The summer holidays are officially over. The kids are going back to school. And it’s time we all get back to work.

But what a wonderful way to kick off and revive the working spirit. The markets are looking strong and confidence among U.S. consumers are continuing to beat expectations. Despite the rise in unemployment last month, this month clearly showed better numbers.

Heck, there’s even positive signs from the US real estate market, regardless of the continued foreclosures. The number of contracts to purchase previously owned houses unexpectedly rose in July, a sign the market may be starting to stabilize. U.S. mortgage rates dropped to yet another record low with the average rate for a 30-year fixed mortgage falling to 4.32 percent. That’s the 11th straight week of matching or setting a new low for mortgage rates. Imagine that. 4.32 percent for 30 years!

Those mortgage rates are eventually going to catch the consumers’ attention. They caught ours – and we live north of the border.

So while we enjoyed the much needed rest over the last few quiet summer months, the rest of the year may not be so quiet.

Mergers and acquisitions are continuing to run rampant (see A Clear and Present Danger), with Goldcorp (TSX: G) ending the week with a huge purchase of Andean Resources (TSX: AND) for C$3.6 billion (see news release).

We have also been keeping tabs on our featured silver companies. They`re not only doing well, but their management teams have told us a lot of great things are lined up. You can be sure that over the next few weeks, we’re going to keep you apprised of what`s in store.

With the positive progress we`re making on our investments and the way the markets are behaving, nothing could give us more reason to be excited.

But that doesn’t mean our economy is safe.

At some point in the near future, governments around the world will eventually be stifled by the cost of all the borrowing they have done in the last few years.

In 2009, 10% of the U.S. Federal Budget was spent paying interest on debt. The CBO (Congressional Budget Office) says that number will reach 20%, or $917 billion, by 2020. These are just estimates and don`t completely factor in any new major loans.

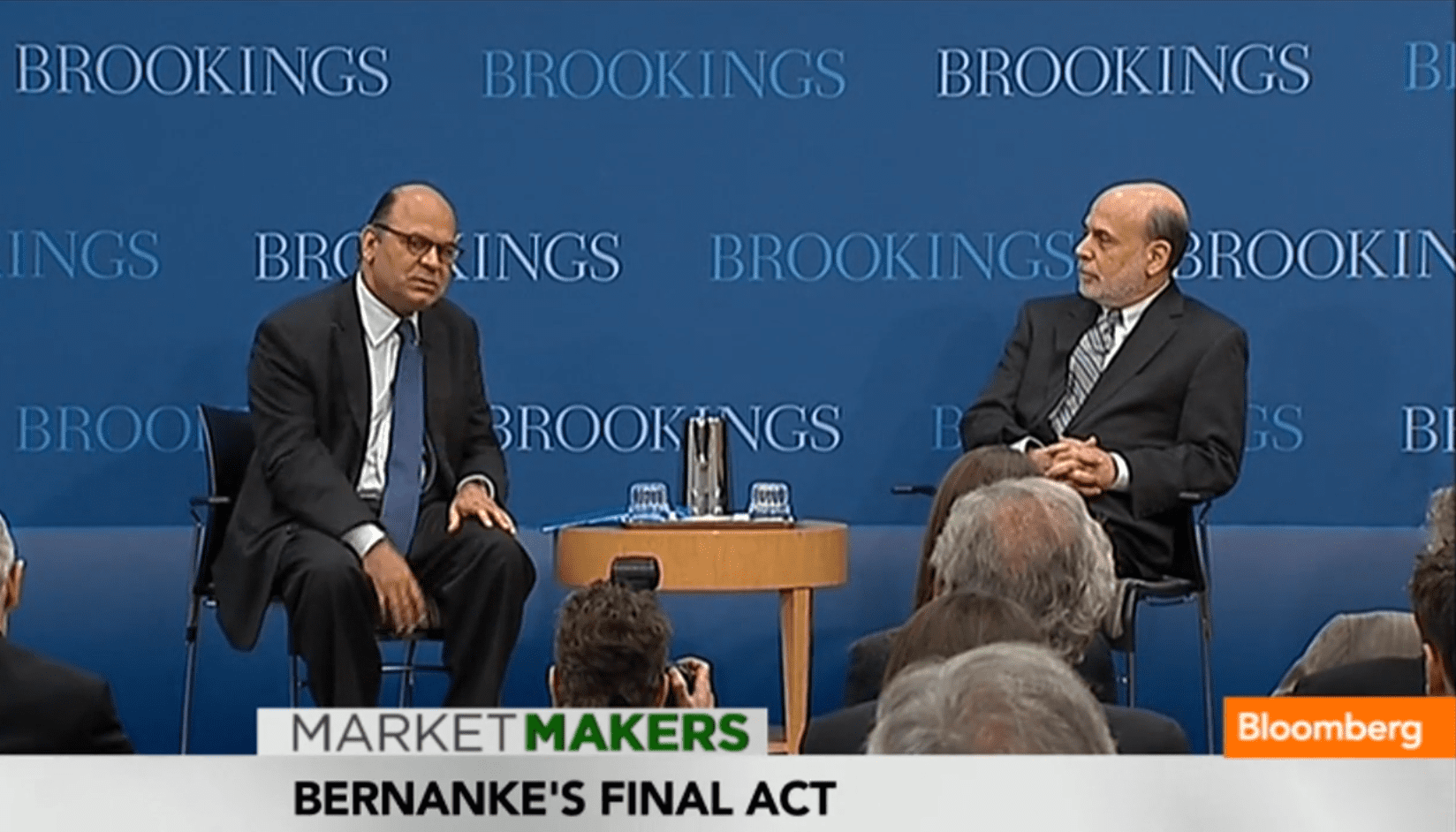

Remember what Bernanke said last week? He reassured Wall Street that the central bank will act if “unexpected developments” cause the recovery to falter. That means there is a possibility that more borrowing, a lot more, could be in the works.

Now combine that with soaring debt servicing costs, underfunded pensions, social security issues, and US states that are flat broke, and we have a recipe for a very tough recovery.

Luckily for us, it doesn’t mean the markets will tumble – although it could. But it does means that we need to be much more diligent when investing. It`s a whole new world out there and we need to change our mentality. However, there is a bright side.

At the rate interest accrues on the government’s debt, gold and silver prices should grow even higher. Other commodities, such as fertilizer stocks should also do well despite any negative economic implications. The world is still growing at a faster pace than ever. That won’t change.

So when the dust settles, and regardless of our economic outlook, there will be a place for precious metals and other commodities.

If the economic outlook turns negative, gold and silver prices should soar – and along with it, gold and silver stocks. If the economic outlook turns positive, we will more than likely see institutions open their wallets and once again get back into the junior markets. This will undoubtedly cause a new bull run in the junior sector and we may once again see some new highs. Either way, there’s strong potential.

Don’t feel bad that summer is over. Don’t feel bad that our economy is still a little shaky. Don’t let the word “double-dip” scare you. Things are looking up…

Until next time,

Ivan Lo

Managing Director, Equedia Weekly

Equedia Network Corporation

www.equedia.com

Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies.Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Equedia.com has been compensated to perform research on specific companies and therefore information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid six thousand four hundred and thirty Canadian dollars plus gst/hst per month for 7 months which totals forty five thousand dollars plus gst/hst of advertisement coverage on Minco Silver Corporation. The company (Minco Silver Corporation) has paid for this service. Equedia.com currently owns shares of Minco Silver Corporation and may purchase shares without notice. We intend to sell every share we own for our own profit. We may sell shares in Minco Silver Corporation without notice to our subscribers. Equedia Network Corporation is a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

�