Dear Readers,

Stocks continue to make new record highs, despite poor jobs data and the potential threat of World War III.

Share buybacks continue to boost the illusion that stocks are attractive, enticing retail investors to pour more money into this bull market.

Fighting (and shorting) the market here is just plain stupid – no matter how fundamentally wrong stocks are relative to the economy.

Over the past five years, I have told readers to never bet against an entity that has an unlimited bankroll.

The Fed has effectively boosted world stocks through asset purchases and low interest rates, turning risk-on mentality into overdrive.

And the risks continue to pile on.

Debt: The Ultimate Cover-Up

Countries and corporations all over the world are turning to debt to cover economic decay.

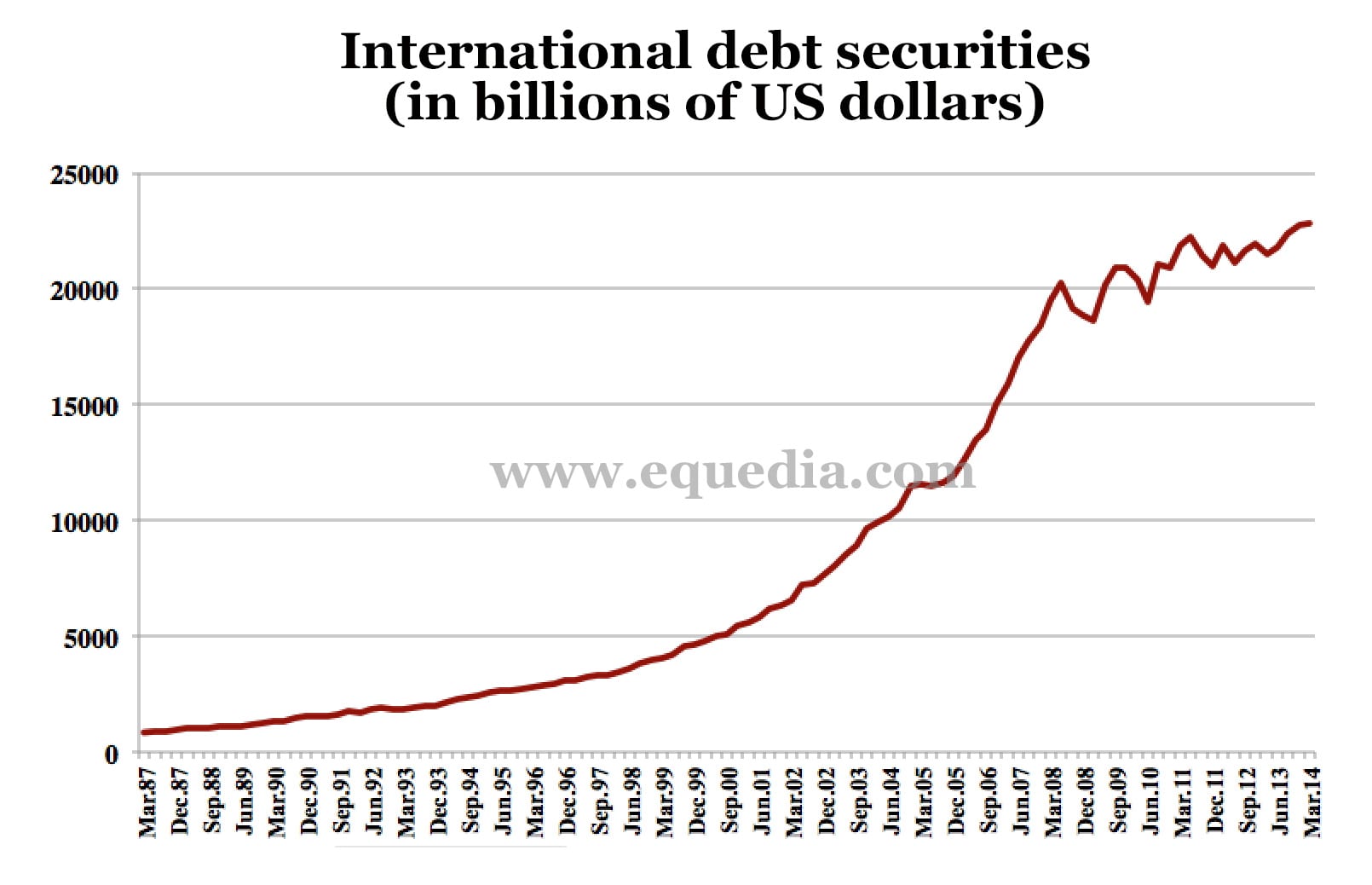

Take a look at the growth of international debt securities:

Here’s a look at the growth of the US outstanding bond market debt:

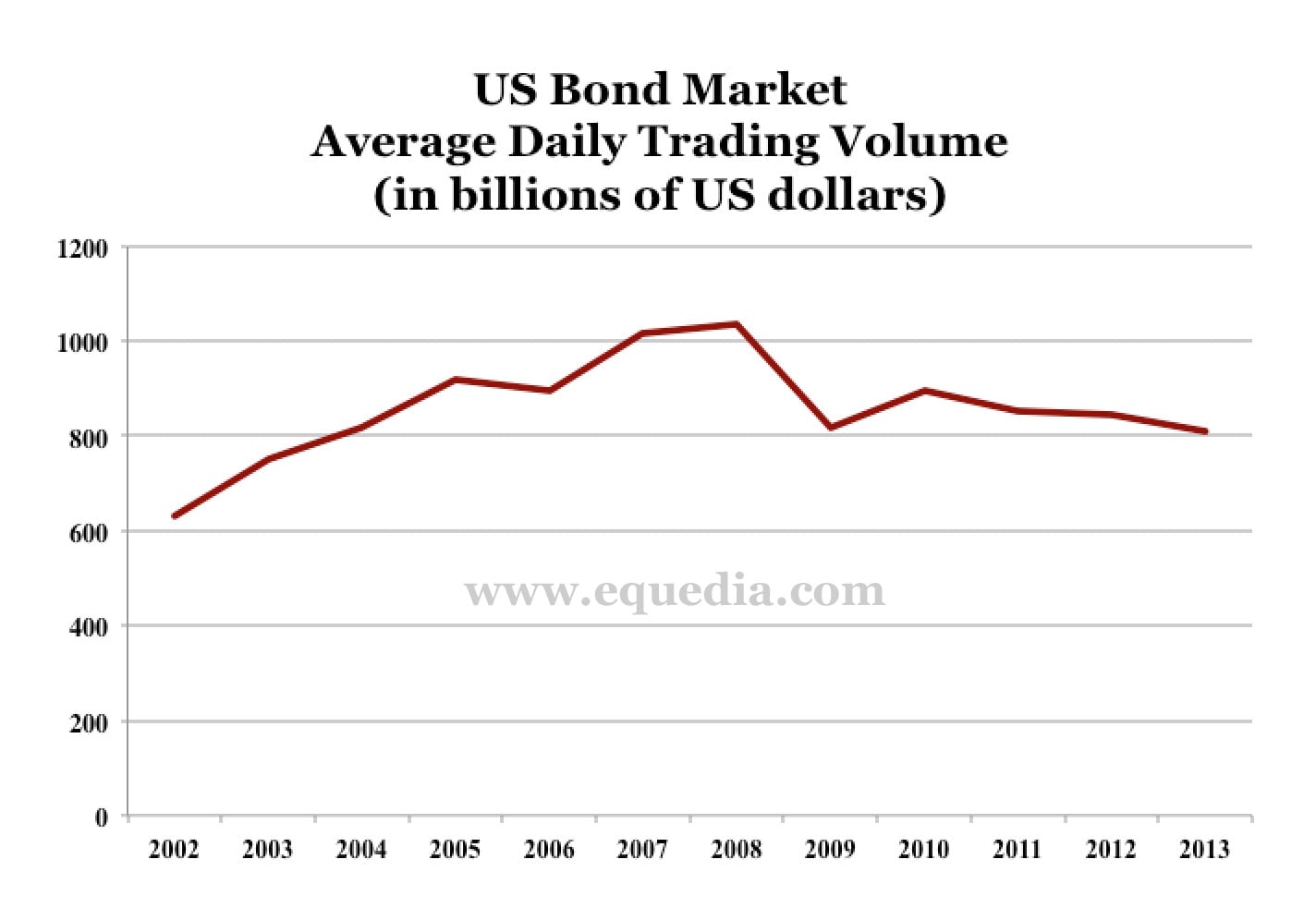

Despite the growth of the US bond market, trading of US bonds has actually declined since 2008:

Despite the growth of the US bond market, trading of US bonds has actually declined since 2008:

That means the once extremely liquid US bond market is running low on liquidity, during a time when bond issuance has never been greater.If the Fed stops its programs, we could witness a bond market crisis.

Because the biggest buyers of US bonds have always been foreign countries.But since 2008, as I mentioned in my letter “The Biggest Buyers of Garbage,” the Fed has been the largest single buyer of US bonds.That’s because nations all around the world have been struggling with liquidity and are issuing their own debt to solve their own problems.As such, as the issuance of bonds debt continues to grow, while the demand for it continues to shrink.

This is happening all around the world.

What do you think of all this debt?

Have No Money? Sell More Debt

When no one else will buy your debt, sell it to the retail investor.

Thailand’s SEC just approved a new rule that would allow retail investors to buy tier-2 subordinated debt. In simpler terms, citizens of Thailand can now buy debt with a low credit rating and take on more risks to chase a higher yield than the 0% the banks are offering.

The Bank of China Ltd., the nation’s fourth-biggest bank by market value, just hired four banks to help arrange its first offshore sale of subordinated securities.

China’s nonperforming loans touched a five-year high of 694.4 billion yuan ($113 billion) on June 30, making it more urgent for banks to build capital buffers to cushion against losses – ironically by selling more debt.

This sale of debt continues to expand at record place all over the world – despite all-time low yields.

According to the Bank of America, forty-five percent of all government bonds now yield less than 1 percent.

And while many so-called experts are expecting a near-term interest rate hike, don’t expect it to happen anytime soon.

Just ask Europe.

Negative Zero Interest

The European Central Bank (ECB) just cut its interest rates again, with the rate on the main refinancing operations dropping to a new ultimate low of 0.05 percent.

That means interest on $1000 will generate only $0.50.

The rate on the marginal lending facility will drop to 0.30 percent and the rate on the deposit facility will be now be negative 0.20 percent.

In other words, you actually have to pay money to make an overnight deposit at the central bank.

But it doesn’t stop there.

In conjunction with the interest rate drop, the ECB has announced a new stimulus program that involves buying private sector financial assets starting next month.

I said this would happen in many of my past letters, but its interesting to see headlines everywhere that the recent announcement by the ECB was a surprise.

As it stands now, the world owes more than $59 trillion, with the US owing more than $17 trillion of it.

Every year, the US has to pay over $500 billion in interest; that’s equal to $16,000 per second.

Debt securities continue to gain strength and momentum, but what happens when the Fed finally moves toward policy normalization?

What happens when the bond market loses liquidity? What happens when there aren’t enough buyers to soak up all of the bonds?

Last month, the high-yield corporate debt market experienced a sudden outflow, with a record US$7.1-billion being pulled out of US funds in the first week of August alone.

Trading volumes in the bond market have already been drying up since 2008.

If we continue to see these outflows, the bond market could come tumbling down.

So why does this matter and why should we, as equity investors, care?

Previously, I explained that record amounts of share buybacks have beefed up Earnings Per Share (EPS) to make stocks look more attractive.

Furthermore, I also explained that much of the borrowed funds from corporations have been used for share buybacks or dividend payouts, rather than capital investment.

This has been enhanced because of a massive inflow into high-yield and leveraged loan funds, which lower funding costs and enables these corporations to embark on massive share buybacks to boost share prices.

In other words, without the support of high-yield credit markets, equity prices won’t be able to sustain its growth for long – especially since both are arbitrage(able) bets on the same capital structure.

What do you think? Will the Fed raise rates? What happens if QE stops?

CLICK HERE to Share Your Thoughts

Until next time,

The Equedia Letter

Ecig was trading as high as $10, now it has lost about 4o%, not a sterling investment I would say.

But ECIG has progressively declined on the share market… now down to near $6-00 what does it have to do to regain so much lost value? and when?

Following your write up on ECIG in March, I bought some shares and am down now almost 65%.

where do you see gold heading in all this turmoil and if there actually is a war?

I wouldn’t worry about gold,in the long run.Gold has been accepted money for thousands of years.I would worry about 100% fiat currencies.That’s where the risk is.There will be a confidence crash in these currencies and I wouldn’t want to be caught holding a large % of my assets in them.

How can rates go up with the lack of bond buying. The Fed will soon be doing most of the buying.as the last resort.

It’s a real mess with a lot of accounting decorations.

What about this mistake or coverup? by The Fed?

http://tinyurl.com/mmehbos

“This means ECIG could soon be the only publicly traded pure-play electronic cigarettes company on the NASDAQ, or on any large cap exchange.”

Correction, Vapor corp (VPCO) is already trading on the NASDAQ and is also a pure-play ecig company. Thankfully I sold it last month before it dropped. Within the past 6 months it went from 9$ a share to 1.80$ a share. Both ECIG and VPCO have tanked recently.

Spot on with this write-up, I actually think this site needs a great

deal more attention. I’ll probably be back again to read more, thanks

for the info!

Здравствуйте господа!

Предлагаем Вашему вниманию высококачественные профессиональные плёнки. Наша организация”ООО Защитные плёнки” работает 15 лет на рынке этой продукции в Беларуси. Дизайнерам, производителям стеклопакетов, мебели и дверей для применения своей продукции в офисах, квартирах и коттеджах мы предлагаем установку декоративной пленки. Проектные и строительные организации для осуществления смелых архитектурных решений могут использовать предложенную нами на выбор тонировочную пленку. Матовые пленки различной цветовой гаммы, установленные в межоконном пространстве, придадут зданию или сооружению неповторимый индивидуальный стиль. Пленки зеркальные оградят посетителей кафе и магазинов или сотрудников офисов на нижних этажах от ненужных глаз.

Более подробная информация размещена https://drive.google.com/file/d/1hceZWkDFW4mFU9sDZ64bQAi3ss41Fo5g/view?usp=sharing

С уважением,коллектив “ООО Защитные плёнки”.