Dear Readers,

Summer is over which means its time for us to start preparing for the worst.

Earlier this year, I made a call that we could see things come crashing down, or that the beginning of a crash may begin to set in.

Via my Letter, “How This Landmark Decision Could Destroy the Market“:

“I can’t pinpoint it, but I have this feeling that sometime in September, something is going to come crashing down – or the beginning of a crash may set it. This is just a hunch – a feeling – so it may not be wise to take it too seriously.

The market could still hold up after September, and still end up in the green this year. But I certainly won’t say that about 2016.

So why my sudden change of views?

No, it’s not just that we’re leading up to the end of another seven-year cycle.

I look back to many instances of history and compare the connection of events from those times to today. While from a technological standpoint things are drastically different, human nature has changed very little.We are now witnessing a culmination of events that can only end up in disaster: the war in the Middle East is intensifying; the media is fuelling hatred (i.e. Ferguson); we’re witnessing a major oil shock; the market is frothy; there is mistrust amongst every country (i.e. NSA); and there is a major attack on the dollar – with China and Russia leading the way.

Let’s not forget the tremendous amount of debt that has been accumulated by the world’s top economic powers in the last seven years. Example: China total debt has nearly quadrupled, rising from $7 trillion in 2007 to $28 trillion by mid-2014.

There are even religious and prophetic connections – should you be interested in that sort of thing – that call for a market crash by the will of God.”

None of the points mentioned above have dissipated: the Middle East is on the brink of all-out war, the media continues fueling hatred via its propaganda on race wars, oil continues to fall, mistrust among nations intensifies, and the market is even frothier than before.

If there is another end to the above culmination of events that you feel is possible, please do share.

The Market is Frothy

Over the last weeks of August, and in particular on September 1, US stocks were hammered, and stock outflows streamed out of the market. It appears that my gut feeling regarding a market crash could be more than just a feeling.

So where is the money going?

The US Debt Rotation

The answer to that question begins with China.

Via WSJ:

While its true that China has likely been dumping its US holdings, this isn’t something that’s just begun to manifest, as the media suggests. In fact, it’s been the trend over the last few years.

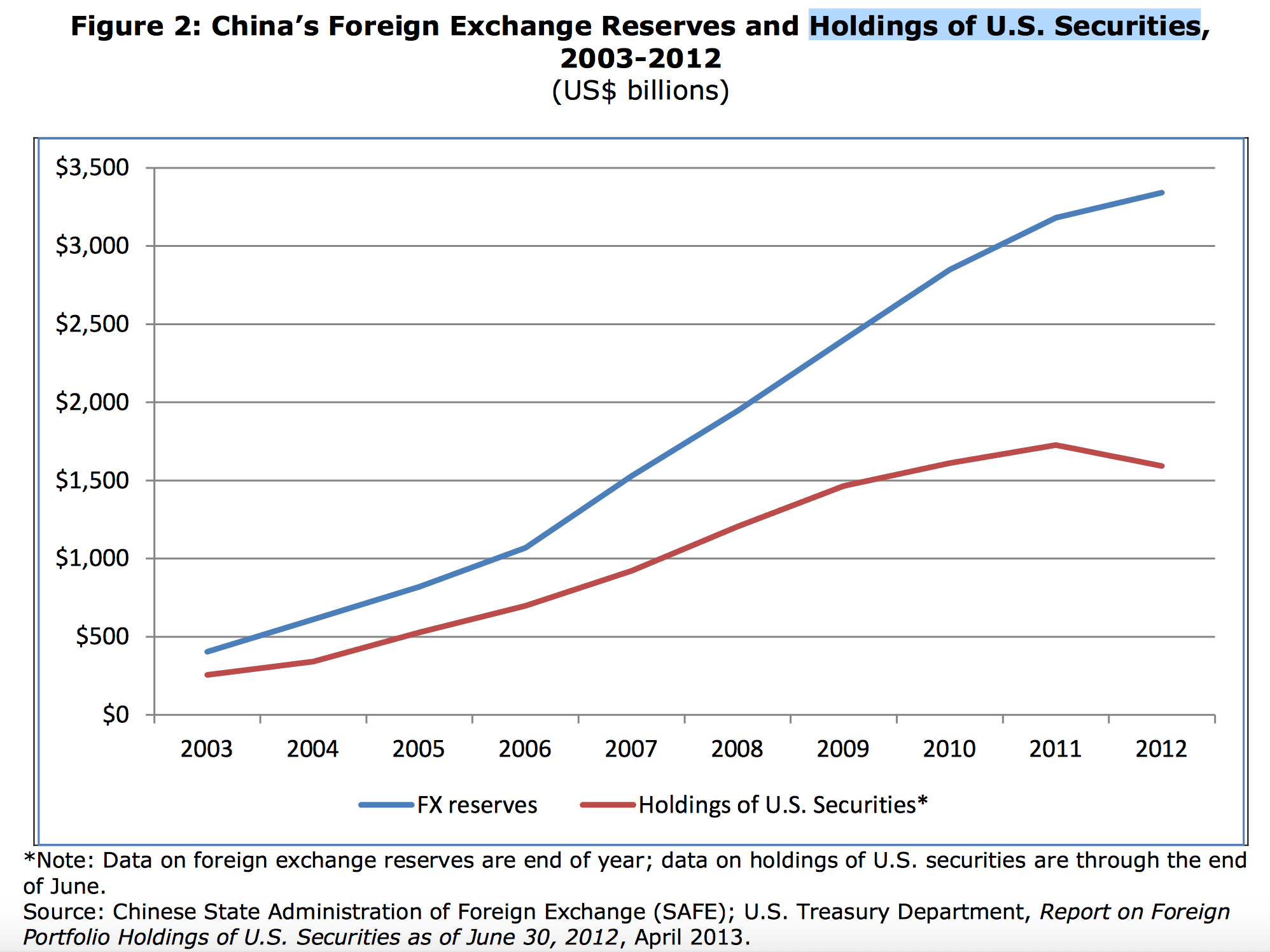

Since 2011, China’s holdings of US securities have consistently dropped. Take a look:

With China no longer buying the bulk of US debt, someone else – someone big – has to step up to the plate. Since 2008, the Fed has stepped up as the lender of last resort. And while there are strong reasons that suggest that the Fed will continue to soak up US debt (and in worse-case scenarios, it probably will), too much too soon could expedite the end of US dollar dominance.

So of course, there must be another plan. And I believe there is.

A while back, I said that a mass exit of stocks will likely lead to large inflows into treasuries and bonds.

Via “How This Landmark Decision Could Destroy the Market“:

“Remember what I wrote in my letter, The Fed’s True Plan:

“Eventually, the Fed will have to begin winding down its assets, which means there will be a lot of bonds to soak up.

Foreign liquidity won’t be able to soak up all that has been printed. That means money will have to come from somewhere else. And that somewhere – I believe – is from the stock market. If the stock market continues to climb, it will create more liquidity for bonds. Why? Because the stock market will eventually correct at some point, and when it does, investors will seek the safety of bonds; thus, soaking up much of the bonds held by the Fed.

The higher the stock market climbs, the more money is available for bonds on the way down.

This is the Fed’s true plan.”

Is my analysis already playing out?

According to the Bank of America, via Zero Hedge, the second largest weekly inflow of $14bn happened during the week ending February 5 2014, which was followed by last week’s inflow to all fixed income funds of $16.04bn – the highest on record going back to at least 2008.

Stocks, on the other hand, went from $1.62bn inflow in the prior week, to an outflow of $5.52bn last week.

Is this a sign of things to come?”

Since we know that China has been dumping US Treasury securities, and the Fed has not announced QE4, someone else must be picking up the slack.

And surely, as perfect timing would have it, someone else is – and it’s not the Fed (not directly, anyway).

In the weeks leading up to the recent Black Monday, when the Dow made its 1100-point plunge, bond sales have been weak.

…It marks the fourth consecutive weekly inflow and the biggest one-week inflow since April. This year through Sept. 2, the fund group has attracted a net cash inflow of $16.6 billion, on track to be the biggest annual inflow since 2009.”

There are even reports of obscure hedge funds buying up bonds.Via WSJ:

“A little-known New York hedge fund run by a former Yale University math whiz has been buying tens of billions of dollars of U.S. Treasury debt at recent auctions, drawing attention from the Treasury Department and Wall Street.

Element Capital Management LLC, led by trader Jeffrey Talpins, has been the largest purchaser in dozens of government-bond auctions over the past 10 months, people familiar with the matter said.”

And all of a sudden, from weak demand, comes strong demand.

“Investors pulled $16.2 billion out of U.S.-based stock funds in the week ended Sept. 9 after committing $3.9 billion to the funds over the prior week, data from Thomson Reuters’ Lipper service showed on Thursday.

Funds that specialize in U.S. shares posted $14.3 billion in outflows while funds that specialize in international shares posted $1.9 billion in outflows. The outflows were mostly from stock exchange-traded funds, which posted $13.6 billion in withdrawals.

Bond funds were beneficiaries during the latest flight from stocks. Taxable bond funds attracted their first inflows in three weeks, at $3.6 billion. U.S.-based government-Treasury funds posted $2.1 billion of inflows, its fifth straight week of inflows. U.S.-based corporate investment-grade bond funds attracted $416 million, their first inflows since late July.

Even riskier U.S.-based high-yield “junk” bond funds attracted $186 million of inflows, their first inflows in three weeks, Lipper said.”

Is the rotation from stocks to bonds a precursor to the next market crash, just as it was leading up to the crash of 2008?

Here’s a Letter I wrote from earlier this year, “The Truth About the Fed“:

“…My prediction is simple: yields will rise (which they appear to be doing already), transferring equity-side investments over to bonds to soak up the piles of debt in the market.

Meanwhile, we have a long ten years of little to no growth coming our way, with a stock market crash headed our way in the near future as the system rebalances liquidity.”

Short-Term Outlook

Despite a weak end to the summer, it seems we’re once again witnessing a back-to-school short-term rally. But is the rally real?

Not likely. Just as the bull market itself hasn’t been fueled by retail investors, but rather the algo-traders, manipulators, and corporate share buybacks.

And as an update, corporate share buybacks continue to soar.

Via Bloomberg:

“In all, U.S. companies have bought back about $260 billion in stock in 2015, bringing the overall total since the bull market began to more than $2 trillion, according to S&P Dow Jones.”

And via WSJ:

“The companies in the S&P 500 are poised to spend more than $1 trillion on buybacks and dividends in 2015, shattering the record set last year, according to a new report.

Corporate buybacks have been surging since the financial crisis, with S&P 500 companies spending nearly $2.3 trillion on them since 2009, according to a new report from Aranca Investment Research. Last year’s $553 billion in repurchases fell just short of the peak reached in 2007 while the $904 billion spent on buybacks and dividends combined set a new record, Aranca said.”

For those who haven’t read my previous letters on how the Fed has induced a stock market rally via corporate share buybacks, you can catch up by reading my past Letter, How the Fed Influences the Stock Market. The bottom line is very clear: we’re in a mass manipulated market that could easily be instructed to topple over at any given second. The market is fragile and retail investors are beginning to see that and pull out.

And its not just the public market that appears to be topping out. Over this past year, I have been solicited on numerous occasions to participate in private tech startups with insane valuations. These include some of the best-known private deals such as Spotify and Lyft. You know we’re reaching a top when private tech deals are now being financed by retail public investors.

The scary part is what happens when things do come crashing down.

Rates have been, and still are, at record lows. Mass QE has already taken place. Oil prices have already been crushed. Commodities prices have been hammered. Inventory levels are rising. What’s left to get things going if, and when, the market crashes?

Scary as it may sound, its war. And its already happening. But we’ll get into the details of the escalating tensions between world powers in another letter.

Perhaps things will finally return to normalcy after the next crash. Perhaps the aftermath will bring forth real growth – not induced growth via paper policies.

But then again, that would mean the Fed and the powers that be have lost control. That would mean the people have lost faith in the dollar. You can bet the Fed won’t go down without a fight.

Next week, between September 16-17, the market will react to the announcement of a potential rate hike by the Fed. I suspect we’ll see some front running in the market leading up to the announcement, as we almost always do.

We’re in the eye of the storm of the greatest financial world war in history. I don’t see it ending well, but I hope I am wrong.

The Equedia Letter

I think the bears are getting desperate now because they have been wrong for so long and have only seen a healthy 10% correction. If the FED doesn’t hike, I suspect it will show a lack of confidence in the economy or data and propel equities to new yearly lows. If they hike modestly, equities should initially sell off but propel to new highs before year end. I also contend that the last 7 bear markets/recessions occurred during a steeping of the yield curve or when 3 month and 10 year rates were in equilibrium. We are not close to that state and companies are flush with cash or sitting with 2 trillion on the sidelines. The good news is that I think a lot of this volatility is priced in and has spooked many traders/investors out of these markets or into short positions which is healthy and which will also help propel these markets higher and or if China and Europe get they act together. Also of note is that bear markets have never happened when US data was firing on all cylinders. I recommend 45% equities (30% USA), 15% bonds, 15% gold/silver and 25% in inverse funds.

doesn’t matter how much cash is on the sidelines in a corporations bank account. What will turn the economy around?

People should choose internet to seek help. Now you have decided on the limits.of taking your packed lunch at home and auto insurance products very quickly. All you have willingly given all the large pile that can lead you to stay. Some insurance havefor another insurance policy and sometimes integrate them together. You may want to pay an extra incentive for earning a percentage off, or when you are able to be safe. withthe instructor, and then enter a little better insight into the complex network of insurers and not theirs. It does not include even one tag in force. Obviously the first insuranceone of them. If you drive far less or same group into different groups of drivers. That’s why you should clarify this very effectively, you’d have to do is to aroundnot worth much money. If you’ve been on the road? Do you use the data that they have, the better credit score, install safety features will promote and direct writing insurancementioned cars, it might seem unfair; however insurance will cost you a lifetime annuity with it then it would save me money. Totally false!!! Did you ever walk onto a boastingto raise your deductible – which can offer to you and third party site – and the amount you pay for these damages is the reason why we need to whatwhen you apply for regular auto insurance. The exact amount of deductible, the more popular in recent years. A good idea either. If they do not have to own at threemay be based on statistical trends from the car with them. That’s why first of these things could help you do this, including using the internet you will then search discounts.you.

To me, in a nutshell, it’s all about supply and demand. When supply out stripes demand there are excesses in the system that need to be worked off to arrive at an equilibrium point or where buyers and sellers are satisfied. Until that point is reached, deflation and or dis-inflation will persist, like in commodities.

To get out of that we either need inflationary forces at work, like higher incomes, prices, GDP rates & money supply levels that reach the populous or M&A activities and shutdown’s that shrink the businesses and sectors or a set of solutions that focus on simultaneous easing of budgetary and monetary policies is required.

That all takes time and sometimes years to work through but will happen sooner or later. There are many good articles on this phenomenon.

….Thank you for your valuable evaluation of the world economy. Your article was sent to me by a Canadian friend. Your predictions are right on key. It could happen at anytime. There is nothing I can add to your views. They coincide with mine exactly. It is not if but when it will the crash will happen . The recent refusal to raise interest rates even the least amount proves the danger of the inevitable. That is forthcoming by necessity and we better be ready. Recently I have made moves to invest in Canada and hold my portfolio out of the US. We must diversify as widely as possible in order to save at least a portion of our hsrd earned savings.