less complex infrastructure, reducing capital expenditure. Furthermore, oxide gold’s smaller environmental footprint can streamline permitting.

Near-surface deposits also enable cheaper open-pit mining, and faster processing times accelerate cash flow—enhancing profitability even in volatile gold markets. With gold nearing $3,300/oz, oxide deposits can be cash-flow machines once in production.

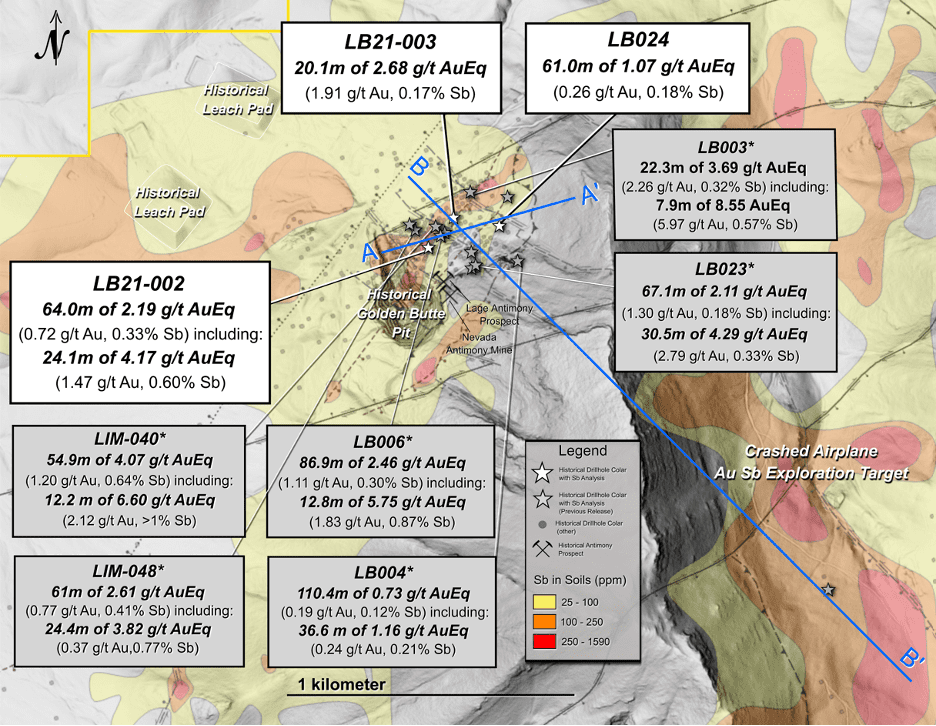

Recent drilling continues to deliver impressive, high-grade intercepts of gold and antimony, setting the stage for a significant resource update by year-end.

Just take a look:

Headline after Headline

Since March, NevGold (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) has continued to deliver positive drill results—headline after headline:

-

March 26 2025 – NevGold Discovers Further Significant Gold-Antimony Results: 2.46 g/t AuEq over 86.9 Meters (1.11 g/t Au and 0.30% Antimony), Including 5.75 g/t AuEq over 12.8 meters (1.83 g/t Au and 0.87% Antimony), and Also Including 6.77 g/t AuEq over 6.7 meters (2.29 g/t Au and +1% Antimony) at the Limousine Butte Project, Nevada

-

April 10 2025 – NevGold Discovers More Significant Oxide Gold-Antimony Results: 1.70 g/t AuEq Over 169.2 Meters (0.89 g/t Au and 0.18% Antimony), Including 2.85 g/t AuEq Over 54.4 Meters (2.26 g/t Au and 0.13% Antimony), and Also Including 13.15 g/t AuEq Over 3.1 Meters (0.76 g/t Au and 2.76% Antimony) at the Limousine Butte Project, Nevada

-

April 24 2025 – NevGold Discovers More Significant Oxide Gold-Antimony Results: 2.11 g/t AuEq Over 67.1 Meters (1.30 g/t Au And 0.18% Antimony), Including 4.29 g/t AuEq Over 30.5 Meters (2.79 g/t Au And 0.33% Antimony), and Also Including 7.12 g/t AuEq Over 16.8 Meters (5.05 g/t Au And 0.46% Antimony) at the Limousine Butte Project, Nevada

-

May 13 2025 – NevGold Adds More Significant Oxide Gold-Antimony Results: 2.19 g/t AuEq Over 64.0 Meters (0.72 g/t Au And 0.33% Antimony), Including 4.17 g/t AuEq Over 24.1 Meters (1.47 g/t Au And 0.60% Antimony), and Also Including 10.86 g/t AuEq Over 4.50 Meters (1.43 g/t Au And 2.10% Antimony) at the Limousine Butte Project, Nevada

For all you mining buffs, you know just how good these drill results are.

Multiple intercepts across Resurrection Ridge and Cadillac Valley reinforce that this isn’t a one-zone project—it’s an expanding oxide system that already spans over 5 kilometers of strike.

Historical data also reveal strong antimony numbers previously capped by assay-detection limits. NevGold is currently re-assaying those intervals, which could further upgrade the project’s already impressive metrics.

That means the market hasn’t yet fully grasped the scale of what NevGold is uncovering at LBP.

These oxide-style intercepts point not only to scale but also to strong economics, thanks to near-surface mineralization.

Limousine Butte’s ore sits in the Devonian Pilot Shale—the very host rock that forged Nevada’s legendary Carlin gold belt. Layer in jasperoid breccias laced with stibnite and stibiconite, and you have the textbook signature that majors pursue.

The ground has already proven its mettle: past operations at the Nevada Antimony Mine and Lage Antimony Prospect, both inside today’s claim block, shipped stibnite running better than 9 % antimony. That production pedigree points to exactly the kind of upside modern investors crave.

In other words, LBP has a significant geological edge: a Carlin-style system with critical mineral upside.

Could NevGold become the next Perpetua Resources?

Perpetua Resources currently has a market cap of over C$1.3 billion (about US$1 billion).

Over the last decade of permitting and project advancements, Perpetua’s Stibnite Project has grown to contain 4.8 million ounces of gold and 148 million pounds of antimony—and is regarded as the only viable U.S. source of antimony production.

But with continued positive drill results and an upcoming initial resource estimate expected by the end of 2025, NevGold and its Limousine Butte Project could be positioning to challenge that narrative.

And institutions have taken notice.

Money Pouring In

NevGold (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) just closed a C$6 million upsized financing led by Clarus Securities, one of the top-performing boutique investment banks in the country. Clarus has long-standing credibility with billion-dollar funds and a track record of spotting market winners early.

Recall that Clarus Securities was a lead financier of K92 Mining—a company we featured back when shares were trading below C$2. Today, K92 Mining trades above $14 with a market cap north of $3.4 billion.

NevGold’s oversubscribed financing is a vote of confidence from deep-pocketed institutions—which is precisely why we also purchased more shares, significantly increasing our position.

NevGold’s market cap after this financing is just under C$50 million; Perpetua is $1.3 billion.

We believe that if NevGold continues to deliver positive results at Limousine Butte, it has a serious shot at becoming the next gold-antimony winner.

But despite all of that, NevGold still offers more blue sky.

Limousine Butte may hog the spotlight given the urgency in the United States for critical mineral assets, but NevGold’s story is bigger than one asset.

NevGold’s Idaho Zeus Copper Project is already flashing the telltale signs of another company-maker. The ground lies on the same mineralized trend as Hercules Metals, just a few kilometres from one of Idaho’s most talked-about copper finds. That discovery vaulted Hercules from C$0.12 to C$1.50 and even pulled Barrick Gold in as a strategic backer, paying C$30 million for a 15 % stake.

NevGold has now pushed Zeus to the front burner, and with its prime address and district-scale footprint, a second breakout discovery could land sooner than the market thinks.

Multiple Catalysts Ahead

Here’s why 2025 could be a game-changer for NevGold:

-

Maiden Resource by Year-End – Limousine Butte’s first NI 43-101 is slated for Q4, pinning a hard-dollar value on the ounces in the ground and opening the door for heavyweight funds to pile in.

-

Grade-Uplift Catalyst – Re-assaying of previously “capped” antimony intervals is underway; uncorking those numbers could spike the Au-equivalent grade and force analysts to sharpen their pencils.

-

Metallurgy Milestone – A 100 kg bulk sample is in the lab right now to lock down the optimal flowsheet for co-recovering gold and antimony—positive results slash technical risk and development CAPEX in one swoop.

-

Drills Still Turning – Fully permitted programs at Resurrection Ridge and Cadillac Valley aim to push the mineralized corridors farther and deeper, stacking fresh ounces onto the resource.

-

Institutional Tailwind Building – Clarus Securities’ diligence and capital set the stage for a broader wave of institutional money to follow.

Conclusion

The world is finally grasping just how razor-thin the critical mineral supply chain really is. Early believers in Perpetua rode that wake-up call to massive profits.

NevGold (TSXV: NAU) (OTCQX: NAUFF) (Frankfurt: 5E50) could be next, armed with:

-

A proven gold-plus-antimony oxide system in Nevada—already punctuated by double-digit AuEq hits.

-

Blue-sky torque at Zeus Copper in Idaho, a mirror image of the Hercules trend that sent a junior parabolic.

-

Smart-money endorsement from Clarus Securities, potentially leading to further institutional support.

-

A fully permitted flagship, ready to scale the moment a maiden resource drops.

Things are lining up: geology, permitting, capital, and timing.

Gold just blasted through $3,500 an ounce in April, chalking up 28 record-setting closes so far in 2025.

Antimony has done one better—catapulting from obscurity to jaw-dropping highs of over $50,000 per tonne, shattering every price chart on record.

Jamie Dimon is telling us to hoard rare earths, not crypto. BlackRock and BHP are elbowing for critical-mineral deals. Yet that torrent of capital has very few places to go—especially if you’re looking for antimony-gold stories to flow into. Perpetua already ran 400 %.

For us, that means NevGold is still parked at pocket-change levels with drills turning and a maiden resource due this year.

If Wall Street titans and trillion-dollar funds are scrambling for critical mineral exposure, where does that leave everyday investors?

That’s why we are invested in NevGold—and why you should be doing your due diligence as well.

Nevgold Corp.

Canadian Trading Symbol: NAU

US Trading Symbol: NAUFF

German Trading Symbol: 5E50

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Nevgold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

This newsletter (this “Newsletter”) is provided by Equedia Network Corporation (“Equedia”, “we” or “us”). Your access to and use of this Newsletter is subject to and governed by this disclaimer and Equedia’s Terms of Use, which is available at http://www.equedia.com/terms-of-use (the “Terms”). Please read this disclaimer and the Terms carefully. This Newsletter is not an offer to sell or a solicitation of an offer to buy any securities or commodities. To the extent that anything contained in this Newsletter may be deemed to be investment advice or a recommendation in connection with a particular company or security, such information is impersonal and is not tailored to the needs of any specific person. In addition to historical information, this Newsletter may contain forward-looking statements, including statements with respect to third parties regarding product plans, future growth, market opportunities, strategic initiatives, industry positioning, customer acquisition, the amount of recurring revenue and revenue growth. In addition, when used in this Newsletter, the words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding a third party’s focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this Newsletter involves risks and uncertainties that may cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those disclosed by the parties referred to in this Newsletter in their public securities filings. You should carefully review the risks described therein. You should not place undue reliance on the forward looking statements in this Newsletter, which speak only as of the date such statement was published. Equedia undertakes no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of their publication, except as required by law. As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. Equedia and its directors own shares of Nevgold (NAU) at the time of this writing. In May 2025, Equedia was paid C$350,000 for a six month advertising contract for NAU, which includes expenses for advertisements on third party sites or other third party coverage that we arranged for NAU. These services were paid for by NAU. We have also previously been compensated by NAU for advertising contracts which have expired. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

I’ve asked this question of Equedia before but never received an answer so am trying for the third time.

I’ve read your newsletter with considerable interest for years now, but have never been able to discover exactly what Equedia actually does. Do you offer a subscription investment advisory? For what kind of subscribers – investment professionals, high net worth individuals, or Larry-Lunchbucket investors such as I am?

If the latter, how does one subscribe and at what price?

I’m surprised that Power Metals Ltd got over looked. PWM.v. An Ontario operation.

All the other metals could be useless without Cesium and PWM is on track to be the #1 source.

Talk about a 10 bagger! Great story.

Cesium is necessary in cell phones, military items. and more.

Take a look on their web site.

70 cents looks cheap as hell to me. I’ve been trading for 50 + years

Power Metals took off this week as it released news that it is the 4th largest Cesium site in the world.

It went from .70 to 1.00 immediately then settled down to .97. Huge volume as the big investment firms rushed to get positioned for the next move up.

Take a look.