Dear Readers,

We just keep hitting it out of the ballpark.

In my last letter, I had mentioned that Balmoral Resources Ltd. (TSX.V: BAR)(OTC: BALMF), a company I first featured on May 13, 2012 at a share price of CDN$0.57, had much more room to run.

This past week, they surprised us with a massive discovery that sent their share price as high as CDN$0.94.

That’s nearly a 65% gain in just a few short months.

But I think the Balmoral story is just starting to unfold. Let me tell you why.

Let’s first go back to my original report:

Balmoral Resources (TSX-V: BAR) (OTC: BALMF) currently owns one of the largest land packages in the Abitibi Greenstone Belt – a belt which hosts one of the largest accumulations of gold in the world.

Outside the Witwatersrand Basin in South Africa, no other area on Earth has produced more gold than the Abitibi Greenstone Belt of Quebec and Ontario, Canada.

Over the past 5 years a number of major gold discoveries in the Abitibi have made investors billions of dollars. These include Osisko Mining, Detour Gold, Lake Shore Gold, Virginia Gold, and none other than West Timmins Mining – the company Balmoral’s current team sold less than two and a half years ago for a potential return of 2215% in less than a year*.

(*Management team took their $0.13 West Timmins stock when the market crashed in 2008 to over $3.00 in 2009 when it was finally bought out)

As I highlighted before and because of the major similarities, Balmoral is an opportunity for anyone that missed the West Timmins story.

The Balmoral story began a few years back when it’s management team, led by CEO Darin Wagner, were part of the discovery of the high-grade Thunder Creek gold deposit in Timmins.

In mid-2007 through their company West Timmins, in joint venture with Lake Shore, Darin and his team drilled the first discovery hole at Thunder Creek.

For nearly two years, Darin and his management team tried to convince the market that they had something really special – something that both Lake Shore or Goldcorp would want.

But the market didn’t care. Up until the bottom of 2008, West Timmins shares did nothing but go backwards, falling to a low of $0.13 in November 2008 – despite hitting significant grades over and over again.

Still, Darin and his team knew what they had and wouldn’t quit. They weren’t about to let Lake Shore bully them out of the joint venture. So they kept drilling and marketing their story.

West Timmins’ yahoo moment came when they returned a hole that produced 83.40 metres (273.55 feet) grading 12.75 g/t gold – one of the best holes in Timmins in the last 50 years.

The hole showed the market that West Timmins was clearly in a superb gold system. As a result, West Timmins shares began their dramatic climb and never looked back until its buyout by Lake Shore just months later.

Look what happened:

As a result of their discovery, West Timmins Mining was acquired by Lake Shore Gold Inc. in a deal valued at $424 million, making a wealth of money for their shareholders.

Why is this important?

Balmoral is a second chance for anyone that missed West Timmins. It’s the same team, built under the same premise of putting together a land package that would be bought out. Only this time, Darin and his team have a much better land package – one that’s right next door to what will become Canada’s largest gold mine next year, Detour Lake.

Since Balmoral’s inception, they have done nothing but hit high grades on their Martiniere project – a project that is within 45km of Detour Lake. Yet, just like West Timmins, their shares have done nothing but trend downward since their inception just a couple of years ago – along with the rest of the TSX Venture exchange.

If you go back to my original report, you’ll see how striking the similarities between the West Timmins story and Balmoral’s really is.

Now here’s where I want you to pay close attention.

Balmoral just had their Yahoo moment – a yahoo moment much like the one that propelled West Timmins shares on a consistent upward trend until its buyout by Lake Shore.

If West Timmins’ yahoo moment is any indication of what’s to come for Balmoral, we’re about to witness something very special.

The Yahoo Moment

On Thursday, Balmoral announced that on their very first of the ME-series holes, they discovered a new bonanza grade, gold bearing structure in the footwall to the Bug Lake Gold Zone.

The Footwall discovery returned, on an uncut basis, 272.39 g/t (8.0 oz/ton) gold over 3.88 metres (12.7 feet) across the width of the mineralized structure. Included in this interval are adjacent bonanza grade intercepts of 1,530 g/t (44.6 oz/ton) gold over 0.55 metres (1.8 feet) and 409 g/t gold (11.9 oz/ton) over 0.50 metres (1.6 feet).

That’s an incredible hole. Just massive.

So how does this compare to the West Timmins yahoo moment, or yahoo hole?

The yahoo hole for West Timmins returned 83.40 metres grading 12.75 g/t. This equates to 1063 gram metres of gold in that block.

Balmoral’s hole returned 273 g/t over 3.88 metres. This equates to 1059 gram metres of gold in that block – nearly identical to West Timmins’ yahoo hole.

But here’s the kicker:

If you take the whole intercept from the top of Balmoral’s Bug Lake zone all the way down through, it’s actually 79 metres from the top of Bug Lake to the bottom of the intercept. Within this intercept, there is only 4 metres of barren rock without grade.

If you average it out to get a comparable to the Thunder Creek hole of 83.40 metres grading 12.75 g/t, which I stress is not allowed in 43-101 reports, Balmoral’s hole would have averaged out to be 14.1 g/t over 79 metres* – a dead ringer to the West Timmins yahoo hole.

(*theres are my own calculations and is not 43-101 compliant)

However, the Timmins hole was drilled down to 710 m vertical depth; Balmoral’s only 120 m – that’s a huge difference.

Does that mean Balmoral’s yahoo hole is better than West Timmins’? You be the judge. Regardless, look what that one hole did for West Timmins.

It Just Keeps Getting Better

Aside from comparing West Timmins to Balmoral, there are so many reasons why their latest discoveries are significant.

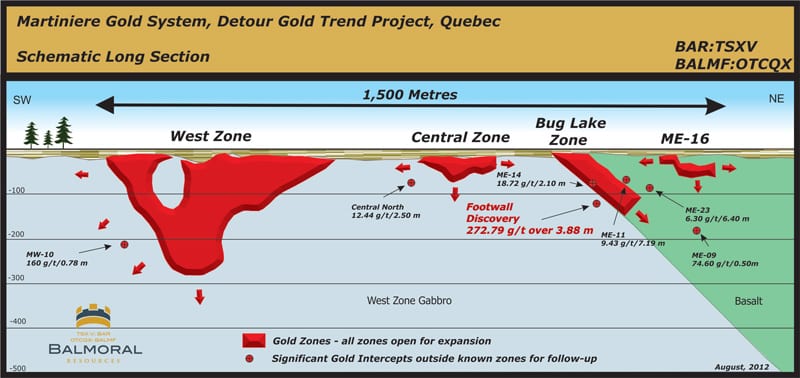

Take a look at this picture:

|

| click to enlarge |

The big red zone on the left is Martiniere West; the green Martiniere East.

Drilling has shown that there is a fault between the West and East zones. The rocks on the green side are totally different from the rocks on the blue side. When the faults move, they bust the rock up and it becomes flooded by gold and silica.

This fault is called Bug Lake; it’s the fault that separates the east and the west zones. It’s about 30-70 metres wide and it seems to be averaging out to be a gram per tonne with some higher grade sections in it.

Management was drilling under the premise that they would get a good cross section of Bug Lake to add ounces to the zone they had already found. They were drilling to hit the fault directly and were going to end it at the gabbro (a dark rock with no value, similar to basalt) on the other side.

But as they were drilling, they found small veins of gold. In gold exploration, you never stop drilling when you know you’re in a system. So they kept the drills turning and the next thing you know, they hit big – really big.

|

| click to enlarge |

This hole is something brand new and no other drilling has been done out here. It’s open in every direction. No doubt there are follow up holes to come, which means we could see this new discovery expand into something special on its own.

Management has been telling the market for a while that there is a big gold system at work here; much like they did when they were talking about West Timmins. But what this new hole does is solidify for people that not only is there a big gold system here, but it’s a gold system that can do some very special things.

This new discovery just gave Balmoral another high grade target for a total of 8 high grade zones along with a bulk tonnage zone at Bug Lake to expand and grow.

Drilling has clearly indicated there is still a lot of areas hiding that could produce big numbers. The system is currently 1.5 km long and open in every single direction. It’s already producing phenomenal grades at the Martiniere West zone and now it’s showing us mind blowing grades in a completely new area.

Barely Scratching the Surface

One look at the Long Section picture above and you will see that Balmoral has only scratched the surface at all of the zones at Martiniere.

So far, they’ve only drilled to about 200 or so metres, if that, at any of their 9 zones. There are a lot of holes that haven’t gone further than 50-75 metres, yet continue to hit.

The joy of these gold systems is that you almost never get out of them – they’re extremely deep.

Just take a look at Aurizon’s Casa Berardi producing gold mine, just 40 km to the south of Martiniere.

Overall, Casa Berardi has about 5 zones over 4.5 km as opposed to 9 zones over 1.5 km at Balmoral. The proximity between all of the zones at Martiniere means lower infrastructure costs. 9 zones over 1.5 km is a lot better in theory than 5 zones over 4.5km.

Aurizon is currently mining Casa Berardi down to a 1200m vertical depth. Detour Gold will open pit to a 700-800m vertical depth. Osisko is planning to open at around a 600m vertical depth. The Kirkland Lake and Timmins mines have been mined to a 1500m vertical depth, with depths as far as 2300m.

The major gold systems in the Abitibi all tend to go deep. Because Balmoral has only gone down to around 200m at any one of their zones, the upside to finding more high grade zones are superb; every zone is open at depth.

The deepest verticle hole Balmoral has drilled is in the West Zone and its drilled to about 350-360m down. The results of these holes should be coming out in the upcoming months which means more excitement and more upside to an already promising story.

If Balmoral’s team can show that the mineralization remains consistent as they move deeper, it will be huge news for me, and all shareholders involved.

Management has told me that we’re going to get results from more exploration holes at the Detour East zone and we’ll be getting more results from other Martinere exploration holes that are completely outside of the trends.

That means the news flow pipeline is full of exciting holes yet to be released.

Balmoral’s Martiniere project is already proving to be a big and rich gold system. Yet, they don’t even have an edge on it – it’s wide open. Every time they drill somewhere new, they find something new. It’s amazing.

As Balmoral CEO Darin Wagner said, “it has been extremely rare for one Company to control the entirety of a given system like Balmoral appears to at Martiniere.”

I am glad I own shares.

A Great Year for Equedia Readers

Thus far, this has been a great year for our readers who own shares in Balmoral and MAG.

MAG Silver just announced that an underground mine development program with their JV partner Fresnillo has been approved. That means one of the world’s highest grade undeveloped silver projects is moving forward. Balmoral just announced an amazing hole that industry experts are drooling over, while continuing to rapidly expand their high grade gold project.

Next week, I am going to try and keep the streak going with a junior gold producer that has major support from analysts and is clearly undervalued. Make sure you open your emails next week for my new report.

Until next week,

Ivan Lo

Equedia Weekly

Disclosure: I am long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies. Balmoral Resources was an advertiser, but is no longer at the time of this report. However, I own shares in Balmoral and I am sure many of my friends do too. That means I am biased. MAG Silver is an advertiser and I also own shares in MAG, along with many of my friends. That means I am biased. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, including MAG Silver and Balmoral Resources, doesn’t mean they all will. Furthermore, neither MAG Silver nor Balmoral Resources, has any control over our editorial content and any opinions expressed are those of our own.

Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Companies do pay us to advertise on our website and we often distribute our reports on featured companies. While we are never paid to write a rosy and positive report on any company, we do market our reports using the advertising fees paid for by our featured companies.

This process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Our revenue is generated by sponsor companies and we grow our readership by using the advertising fees we charge to distribute our reports. This helps both Equedia and our client companies gain exposure and allows us to provide you with our research at no cost.

Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid $5833.33 plus HST per month for 6 months which totals $35,000 plus hst of media coverage on MAG Silver Corp. plus any additional expenses we may incur as a result of additional distribution. MAG Silver Corp. has paid for this service. Equedia.com may purchase shares of MAG Silver without notice and intend to sell every share we purchase for our own profit. We may sell shares in MAG Silver Corp without notice to our subscribers. Equedia Network Corporation., owner of Equedia.com has been paid $7143 plus HST per month for 7 months which totals $50,000 plus hst of media coverage on Balmoral Resources Ltd. plus any additional expenses we may incur as a result of additional distribution. We have also been given a budget of $75,000 for additional advertisements we make on behalf of Balmoral. Balmoral Resources Ltd. has paid for this service. Equedia.com owns shares and may purchase shares of Balmoral Resources Ltd. without notice and intend to sell every share we purchase for our own profit. We may sell shares in Balmoral Resources Ltd. without notice to our subscribers.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.