How China’s Problems Affect Canada and a Potential Financial Disaster That’s Bigger Than Subprime

MacLean’s’ most recent issue gives us 99 reasons why Canada is better than America. It says we’re happier, fitter, and richer – and our kids are smarter too.

While much of it may be true, there are economic factors unraveling that might give every Canadian a reason to be scared.

While our economic numbers have been strong, we need to look at the bigger picture.

Strong Growth or Just Getting Lucky?

Last month, statistics Canada released Q1 data that shows a surprisingly strong 2.5% annualized growth between January and March.

That means growth in the first quarter outperformed every three-month period over the past year and a half. And exports – particularly shipment of oil products to the United States – made a nice 1.5% gain.

It may sound like Canada is doing great, but the numbers don’t tell the whole story.

Most of Q1 growth came from trade with the U.S., and partly due to a one-off rebound in energy exports – also to the U.S. – that are now pretty much recovered after the disruptions to production from last year.

Domestic demand was soft and outlook is weak. If it wasn’t for the contribution from government, which showed the strongest component of domestic demand, the numbers could’ve been a lot worse. Expect the weakening trend to continue as the housing market softens, and consumption spending shrinks as Canadians tackle their highly elevated debt levels

According to TransUnion, the average Canadian’s non-mortgage debt – which includes credit cards, car loans, installment loans and lines of credit – reached a whopping $26,935 in the first quarter. In BC alone, the debt per person has now reached a staggering $38,619, surpassing Alberta’s $36,223.

Factor in housing costs and we’re looking at a country that is living well beyond its means (I’ll talk about the housing situation next week).

Are we living beyond our means? Share your thoughts by CLICKING HERE

You know there are growth issues when government spending is one of the strongest component of domestic demand – especially when the budget balance for Canada has been negative since late 2008 and the government is trying cut back on spending.

|

|

Budget Balance

|

If consumer spending falls, business investments usually fall with it. Combine that with government cutbacks and we could be looking at a much stronger decline in domestic demand moving forward.

That means we’ll have to rely on our Canadian exports to keep moving forward.

Canadian Exports

While further oil exports to the U.S. should continue to drive strong numbers, based on U.S.’ predicted growth rate (may also not be as bright as it appears), we need to take yet another step back and look at a sector that will likely continue to decline in Canada: mining and resources.

Mining and Resources

A few weeks ago, I went over the potential effect of what losing the TSX Venture could mean for the Canadian economy. If exports are needed to drive the growth of Canada, and all signs point to this being the case, then we are in a heap of trouble.

Last year, the total value of Canadian mineral exports was $92.4 billion, accounting for a whopping 20.3 percent of Canada’s total exports.

In 2011, more than $17 billion in capital investment, $63 billion in nominal GDP and $24.7 billion in trade surplus from the mining and mineral processing industries contributed directly to Canada’s economy

The $63 billion from the mining sector accounted for 3.9 percent of total GDP, while mining and processing companies paid around $7.1 billion in corporate taxes and royalties that help support the programs and services that Canadians in every part of the country use every day, from roads and bridges to education and health care.

According to the Mining Association of Canada’s latest Facts & Figures report, Canada’s mining industry broke records in 2011 for exploration spending, production and exports. Canada remained the world’s top destination for mineral exploration in 2012, attracting 16 percent of budgeted spending.

Canada is also a world-leader in raising equity for mineral exploration and development.

Via Natural Resources Canada:

“In 2011, companies listed on Canadian stock exchanges raised almost 40 percent of the world’s equity financing for mineral exploration and mining. Canadian-headquartered mining companies accounted for nearly 37 percent of budgeted worldwide exploration expenditures in 2012. Total exploration expenditures within Canada were about $3.9 billion in 2012.

…While the United States remains Canada’s leading trading partner, the percentage of total exports to the United States has been steadily declining since 1999 while emerging countries have become important destinations for Canada’s mineral products.

In 2000, less than 2% of Canada’s total mineral exports went to China, but in 2011, 6.1% of Canada’s mineral exports – with a value in excess of $6 billion – went to China. Exports to Brazil, valued at $1.5 billion in 2011, have more than quadrupled since 2000, while mineral exports to other emerging countries, including Mexico, Indonesia, India, and Russia, have also increased over the same period.”

Clearly, much of Canada’s GDP over the last few years stemmed from strong and rising minerals exports to emerging markets, in particular Brazil and China.

But both Brazil and China are now showing strong signs of trouble. Brazil has had over two years of lackluster economic growth while experiencing high inflation.

China, while not experiencing the same levels of pressure, is once again in the spotlight on a number of factors that will likely impede world growth and commodity prices.

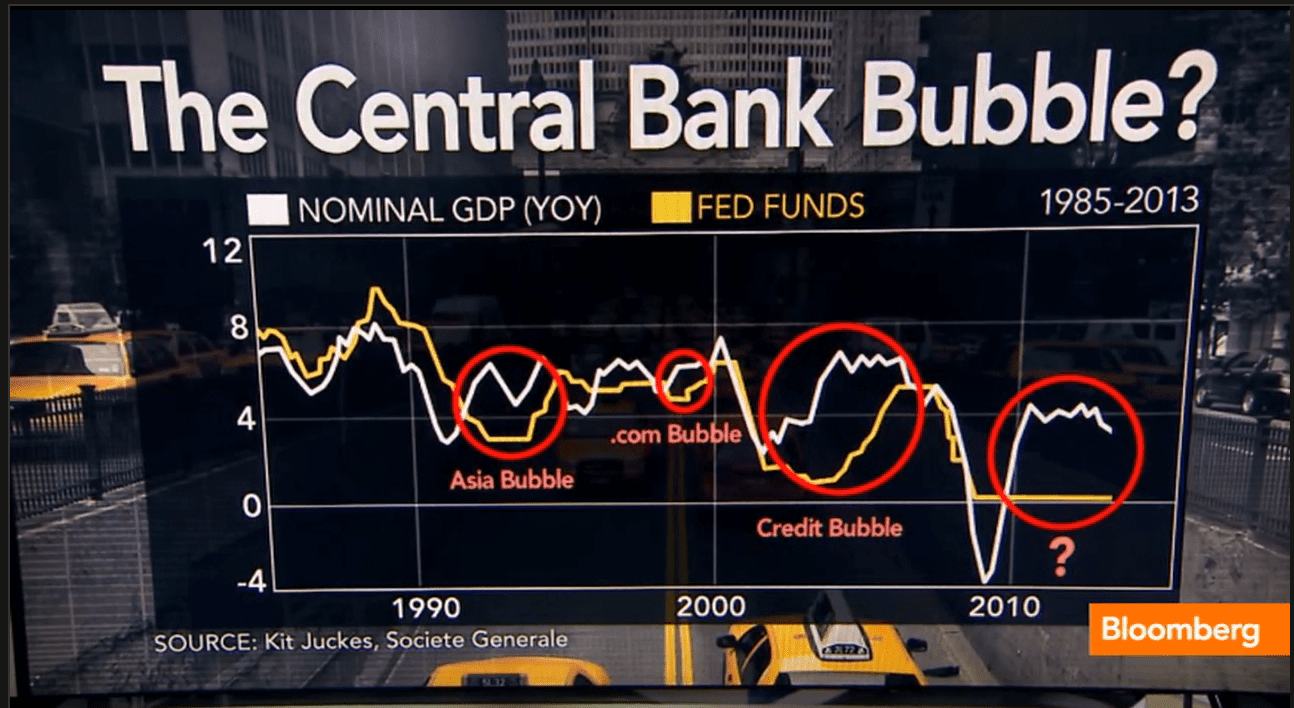

China – An Even Bigger Bubble?

Numbers and surveys on economic growth are often manipulated to give the grand illusion that everything is getting better, even when strong indicators point to the contrary.

Last week, the proof was in the pudding.

China’s National Bureau of Statistics has now publicly ousted a local government it says was involved in a shocking case of number fudging.

According to a statement on the statistics bureau’s website dated June 14, the economic development and technology information bureau of Henglan, a town in China’s Guangdong province, massively overstated the gross industrial output of large firms in the area, by as much as four times:

Via WSJ:

“An investigation by the state statistician into a sample of 73 out of a total 249 firms counted in the data found that 38 were too small to be counted as large firms and so shouldn’t have been included, and a further 19 had either stopped production, moved out of the town or otherwise ceased to exit.

The statement said that 71 companies surveyed by the statistics bureau had industrial output of 2.22 billion yuan ($362 million) in 2012 in total, but that the local government recorded it as being 8.51 billion, almost four times as much as the actual figure.

The data was supposed to be contributed by the firms themselves using an online platform. Instead, employees of the Henglan economic development bureau entered the figures themselves from their office, the statement said. It also said that by May or June last year the relevant government leaders in Henglan knew about the distortions but chose not to do anything about it.

The statistics bureau doesn’t say why Henglan inflated its industrial output numbers. But indications that a local economy is sagging could reflect poorly on the prospects for promotion of local officials, and China’s southern provinces have been particularly hard hit by the global slowdown in demand for the country’s exports. Factories have closed, moving inland and overseas in search of cheaper labor, denting local government revenues.

…How widespread the problem is elsewhere in the country is anyone’s guess…”

That last line says it all.

But if you wanted to make an educated guess on how widespread the problem is, you can start by looking at the health of China’s banks.

Do you trust China’s economic numbers? Let us know by CLICKING HERE

Liquidity Crunch – Another 2008?

Chinese cash rates shot through the roof last week, reaching 25% at its peak, before dropping to just over 8% on rumours that China’s central bank, the People’s Bank of China (PBOC), has injected cash into select banks amidst the liquidity crunch.

Chinese cash rates shot through the roof last week, reaching 25% at its peak, before dropping to just over 8% on rumours that China’s central bank, the People’s Bank of China (PBOC), has injected cash into select banks amidst the liquidity crunch.

According to Hao Hong, the chief China strategist at Bank of Communications Co., who cited unidentified industry sources, the People’s Bank of China used “targeted liquidity operations” to supply 50 billion yuan to a bank in China.

“It was only a matter of time before at least one Chinese bank (and then many more) needing to rollover overnight/short-term funding and unable to do so in an interbank market that is now completely frozen, had to be bailed out.

Hong added that more banks are in talks with PBOC to obtain funds amid a cash squeeze, as expected. The problem is that the PBOC can’t continue targeted bail outs, and will sooner or later be forced into a broad liquidity-providing move, which will unleash a repeat of the 2011 in China scenario, which did not have a very happy ending.”

Via Centralbanking:

“The tight credit conditions are a result of what Amy Yuan Zhuang, Nordea’s senior analyst for Asian economies, said is “abnormally high” demand.

Commercial banks, she explained, are preparing for their biannual balance-sheet inspections. In order to meet their capital requirements, many banks rely on issuing wealth-management products (WMPs).

This drain on liquidity is compounded by a growing “mistrust” between banks in the interbank market following the failure of the China Everbright Bank to repay a 6 billion yuan loan on time earlier this month.

When the WMPs mature, Zhuang said, the banks will look to borrow money from the interbank market to repay the WMP-holders. This process could, however, be complicated by the high and volatile money-market funds.

Fitch Ratings today observed that “persistent tight liquidity conditions in China’s financial sector could constrain the ability of some banks to meet upcoming obligations on maturing WMPs on a timely basis.”

In other words, many small to mid-sized banks in China are at a very real risk of default.

While the PBOC appears to be tightening their stance on imposing market discipline on banks that are overly reliant on short-term funding, the potential risk of over-leverage is very real.

This includes not only short-term funding, but also the overly leveraged economy of China.

According to the Taipetimes:

“…the lack of cash is a problem for smaller Chinese banks and trust companies, private businesses and even smaller state-owned enterprises that may have built up significant debt in the easy money years since recession-fighting stimulus was unleashed into the economy in 2009.

The closing of the credit spigot could have a domino effect, said Zhou Dewen, chairman of the Wenzhou SME Development Association, which represents private businesses in Wenzhou, a bastion of entrepreneurship in southeastern China

“The rate of bad loans has kept rising and liquidity is getting even tighter. This capital chain reaction could break some companies, and it will get even worse in the second half of the year,” Zhou said in a phone interview.”

One look at the Libor’s surge prior to the Lehman Brother’s bankruptcy, which led to the death spiral of events in 2008, should be a strong call to memory on a hard lesson learned.

Keep your eyes on the Shibor (Shanghai Interbank Offered Rate), the barometer of Chinese credit liquidity.

Ramp Up the Printing Press

China’s credit-to-GDP ratio is over 200% and its corporate debt bubble is the largest of any developed and developing country, and at 151% of GDP (and rising rapidly) is the biggest in the world.

China’s credit-to-GDP ratio is over 200% and its corporate debt bubble is the largest of any developed and developing country, and at 151% of GDP (and rising rapidly) is the biggest in the world.

Goldman Sachs shows that in 2013 the total credit outstanding in China is expected to rise to a whopping 240% of GDP, and continue rising from there at an ever faster pace.

China wants to maintain its 8% growth per year, so it will have to continue injecting massive amounts of debt to achieve that – just as the Fed, the BOE, and EU have done.

China will likely bailout more banks this year, which means more money printing.

Funny how GDP growth for the world most powerful nations are now simply a reflection of how much credit is entering (or leaving) the system.

What it Means for Canada

If China’s bubble bursts, a large part of Canada’s GDP will be wiped out.

One of Canada’s biggest GDP drivers, the mining and resource sector, continues its decline as commodity prices continue to drop and investments into the sector continue to fall dramatically.

The mining sector represents more than 460,000 jobs directly and indirectly in Canada – that’s more than 2.5% of Canadian jobs.

That means GDP will likely shrink, as exports to Brazil and China fall along with commodity prices, leading to a loss of jobs and a further decline in domestic demand.

I haven’t even begun to talk about housing prices.

If this continues, Canadians may not be so happy anymore.

Next week, I’ll talk about the Canadian housing market – you won’t like what I have to say.

An Early Look at Another Market Disaster

According to the Financial Times, the big wave of selling last week caused many exchange-traded funds to tumble below the value of their underlying assets.

There was so much selling that dealers not only struggled to keep up with the sell orders, but could no longer accept orders to redeem underlying assets from ETF issuers.

Via FT:

“One Citi trader emailed other market participants to say: “We are unable to take any more redemptions today…a very rare occurrence due to capital requirements we are maxed out on the amount of collateral we have out.”

A person familiar with the situation said it was a temporary suspension affecting only some clients, caused by the significant amount of sell orders. Citi declined to comment.

State Street said it would stop accepting cash redemption orders for municipal bond products from dealers.

Tim Coyne, global head of ETF capital markets at State Street, said his company had contacted participants “to say we were not going to do any cash redemptions today”. But he added that redemptions “in kind” were still taking place.

Market participants described the heavy volumes and losses on Thursday as a rare occurrence and said that it could translate into further selling on Friday or early next week.

“The losses for ETFs today were far beyond what the most sophisticated financial risk models could have predicated for worst-case scenarios,” said Bryce James, president of Smart Portfolio, which provides ETF asset allocation models.”

In other words, the ETF sell-off last week was worse than what the most sophisticated financial risk models could even come close to predicting.

Funny, I remember them saying the same thing about the subprime mortgage crisis…

The value of American subprime mortgages was estimated at $1.3 trillion as of March 2007. The value of the ETF industry…$2 trillion.

Food for thought.

Until next time,

Ivan Lo

The Equedia Letter

Most Western Countries are living beyond their means….its the inevitable result of fiat currency, human nature, and corporate influence on the “democratic” process of decision making.

its clear that the whole world is living in a credit bubble. spending is only the result of cheap credit

Canada is not better than America but I have to admit your financial system is better. I live in America, and its amazing to see the lives we are living. Its very sad to see such high obesity rates and unemployment.

but it sounds like Canada is well on its way to a downward fall

Canada is better than America.

Americans are all fat and uneducated. Their greed and banking system has already caused the collapse of many nations around the world.

Every one is reading this piece all wrong. There is nothing in here that says Canada is better than America or vice versa.

It simply says that Maclean’s published an article that gives us many reasons why Canada is better. I am sure there are many reasons why America is better as well.

This piece was simply something to help Canadians open our eyes to the problems that lie ahead and to protect ourselves by paying off our debt because the economic outlook isn’t pretty.

Many Canadians live as if nothing could ever go wrong. We need to open our eyes.

We are beginning to see what investing in ETF’s has done. If investors put their money in the underlying companies (etc) they are directly supporting that industry. When the money goes to an ETF the industry loses that support. Mining is just one example.

Next, many investors have no idea what the impact of algo trading does to ETF’s. The three hedge fund managers on BNN skirted that issue this week but acknowledged the severity of the impact. They agreed that Canada is not telling the truth about our prospects and one manager is short REITs with Canadian properties while more bullish on Cad holding USA properties. In my opinion they were largely correct.

Our government did what others did by injecting cash. The problem is that the shovel ready projects were a farce. The only ones shoveling cash were banks and oil companies. Very little actually hit the streets. Prince George, BC is an example. They are doubling the highway. 25 people are working and 30 pieces of machinery are on site. Guess where the money is going! Parked machinery. The jobs initiative is reminiscent of the BC NDP days. It’s a farce and we are being lied to.

We gave 200 mining jobs away to China and a court challenge was defeated. The way Canadian were kept out is by language. The Chinese company was allowed to require Mandarin be spoke! Does this stink? Ya, I bet there was an aweful smell wafting out of that court room. Corruption is alive and well here. The government here aided in that. They also plan to do it again.

The IT sector is not the only farce. Canada is bleeding jobs like crazy. We are selling out wholesale. Industries, jobs, taxes you name it. Makes you wonder what the hell is going on? As long as Canadians refuse to stand up for themselves this is just going to get a whole lot worse.

Canada is bleeding to US firms because we cant compete with our laws and taxes. Walmart, target are all taking over. even the BAY is now american owned.

Very nice, webgogs

les titres d or abx. g. slw. etc est ce un bon endroit comment investissement ?

Ivan, your comments are all interesting and useful, but the ones related to ETFs need a “however” added to them, and that is as follows. Whereas the value of the assets underlying ETFs is possible to assess, however muich iut is in decline, the value of the assets underlying the mortgage-backed securities in 2008 was impossible to assess. In nay cases, the value was zero.

Nelson, you make a valid point. To that, I must ask, “What happens if physical delivery of asset-backed ETFs was mandatory?”

Does the SPDR GLD, for example, actually have the amount of gold it claims it has available for trade?

Great article — gives one food for much thought. Current government and personal debt levels are simply unsustainable. But I might add, after an initial collapse of ALL markets I would speculate that the price of gold and silver would skyrocket upwards. After all, gold has no debt attached to it and is the only real worldwide currency.

I look forward to your article next week on Canada’s over-inflated bubble called the housing market.

The only reason Canada’s banks did not collapse as some of their american counterparts was the policy of then minister of finance Paul Martin who did not let canadian baks merge with larger international institutions or between themselves. By doing so, he prevented risky and irresponsible management from entering the canadian banking system… if the bankers (reined in by Martin) would have had it their way, no doubt the financial demise in Canada would have been equal or greater (proportionaly) than in the US. It took a man of experience, wisdom and with balls in his pants to oppose big banks and their apocalyptic plans. Thank you Paul Martin ! As for our consumer habits, they are no different from the US, sooner or later, the housing and credit bubbles will burst here too

So long as the Cdn Gov. is allowed to expand like Europe we will end up like Europe and it’s irreversible. You cannot steal from productive citizens and redistribute to non productive indefinitely. There’s got to be responsibility and accountability. Politicians have gone wild in search of votes to keep their jobs and fattening their wallets.

Canada is being forced by Obama to bow to China instead of being like a god neighbor Obama rides on Warrens Oil Train and blames big oil. Seems that Big oil pays more in taxes than they make in profits. Warrens secretary has a tax problem or Warren said she paid to much which was a problem. He is the master of accounting and he brings big oil Companies there product at 10$ a barrel more . Plus makes the train oil tankers and big oil pays the taxes. go figure why there is no pipeline but wait for a train derail that will be who’s fault? Not Canada they are a god neighbor.

While all this “analyzing” of ETFs, CDSs, CDOs GDPs and “QEs” is all well and good – and often very revealing and fascinating – it is for the most part navel gazing, if not down right redundant.

If anyone was paying any REAL attention since the late 50’s – and you didn’t need to be a “financial expert” or “academic” – it was, and is even more so today – painfully obvious that decisions AND CHOICES were made on how post war “development” and human economic activity and “progress” was to proceed.

Regrettably, many of those that found themselves in charge of the means for all that development, also found all that power intoxicating – especially as they realized after they successfully diffused the brief revolt of the post war generation – that by “doping up” and “dumbing down” the restless sheeple, they were easily herded and made “comfortably numb” by the late 70’s.

This then made it oh so easy to fleece the herds and opened the floodgates of deregulation of the “free market forces” which was really nothing more than devious schemes – or rather scams – to plunder the public wealth and assets in the 80’s.

And yet despite all the various “crisis” around the world – starting with the first “oil crisis” in the mid 70’s and probably the biggest scam of all, the “petro dollar” – to the more recent “boom and busts” and criminal insanity of 2007/8, here we still are, picking lint out of our navels. Oh yes, and I wonder how many banksters, political lackeys, “experts”/pundits and presstitutes will say they didn’t see the next “crisis” coming… again…

Oh, and by the way, it may also be wise for all those oil and mining “experts” – and the rest of us – to bloody well realize that Mother Nature does NOT do ‘bail outs’ and “QE”…

who do you include when you say that the “average Canadian” owes $38,619,?

Anyone who pays taxes I assume.

America has sadly devolved into a nation of ignorant, illiterate savages, consumed – just as was ancient Rome – by little more than an endless desire for “bread and circuses” (Juvenal). This will all end badly, of course, when the US$ begins its final collapse, and the repercussions of that will trigger the Second American Civil War. Unlike the first American Civil War, though, there will be no reunification, so you kind folks there in Canada better start preparing to either welcome an enormous stream of American refugees or start building a really stout fence along the Parallel, complete with attack dogs and machine gun towers, and don’t be afraid to use either, or both.

It’s really very complex in this active life to listen news on Television, thus I only use world wide web for that reason, and take

the most up-to-date information.

I want to make sure my patients receive the best care available at a pride that they caan afford, and our office specials allow me to do just that,

” said Dr. Massaghe therapjsts should take advantage of the oppoirtunities offered tto them by the instructors and administrators in massage school. Experience Before you boo yourr Breckenridge spa appointments make sure all estheticians, massage therapists and staff have adequate experience.

Thanks for finally writing about >Equedia Investment Research How

China’s Problems Affect Canada

always i used to read smaller articles that also clear their motive, and that is also

happening with this piece of writing which I am reading here.

Thank you for any other informative website. Where else could I am getting that type of info written in such a perfect manner?

I have a project that I am simply now operating on, and I’ve been at the glance out for such information.

Awesome! Its in fact amazing paragraph, I have got much clear idea on the topic

of from this paragraph.

I’m now not positive where you’re getting your info, however good

topic. I needs to spend a while finding out more or understanding more.

Thanks for fantastic information I used to be looking for this

information for my mission.

Undeniably consider that that you said. Your favourite justification appeared to be at the web the easiest factor to be mindful of.

I say to you, I definitely get irked while other people

think about issues that they just do not realize about.

You managed to hit the nail upon the top and also defined out the whole thing with no need side-effects , folks can take a signal.

Will probably be back to get more. Thank you

I am regular reader, how are you everybody? This article posted

at this web page is actually good.

You actually make it appear really easy together with your presentation however

I to find this matter to be really something that I feel I might by no means understand.

It seems too complex and very wide for me. I’m taking a look forward on your next put

up, I will attempt to get the dangle of it!

I do believe all of the ideas you’ve introduced for your post. They’re very convincing and can definitely work. Still, the posts are too short for starters. May you please lengthen them a bit from next time? Thanks for the post.

Thank you for every other wonderful article. Where else may anybody

get that type of info in such a perfect means of writing?

I have a presentation next week, and I am on the look for

such information.

Excellent post. I definitely love this website. Thanks!

magnificent put up, very informative. I’m wondering why the other experts of this sector do not notice this.

You should proceed your writing. I am confident, you have a

huge readers’ base already!

Today’s Rattan grosfillex bahia conservatory furniture can be very usefuhl wood for many years of enjoyment.

I’m amazed, I must say. Rarely do I come across

a blog that’s both educative and interesting, and let me

tell you, you’ve hit the nail on the head. The

issue is something too few men and women are speaking intelligently about.

Now i’m very happy I stumbled across this in my search for something relating to

this.

Exceptional post however I was wondering if you could write a litte more on this subject?

I’d be very thankful if you could elaborate a little bit

further. Many thanks!

Hi there outstanding website! Does running a blog such as this take a large amount of work?

I’ve absolutely no expertise in coding but I had been hoping

to start my own blog in the near future. Anyways, should you have any recommendations or techniques for new blog owners please share.

I know this is off subject however I just wanted to ask.

Appreciate it!

Thanks for sharing your thoughts on wireless routers. Regards

I constantly spent my half an hour to read this

weblog’s content all the time along with a mug of coffee.

Currently it appears like Drupal is the

top blogging platform available right now.

(from what I’ve read) Is that what you are using on your blog?

Why people still use to read news papers when in this technological world everything is accessible on net?

My brother recommended I might like this web site.

He used to be totally right. This put up actually made my day.

You cann’t imagine just how a lot time I had spent for this information! Thank you!

I take pleasure in, cause I discovered exactly what I used to be looking for.

You’ve ended my 4 day long hunt! God Bless you man. Have a great day.

Bye

Everyone loves what you guys are up too. This kind of clever work

and exposure! Keep up the excellent works guys I’ve added

you guys to blogroll.

Spot on with this write-up, I actually believe that this

amazing site needs much more attention. I’ll probably be back

again to see more, thanks for the information!

Appreciating the time and effort you put into your site and detailed information you offer.

It’s great to come across a blog every once in a while that isn’t the same outdated rehashed

information. Great read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

You should be a part of a contest for one of the highest quality

websites on the internet. I will recommend this site!

For latest information you have to pay a quick visit world wide web and on internet I found this site as a

most excellent web site for latest updates.

Excellent web site. Lots of helpful info here. I’m sending

it to some pals ans additionally sharing in delicious. And certainly,

thanks on your effort!

Definitely imagine that that you said. Your favorite justification seemed to

be at the internet the easiest thing to take note of.

I say to you, I definitely get irked while folks think about concerns that

they plainly don’t realize about. You controlled to hit the nail upon the

highest and defined out the entire thing with no need side

effect , other folks can take a signal. Will likely

be back to get more. Thank you

It’s awesome to pay a visit this website and reading the views of

all mates regarding this piece of writing, while I am also keen of getting knowledge.

I relish, lead to I found just what I was having a look for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a nice day.

Bye

Thanks for sharing your thoughts on best headset. Regards

Very quickly this web page will be famous among all blogging users, due to it’s pleasant content

Appreciating the hard work you put into your site and detailed

information you offer. It’s great to come across a blog every once in a while

that isn’t the same old rehashed material. Wonderful read!

I’ve bookmarked your site and I’m adding your RSS feeds to my Google

account.

My brother suggested I may like this website. He was totally right.

This publish truly made my day. You cann’t imagine simply how so much

time I had spent for this information! Thank you!

naturally like your web-site however you need to check the

spelling on quite a few of your posts. A number of them are rife with spelling problems

and I find it very troublesome to tell the truth nevertheless I will

definitely come again again.

Please let me know if you’re looking for a article writer for your weblog.

You have some really good posts and I believe I would be a good asset.

If you ever want to take some of the load off,

I’d really like to write some material for your blog in exchange for

a link back to mine. Please send me an email if interested.

Cheers!

If you desire to grow your experience just keep visiting this web

page and be updated with the hottest news update posted here.

Greate pieces. Keep posting such kind of information on youhr blog.

Im really impressed byy it.

Hey there, You’ve done an excellent job.

I’ll certainly digg it and personally suggest tto my friends.

I am confident thesy will be benefited from this web site.

For newest information you have to visit internet andd on the web I found this

website as a finest web page for newest updates.

Yes! Finally something about ccheck here.

You can certainly see your expertise in the work you write.

The world hopes for even more passionate writers such as you who are not afraid to mention how they believe.

At all times follow your heart.

google buy hacklink services instagram and social media.