I need your help.

No, Canada needs your help.

Today, I urge you to read this Letter in its entirety because what you read can and will affect you.

After you read it, you can take immediate action by CLICKING HERE.

In just a bit, I am going to ask you to do something.

Something that could prevent the complete failure of Canada’s market.

But first, let me explain.

Canada is Failing and it’s Getting Worse

Canada’s equities market is like any other exchange in the world.

It consists of buyers and sellers that exchange goods – in the case of the stock market, securities.

But unlike many other places, Canada is at a major disadvantage.

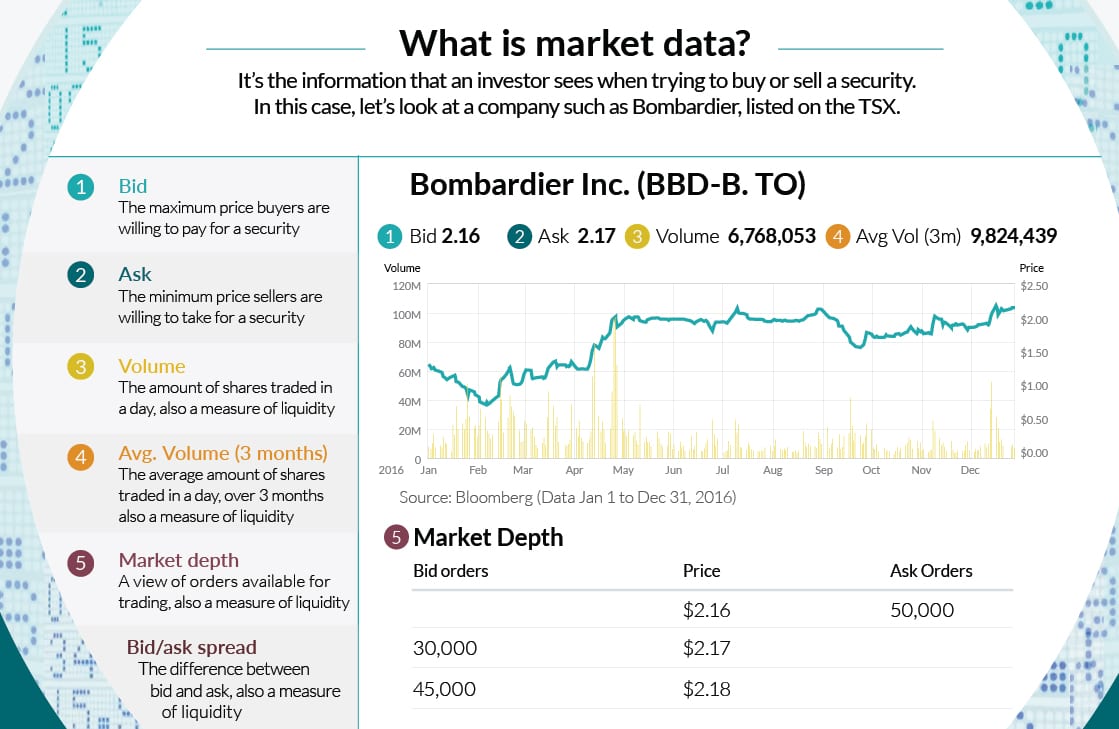

You see, investors need to have the right information – the right market data – so that they can make proper decisions.

This is straight forward stuff for anyone who trades stocks.

But what you don’t know is that most Canadians – and those who trade Canadian stocks – have information that is likely both inaccurate and incomplete.

And that means Canadian investors are at a serious disadvantage.

Let me explain.

Why the TSX Venture is Failing Revisited

Four years ago, I wrote:

“The biggest and most important aspect of any stock-trading platform is transparency.

Investors should be able to see exactly how many bids and sell orders are available for a stock at any given time – especially for an exchange that has minimal liquidity and therefore is much easier to manipulate. This is how investors calculate at what price he/she should place a buy or sell order.

The depth of the market can be seen using a paid service called Level II that gives you access to the order book in real time. I have always said that anyone who trades should pay for such a service. However, even with this service, you’re far from being protected.

Multiple Trading Platforms

Many retail investors I speak with have no clue that there are multiple parallel trading platforms for the stocks they buy in Canada.

…There are now many alternative market centers that process trades for stocks listed on the TSX and TSX Venture. Some of these include Alpha Trading Systems, Chi-X Canada, Pure Trading, Omega ATS, and dark pool Match Now.

According to Stockwatch:

“Alternative trading systems in Canada handled 33.7 per cent of trading volume during the week ended May 3, 2013.

…The Toronto Stock Exchange and the TSX Venture Exchange handled the other 66.3 per cent.

…Looking at securities listed only on the TSX, the exchange captured 61.2 per cent of volume. Chi-X handled 18.3 per cent, Alpha had 11.7 per cent and together the other ATSs handled the rest, 8.8 per cent.”

As you can see, these alternative trading systems handle a large portion of the trading volume in Canada, yet most regular Canadian investors don’t see this because most quote systems do not include transactions from all the different platforms.

Furthermore, while volume of trade can be seen by the select few quote platforms that incorporate the volume between these exchanges, (few) of them combine them in the same bid/ask level II depth because they are being traded on different platforms via parallel order books.

In other words, while you may be trading a stock on one platform, that same stock is being traded on different platforms at the exact same time.

This not only removes transparency – especially for the average retail investor – but it also removes visible liquidity for any particular stock.

The retail investor using his/her online trading quote system doesn’t stand a chance – especially when playing on an exchange with little volume, such as the TSX Venture.”

If you think things have gotten better, think again.

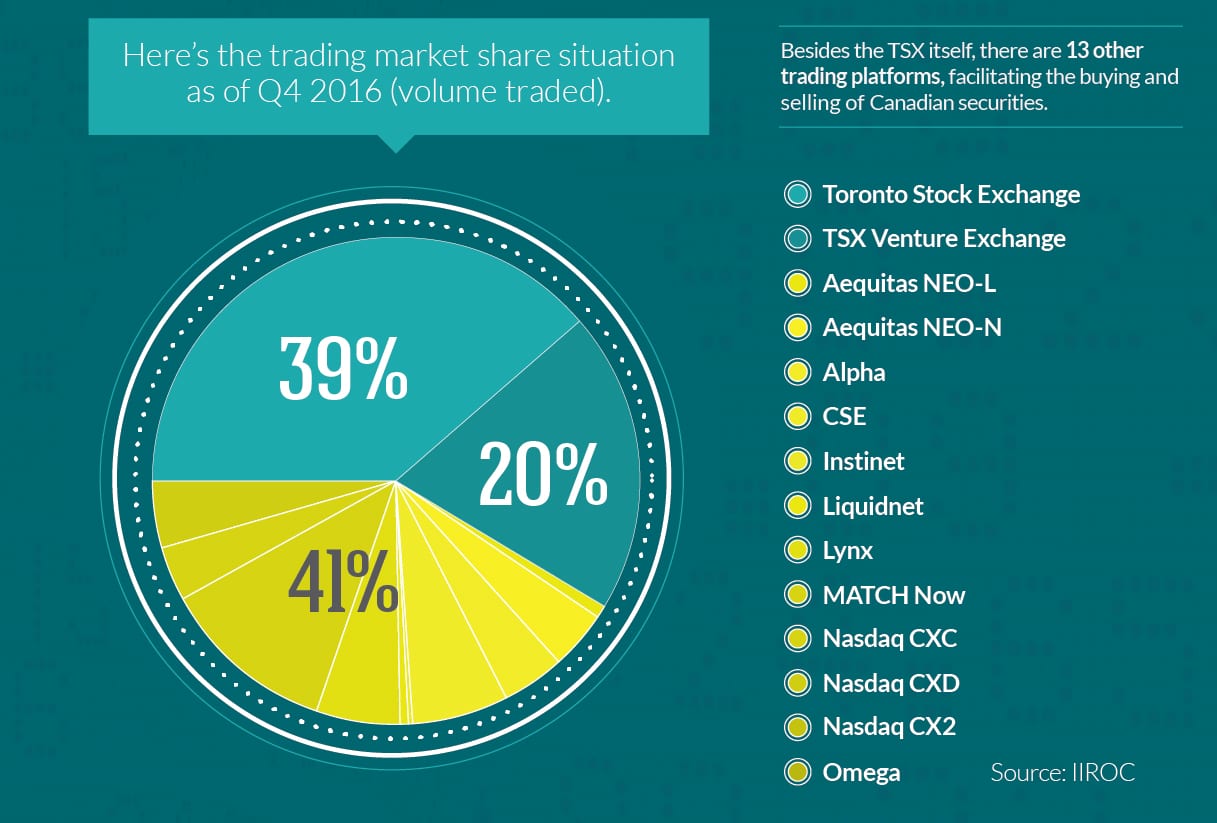

Today, there are now 13 trading platforms facilitating the sale of securities in Canada.

And a whopping 41% of the volume traded in Canadian securities originated from platforms outside of the TSX and the TSX Venture:

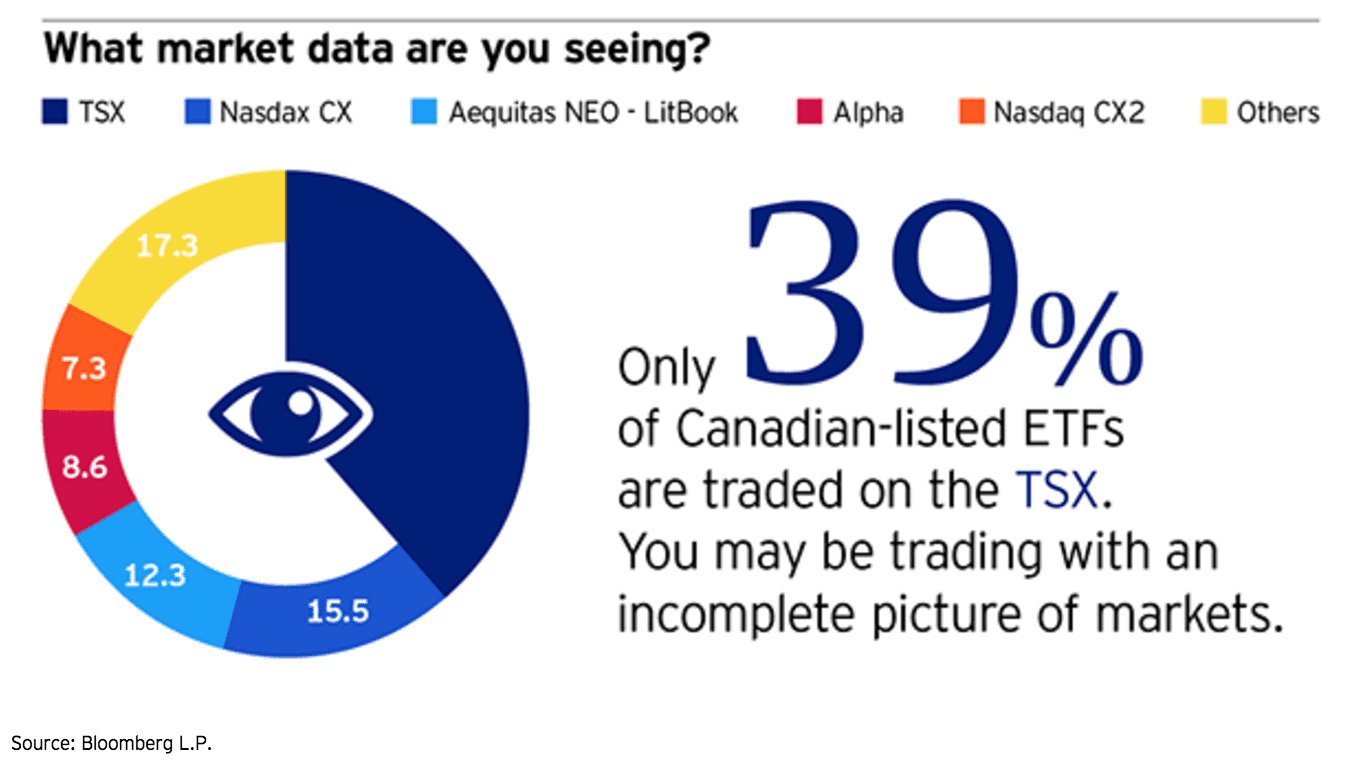

When it comes to ETF’s, the visibility is even more opaque.

According to Invesco:

“…in 2016, the TSX represented only approximately 39% of total ETF trading volume, with the remaining 61% taking place on alternative venues…

… The result is that many ETF investors may be trading with inaccurate or incomplete price and liquidity information. Without the whole picture, market efficiency suffers and investors may struggle to obtain an accurate price for their securities.”

What’s worse is that, according to Aequitas, 100% of retail investors don’t have a full view of the market data at all:

Most online brokerage platforms only show what happens on the TSX and the TSX-V.

When you see the price for a stock on your online trading platform but see a different price on Bloomberg, now you know why.

That is neither fair, nor transparent.

What do you think?

CLICK HERE to Share Your Comment

CLICK HERE to Take a Quick Survey

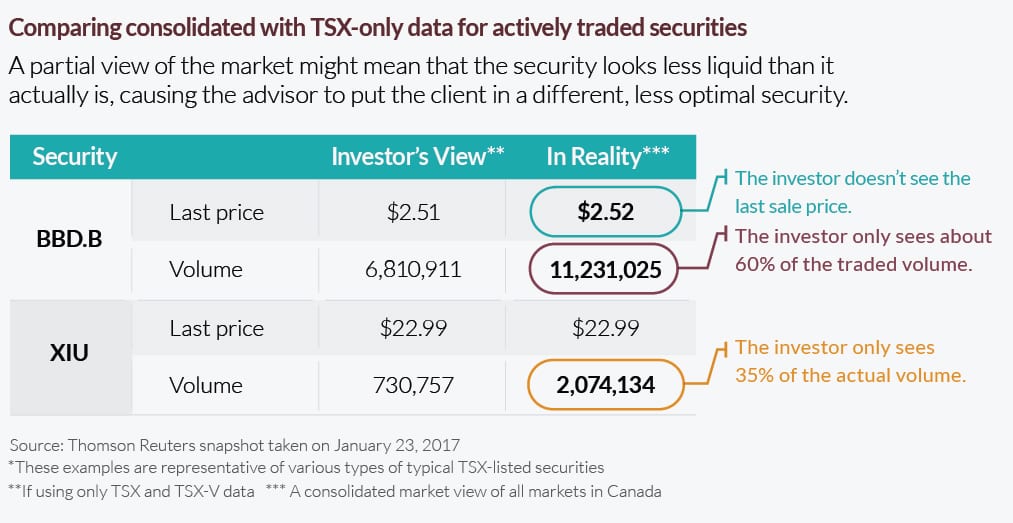

But what does that mean?

It means unless you’re a professional trader or trading firm paying astronomical amounts of money for consolidated real-time market data, you’re not trading with the right information.

In fact, you’re not seeing the true liquidity or price of Canadian stocks at all.

Take a look:

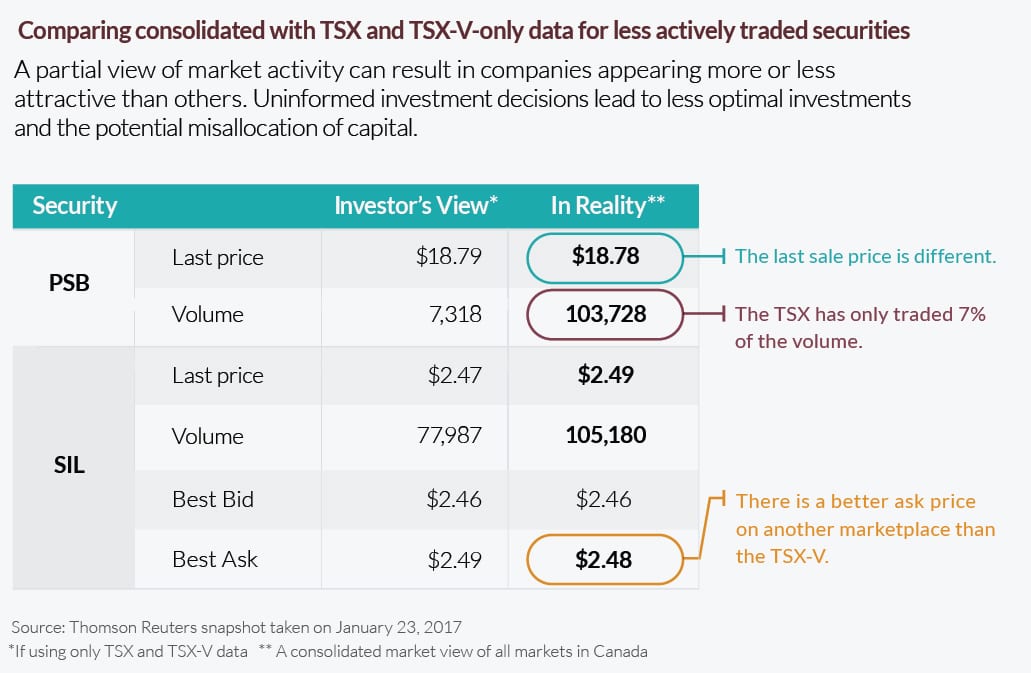

It’s even less transparent when you look at data for less actively traded stocks:

This lack of data transparency can be detrimental to your investment decisions.

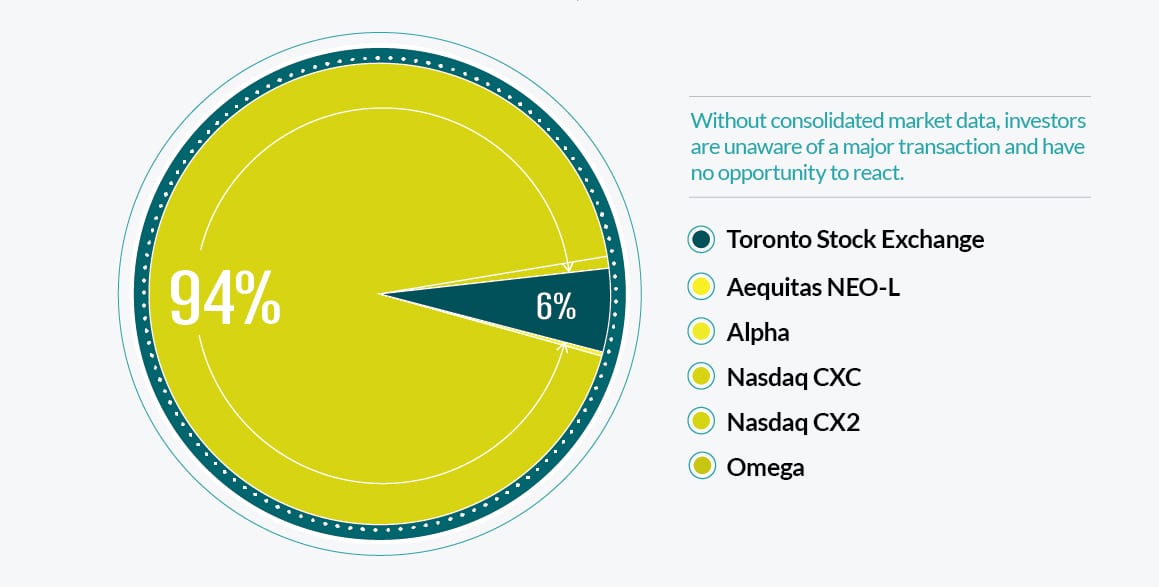

For example, on October 26, 2016, a named shareholder in Eastmain Resources Inc. sold 7 million shares through the facilities of the NASDAQ CXC alternative trading system.

This sale represented a whopping 94% of the volume that day.

But most retail investors and investment advisors did not see this until the Company issued a press release the next day.

Here’s what happened after the sale:

Do you think it’s fair that most investors didn’t see this transaction because it occurred on an alternative trading platform?

CLICK HERE to Take the First Step in Fixing Our Market

This lack of transparency is a major issue – one that even IIROC has acknowledged.

Via IIROC in March 2014:

“IIROC is concerned that firms engaged in the on-line retail trading business that provide limited market data may not be clearly describing the scope of the market data offered.

Clients that are unaware of the constraints of the market data provided may make uninformed and therefore sub-optimal order entry decisions.

IIROC believes it is important for firms to provide disclosure that describes the scope of market data provided to clients.”

The irony is that one of the most important aspects of trading stocks is transparency and timely disclosure; without a mandate for consolidated market data, we have neither.

The first step you can take to solving this very important issue and protect your future is to speak out.

You can to do so by CLICKING HERE.

Once you do, I will forward it over to the Canadian Securities Administrators (CSA) to show that industry professionals aren’t the only ones that realise there is a problem with the Canadian market. Then we can move forward to signing a petition.

I urge you to complete the survey. It will only take a minute but could go a long way in addressing this problem.

Unfortunately, transparency isn’t the only problem.

There’s another huge problem that when combined with the lack of market data transparency, could destroy the Canadian market.

Short Selling Runs Rampant

Short selling is believed (or so “they” say) to be a necessary part of the market, providing balance and efficiency.

While this may be true in some instances, especially with the advent of high frequency trading and ETF’s, the basic idea of short selling is completely absurd.

As I mentioned in a previous Letter:

“Short selling is simply selling stock you don’t have.

You borrow stock from someone (who likely doesn’t know you’re borrowing it), sell it, and hope that the stock goes down so you can buy it back at a cheaper price.”

To put that into context, it’s like saying:

You go away for vacation.

While you’re away, a stranger rents your house out on Airbnb without your knowledge.

You come home only to find your house is trashed – and now worth less than it was before.

You lose money on your house, but the stranger legally made money renting your house out.

It’s no secret that short selling can and often does hurt companies. While short selling can provide efficiencies in the market and create more liquidity, Canada’s market doesn’t stand a chance.

This is because of yet another Canadian regulatory hurdle.

This regulatory hurdle has caused short selling in Canada to run rampant – especially on Canada’s small cap exchange, the TSX Venture.

Just how much has short selling grown?

According to IIROC, short sales as a percentage of trades on the TSX Venture from Jan 2009-April 2010 averaged 4.39%.

But then, in the January 21, 2013 Short Sale Report, short sales as a percentage of trades on the TSX Venture averaged 6.89% for the two weeks prior.

Two years later, in the January 1, 2015 Short Sales Report, short sales as a percentage of trades on the TSX Venture averaged 7.90%.

In the most recent Short Sale Report, short sales on the TSX Venture averaged 8.57% – nearly double the average in 2009.

But why and how has short selling doubled? And what is the regulatory hurdle that may have caused this?

The Removal of the Uptick Rule

Back in October 2012, a wide number of so-called trading enhancements were implemented by the TMX Group, home to Canada’s two largest exchanges, the TSX and the TSX Venture.

From my Letter, Why the TSX Venture is Failing:

“On October 4, 2012, the TMX Group sent notice to confirm “trading enhancements,” set to begin on October 15, 2012.

The enhancements in the notice reflected recent regulatory amendments respecting short sale regulation, the introduction of a short marking exempt designation, amendments respecting dark liquidity on Canadian equity marketplaces, and functionality introduced as a result of client demand and market quality initiatives.

When you try to fight one problem with another problem, the result is never positive. I will explain what’s happened in a bit.

But first, look at the one-year chart for the TSX Venture Composite since the rules were announced:

It doesn’t take a rocket scientist to break down the above chart.

Since the notice of the “Trading Enhancements Update” by the TMX, the TSX Venture has dropped like a rock.

Why?

The Death Spiral

When regulators forced the TMX Group to allow trading through alternative trading systems operated by third parties, it caused real-time transparency issues.

When you combine the lack of transparency in parallel trading platforms with the use of High-Frequency Trading (discussed last week), regulators had no choice but to eliminate the tick test rule, or uptick rule, for short selling.

Let me explain.

Discontinuing Price Restrictions of Short Sell Orders (Tick Test)

Historically, you could only sell a stock short if the price is higher than the last different price; simply put, you can only short a stock as it was moving up.

(This was know as the Uptick Rule.)

However, this rule only works when there is a strict sequence of orders in the order execution book; when bid/ask orders are placed in line on a first-come, first-served basis.

But with parallel trading systems, a definitive sequence of different prices can’t be established at any exact given point in time because one order book might show a downtick, while the other an uptick.

As a result, it would be extremely difficult to enforce the uptick rule.

By allowing competing trading platforms and encouraging HFT (which was believed to create more liquidity), regulators had no choice but to remove the tick test rule.

In the October 4th announcement, the rule was eliminated:

“TSX, TSX Venture Exchange (TSXV) and TMX Select will no longer constrain short sell orders to the last sale price. Short sell orders entered will be permitted to trade down to their limit price establishing a last sale price on a downtick. Short Crosses will no longer be constrained by the last sale price.”

This means we can now short a stock anytime we want.

That’s great news for short sellers, but for companies trying to raise money at higher prices to hire more staff or move their projects forward, this rule change can cripple them – especially under the liquidity constraints of the Canadian market.

It doesn’t take a lot of money to control a stock via short selling on the TSX Venture.

As a matter of fact, institutions often hammer stocks via short selling and back up their shorts with warrants they obtained in a previous financing. They often force the price of a stock down to finance the same companies they’re shorting to get a better financing price, or to force a company into a financing arrangement.”

The removal of the uptick rule has created a breeding ground for short funds to make a lot of money betting against companies – especially companies that trade on the TSX Venture.

When you consider that companies that trade on the TSX Venture are likely companies that are speculative and often negative cash-flow businesses, short selling can immediately hurt a company’s ability to finance.

Furthermore, short funds can use computer trading to add additional pressure on stocks to the downside by making it look like there is a lot of stock for sale. In other words, stock manipulation.

And yes, stock manipulation is illegal.

So how do they do this?

How to Manipulate Stock Through Short Selling

When the removal of the uptick rule was implemented on October 4, 2012, a short marking exempt designation (SME) was also introduced.

Via IIROC:

“The “short-marking exempt” designation is required to be applied to orders for qualifying accounts of arbitrageurs, market makers and “high-frequency traders” that typically generate a high volume and speed of orders on a fully automated basis, may have orders on both sides of the market on various marketplaces at the same time, and that adopt a “directionally neutral” strategy such that generally, the position in each security in the account is flat at the end of the trading day.”

In other words, as long as a firm adopts a “directionally neutral” strategy, such that generally, the position in each security in the account is flat at the end of the trading day, it doesn’t have to declare the short sale.

This was done because IIROC believes that the use of the SME order designation allows them to separately monitor the trading activities of those accounts which are actively buying and selling the same security without taking a directional position and that of actual short sale activity on accounts that may have adopted a “directional” position.

While this may have good intentions, it actually makes it easier for firms selling short to manipulate the price of stocks.

Spoof Trading

Here is Bloomberg’s take on Spoof Trading:

“Spoofing is when a trader enters deceptive orders tricking the rest of the market into thinking there’s more demand to buy or sell than there actually is.”

In the case of short selling, a trader would show pressure on the sell side through stacked sell orders, but remove them if the market begins to move higher.

These stacked sell orders are often viewed – especially by retail investors with a lack of market data – as weakness in a stock.

You may be wondering: What happens if buyers come into the market? Wouldn’t the sell orders be on the hook to buy the stock?

You see, these sell orders are often in small board lots (usually 100 shares) so that anytime the lead sell order is hit, the firm only has to sell a few shares short.

When this happens, the computers automatically adjust their sell orders higher, while still maintaining pressure on the stock by maintaining the multiple stacked sell orders – often times behind a real sell order.

This allows the short sellers to put downward pressure on a stock without having to declare a short because they remain “neutral” by buying just enough shares to end up with a flat position in the account at the end of the trading day.

And because the uptick rule was removed, short funds can now downtick a stock and still short the next day.

What is Downticking?

Downticking is when a trader sells stock so that the most recent change in the share price is negative. This is usually done right before the market closes using very small amounts.

And since stock charts only follow the closing price of a stock, you can see how easy it is for a short seller to create a nasty looking downward chart by spoofing and down-ticking.

These practices are illegal but happen to many Canadian stocks.

Just ask the Ontario Securities Commission.

Most retail investors don’t see this type of activity because most trade without the use of Level II data. They only see the last bid/ask price, which as I already mentioned earlier, may not even be correct.

The next time you see a stock in the green for the whole day, only to end up in the red with less than a minute to go, you now know what could have happened.

The problem for Canadian regulators is that they can’t keep an eye on the thousands of stocks that trade every day.

Even when they do catch it, it’s extremely difficult to find the culprit behind the trades since the short sellers have multiple accounts at different financial brokerages and often work with other short sellers.

Furthermore, regulators often rely on complaints.

But how can a retail investor make a complaint if they don’t even see this “spoofing” or the down ticking because of the lack of mandate for consolidated market data?

Retail investors don’t get to see the Level 2 data because it’s expensive. How can an investor react to this type of predatory short selling?

How can an investor report manipulative trading to IIROC or the Canadian Securities Administrators (CSA) if they don’t have access to the data?

If there was a regulatory mandate to provide consolidated market data in Canada, we could make much more informed investment decisions.

If Regulators could mandate market data transparency with new short sale regulations such as the re-implementation of the uptick rule and more frequently updated short reports (currently only reported semi-monthly), then maybe we could prevent the Canadian market from failing.

I think these rules need to be changed immediately.

Do you?

CLICK HERE to Share Your Thoughts

But that’s just the beginning.

The Dark Side of Short Sales: Short and Distort

Via Desjardins:

“…short selling also has a dark side, courtesy of a small number of traders who are not above using unethical tactics to make a profit.

Sometimes referred to as the “short and distort,” this technique takes place when traders manipulate stock prices in a bear market by taking short positions and then using a smear campaign to drive down the target stocks.

…Short selling abuse like this has grown with the advent of the Internet and the growing trend of small investors and online trading.”

“Short and distort” participants have amassed fortunes driving Canadian companies into the ground.

And with the removal of the uptick rule and the introduction of the SME designation, predatory short selling became even easier.

Unfortunately, I have yet to see a regulator come down on illegal “short and distort” participants.

Do you think regulators should do more to prevent “short and distort” activities?

CLICK HERE to Share Your Thoughts

Combine the lack of required consolidated market data, the removal of the uptick rule, the introduction of the SME designation, with the illegal practice known as “short and distort,” and many Canadian companies and Canadian-born innovations listed on Canada’s stock market could be doomed to failure.

And it makes it even harder for retail investors to succeed.

In the U.S., they have already reintroduced an alternative uptick rule and news just broke that they are looking at bringing it back completely.

The regulators know that these practices not only hurt Canadian companies but that it can have serious consequences on our whole financial system.

Which is why…

Selective Short Sale Ban

On September 19, 2008, the Ontario Securities Commission (OSC) ordered a restriction on the short sale of 13 financial stocks.

These stocks included Canada’s Big Five banks: the Bank of Montreal, the Bank of Nova Scotia, CIBC, TD, and the Royal Bank.

It also included Canada’s largest insurance firms including Manulife Financial and Sun Life Financial.

This was done because the regulators wanted to prevent the banking system from collapse during the 2008 financial crisis and feared that rampant rumours spread by short sellers combined with the downward pressure of short sales would become a self-fulfilling prophecy.

Via the Star:

“This order (the restriction on short sales of 13 financial stocks in Canada) is being issued as a precautionary measure to prevent regulatory arbitrage with respect to short selling in Ontario of the securities of the financial sector issues and to promote fair and orderly markets in Ontario,” the provincial regulator said.”

In other words, the Canadian regulators were worried that short sales would drive down the price of financial stocks, which would lead people to believe the banks were in more trouble than they really were.

And this didn’t only happen in Canada.

Via the international law firm Eversheds Sutherland (US) LLP:

“…Due to ongoing concerns within the financial markets regarding perceived artificial price movements based on rumors involving financial institutions and other issuers, exacerbated in part by active and potentially widespread short selling, on September 18, 2008, the SEC issued a series of three emergency orders focused on the present crisis within the financial markets.

…The first emergency order, SEC Release No. 34-58592 (the “Short Selling Order”), prohibits any person from engaging in any short selling transactions involving publicly traded securities of 799 financial companies…

…The SEC indicated its belief that, “short selling is contributing to the recent, sudden price declines in the securities of financial institutions unrelated to true price valuation,” and further noted that “[s]uch price declines can give rise to questions about the underlying financial condition of an issuer, which in turn can create a crisis of confidence, without a fundamental underlying basis*.”

(*In other words, driving the price of a stock down becomes a self-fulling prophecy.)

The stated purpose of the Short Selling Order is to prevent “short selling from being used to drive down the share prices of issuers even where there is no fundamental basis for a price decline other than general market conditions.”

As you can see, short selling was banned for financial stocks because false rumours and misinformation were being spread, and manipulative short selling caused unjust downward pressure, leading to a decline in the share prices of the banks, which then led to a lack of confidence in the banks themselves.

Should the same principles not apply to ALL stocks?

CLICK HERE to Share Your Thoughts

CLICK HERE to Help Change the Rules

The Time to Take Action is NOW

I get it. With ETF’s and HFT’s in play, short sales may be required to “balance” the market.

But predatory short sales should not be allowed.

There is a serious problem in Canada’s stock market – one that has not been addressed for many years.

When you combine the removal of the uptick rule, the introduction of the SME designation, AND a lack of consolidated market data, Canadian investors really are getting screwed.

If this is allowed to continue, I fear it will eventually lead to the failure of the Canadian market altogether as retail investors lose confidence.

That would be a shame because the Canadian capital markets is a HUGE part of the Canadian economy. It provides jobs and brings about innovation.

We need to fix this before it’s too late.

I have talked about this in-depth in the past but with recent events, I feel compelled to do it once again.

And I urge you to participate.

I am calling all investors, all market participants, brokers, deal makers, and the CEO’s of publicly traded companies to take action by participating in the following survey.

If we receive enough support, we’ll move forward with a petition like the one circulated in the U.S. by Jim Cramer that garnered thousands of signatures and led to the implementation of the alternative uptick rule.

Then the regulators will have to listen.

Consider this: the total listings for the TSX Venture has declined year-over-year:

- March 2013: 2,497

- March 2014: 2,437

- March 2015: 2,318″

Today, there are only 1639 listed issuers on the TSX Venture.

It’s time for the Canadian Securities Administrators to mandate access to consolidated market data AND put an end to illegal and manipulative short selling by first re-implementing the uptick rule.

If we can get enough people to participate, we can proceed with the petition process.

Let’s get on it.

If you want to save Canada’s market, forward this to your friends, your colleagues, and any other investor you know.

CLICK HERE to Take the Survey and Help

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

A TSX stock I’ve been invested in for several years is constantly subject to down-ticking. It is very frustrating and unfair – the stock has often had great support on strong activity all day and then someone sells 100 shares in the final 60 seconds of trading which can often erase the whole day’s gains or at the very least leave the impression that the market has cooled on the stock. I track this stock intensely on most days, using Level II data, and am constantly anticipating this action in the final seconds of trading. I can’t remember how many times I’ve commented to my wife just before the end of trading that I’m waiting to see the usual idiot who invariably ‘gives away’ a 100 shares or so just at the end of the day. And then I confirm to her, that yes it’s happened again. Thanks for sharing with your readers that this is a common practice, why it happens on the TSX in particular, and letting me know that it isn’t just happening with my junior gold stock.

Your article has opened my eyes and explained any number of “curious” pricings that I have seen develop. While I believe the U.S. Traders still lead, in total dollar amounts, the world in stock price manipulation, this activity in Canada hurts the companies most at risk, the junior up and coming firms. Who will continue to invest in these firms knowing how greedy traders can manipulate them out of business?

You are right the stock Aphrea has been run up then dumped for months with some algorithm Buying or selling huge quantities at exactly 9.40 am and never allowed to pass the $12.00 mark till recently and now it seems between $18.00 and $19 is the new mark, I have an idea which bank is doing this but need more info to prove it.

Literally no venture stock seems to get on a great run and hold a price because as soon as they do these predatory shorts come in and attack them over and over which has taken the life out of the venture exchange because now retail investors dont see that hope they once had in having a chance to make a great return so they no longer play the market or they now get in and out very quickly and it is a game of a penny here or a penny there absolutely pathetic it has to be stopped now – The only one making any fortunes are these crook predators what a absolute shame !!!!

There should be full disclosure on all markets and short selling should not be allowed.

Short selling should not be allowed.

Full disclosure on all markets should be available to all.

Short sellers and HFT are just swindlers and bank robbers that don t use a gun!Market is rigged against retail investors worse than Las Vegas.House always wins.

its not just the naked shorting of stocks. its also the nake shorting of commodities, especially gold and silver. the nake shorting of anything should be prevented.

The whole area of short selling should be evaluated. Why should a broker have the authority to take stock from my account and loan these shares to someone else to sell as if they own the shares? I believe my permission needs to be obtained before any shares in my account can be “borrowed” by anyone else.

Brokers are not your friend. The game is stacked in favor of the professionals. More so since the investment bankers were allowed to own stockbrokers. More so since the trading floor disappeared. The game is now being played with the same ‘rules’ as in existence during the 20’s and 30’s. Just look up Jay Gould. GS will pay $670,000 to HC for a speech. No uptick rules. No rules you can use to sue. Challenge an execution and the word comes back “nothing untoward happened”.

. The trading floor in Toronto during the 60’s,70’s and 80’s was controlled by the market maker in Nickel and Falcy . He resisted a rule book being published and when it finally came to be it was a useless document.. a truck could drive through the holes. The separation of investment banking and brokers done in the SEC Act of 32,33 was a positive but we are back to the rules of the Twenties. The uptick rule was established in 1932 but was habitually violated by the floor traders and the market makers who destabilized markets at will.

Good luck with your petition

Consider also to prevent short selling if the value of the stock is less than % 5

tic, toc… tic, toc…. https://www.facebook.com/photo.php?fbid=10212898207560272&set=p.10212898207560272&type=3&theater

Oh and btw, did you see “The Big Short”?

After all that film revealed about the CDO ponzi scams, the last caption read….

“In 2015, several large banks started selling billions in something called a “bespoke tranche opportunity.”

Which, according to Bloomberg News, is just another name for a CDO.”

“You have no idea of the crap people are pulling (STILL) and everyone is walking around like they’re in a goddamn Enya video”

! https://www.youtube.com/watch?v=jmCN4F9SgNY

Shorting of stocks is a form of legalized fraud that should not be allowed in a fair and honest market. When the supply of stocks is artificially increased by so called borrowing, then re-selling, it is evident from economics that the price will drop. No sane owner of the stocks would lend them out if he truly had a choice, only to see them returned at a depreciated value.

It is the responsibility of stock exchanges to set up an ideal system of fair and honest rules and likely disallow companies from trading their stocks on multiple exchanges. If they fail in this regard, all they will be left with are cheaters and suckers.

The consolidated data feed service is a must for professional traders and institutions where the cost is meaningless, but for the average retail investor and investment advisor out there trying to make a living or manage their costs, this is a big issue and not knowing the true bid/ask spread on the stock or depth/liquidity in the order book will affect their bottom lines as well. I think this service should have been incorporated into the cost of trading.

I would also go one step further and say that the way Exchanges operate is also not on a level playing field. I still find that if you’re not a big player or institution with endless amount of money to trade with, you’re still swimming in a big lake with all those big fish lurking around so do speak.

To alleviate advantages over smaller investors, traders and the like, is for Exchanges to implement similar measures like what the NHL has done with their salary caps per team. They can implement a maximum cap on total volume and or total value traded on buy/sell trades per/stock per/day per/account per/broker. I know that sounds radical, but this in my opinion would reduce and contain manipulation of stocks, front running, HFT, prevent layering the books, help market makers stay in touch, prevent shorting pressures and many more strategies that hedge funds and otherwise are imposing on Exchanges.

In short, rich traders and institutions will have to abide with the restriction limits which will force them to better manage their affairs and take responsibility for being on a level playing field with small time traders/investors.

This is another example of how the dishonest and greedy come out ahead of the working, honest people every time. It all starts at the top with crooked, greedy politicians and people with power. The system has evolved to where you can’t make any return on money in the bank so you are forced to try to get a return somewhere else. Only to be swindled by con artists waiting for you which ever direction you go. Usually in a scam dressed up to look like a reasonable investment by some bank, financial institute, brokerage firm, etc. In my opinion the whole world economy is a ponzi scheme and the investments most of us have are not worth the paper they are printed on. Which is going to make for a big shit show not to far down the road. But I am sure all the greedy douche bags who have allowed it to get to this will O.K.

You are misguided when you say that stock market manipulation is against the law, banks, central banks and the government do it all the time.

What you probably meant to say is the stock market manipulation is against the law for non-authorized, the average investor, personal.

“All animals are equal, but some are more equal than others” George Orwell, Animal Farm

LOL… typical contradictory and hypocritical waffle….

Thanks Equedia for bringing up this serious issue again as my stock portfolio has experience the strange end of day stock selling behavior so many times I’ve stop counting. Something we Canadians should be very concerned about is the up coming nafta renegotiation where the US is going to become more demanding to get what they want at our expense. Our government has started making more market deals with other nations lessening our dependence on trade with the US as I believe the new nafta deal will cause great pain for many employees as jobs will be lost on both sides. Small businesses create many good and unique jobs in this country many of them trade on the Tsx Venture such that shorting these stocks should be banned completely. It has always be wrong that governments fiercely protect large corporations, but the let them beat up the venture companies drive their share price down so they can buy them out cheaply. They then brag about what great deals they have made then slap us in the face by selling the products these ventures companies spent so much time and effort to create a product that would benefit so many, then selling them back to us at exorbitant prices, now both retail investors and product customers loose. It’s time that we make it urgent that Tmx and government protect our venture companies who are doing great work proving good jobs also developing new technologies that can be exported making Canada a more desirable place to do business. We also need to make sure that phony companies that use the Venture to rob retail investors of their hard earn money be severely dealt with as over the years this has caused many investors to stop trading the Txs venture.

Who owns the Exchanges in Canada? Your Answer the 5 Big Canadian Banks along with there HFT Algo’s robbing the joe public with there manipulation and stealing investors money! What a Shame our Canadian Banks stealing from us with spoof trading playing both sides of the market and not only that they route there trades to mask there trades on both bid and asks.

Irroc people have no clue on what’s going on these days

Time the Canadian Government steps in

We are being kept in the dark Corruption is rampant in the markets. This keeps up the public will exit for good Many investors I talk to have told me their intention is to exit The market oversite people don’t seem to care. These machines run by banks should be outlawed immediately. Government regulators are a joke

As a Canadian stock investor things need to change for those individual investors who wish to purchase Canadian Stocks. Both the TSX and TSXV have been hammered these last few years because of the way things are currently set up. If we want a thriving Canadian stock market than things need to change or it will go down the tubes as it has been steadily declining over the past several years now. I am at the point where I will not buy any Canadian stock because it is so manipulated. It is pretty sad when as a proud Canadian you can’t invest in your own Country.

I did not realize that the TSX, TSX_V were only recording a percentage of all the activity in the market day. It in my mind is as dishonest as taking money from my account.

Just finishing reading reading Flash Boys by Michael Lewis and recommend it to all to really be enlightened on this subject.

Great article that accurately describes the problems of the Canadian system.

Uptick rule needs to be reinstated. Short selling abuse in Canada is rampant. 15 day reporting period is nothing more than a smoke and mirrors scam. 15 day reporting periods do not paint an accurate picture of what is really happening. Short positions should be reported daily.

Alternative markets are a real pain. Data for these markets is either expensive or not available in many places. This is one of the reasons I rarely use Canadian markets now. Just when you think you have all the data you need another one of these things pops up. Pure is a good example of excessive fees.

Manipulation and insider trading seems to go on almost unchecked in Canada. Insider trading on smaller cap stocks seems to happen a lot. It’s too much a coincidence to see so many stocks move higher 1-3 days in advance of news on higher volume only to be crushed when positive news comes out. This happens too frequently to simply be luck or timing. General manipulation low closing and high volume order board manipulation is a huge problem in Canada.

Stornoway diamond is a perfect example of a manipulated smaller cap stock. This stock is low closed in the final seconds of the day 2-3 times per week usually by house 2 rbc but not exclusively them. This stock has a problem with high volume order board manipulation or spoofing as you call it attempting to prevent upside and deter buying. Alternative markets are being used to sell cheaper even though the sell order is not on the board at the time the buy order is placed. If you try to buy for example at 77 cents you will be sold stock at 76.5 cents. Then the stock will almost immediately be sold down. Sure everyone loves cheaper stock but not when the seller is only doing it to prevent upside on the stock. The manipulation on this stock is so bad it has killed the volume and driven away most interest. I am not suggesting this stock should be higher or lower only that it’s manipulated daily. It is definitely not a freely trading stock. Who wants to own a stock that never goes up.

Crescent point energy is a great example of what abusive naked short selling looks like.

I barely trade in Canada anymore. I prefer US markets now. I just don’t believe regulators can or will do what is necessary to fix what is broken in Canada. Even if they do I can’t see myself coming back to Canadian markets. I will definitely never use the venture market again.

All investors should be playing on the same field for investing their funds.

I really hope a petition gains momentum. A lot of us put up with the inequities, but we shouldn’t. Naked short selling boarders on criminality and is just not right. The authorities should be clamping down on this through prosecution

Due to the issues described 4 years ago and today I am systematically unwindng my tsx.v portfolio. In tired of the shorts and limited information. And what I suspect professional manipulators destroying the market

It is federally illegal for Americans to Profit in anyway through the sell and distribution of Cannabis PERIOD !!! Any OTC/ADR US funds that claim to buy and sell Canadian Cannabis stock are fraudulent, and are in no way going to investments in a canadian cannabis company.

Example: OTC Stinky Pink Ticker INVALID Because Tweed no longer trades on the TSX, So your Illegal US Tweed shares are not invested in CGC and doesn’t go into Tweed Coffers, because that would be a crime for a Canadian Weed company to sell or buy shares from Americans, YOUR US INVESTMENTS ARE ILLEGAL AND CRIMINAL.

Financial Reporting/Disclosure

Reporting Status International Reporting: TSX Venture Exchange

Fiscal Year End 3/31

OTC Marketplace Pink Current

https://www.otcmarkets.com/stock/TWMJF/profile

Hello my name is Wilson and am a private loan lender.

Greetings to you today. Thank you for helping and ending your financial problems. We offer all kinds of loans (personal loans, commercial loans, etc.). Our loan amount ranges from 2000.00 USD to USD 50.000.000.00 USD and the repayment period from one year to 30 years. To start the loan application process, contact us at wilsonfastloan@yahoo.com

I’ve always contended that short selling of any description should be discontinued throughout the world. If that is not possible then at least a return to the uptick rule.

There is an easy way to solve the shorting, up tick rule and other platforms. Simply there should be no short selling period on any stock below a certain price level. Maybe that is 35 cents or 50 cents or $1.00? Low priced stocks with low market caps are to easy to manipulate. Perhaps a combination of price and market cap. This would in turn also aid in manipulators driving a price too high as it would be open to short sellers at the higher price threshold

I am a shareholder in a TSX-V company where the price is constantly and aggressively marked down very close to each days close. Today 99% of >500000 shares traded around 20-21c yet a few tiny share share trades (500 shares) at the end pushed the closing price down 10%+. This has been happening day after day despite persistent positive performance by the company. IIROC say its algorhythm trading and that’s fine by them. So if an algo is designed to drive the price up is that OK too?

Canadian share trading is a joke it is not a genuine stockmarket at all, its just a computer game played by a tiny number of corrupt people with access and its all fed by genuine investors money.

Canadian regulators should be ashamed of themselves. If this was happening in London the guys who manipulate this market would be in jail.

Canadian markets are so corrupt I’ve had to take my investments to the NASDAQ. It was a sad day when I had to leave. I really enjoyed supporting Canadian economy. The corruption and stock manipulation was too much to handle. And for a country that claims to have fair markets. What a joke . Get your shit together IIROC , CSE, TSX. You’ve created a market to steal hard working Canadians money and give it to the rich investment firms. You’re a bunch of criminals if you ask me.

Short selling should banned, period. It is based on false pretents, first by borrowing shares from brokers that do not have ownerships of said shares, this action is a fraud to begin with according to our Canadian Criminal Code, as none of the owners of lended shares agreed at first. This very fact I am positive constitues grounds for a civil action against brokers involved in short selling, the lenders and likely serious criminal charges;

and second by manipulating the psyche, false rumors, deprecating the credibility of shares issuers shorted. As one can see, this short selling scam is not serving the purpose set forth by the legislation governing our financial institutions, which is to permit shares issuers to obtain financing from the public on the basis of fairness, honesty driving one’s innovation, projects, etc.. etc…

The market does not need these ”crooks” short sellers to destabilize, manipulate the value of public companies, value that shall be according to merit given each by the general public investors own’s opinion of said value.

These crooks are slowly suffocating the source of public financing. IN-DEPTH RESEARCH SHALL BE INVESTED IN THE POSSIBILITY OF CIVIL SUITS AND CRIMINAL CHARGES BE LAID IN ALL PARTICIPANTS OF SHORT SELLINGS.

there is an issue where the TD bank has been removing peoples QUOTE access when the markets are being forced down by the pension funds and Banks till it is too late to respond to the market then they magically make the quotes work again after it’s too late ,this causes excessive loss if someone sells then at that point.

and the 15 minute delay for quotes is a problem only for the actual traders with NORMAL connections,the high speed connections already have an advantage ,they see your orders before the wheels stop spinning on your account screen so that enables them to undercut or over price the stock that you are either selling or buying.

WE NEED A LEVEL PLAYING FIELD !

all the scare tactics they use on the investors through the aid of the media also needs to be addressed.

basically we the regular folk are getting screwed by the big banks and funds and crooked brokers and manipulative MEDIA.

Hey you think the stockmarkets are the only corrupt thing in Canada? take a look and I do mean look into all the legislation that has been corruptly changed behind closed doors while the Harper Government was in power for so long! Remember Employment insurance? EI ,we all paid into it for our whole working carreers under the guise that “it would help protect us in case we were ever out of employment for any given period.It was suppose to be there,well I paid into it for about 40 years ,then I was physically broken so couldn’t do the job which I had been doing,so to be fair to the company I worked for for my whole career,I pulled the plug,well they gave me my ROE (record of employment)and I left the industry. It took a couple of years till I could walk right again and up to that time I would not qualify for the EI claim ,being as I could not work all broken up, so when I was able to walk again (up to this point I was depleting my savings (what little I had) anyways I was now able to try to work so I took my ROE with me into the EI office to initiate my claim ,WELL thats when the reality hit….they had NO INTENTION of honoring my ROE from the large public company which was my employer for my whole career,they did not help me initiate any unemployment claim ,instead they deflected me away to some other office which apparently had nothing to do with EI. I went there all they wanted was to keep bringing me back once or twice every couple of weeks for yet another “workshop on resume building” this process was drawn out over three months and I still never did get a completed resume made ,yet they still wanted me to come back more for more “usless workshops”

I finally said to the woman there that ALL I SEE IS THEM MAKING MONEY KEEPING ME COMING TO THESE BULLSHIT WORKSHOPS FOR SEVERAL MONTHS to do what should have been completed in the very 1st week of going there.I told them to shove it and never went back ,as well I never did get my EI claim initiated so I am living in poverty with nothing coming in. this is all because of the corrupt HARPER government having gone in and changed all of the legislation covering the EI and many other things behind everyones back without our knowledge and knowing full well it wouldn’t come to light right away ,and most likely long after they were not in power anymore. to make a long story short,these governmentTypes have changed too many things so as to allow themselves to NOT have to keep their end of all these forced on us policys that we pay into. the moneys they collect are astronomical from all the working slaves out there but until it comes time when their end of the contracts is required no one knows about it. basically they have set all the LEGISLATION out there to fill their slushfunds at the expense of the working man and they have too many loophole so they (the government) can weasel out of any financial responsibility they may have to the people of the country. WORSE PART IS WE KEEP HAVING TO PAY INTO THEIR SCAM PROGRAMS EVEN THOUGH THEY HAVE NO INTENTION OF EVER HONORING THEIR END OF IT. this happening currently 2015-2018 . and of course it finally came to light for me now that the HARPER GOVERNMENT is not the all powerful ones running the country.

the Liberals should go through ALL the legislation that causes our people to pay into anything which has been changed by the HARPER CROOKS. most people are blind to the fact that they are being scammed by these corrupt policys every working day of their careers in Canada and don’t find out till it’s way to late to do anything about it.

So YEA THE STOCK MARKET IS NOT THE ONLY SCAM IN THIS COUNTRY. the other main one is the “locking in of your pension money, o and thats suppose to be to “protect the people from themselves” and we all know it is not to protect us the people but is there to protect the big banks and government slush funds which they call OUR PENSIONS. the people would do better off with the money up front rather than having it extorted through legislation to where you NEVER ACTUALLY GET TO UTILIZE THE FUNDS THAT HAVE BEEN SCALPED FROM YOUR WORKING WAGES then they charge you EXTREME TAXES to try to use any of it IF YOU EVEN QUALIFY UNDER THEIR LEGISLATION to recieve anything from the pension which was all paid for by you the worker all your career.

I know it was a little off subject but that just shows you the extent of corruption that is going on at a legislative level in this country! TRUST NONE OF THEM they believe our only purpose is to be slaves and line their pockets with our money.

I just wanted to say thank you for this article and your efforts to bring awareness and much needed change to this serious problem we have in the Canadian Markets. I, like many others, have fallen victim to market manipulation and have lost very significant amounts of my hard earned dollars. Short sellers have managed to inflict mental and financial ruin on me and my family and it must STOP! Please continue your efforts to bring this much needed change. The regulators are essentially backing/supporting criminal activity by being aware of these problems and not making changes to support and protect the honest investors and the respective companies they’re investing in that are trying to grow. Once again, thank you for doing this. God Bless you.

Corruption and stock manipulation is quite apparent and regulators should be ashamed of themselves. For a country that claims to have fair markets…what a joke . Get your shit together IIROC , CSE, TSX. You’ve created a market to steal hard working Canadians money and give it to the rich investment firms. You’re a bunch of criminals! Ban short-selling!

All this criminal practice should not be allowed

Shorting should only be allowed on dividend paying stocks and stocks trading over 3 bucks.

Thank you for this article.

Very small stock market and easily manipulated. I was not aware that regulators were making it easier to manipulate. It seems the best way to make money in Canadian companies is to short and naked shorting which is allowed in Canada makes it easier.

What a joke of a stock market!

I do not think short selling is a necessary feature of our stock market. Far too much manipulation these days. In my opinion, if you want your shared to be borrowed by others, you should rent them to them for a fee, kind of like buying an option….If they borrow my shares and make a profit, why should I not get a piece of it ?

I certainly would not give anybody else control of my shares. We should have to precisely declare that our shares are allowed to be rented out, otherwise they can’t be touched.

If somebody thinks the stock is overvalued, that is just too bad. Find another stock that will go up in value and invest. It is a bad thing to beat down a stock price just because you can.

I have one stock that is on TSX. It is pushed down at the end of the day nearly everyday. There is a 1.2M short position and I think that these players are holding the stock back. It moves up, then between TD and Anon – the drop the price.

Any potential upside is totally lost to these players. An investor should have a platform to complain. I am truly hoping that there is a major short squeeze and these players get burnt.

To whom it may concern at IROC, look into isodiol, ticker isol… major stock manipulation on this security… want some homework that would lead to marker manipulators.. this stock is a shorters dream.. please stop this from happening.

The dow….the TSX…the venture…are all extremely controlled by manipulated computers….it is so obvious….it makes me want to through up.

The minute you invest…..the minute your $$$$ will be lost. The big guys will always win…..and try it….I know.

I call bullshit! What a scam. Pass along the survey and get the word out! We need to press for change and turn up the heat.

Crescent point energy is a perfect example of what short selling abuse and manipulation looks like. Houses 1 and 79 are manipulating this stock lower or preventing upside every single day for the last year and a half. It’s pretty disgusting that this can happen on Canadian stock markets. If this kind of crap can happen on tsx60 stocks then all hope for this market is lost and there is just no point to owning Canadian listed companies any longer.

June 19 and 20 2018. Two days in a row manipulated lower right near the close with an avalanche of selling.

LET’S FACE IT FOLKS…CANADA IS NOT BEING RUN BY THE ELECTED OFFICIALS ,IT IS BEING RUN BY PRIVATE BANKING INSTITUTES AND CORRUPT BROKERS! and most are not even from CANADA!

The market has become corrupt with unregulated short selling and criminal activity. Many investors and retirees have lost almost everything they have worked so hard for. Including myself. This is a disgusting corrupt way to run a market. Canada should be sued over allowing this!! Discusting

Make fair market for all!

On the TMZ Money website I have watched the same broker down tick the price. Each time the price dropped 1 cent it was the same broker selling 100 to 300 shares,

I read very carefully your letter and I share all your comments as I saw it when watching the stock market in action for many years.

Furthermore, on the TSXV, the “Delayed Market Depth By Price Summary” is most of the time incorrect as it shows false informations like this:

Last Market by Price Update: 12 Oct 2018 16:15 ET

Instrument Name: Enerdynamic Hybrid Technologies Corp. Symbol: EHT

The market data displayed is provided on a 15-minute delayed basis and we do not guarantee its accuracy or completeness. Please refer to the date/time stamp above to obtain the age of the data in this table.

BID

Orders Volume Price Range

59 4,088,000 0.05500-0.07500

ASK

Price Range Volume Orders

0.07000-0.09000 1,166,000 33

The table displays a summary of the orders entered at the best five price levels for each of the buy and sell sides of the market for this security. The best prices for each side are highlighted in bold type above.

As you may notice, the highest BID is 0,075 and the lowsest BID is 0,070; it should be the opposite.

Once, not a long time ago, I placed a bid of 150,000 shares of TCI.V at 0,075 through my broker ( NationalBank ) and I knew I was the first to bid at that price as the highest bid was 0,070 .

Only 90,000 shares went through…!

I called my broker to krow why and he could’nt answer…

I watche the close every night and TD sell lower almost all the time at one minute of the close…

I could go on and on as I saw so many things happen. I’m getting very frustated and so many companies delisting the TSXV to go on CSE..

Good day

I could go on and on as I

Can Canadians sue aphria such as the USA lawyer are?

Current market conditions are unfair to retail investors . Stock manipulation ,shorting and distorting are rampant. Shorts are able to distort with no accountability. Companies taking legal action against them draw more negative attention to there stock so the distorters get away with it. News media and sites like seeking alpha etc. Seem to have no accountability and the power of media is very strong . Shorting is inherently a negative thing. Let’s get things changed so there is a balance. Scales are tipped to favour shorts .I am not investing anymore till rules change this last fiasco with the short and distort on Aphria has sealed the deal with me. Thank you for listening!

There is definitely underhand and manipulative shenanigans inherent within the Canadian markets. It appears to me that there is a reverse Robin Hood scenario where financial bodies blatantly part rookie and retail investors of their hard earned cash via deceit, intimidation and financial institute collusion. The rich get richer. We have watched thousands of dollars of our money lost to manipulators; akin to parasites. Preying on the weak and vulnerable. My wife and I worked hard all of our lives to provide for our children and our own retirement, only to watch our investments pillaged by criminals. We had reasonable faith that Canadian Investments would be protected by law based upon fairness and transparency and protected by our Government. This is evidently not the case.

THE CANADIAN CRIMINAL CODE does state that short selling must not be used to manipulate the stock prices.

BUT IF YOU ASK A BANKER OR BROKER THEY WILL SAY THAT IT IS PERFECTLY FINE!

IT is about time the UNDERLYING companies whose stocks are being decimated go on the attack mode and FORCE the “REGULATORS to DO THEIR JOBS!

AND IF THEY WON’T THEN START SUING THE BASTARDS AND ACTUALLY MAKE USE OF THE CRIMINAL CODE, that is what it is there for!

there has been an acute attack on our stocks and we the actual investors and the companies who’s stocks we purchase are being SCAMMED BY THE BIG PRIVATE BANKS AND BROKERS!

LIKE BACK IN the march -april trading sessions when the WEED stock was shorted just over TWICE the amount of stock than what they have issued and outstanding. NOW if that was not manipulation than what the hell is their definition of manipulation?

in order to short a stock, the shorter has to borrow the stock to sell it short,so where did these short sellers acquire the NON-EXISTENT STOCK TO SHORT WITH? and secondly I am sure that I am NOT the only LONG holder of the stock so add my stock to all the other LONG holders who did not lend our stock together and remove that # from the # of issued stock and you will see that there was even less AVAILABLE to BORROW so they could short the mass #s that they did!

SO if that is not fraud on their part then where does the NONEXISTENT stock come from to COVER the shorts to complete the transaction? and if they are loaning out OUR stock without our permission, I believe we should be getting a cut of the profit they take! BUT THATS NOT HAPPENING IS IT!

SO THERE THEY ARE CRIMINALLY CONDUCTING BUSINESS WITH FRAUDULENT NON_EXSISTING SHARES AND THEFT FOR STEALING OUR SHARES TO LEND TO THE SHORT SELLERS WITHOUT OUR PERMISSION OR KNOWLEDGE!

IT”S TIME THE REAL AUTHORITIES DO THEIR JOBS THAT THEY ARE BEING PAID FOR AND PROTECT THE INVESTORS NOT THE SPECULATING CRIMINALS (IE> THE BANKS AND BROKERS) UNTIL THEN THE CANADIAN MARKETS ARE LOOKING EXTREMELY UNATTRACTIVE

LETS GET ORGANISED! AND GO AFTER THE ASSHOLES

Scottie, I am in when you are ready to get serious. I have watch 67% of my investment deteriorate through price manipulation that occurs on some of my stock every day. Perhaps a class action lawsuit is in order for IIROC? Let me know where to sign up.

A petition was just started by someone on reddit in the last few weeks if anyone is interested. There are almost 2,000 signatures.

https://www.reddit.com/r/weedstocks/comments/acyt35/combating_hfts_and_market_manipulation/

https://www.change.org/p/iiroc-combating-hft-s-and-market-manipulation

There is definitely manipulation of the Canadian markets on all levels!! Naked Shorting and Dark Pools should be totally criminalized with the convicted spending many years incarcerated!! Otherwise we are being robbed by the modern day highway men pure and simple!!

Retail investors are being robbed by bots

There are other concerns that I feel are worse than the items that you brought up in this article:

1. IIROC & other regulatory agencies seem to be influenced more by institutions that be the “average” day trader. I’ve complained several times to IIROC with video-recorded content to illustrate issues with my bank

having a “delayed” feed in terms of when I bid. In other words, what I was seeing live was in fact delayed!

The bank I dealt with forced me out and to seek another bank. I also complained to my current bank about issues, but again, IIROC took the position of the bank.

2. Market Makers: These institutions (banks and brokerage houses) are “supposed” to create bids and asks

throughout the day in order to keep the shares and trading “fluid” and in constant motion. However, they appear to “manipulate” the market, more often by driving down the market,rather than creating a “fluid movement” of stocks moving up and down. Also, the “fluidity” appears to be done faster than I can place a buy or sell order – as if the “market” was run by computer programs. One can also view the same market maker placing bids and asks throughout the price range.

3. If you read the IIROC rules, you will see that many rules have been modified or changed with the input of the banks and stock brokerage companies. I have NEVER seen an individual trader been mentioned in terms of asking and getting a rule changed!

4. Where in fact penalties have been instituted, they are written up. However, the penalized companies or individual listings are mostly from years ago, rather than any most-current “settlements”

Yes,, these practices have to change asap. This is a very unfair to retail investors . This is a rigged system and is criminal. I will be complaining to my MP also . It all makes sense now as to why I am so deep in the red with my portfolio on the TSP Venture . Your rules are catering to the white Collier criminals and this has to stop immediately .

I noticed from my holdings page that some adjusted cost base have been changed when I did not make any trades. When I emailed and called, there were no replies. Stonewalling!

How nice to protect ONE sector from the ravages of short sellers while leaving the rest of the market at the mercy of these jerks! By doing so, they practically admitted that short selling distorts the market! I say ban short selling permanently!

I am a small investor. 57 years old. Got tired of my ETF not moving, and paying fees to an invisible person to manage it so I tried investing myself. I have lost money, simply because I didn’t realize the cut throat environment I was entering. Now that I have bought shares in various mostly Canadian companies, my portfolio is down about 20%. Short selling tactics have made it impossible for me to try to regain my initial investment. It’s criminal, and I’ve been watching these tactics destroy my portfolio, as well as quite possibly the very companies I am invested in. I entered a trap, and I can’t get out because criminals and greed are allowed to carry, running rampant. bring back this uptick rule. Get rid of layers upon layers of exchanges that a retail investor can’t even see. The whole system is rigged to allow the little guy to get decimated, and crooks and unethical shooters etc to get rich. How many are there like me? . It’s disgusting. How can this be legal?

This should be presented to A Scheer as a future policy change when he is elected as prime minister.

A very insightful article an exactly my experience as well. I run a small junior mining Company and believe these policies are destroying an entire sector of our economy. Resources are what CANADA was built on and this manipulation will be our ruination. Talk is cheap however I have been talking with some fellow mining companies and it’s time to wake the hell up and make the public take notice.

Only through galvanizing the public attention will we get the politicians to change the rules…otherwise it will never change.

Stay tuned

Hi, i feel that i noticed you visited my website thus i

got here to go back the want?.I’m trying to to find things to enhance

my website!I suppose its adequate to make use of a few of your concepts!!

Don’t just say you want to see a change. Make a change. Do what’s needed to make a change. You’ll have my support if we can make a change together. IIROC or any other agency needs to be made aware of all the theft and manipulation going on in the market

Predatory short selling is OUT-OF-HAND ! ! The stock price for new Canadian companies are being beaten down so low by these practices that they are threatening the financial viability of the companies (ie having a hard time raising money) and hurting investors (forces new companies to seriously dilute the sharehoders to raise the money they need). How does Canada benefit from this? Yes you may bring in some short-term revenue from the culprits of the shorting, but in the mid-term, you lose tax on investor gains, taxes from new companies keep declining and eventually the companies may go out of business which eliminates even more tax revenue as employees of these companies lose their jobs. In addition, investors quickly learn that Canada could care less about the small venture exchanges, which then just makes the situation worse as investors stop investing in the venture exchange. At the very least, Canada needs to help establish a program which allows the company to sell additional stock (for investment purposes/operating expenses) DIRECTLY to existing shareholder, versus the institutions which are manipulating the stocks.

PS One of my bio-tech stocks (KALTF) can have 90+% of the daily volume shorted ! ! That’s INSANE ! !

PSS How can a shareholder participate in the purchase of warrants, when they KNOW the short-sellers can easily make them worthless ! (even when there is goood news.)

Been on the Canadian stock market for over 20 years.

Naked short is killing almost every penny stock that is worth something, very unfair.

Shorting should simply be illegal in the canadian market, we’re to small and everybody is taking advantage of us.

So our small business never get a chance to grow…. That’s the way canada….

To be honest I’m getting out of the canadian market, every body(Shorter) are making money from my investment….mmmmh

Very well said I agree 100%.

I also follow the company that your talking about.

Just to add, This company(kly.v) is on the verge of saving 1000 of life yearly, and the shorter are bringing this stock down so this company is being Naked short for 90% and more… so of courese the company is in trouble…

So the Moral of the Story is, that you can “ILLEGALLY Naked short in canada and the SEC won’t do NOTHING”.

Forget about bringing money together for a good reason…

Shorter can do what they want, very disturbing….

It’s all a scam and when the credit finally dries up, the system implodes. Capitalism is a PONZI scheme.

Shorters have become a invisible robber of investors trying to create their retirement funds. This really has become a crime not only to investors but also destruction to the companies that have issued stock that’s being traded. Far too many companies coming out with really good news seldom see their stocks move up that much any more and in so many cases actually see their stock rise a little and fall back to where it started, now is the time to stop this it has gone out of control almost every stock traded appears to be shorted on the Venture Exchange.

I trade with an onlline broker and have many times been frustrated with the lack of transparency, because my online broker splits the shares between two platforms and sometimes only half of my shares get sold. Thus because of using two platforms or alternative exchange it’s costing me more in commissions and sometimes at a lower price. Because I can’t know how much they actually sold my shares at the alternative exhange/platform I cannot be sure if my broker is keeping some proceeds of the sale. There is no transparency.

Any Update on this petition? How many signed? When is is it submitted?

Just to add a point, CSE is much worse than TSX.

What would Adam Smith say, I wonder? It’s this dilly-dallying, tip toeing, and double speak that sends mixed messages. Don’t ever expect people who have an advantage to give up their advantage. Notwithstanding, if transparency is required for fair play in fair markets, then that’s what you’re asking, for those with the power to give up their advantage, ha.

The security regulators, whom are suppose to be looking out for interests of ALL investors are involved in a deliberate scheme to defraud small investors of their assets. They do this by lying and cheating in a game of smoke and mirrors, all while hiding behind a name and appointed power. Surprise surprise we are finding out they are only looking out for their puppet masters.

Just read EVERY comment here. Talk about interesting and eye-opening. I have barely over two years trading experience but I have been hit by just about every illegitimate scam running out there. I wrote to the TSX recently, but have yet to receive any reply. I’m not holding my breath. Like several others before me, I will be exiting my Canadian positions at the earliest opportunity and trading mainly in the US markets. Not that I am gullible enough to think that manipulation doesn’t go on down there as well, I’m certain that it does. But hopefully less than it does in Canada. I am part way through a book on day trading and I wasn’t really surprised to discover that all these high volume trades that you see go through in the closing seconds just about every single day, is done by pre-arrangement between two market makers. That certainly sounds fine and dandy to me…NOT! I have one security, which will remain unnamed for now, that I’ve had for 18 months or so. It went through a 26 to 1 reverse split (nice loss there) and is now hovering at a dime, give or take. So you know that the loss here has to be huge. Promise after promise, none of which are ever kept. Eric Sprott, who should be familiar to all Canadian investors, is trying to get the uptick rule re-instated. It is long overdue and should never have been removed in the first place. I read an article yesterday to the effect that the US funds are playing havoc with our Canadian securities and think it is all just a big joke. Writing to your MP will only get results if you keep after them every week. Expect to get nothing but a runaround, especially if you live in a jurisdiction where the MP is Conservative. And no, I don’t care who you vote for, just stating a fact of life. All this talk of Canadian Banks having too much control doesn’t even cover the half of it. For example, how many readers are aware of just how much silver is being shorted by the Scotiabank? Yes, ’tis true. Until last year they were the biggest shorters of silver IN THE WORLD!. Even more than those crooks at J P Morgan, who have now taken the lead away from Scotiabank. And hopefully, you are all aware of the many execs at JPM who have been arrested for price manipulation in the precious metals markets. While it would be nice if the markets really did play fair and it was a level playing field for all, I fear it will not happen in my lifetime. Too much money, too much greed, too many dishonest politicians on both sides of the border, the list goes on. I’m sure you all know what I’m talking about. I will close by saying that I sincerely hope we, as Canadians, can effect the changes that we see as being necessary, and the sooner the better. Our legislators and those in charge of the exchanges in Canada seem to lack the cajones to do anything to upset the big money players. That has to stop. Thank you for reading.

Stop all bot trading

Hat’s off to you for the your research efforts and sharing your work.

Thanks

The issue with short selling in Canada is disturbing and unhealthy for the markets. Market data should be available to all retail traders and advisors, transparency is one of the most important pieces for a healthy market. Please make regulatory changes.

The manipulation by especially large funds is rampant. Drive a stock price down with ‘unlimited’ funds, start buying it back after the panic subsides. Gain $Thousands, 10’s of $Thousands, 100’s of $Thousands, $Millions by selling stock you DO NOT OWN ! Nor do you have to qualify that the stock has been borrowed legitimately.

The market is grossly skewed toward the non-individual buyer. The best example is the gold/silver stocks. Gold and/or Silver goes up, the Gold/Silver stocks go down. Literally thousands of examples. The funds are just sucking money out of the market, with nothing to restrain them.

All stock certificates/shares are numbered. If a shorter ‘borrows’ shares to sell short, then the actual cert #s of those shares should be recorded. This way there can be no naked shorting of shares.

Rod

Most of this is now done on the Canadian exchanges, since the only real rule in Canada is that you have to have confidence you can “borrow” the shares. So hedge funds sign agreements with owners of large blocks, sometimes insiders, to give them the right to borrow. Ultimately these shares never get transferred, as the short hedge funds just get squeezed if the market goes higher by buying in open market. With algorithms, these short hedge funds can wreak havoc on Canadian stocks, since there is no uptick rule. In other words, they can downtick stocks everyday to make the market look weak.

Feb. 19/2021 1:08 p.m.

Years ago I figured this calamity out and stopped Direct Trading. I kept one stock for over 15 years.

Finally, I saw this stock jump due to stock manipulation and I figured, take my money out while I had a chance, to break even.

The same day, I could not get through- Jan. 27/28, 2021.

I found out the employees of the same company all cashed their stocks at the same time and made tons of $, the stock then took a dive. THIS SHOULD NOT BE ALLOWED, It smells of INSIDER TRADING- SHAMEFULL..

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Thanks IIROC for massively screwing the average joe investor…further more, the junior miner investors. Respectfully, all of you responsible people should lose as much as us. Shorts on TSX looks minimal but shorts on the OTC are huge which is effecting over all Share Price. I will never ever invest in TSX based stocks again. You can’t even protect your own people…disgusting. Seriously think about it.

Oh by the way…we’ve done our due diligence: we are all in one of the strongest future gold miners that exists….the largest gold find in North America in 30 years….and we’re getting chewed apart. Save Canadian Miners…reinstate the tic rule….and so much more.

Believe it or not just a week ago I tried acquiring this information..I think it’s only fair to be able to see both the bids and asks for at least 6 positions in depth . For example on the bid 500 shares at .50 , 6000 shares at 51 , 300 shares at .52 …NOW on the ask 6000 available at 50 , 500 at .51 , 3000 available at .52 .

I’m with Kendall Turner….mostly the same investment as I’ve been posting the shorts on OTC daily. The TSX shows no shorting but the OTC shows a lot of shorting. And our SP is decimated. But one must understand it’s all a fictitious price…nothing is real. It’s all just a psychological game being played. If your strong enough to hold- you’re good. But most people don’t know the truth. You have literally screwed the independent investor and enhanced the professionals advantage ten fold. It’s just not right. You need to fix this ASAP

WOW! The things I want to say are full of swear words! I am continually shocked at the depth of depravity that is the Canadian stock exchange! 2012 is when they removed the Tic test, the group who did that is the ones responsible for the misery that followed. Follow the money trail and you’ll figure out the reasoning as well.