Growth is in our DNA.

From 1900-2000, world population grew from 1.5 to 6.1 billion.

In just 100 years, the increase in world population was three times greater than the entire previous history of humanity.

Every second, our population grows by more than two people.

20 years ago, there were 16 million Internet users. Today, there are over 3.6 billion.

This growth in Internet usage has allowed us to harness more information.

In the past two years alone, we have created more data than in the entire previous history of the human race.

And this data is growing faster than ever before.

From 2013 to 2020, the digital universe will grow by a factor of 10 – from 4.4 trillion gigabytes to 44 trillion. It more than doubles every two years.

And with rapidly advancing new technologies such as quantum computing and light-based memory storage (See How Light Will Change the World), the digital universe is about to grow even faster than ever predicted.

Everything is growing, and its growing fast.

Including money.

All the Money in the World

It’s hard to determine just how much money exists because it includes everything from currencies, bank notes, coins, and money deposited in savings or checking accounts.

It could also include the value of derivatives and stocks.

In fact, if we took everything into consideration, money would be one of the fastest growing things in the world – since there are over 1.2 quadrillion dollars worth of derivatives alone.

That’s $1,200,000,000,000,000.

And let’s not forget debt.

It’s estimated that the combined total debt of every single person and country in the world is around $200 trillion – a third of it accumulated since 2008.

Okay, you get the point. Everything is growing fast.

Everything except for this…

CONTENT LOCKED

Enter your email to get instant access (it's free!)

to this special content post:

*By entering your email, you are agreeing to our privacy policy and terms of use. You will also receive a free weekly subscription to the Equedia Letter, one of Canada's largest private investment newsletters. Don't worry, it's free and you can cancel at anytime.

The Global Economy

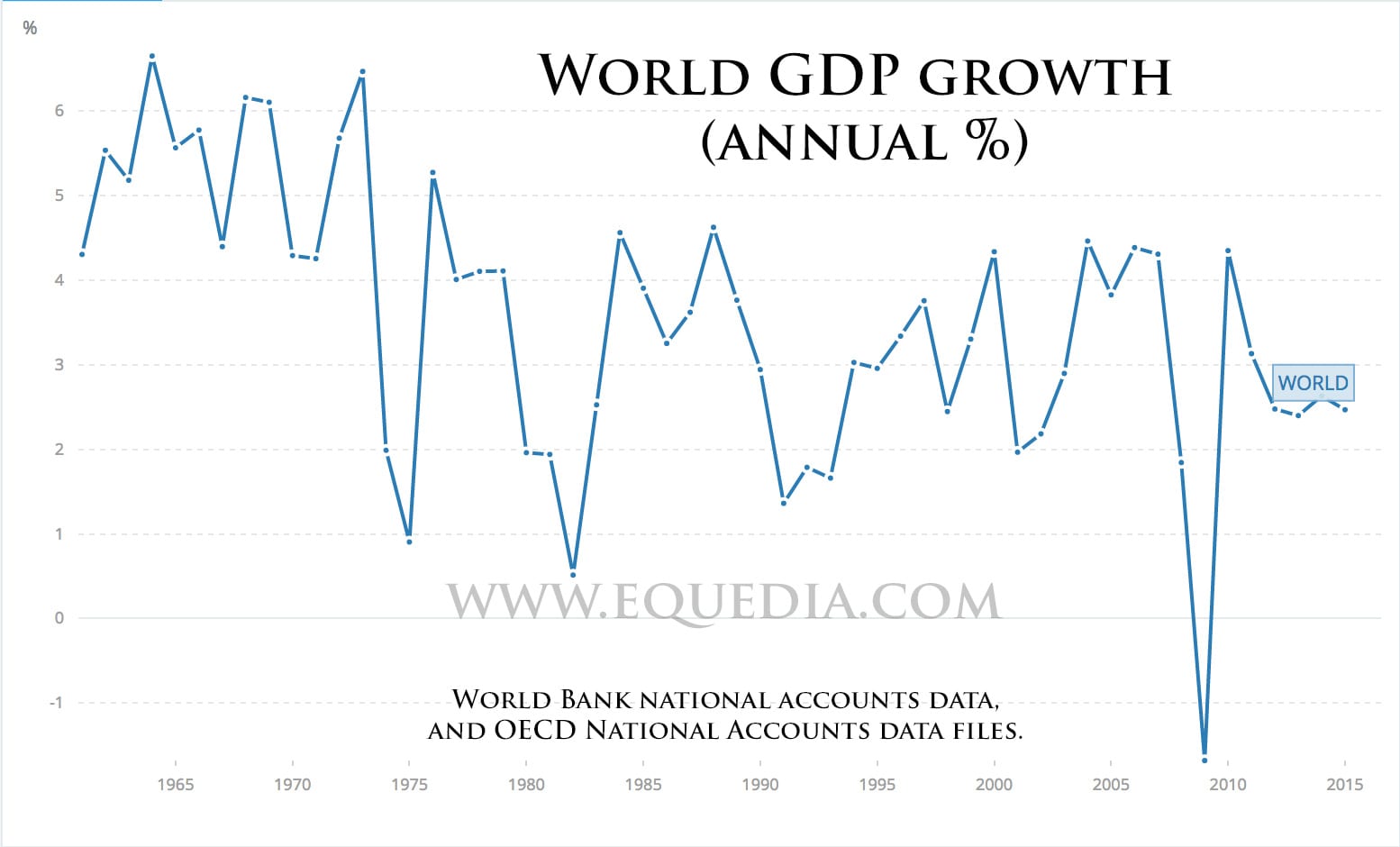

While everything is growing at an insanely rapid pace, global economic growth is shrinking.

Here’s a look at the global economic growth rate from the World Bank:

With Brexit still very much unfolding, Europe bracing for another recession, and talks of a Chinese slowdown, the outlook for global growth isn’t very bright.

But that’s just the tip of the iceberg.

As technologies advance, we become more productive. But productivity today almost spells an immediate doom for job growth tomorrow.

Rise of the Robots

Not long ago, we exported dollars for sweat equity in return for cheap imported goods.

It was a simple process: pay someone from a third world country to do a job far cheaper than you could pay someone to do at home.

But what happens when technology makes manufacturing, or other processes, so efficient that it no longer requires the use of human labour?

What happens when the costs of import/export – shipping for example – outweigh the currency spread and social economic discrepancy?

There’s a reason growth in world trade isn’t what it used to be.

Just ask Hanjin Shipping, one of the world’s top ten container carriers that transports over 100 million tons of cargo a year.

They just filed for court receivership.

Technology is also the reason why the majority of the jobs being created in the United States are in the services industry, where social skills are required – such as restaurant servers and bartenders.

Via Zerohedge, September 2, 2016:

“…Since 2014, the US had added 523,000 waiters and bartenders, and has lost 13,000 manufacturing workers.”

But even soon, many of those jobs could be gone and replaced by robots.

Want proof? Just look at Wal-mart.

Via WSJ:

“…The largest private employer in the U.S. is eliminating about 7,000 store accounting and invoicing positions over the next several months.

The jobs are mostly held by long-term employees, often some of the highest paid hourly workers in stores.

The retailer wants those employees working with shoppers, not in backrooms, say company executives.

Centralizing or automating most of their current tasks is more efficient, they say.”

The question is, “How many frontend jobs will they actually create in return for slashing the 7000 backend ones?”

My guess is not many – especially considering that much of the shopping volume has shifted to online retailers such as Amazon, who already automates much of its workload.

Automation is going to be the driving force of our future and this will undoubtedly take more jobs away from society.

Just look at what they’re doing with self-driving cars.

Good-bye, cabbies.

As you can see, job creation isn’t what it use to be.

Which leads us to the next topic.

Will the Fed Raise Rates?

Much of the story surrounding this topic revolves around job creation and economic growth – both from a localized and global scenario.

I am sure you have read every opinion imaginable regarding this subject, with the majority of the coverage shifting to the Fed raising rates at their Sept. 20-21 policy meeting.

Then the jobs report came out, showing the US added only 151,000 jobs in August instead of the expected 180,000 jobs.

Then we were told wage growth slowed to a disappointing gain of just 0.1 percent while many economists had expected 0.3 percent.

The manufacturing sector also contracted in August for the first time in six months.

All of a sudden, there are mixed opinions about a rate hike.

Now recall the Fed’s dual mandate:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

Based on the Fed’s goal of maximum employment, it just wouldn’t make sense for the Fed to raise rates this month.

In fact, no one has even mentioned that over the last 10 years – excluding the 2008 and 2009 anomalies – June, July, August, and September have generally been the worst months for employment.

Yet, with gold performing the way it has over the last week or so, it would appear the market is bracing for a rate hike, strengthening the US Dollar.

But why would the Fed possibly raise rates following a poor jobs report, and while heading into one of the year’s poorest performing months for employment?

The Fed Isn’t Stupid

If the Fed’s hikes rates during a time in which wages and employment growth is falling, and following the Brexit aftermath, then perhaps it has plans to deliberately push the economy back into a recession.

Recall from my Letter, The Truth About the Fed:

“…While it appears central banks are reckless, they certainly aren’t stupid – even if they may often act the part.

…The reason experts are wrong in their inflation outlook is because they base their rationale that central banks – in particular, the Fed, want what is best for us.

I have discussed many times about the Fed’s plan to erode capital in order to preserve their system – not our economy – and that, “the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

In other words, the Fed could care less about our economy: If inflation rises, it just gives the Fed a reason to sell back the bonds they purchased at a better price.”

In short, the Fed doesn’t lose. If the Fed raises rates, they benefit; if they don’t, they still benefit.

Now here’s the kicker.

The Power of One

If you look at the statements made around the world by central banks, you’ll notice that many are signaling to “coordinate policy” under a single directive.

In other words, one centralized central bank – much like the EU has done.

But in order to accomplish this, there needs to be what Christine Lagarde at the IMF calls an “economic reset.”

This could be in the form of an economic depression so powerful that it forces the complete control of assets from the private sector to the central banks.

This plan was evident in Fed Chair Janet Yellen’s last speech.

Via Reuters:

“Yellen, in her speech on Friday, said balance sheets would likely swell again in future recessions as the Fed snaps up assets to stimulate the economy.”

That means if the economy should fall into another recession – one potentially caused by rising rates – the Fed would own even more assets.

Because – they would say – “desperate times call for desperate measures.”

Even more disturbing are the hints Yellen gave suggesting the Fed could break policy and consider “some additional tools that have been employed by other central banks.”

This, of course, includes buying a wider range of assets or raising the inflation target – both of which means the Fed will own more, for less.

It could also mean that the Fed may buy equities in the future.

For those who believe that the Federal Reserve Act prevents the Fed from doing such things, I urge you to read Greg Shill’s, “Does the Fed Have the Legal Authority to Buy Equities?”

Here is brief excerpt:

“The argument that the Fed has the authority today to buy equities is not definitive, but is stronger than is currently acknowledged.

Gagnon, an expert on monetary policy, maintains that “the Fed is not authorized to buy equities,” but to a lawyer, this statement is fraught with ambiguity.

True, the Federal Reserve Act does not expressly authorize the Fed to buy equities. Section 14 of the Act, titled “Open-Market Operations,” enumerates several categories of assets the Fed “shall have power” to buy-they actually extend beyond U.S. treasuries and agencies to include assets like gold, state and local government bonds, and foreign exchange-and equities is not among them.

Yet this does not really establish the outer bounds of the Fed’s authority to buy assets.

The mere fact that a government agency lacks express statutory authorization to pursue a given policy does not necessarily render that policy illegal.

Assuming no other provision of law forecloses that policy (and here, none does), it just means that to be legal, the Fed’s action would have to find a footing on another source-statutory interpretation, case law, a regulation-rather than the text of the statute itself.”

The Fed wouldn’t be the first central bank to buy equities – nor would it be the first one to change policy.

The European Central Bank just changed policies this year and gave itself power to directly influence corporations through the purchase of corporate bonds.

And given that the ECB is even buying junk bonds – bonds with high-risk – they don’t seem to really care what they are buying.

That’s because if the bonds default, the ECB would gain control over what happens to those corporations.

But that’s just the beginning.

On Friday, Reuters told us that, “The ECB may soon be forced to follow the Bank of Japan’s example and buy equities as part of any expanded stimulus programme.”

Via Reuters:

“The European Central Bank could run out of eligible bonds for its 1.7 trillion euro bond-buying scheme, meaning alternative options are on the table should it decide to loosen policy further to lift growth and inflation across the bloc.

Analysts say these could include large-scale share buying, a policy that the BOJ has already adopted after it started purchasing equity exchange traded funds (ETFs) for its own quantitative easing scheme six years ago.”

Now remember what we just said about the Fed’s potential action of raising its inflation target?

By doing so, it gives the Fed more reason – no, more excuses – to deploy even more “tools” to reach the new target.

This is exactly what Japan has done.

Bank of Japan: We Own You

In attempts to hit its new inflation target, the Bank of Japan now controls a massive portion of Japanese equities.

In fact, it has become the largest single shareholder of the world’s largest equity market by country.

Via Bloomberg:

“…The central bank owned about 60 percent of Japan’s domestic ETFs at the end of June, according to Investment Trusts Association figures, BOJ disclosures and data compiled by Bloomberg. Based on a report released on Friday by the Investment Trusts Association, that figure rose to about 62 percent in July.”

And its about to get even bigger:

“…Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings.

… By 2017, the central bank will rank No. 1 in about a quarter of the index’s members, including Olympus Corp., the world’s biggest maker of endoscopes; Fanuc Corp., the largest producer of industrial robots; and Advantest Corp., one of the top manufacturers of semiconductor-testing devices.”

But just how well are Japan’s stock purchases working to increase inflation?

Not so good according to one of Shinzo Abe’s most trusted advisors.

Via Bloomberg:

“One of Shinzo Abe’s advisers cast a shadow over the prime minister’s revival program for Japan, warning that he’s starting to see a chance that Abenomics may not do well.

…”I’ve studied economics for more than 50 years and I’ve believed that what works in the world mostly works in Japan as well,” Hamada, 80, said at a seminar in Tokyo. “But, in the past six months, I’m starting to see there is potential that Abenomics may not work well.”

In other words, Japan has essentially socialized its market without giving much back to its citizens in terms of inflation through economic growth.

And the ECB may be on track to do the same.

All of this leads to the conclusion that central banks will continue owning more of us – no matter the scenario.

Global Central Bank

If we see a rate hike this year, the US and emerging markets will lose much of the support it received from lower interest rates.

Regardless of who is elected to head the US, world economic conditions will continue to deteriorate and we’ll begin to see central banks around the world openly coordinate policy.

And who will likely lead this charge?

The IMF – an organizations with no debt, half a trillion dollars of SDRs (worth about $659 billion based on the devaluation of currencies within the basket), and a world of power (see A Simple Solution to the World’s Debt Problem.)

As suggested during the Jackson Hole Conference, many central bankers are arguing for “new tools” to fight future fiscal downturns.

And since the idea of negative interest rates was not mentioned by the Fed, we could see them raise the inflation target (as was just mentioned), or adjust the relative value of currencies through agreements with other countries instead of allowing free markets to determine the value of currency*.

(*Jim Rickard’s theory of revaluing currency and inflation by raising the price of gold is a very valid theory in this regard – since both the Fed and the IMF have a backdoor route in acquiring gold.)

In other words, they could revalue currency and inflation through a single directive.

This strategy becomes even more apparent when you consider the role of the Bank for International Settlements.

The Bank for International Settlements is an international financial institution owned by central banks which “fosters international monetary and financial cooperation and serves as a bank for central banks”.

The reality is that central banks already coordinate policy privately, but it’s preparing to do it publicly – all it needs is that “economic reset.”

They would say, “desperate times call for desperate…”

Now, this may seem like a story out of a John Grisham novel, but I am presenting an outlook based on fact and public knowledge.

It isn’t to induce fear, but rather open your eyes to the realities of our new world – one controlled ever more so by central banks.

It’s not that the world will stop and you will lose all of your money to the central banks. Their theories and policies rely on taking advantage of weak citizens who are immune to the truth.

Should we choose to accept this reality, our job is to protect our wealth based on their policies.

This includes everything from investing in and exiting the right areas at the right time.

(Yes, gold is just one of the viable long-term options in this regard.)

We’re in an era of cheap money and there is A LOT of it – but only if we put it to work.

Holding cash means you’re likely losing wealth over time. If you want to protect your wealth, you have to put it to work – that is the position the central banks have put us in.

Most stocks are frothy now, but there will always be a sector that booms.

Over the next few months, I’ll introduce you to some ideas that I believe are as recession or monetary policy proof as there are.

Near Term Strategy

Over the past month, we’ve seen some heavy profit taking in the Canadian market – one that was expected when you consider the number of financings that have taken place earlier this year.

These financings generally have a four-month hold period, which are now being released into the quieter summer months.

Their release has put a lot of pressure on many of the juniors, but it also can translate into a great buying opportunity should the asset class continue to climb.

That is precisely why I’ve taken some profits on a number of gold stocks on recent weakness, with the intent to look for better entry points.

End Notes

As I promised, in the coming weeks and months, I’ll be introducing a few new companies in very different spaces that I believe are not only recession proof, but have very few competitors.

Let’s make some money while our money is still worth something.

Stay tuned.

How does the China-Russia axis and their clients figure into all this?

no comment

Great insight. The Bank of Internstjonal settlements is something I am surprised no one talks about more. A central bank for central banks but ran by who? The powerful elites continue to get a bigger hold of us and this article shows it very clearly, and not only that shows us in pretty simple detail. It’s not rocket science. People who choose not to believe in this and dismiss it will themselves buried at the bottoms like slaves

A more startling statistic is, the North American and Chinese birth rates are population growth negative, less than 2 children per family.

Can you guess who’s making up the difference and more?

“The Fed Isn’t Stupid”LOL…. no just criminally insane….