Something incredible is happening.

Not since the dotcom boom have I seen so much money poured into a sector with such reckless abandon.

Even silicon valley gurus, such as Pay Pal co-founder Peter Thiel and his Founders Fund, are invested.

And the market is asking for more.

In fact, the feeding frenzy has even caused stocks within the sector, in one of the world’s largest stock exchanges to crash – not once, but FIVE times in one day.

Despite the parabolic rise, big funds and institutions continue to pour money into this sector.

This may be considered one of the biggest new markets of our time.

And its about to get even bigger.

In just a bit, I am going to tell you why a specific event next week could send these stocks even higher.

More importantly, I am going to introduce you to what I believe is one of the most undervalued companies in the space.

But before I do, its important to understand why.

The End of Prohibition Part II: Marijuana

The legalization of marijuana in the US and Canada has brought about one of the biggest and fastest growing investment trends in the world.

Practically every marijuana stock is climbing to new highs and many millionaires are being created along the way.

Whether you’re for or against the legalization of marijuana, the boom is coming and you can either participate or watch in disapproval.

Marijuana is not only going to give liquor a run for its money, it could overtake the entire industry.

In fact, just last year, marijuana already brought in more tax revenues than liquor in the state of Colorado.

And there’s no telling how big marijuana could be if the path to legalization continues with such force.

It’s a bundle of untapped potential.

What do I mean?

Imagine a dam holding back an ocean’s worth of water.

That dam represents marijuana criminalization laws. The water behind it represents the demand for marijuana – billions and billions of dollars worth.

Now divide that dam into fifty-one parts. Fifty of those parts represent the fifty states of the U.S.A. – two are already legal from a recreational perspective. The last big part is Canada.

Every time marijuana is legalized somewhere in North America, a part of the dam disappears.

An endless stream of cash comes pouring out of the hole because marijuana is a very high margin business.

When one part of the dam is removed, the strength of the other parts weakens and eventually have to give way also. If other states don’t follow, they miss an untapped and very rewarding source of tax revenue.

A Flood of Profits

There is a flood of profits waiting for marijuana regulations to change.

Low estimates put that flood’s size at $50 billion/year. High estimates put it at more than $100 billion by 2029.

Analysts at Canaccord predict that legal marijuana sales would reach $6 billion in Canada by 2021 if sales begin in 2018.

Just last month, Deloitte estimated initial sales between $5 billion and $8.7 billion annually in Canada.

That would make the legal marijuana market similar in size to hard liquor sales or wine sales.

In fact, Deloitte says the economic boost to Canada from a legal pot market will be as much as $22.7 billion annually, when including things such as growing and distribution, pot paraphernalia sales, and increased tourism and business taxes.

But before we get carried away, it’s important to understand where we are today.

Right now, the legalization of marijuana falls into two distinct categories: Medical and Recreational.

This is the same in both Canada and the U.S.

So let’s first start with the one category that is already legal in Canada and 28 states in the US.

Category 1: Medical Marijuana

There’s no doubt that medical marijuana already plays a significant role in medicine.

In fact, the scientifically proven benefits of marijuana continue to expand.

Some studies suggest it may even help kill cancer.

According to the National Institute of Drug Abuse:

“…recent animal studies have shown that marijuana extracts may help kill certain cancer cells and reduce the size of others.

Evidence from one cell culture study suggests that purified extracts from whole-plant marijuana can slow the growth of cancer cells from one of the most serious types of brain tumors.

Research in mice showed that treatment with purified extracts of THC and CBD, when used with radiation, increased the cancer-killing effects of the radiation (Scott, 2014).”

But that’s not all it might be able to do.

Researchers are starting to believe that marijuana can:

* Prevent and treat Alzheimer’s

* Treat Glaucoma, and thus potentially prevent blindness

* Relieve Arthritis

* Control Epileptic seizure

* Ease the pain of multiple sclerosis

* Sooth tremors for those with Parkinson’s disease

* Helps with Crohn’s disease

* Decreases the symptoms of Dravet’s Syndrome

* Lessens side effects from treating Hepatitis C, and increases treatment effectiveness

* Decreases anxiety

* Reduces severe pain and nausea from chemo, and stimulates appetite

* Improves symptoms of Lupus, and other autoimmune disorders such as HIV

* Protects the brain after a stroke

* Helps veterans suffering from PTSD

* Controls other types of muscle spasms

* Treats inflammatory bowel diseases

* Protects the brain from concussion, and trauma

I could go on, but you get the point.

Each and every one of these potential benefits has scientific research to back it up.

Which is why the size of the medical marijuana market is expected to grow.

According to the Calgary Herald:

“Health Canada has estimated revenues from medical marijuana will hit $1.3 billion with 450,000 patients by 2024.

…Dundee analyst Daniel Pearlstein estimates Canada’s medical market will be worth $2 billion to $3 billion in the same time frame, with 800,000 projected patients.”

It’s no wonder why Big Pharma is scared – marijuana could replace a myriad of drugs and treatments, and patients are already adopting the trend.

Of course, we’re still years away from it being accepted by the overall medical community – especially considering how many potential problems it could address.

So for now, let’s look at the one proven market where marijuana is gaining market share – a market worth hundreds of billions of dollars.

Do you believe in medical marijuana?

CLICK HERE to Share Your Thoughts

Big Money Painkillers

The US annual cost of chronic pain ranges from US$560 to $635 billion.

The market for drugs associated with pain management is estimated to be over US$300 billion per year globally.

And the market for opioids, a more serious type of pain medication, was nearly US$35 billion in the last year alone – with the majority of drugs coming from the US.

That’s because Americans are in more pain than any other population around the world.

According to Consumer Reports, about 17 million Americans take either one aspirin, ibuprofen, or naproxen every day to relieve pain.

And when it comes to the harder drugs, Americans are once again in the lead – by a long shot.

Approximately 80 percent of the global opioid supply is consumed in the United States and American usage is 14 times more than the global average

Factor in Western Europe and Canada, and you have 95% of the world’s total opioid usage.

In other words, Big Pharma makes A LOT of money from these medications.

Just how big are these profits?

In the last year, 300 million pain prescriptions were filled.

One can only imagine the amount of money drug makers have been making as a result.

For example, OxyContin, a drug owned and controlled by Purdue Pharma, generates around US$2.5 billion every single year.

But don’t let the name fool you.

OxyContin is synthesized from thebaine, an opioid alkaloid found in the Persian poppy – and one of the many alkaloids found in the opium poppy.

That means some of the best selling painkiller drugs are derived from the same sources as opium. In other words, they can be extremely dangerous and addictive, too.

Let’s put that into perspective.

The Opioid Epidemic

Since 1999, the number of deaths attributed to opioid overdoses has nearly quadrupled.

In 2012, there were 467,000 addicted to heroin in the United States.

In that same year, there was a mind-boggling 2.1 million people suffering from substance use disorders related to prescription opioid pain relievers.

And these numbers have grown to a full-on epidemic.

In fact, in the final weeks of his administration, President Obama is leading a push to help the rising epidemic of opioid use:

President Obama via Press Herald:

“In the final weeks of my administration, we are as focused as ever on a promise I made in my inaugural address: putting American ingenuity to work to help Americans live healthier lives.

In honoring this promise, I remain committed to addressing the prescription opioid and heroin epidemic, a crisis that is taking a devastating toll on far too many families.

…Seventy-eight Americans die every day from opioid-related overdoses. So every day that passes without Congress’ action is a missed opportunity to save and improve lives and to spare families pain and heartache.

…The time to act is now.”

President Obama has officially addressed America, and the world, on the dangers of prescription painkillers.

In other words, Big Pharma’s painkillers are under attack.

To add insult to injury, marijuana is already taking over as an alternative to pain medications in places where medical marijuana is legal.

The Numbers Don’t Lie

In 2013, the 17 States approved for Medical Marijuana saw painkiller prescriptions drop significantly.

Via Washington Post:

“Ashley and W. David Bradford, a daughter-father pair of researchers at the University of Georgia, scoured the database of all prescription drugs paid for under Medicare Part D from 2010 to 2013.

They found that in the 17 states with a medical marijuana law in place by 2013, prescriptions for painkillers and other classes of drugs fell sharply compared with states that did not have a medical-marijuana law.

The drops were quite significant: In medical-marijuana states, the average doctor prescribed 265 fewer doses of antidepressants each year, 486 fewer doses of seizure medication, 541 fewer anti-nausea doses and 562 fewer doses of anti-anxiety medication.

But most strikingly, the typical physician in a medical-marijuana state prescribed 1,826 fewer doses of painkillers in a given year.”

But that’s not all.

In addition to making money, Marijuana could actually be saving the government money:

“…In what may be the most concerning finding for the pharmaceutical industry, the Bradfords took their analysis a step further by estimating the cost savings to Medicare from the decreased prescribing.

They found that about $165 million was saved in the 17 medical marijuana states in 2013. In a back-of-the-envelope calculation, the estimated annual Medicare prescription savings would be nearly half a billion dollars if all 50 states were to implement similar programs.”

That’s precisely why Big Pharma has spent – and continues to spend – millions to shut down the legalization of marijuana.

Big Pharma is Scared

Earlier this year, Insys Therapeutics, the makers of the opioid Subsys Fentanyl, poured $500,000 to fight marijuana legalization in Arizona.

They’re not the only ones.

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

According to the Nation, Big Pharma has been pouring money to keep marijuana as a Schedule I, a designation indicating that it has no recognized medical use and is among society’s most dangerous drugs.

“The Nation obtained a confidential financial disclosure from the Partnership for Drug-Free Kids showing that the group’s largest donors include Purdue Pharma, the manufacturer of OxyContin, and Abbott Laboratories, maker of the opioid Vicodin.

Community Anti-Drug Coalition of America (CADCA) also counts Purdue Pharma as a major supporter, as well as Alkermes, the maker of a powerful and extremely controversial new painkiller called Zohydrol. The drug, which was released to the public in March, has sparked a nationwide protest since Zohydrol is reportedly ten times stronger than OxyContin.

Janssen Pharmaceutical, a Johnson & Johnson subsidiary that produces the painkiller Nucynta, and Pfizer, which manufactures several opioid products, are also CADCA sponsors.”

I hope by now you’ve seen just how big the market for medical marijuana is and how disruptive it can be for Big Pharma.

But even still, it’s just scratching the surface.

What happens when you factor in those who want to smoke it recreationally?

Category 2: Recreational Marijuana

In the U.S., the legalization of marijuana for recreational use was on the ballots in five states this year – that’s close to a national referendum on the drug. Four of those ballots passed.

Four states, Washington, Oregon, Colorado, and Alaska, plus Washington DC, already allow adult use.

That brings the total to eight states that now allow the use of recreational marijuana – including the biggest, California.

Some of these laws won’t take effect until next year and into 2018, but preparations are already under way.

That means more than 20% of Americans over 21 could soon legally light up under state law.

With around 60% of Americans saying that weed should be legal, we could see the other states vote in favour of recreational marijuana in the coming years.

Why Recreational Marijuana Will Pass

How do you subdue a growing population of people fed up with government, while bringing in a massive amount of tax revenue?

You let them get high, while making money.

According to new data from the state Department of Revenue, licensed and regulated marijuana stores in Colorado sold $996,184,788 worth of recreational and medical cannabis in 2015.

Washington and Colorado each took in nearly $150 million revenue last fiscal year tied to pot sales, and the industry has created thousands of jobs in those states.

According to an analysis from the Marijuana Policy Group, the marijuana industry created more than 18,000 full-time jobs last year and generated $2.39 billion in economic activity in Colorado.

In fact, the Rocky Mountain state became the first known jurisdiction in the U.S. to generate more tax revenue from marijuana sales than from alcohol last year.

And even if you’re against marijuana use, there’s no denying the money generated from its sales can be used to do great things for the states.

“…Colorado also collected more than $135 million in marijuana taxes and fees in 2015 – more than $35 million of which is earmarked for school construction projects.”

But Washington and Colorado are peanuts compared to California.

California is the real game changer.

Its population is bigger than all of Canada combined, and it’s the 6th largest economy in the world.

When the laws come into effect, it could bring in an extra $1 billion in tax revenue for the state and create tens of thousands of new jobs.

But what about Canada?

The Size of the Canadian Marijuana Market

According to the Huffington Post last year and based on 2014 figures:

“…Colorado generated $70 million U.S. in weed revenue on a GDP of $306.6 billion.

If Canada were to generate the same amount of tax revenue, relative to the size of the economy, the government would bring in around $411 million Canadian in revenue, assuming a GDP of $1.8 trillion.”

According to Canaccord analysts, Canada’s push to legalize marijuana could be a “game changer” for the recreational pot industry with the potential to reach C$6 billion in sales by 2021.

Via Bloomberg:

“The federal government is planning to legalize recreational marijuana in Canada by 2017 with sales likely to commence in 2018. A vast illicit market exists that if brought into legal channels could result in demand of about 400,000 kilograms (882,000 pounds) of cannabis in its first full year, Canaccord Genuity analysts Matt Bottomley and Neil Maruoka said Monday in a note.

If legalization occurs along expected timelines there will be about 3.8 million legal recreational users of marijuana across Canada by 2021, according to the note.”

And Canada could be on the verge of making recreational use a reality.

Recreational Marijuana: Coming Soon to Canada?

On November 30, 2016, the Task Force on Cannabis Legalization and Regulation said that it has fulfilled its mission and soon will deliver a final report to the government outlining recommendations for the country’s legal cannabis framework:

“We are pleased to announce that the Task Force has completed our work.

..Our report is now being translated and will be provided to Ministers and the public once it is available in both official languages.

Translation is expected to be complete in mid-December.

The final report will then be received by Ministers and posted online at Canada.ca/Health.

At that time, we will be pleased to speak to its content.”

If the report shows strong support towards the path to legalization of recreational marijuana, we could see yet another major spike in marijuana stocks.

The problem is that many of the currently listed marijuana stocks have already climbed in share price and one could say that the majority of them are significantly overvalued – even when factoring in the potential of recreational legalization next year in Canada.

But that’s what makes the Company I am about to introduce so special.

It hasn’t even come to trade.

But it will tomorrow.

On Monday, December 12, 2016*, a brand new marijuana listing is coming to the Canadian market.

*originally planned trading date was December 9, 2016.

This Company could generate more than $100 million in revenue in the recreational space alone, should Canada pass the law on recreational use.

But that’s just the tip of the iceberg.

This Company is not only a licensed producer, but it has a team of healthcare and Big Pharma executives who together have founded and run multi-billion dollar companies.

They not only believe in the sector but have directly aligned themselves with investors by investing C$6 million of their own money into the Company.

That means the Company will not only be able to gain market share in the Canadian recreational marijuana space, but it could take on Big Pharma head on.

And tomorrow, this Company will begin to trade…

Emblem Corp. (TSX-V: EMC)

Emblem is one of the few licensed producers in Canada that is licensed by Health Canada to be able to cultivate various strains of cannabis and sell those strains to patients in Canada.

But what makes them unique is that they aren’t just a licensed producer.

Emblem has three divisions: Production, Pharmaceutical, and Cannabis Education.

And in just a bit, I’ll tell you why I believe Emblem is onto big things – things far beyond just the production of marijuana.

But first, let’s talk about the most obvious.

Emblem Production

Emblem has a state of the art facility in Paris, Ontario, with two buildings situated on a massive 4.1-acres of land.

This massive land position is important because licenses are tied to the property. If a license is tied to a small property, it limits the amount of marijuana that can be produced.

In other words, the bigger the property, the better.

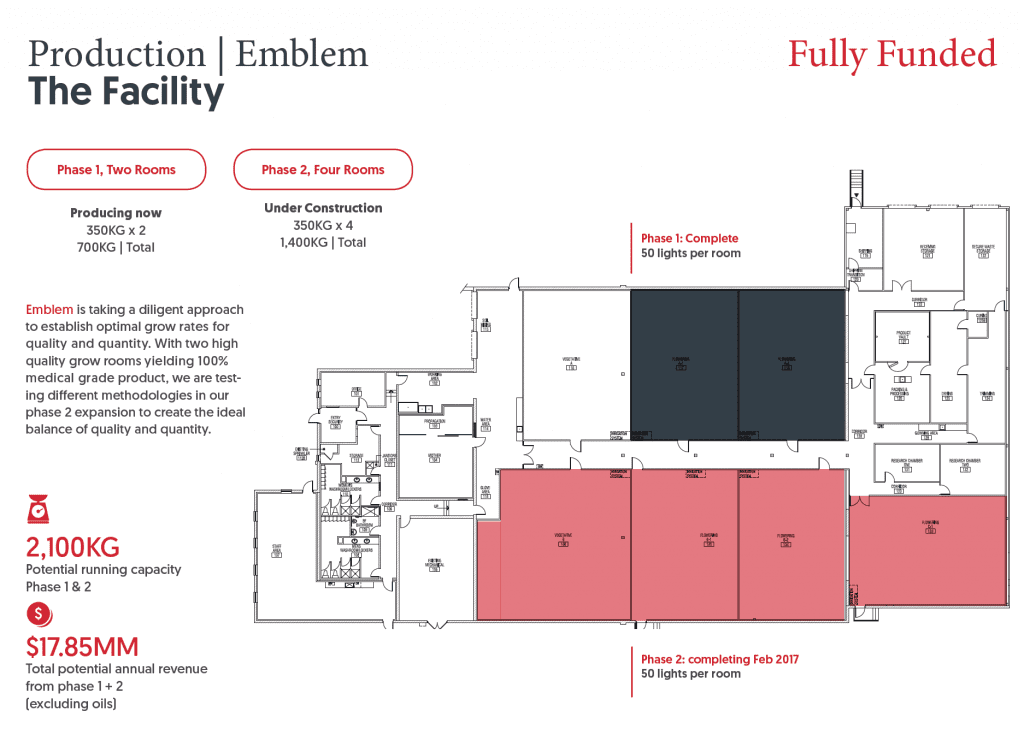

Phase 1 and 2: C$17.85 Million Potential

Right now, Emblem is fully funded for Phase 1 and 2 of their expansion – with Phase 2 expected to be completed in February 2017.

The combination of Phase 1 and 2 is expected to produce a total of 2,100kg/yr. This could potentially generate C$17.85 million of revenue per year at a full run rate, with 71% margins.

Now those are great numbers, but that’s just the beginning.

Now those are great numbers, but that’s just the beginning.

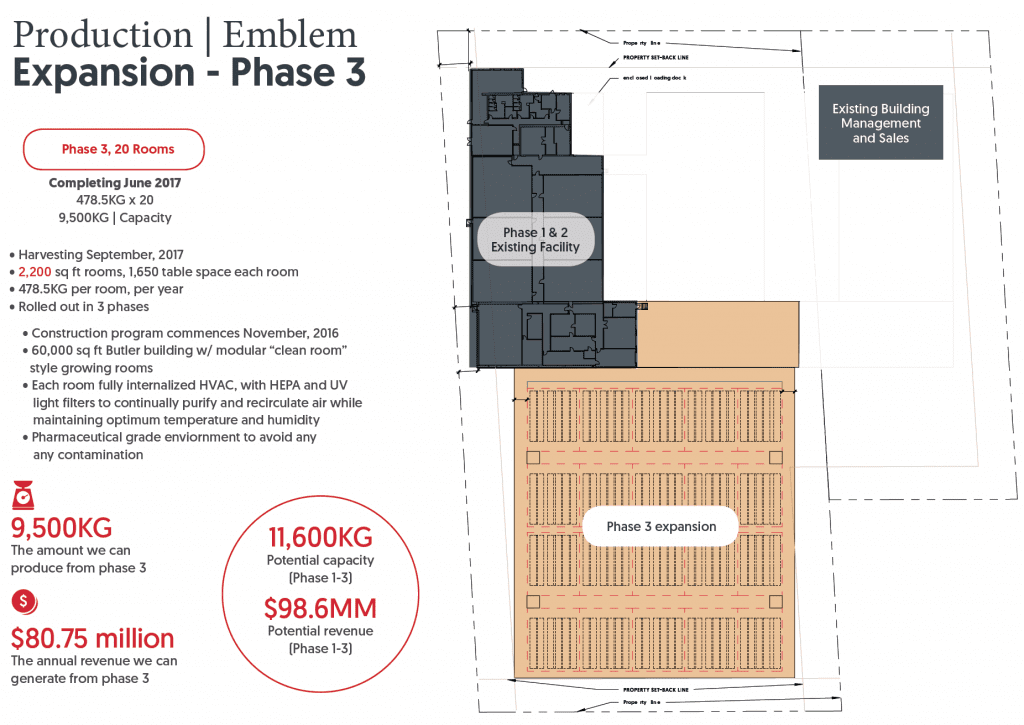

Phase 3: C$98.6 Million Potential

This is where it gets exciting.

When Phase 3 is completed, Emblem could produce up to 9,500kg/yr., and potentially bring in $80.75 million per year in revenue.

Combine the three phases and Emblem could potentially generate revenues of nearly C$100 million per year.

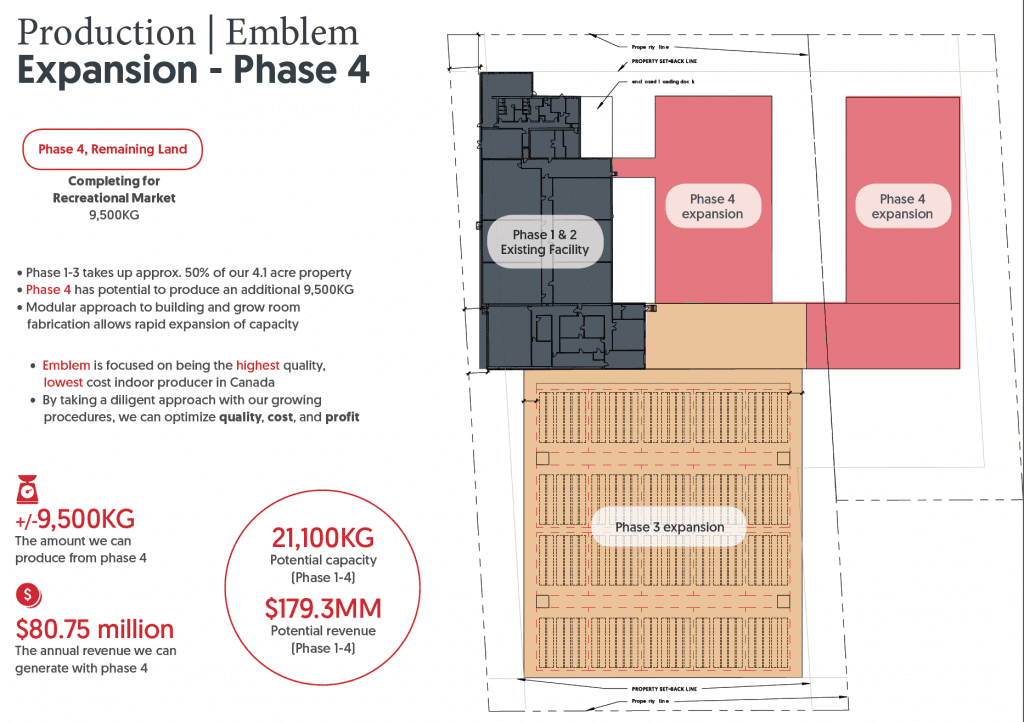

Phase 4: Game Changer

Together, Phase 1, 2, and 3 will take up about 50% of Emblem’s 4.1-acre property.

But if recreational laws pass in Canada, which many expect, Emblem can further expand their facility with Phase 4 and produce an additional 9,500kg/yr.

If all 4 Phases are complete, Emblem has the potential to produce up to 21,000kg, which could generate $179.3 million in revenue every year!

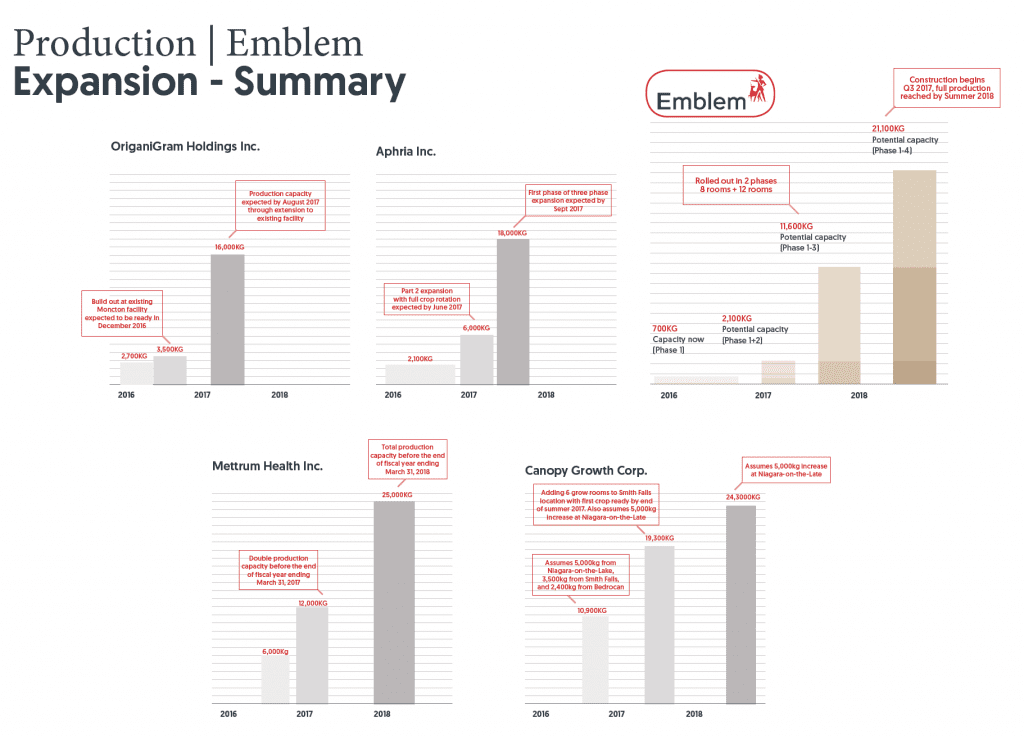

So how does Emblem stack up in terms of potential production power when compared to some of the other names in the Canadian marijuana space?

Take a look:

And from a valuation perspective?

On a fully diluted basis, Emblem has an Enterprise value of $92 million, with $27.5 million in the bank.

How does it stack up to the above peers based on Enterprise Value?

So right out of the gates, Emblem is undervalued when compared to its peers.

So right out of the gates, Emblem is undervalued when compared to its peers.

But that’s not all.

Unlike every marijuana stock out there, Emblem has something – or rather someone – very special.

They have John Stewart.

The Big Pharma Play

40 years ago, John Stewart joined Purdue Pharma in their marketing and sales departments.

But as a scientist with an education in microbiology, he felt his heart was elsewhere.

So he moved over and got involved with Purdue’s clinical research organization – a group that is associated with doing clinical trials of existing drugs and new drugs, which, in some cases, ultimately wound up with a new drug application to either Health Canada or the FDA.

His success moved him up in the ranks of Purdue where he eventually became the head of their R&D Group in Canada, and then the Vice President of R&D from the early 80s through until 1991.

Eventually, in 1991, John became President and CEO of Purdue Canada where he took the business from about $20 million to $330 million by 2007.

In 2007, he transferred to Purdue US in Stamford, Connecticut, and was President and CEO of that organization from 2007 through until the end of 2013 when he finally retired.

By that time, Purdue had become a multi-billion dollar company and is now one of the largest privately held pharmaceutical companies in the world.

While working for Purdue Pharma, John was responsible for launching 11 new products – one of which is now the most widely used opioid painkiller in the world, OxyContin.

In other words, he has an amazing track record of success.

When John retired, he became a private investor in the biopharma space.

For years, even during his time at Purdue, he recognized that cannabinoids were genuine therapeutic agents with massive potential.

More importantly, he felt that it could certainly be an alternative to the heavier drugs for pain management.

So when he was looking for opportunities to invest, he decided to make a big bet on cannabis.

Fast forward a couple of years later and not only has he invested more than $900,000 of his own money into Emblem, he has come out of retirement to head up Emblem’s pharmaceutical division.

Beginning in Q2 2017, Emblem will be launching cannabinoid-based medications in

customary pharmaceutical dosage forms such as liquids, gel caps, oral sprays and

inhalers.

Given John’s track record of success, as well as being one of the most prominent figures in the painkiller space, it could mean hyper growth for Emblem.

GrowWise Health Division

GrowWise Health Division

All of this excitement and explosive valuations in marijuana stocks revolve around the expectation that Canada will legalize cannabis for recreational use next year.

And next week, we may be one step closer to understanding if and when that could become a reality.

However, we also need to be cognizant that the recreational usage of marijuana may not be legalized, or it may take longer than people expect.

If this were the case, then most of these marijuana stocks would be considered significantly overvalued and many of them would have excess capacity – especially considering their expansion plans.

But this is where Emblem stands out.

Emblem’s leaders know that they have to prepare for expansion, but they also know that they need to focus on what’s available now.

And that’s medical marijuana.

If recreational laws don’t pass next year, a lot of the capacity and expansion plans for some of these marijuana stocks may not come to fruition. At which point, these licensed producers will have to put a lot of their money into client acquisition in the medical space.

That’s why we’ve recently seen marijuana producers go out and acquire companies with a large patient database.

And that’s why Emblem has a third division: GrowWise Health

GrowWise Health is Emblem’s patient and medical education division.

This is important because medical marijuana doesn’t sell like a prescription drug.

There’s no involvement with a pharmacy because of the way the medical marijuana regulations are set up in Canada.

That means there’s a gap in the ability to give patients independent information on the appropriate strains and appropriate dosing.

GrowWise is a division mostly staffed with educated registered nurses who interact with the patients on helping them navigate the process of making the most appropriate strain selection, initiating dosing, and doing close follow-up as patients are moving into medical marijuana therapy.

For medical marijuana, this is extremely important because it transforms the pot industry into one of medicine.

This then also helps refer more registered medical clients back to Emblem, so that Emblem can sell its medical grade products directly to the patient.

So regardless of whether recreational marijuana laws pass in Canada, the acquisition for registered medical marijuana patients will continue to be an integral part of the marijuana system.

And Emblem is preparing itself for that with its GrowWise Health division.

Conclusion

There are a handful of marijuana stocks out there, but Emblem is unique.

Sure, they are a licensed producer with the capacity to expand and produce as much as some of the biggest licensed producers in Canada.

Sure, they can make millions of dollars growing and selling marijuana.

But Emblem has what no other company has.

It has John Stewart.

Together with his team of healthcare professionals, John could lead Emblem into a whole new category of pain management therapies.

Imagine being able to invest in Tylenol or Advil when they were first introduced into the market.

Yes, marijuana pharmaceuticals are in its infancy, but that’s precisely why we could witness explosive growth.

So regardless of whether recreational marijuana laws pass in Canada, Emblem could still benefit from growth in the coming years with its pharmaceutical division.

Emblem isn’t just another licensed producer listed on a stock exchange and reaping the rewards of a hot sector.

Emblem is a fully integrated Canadian healthcare and pharmaceutical company led by a team of healthcare and Big Pharma executives.

The last financing was done at $1.15, so I expect that’s likely where the stock will open. But where it opens and where it ends up is a completely different ball game.

I expect a frenzy of buying coming into this Company the moment it begins to trade, based on how undervalued it is when compared to its peers and the team leading the charge.

While the legalization of recreational marijuana is still up in the air, we’re expected to get a glimpse of what the government wants to do next week.

If the report is positive towards the path of legalization across Canada, we could be in for another explosion of buyers into the sector.

If that happens, I don’t expect Emblem will be trading at its current EV for long.

Seek the truth,

Ivan Lo

The Equedia Letter

Disclosure: We’re biased towards Emblem Corp. because they are an advertiser. We currently own shares in the Company (subject to a 6-month hold period) purchased in a previous private placement. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Emblem Corp.. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Canada Emblem Corp. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

When and how will I be able to invest in this company in the U.S.?

Hello,

I am very intrested in being a part of this.

Please let me know how and when I will be able to in the U.S. ?

Every Friend I grew up that used weed a lot is dead from the neck up.

They have trouble putting together any type of meaningful conversation.

Or some of them cant even finish a sentence.

Worse most moved onto opiods or other hard drugs.

And we now want to legalize this stuff.

I visit Our jails and they are full of kids with no purpose because they wasted away using.

And now the rich want to get richer on the backs of these kids.

You asked how we felt

Well while some moved on to harder drugs, alot just lept it behind closef doors. They actually benifited from its euforic effects, there for keeping these ones from a life of phycoligest and nerve pill addfictions. As for the kids wbo got landed in jail, they never needed to be there to start with, its less harmful than going to school this day an age. It will free up room in prisons for real offenders like child molesters, snd rapist. Give pot a chance and see what sience can help it accomplish. I think you will be glad you did.

That’s like saying everybody that drinks alcohol are all alcoholics irresponsible aggressive argumentative etc. etc. etc., sorry if you had a bad experience in that most of your friends have passed away now but I on the other hand I’ve had many a good people around me some use some don’t… And no we’re not a bunch of zombie smoking pot heads sorry that I don’t agree with your last statement…. I am all for legalize Asian recreational more so… And yes there would also be a need for pharmaceuticals but it should not all be put through that narrow hallway for big profits and greed The last generation of pharmaceuticals that was generated for pain has caused millions of people to suffer emotionally financially and physically

I know that marijuana is good for a lot of stuff like for pain it helps ease the pain I know for a fact because when I smoke my bud it helps me to forget that I’m in a lot of pain!!!!!

A lot of people are unaware that in the 1960s The prime minister of Canada,pierre trudeau put together the Le Dain commission-with judges,scientists,doctors etc to determine if marijuana penalties should be decreased-after 2 years of intensive study the panel either suggested it be legalized or decriminilzed then.

But,at the same time,richard Nixon put his own panel together and apparently did close to the same as Canada in studying this.Pretty well ,the same results came back and if you check the records, when Nixon was told of this his reply was – NOT ON MY WATCH!-

How can i invest

I want to invest for a while and love to visit the Paris plant when possible thanks Hilda

Hello I am very interested in investing in medical Marijuana how do I go about this

I’m really interested in (HOW TO INVEST IN MARIJUANA)

How do I go about investing in Marijuana

How can I nest in Marijuana

If it is legalized can anybody grow ut sell it to buissenese that already are selling it ,and how many plants ccn one person grow and what are the regulations.

If it is legalized can anybody grow ut sell it to buissenese that already are selling it ,and how many plants ccn one person grow and what are the regulations.Also i would like to invest in the business how do i gp about this.Thank u

If it is legalized can anybody grow ut sell it to buissenese that already are selling it ,and how many plants ccn one person grow and what are the regulations.Also i would like to invest in the business how do i gp about this.Thank u

I think It is time for everyone to realize the benefits that this will make in our world today

Hello, I would like to know where to invest in the Emblem corporation! I would also like to learn more on investing in marijuana as a whole. Thank you I look forward to your reply.

How to do NOT invest in Marijuana !!! Emblem is overvalued and falling down one of my worst investments ever also company is based in Ontario so expensive electricity and lot competitors … ACB is the righ one

Good Lord! Can someone from equedia please answer these poor folks. It is downright shameful to read these comments from “your” fellow readers who have made you as successful of an investment letter as you are today. Now pay back your dues and answer these folks.

Mart go by apple and relax. Tell me when you want to sell your shares and I will buy them.

Regards

My stop loss was activated at 3.7 .Downtrend still continue even after news sp2.33 .So now is time wait for reversal maybe this can be good investment before April .

…Thx Cressco but I’m not apple fun…

Ivan can you please address this…

Canaccord Genuity did a snap presentation. They forecast future sales for 2018 to be around 2000 Kgs, and 2018 around 5000Kgs.

Why such low estimates if with phase three as of this fall they will have an annual capacity of 11 600 Kgs? Do they think patient acquisition will be slow or are they not licensed fully to grow phase three.

This in my opinion is a big setback for this company if these Canaccord forecast happen to be correct.

Hi Cressco,

I’ve been to many marijuana producers and I think I know why Canaccord is shooting low. You are correct: just because you have the capacity to grow, doesn’t mean you are licensed to use up the square footage. You still need inspection, etc.

However, analysts are almost always conservative.

If recreational laws pass, I do like Emblem at these levels. However, as I stated before, I feel they came out of the gates too fast in terms of share price, which is why I told readers to take profits off the table above $4.

Hope this helps and thanks for your patience in this response.

Ivan

* For 2019 forecast is roughly 5000 kgs.

FYI

You need to update this article as it is misleading. New investor presentation is available upon contacting IR person named Ali.

Key point is that phase 2, not 3 which this letter suggests will be completed this June.

In the presentation no mention of phase 3. Oil production license was obtained in December, oil sales license should be approved in April.

Regards

WHY are you not answering the questions Can someone from equedia please answer . It is disgraceful that so many people can ask you WHERE they can invest or a list of brokers where they can takes trade for this company your readers who have made you as success as an investment letter and yet when an important question comes up you dont answer. maybe your Not as good as we all thought.

Yes I do believe marijuana is a big medicine

Absolutely in fact I can attest to the fact that simply smoking marijuana in the 1970’s literally “stopped” me from gran mal seizures 100%

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/