Something incredible is happening. And those who see the signs are already reaping the rewards.

But this is just the beginning.

You see, politicians, central bankers, and mainstream media figures repeatedly assure us everything is under control—that inflation is temporary, debts are manageable, and that America’s financial fortress is impenetrable.

But history whispers otherwise.

It reminds us that whenever politicians declare financial victory too early, ordinary citizens eventually bear the brunt of their miscalculations.

We’re entering one of those critical junctures today.

Trillions of dollars in new spending, escalating debts, and the rapid erosion of the dollar’s global dominance are setting the stage for an unprecedented financial upheaval.

And while there are opportunities to protect your wealth from the actions of politicians, there is only one true, timeless asset that has proven it can withstand everything.

Today, as the numbers reach cartoonish scale, that something is once again waiting in the wings—quiet, incorruptible, and utterly outside the reach of politicians.

America’s Dangerous Gamble

Earlier this week, the US passed the Big Beautiful Bill (BBB).

The sprawling piece of legislation will pour $3.3 trillion of new red ink onto an existing sea of obligations and, crucially, lift the statutory debt ceiling by another $5 trillion to avoid a technical default.

At nearly 900 pages, the bill is an expansive compilation of tax cuts and incentives, spending reductions, and other key Republican objectives, including additional funding for national defence and immigration enforcement measures.

Within those 900 pages lies a critical opportunity – but it may not be obvious until you understand why.

President Trump’s BBB has eliminated long-standing federal incentives for solar and wind energy; instead, it provides an incredibly favourable climate for oil, gas, and coal production.

Trump has clearly articulated his energy priorities, emphasizing that the United States will continue to depend on oil, gas, coal, and nuclear power to meet its increasing energy demands. Last weekend, he explicitly criticized wind and solar energy.

“I don’t want windmills destroying our landscape,” Trump said during a Fox News interview broadcast on June 29. “And I certainly don’t want these solar installations sprawling across miles and covering mountainsides, looking ugly as hell.”

This preference for fossil fuels and resistance to renewable energy is embedded in the president’s flagship domestic policy legislation.

The bill addresses key requests from the oil and gas industry, according to their leading lobby group, while eliminating the tax incentives critical to the expansion of solar and wind power.

With the passing of the BBB, oil and gas, as well as other traditional energy producers, have already seen the benefits in rising share prices.

But while this seems to be an easy opportunity, that is not the opportunity we are about to uncover.

More in a bit.

Spend, Spend, Spend!

When Rome clipped silver from the denarius, prices of bread and olive oil soared. When Weimar’s presses ran day and night, a postage stamp cost billions of marks. And when Congress authorizes trillions that the taxpayer cannot cover, the Federal Reserve must manufacture the difference or the US must borrow from others.

Every new dollar printed to fund this debt reduces the purchasing power of existing dollars, silently robbing savers and wage earners.

But that’s not all.

You would think that this type of spending should truly Make America Great Again. But in truth, this is yet another Band-Aid solution to a hemorrhaging financial system.

America’s debt has now surpassed $36 trillion, and the Congressional Budget Office acknowledges that interest payments alone will soon exceed military spending.

I repeat: $36 trillion!

That means every dollar earned by Americans—and every dollar generated by the entire U.S. economy in a single year—is nowhere near enough to repay this debt.

Competitive Devaluation: A Global Currency War

Yet the U.S. isn’t alone in its fiscal recklessness. Nations around the world are locked in a subtle but aggressive currency war.

When the U.S. floods its market with freshly printed dollars, other countries must follow suit or face economic annihilation. They must debase their own currencies to remain competitive exporters to America, the world’s largest consumer market.

Japan proves the point with perpetual quantitative easing; the ECB joined long ago; Beijing has cut reserve requirements twice this year to weaken the yuan.

The result is a race that no one can win, only out-lose.

But there is a solution for those looking to protect themselves against this battle.

BRICS and the End of Dollar Dominance

Unfortunately, US spending is far from the only reason the US dollar is losing value.

As we have mentioned many times before, there is an escalating movement to abandon the U.S. dollar as the world’s reserve currency.

Nations within the BRICS alliance (Brazil, Russia, India, China, South Africa) are aggressively pushing to dethrone the dollar’s dominance.

Brazil and China have already begun trading directly in yuan, completely bypassing the dollar. India is buying Russian oil in rupees, and Russia has accumulated massive reserves of Chinese yuan. Saudi Arabia, historically America’s partner in maintaining the petrodollar, has expressed openness to accepting Chinese yuan for oil payments.

These shifts represent seismic geopolitical changes.

Each agreement chips away at the dollar’s influence.

While G7 treasuries dilute value through excess supply, the BRICS bloc is attacking the system from the demand side—reducing the need to hold dollars. The blueprint was sketched in 2014 when the BRICS Development Bank was born.

As we wrote in 2014:

“Emerging economies have had enough of being slaves to a currency that has unlimited production… de-dollarization is the battlefield.” — via When Nations Unite Against the West: The BRICS Development Bank

What does this mean in layman’s terms?

When the US government spends more than it collects in taxes, it must borrow the money.

So it borrows the money from institutions and other countries. However, lenders want a return on investment that beats inflation. And when the government spends more than it collects, it always leads to inflation.

That means the more money the US borrows, the higher the interest rate the lenders will want.

And when there aren’t enough lenders, the US borrows from the lender of last resort, the Federal Reserve, further devaluing the dollar.

For more information on how the US actually borrows money, see How the Government Borrows Money.

Don’t Listen to the Media

Earlier, we talked about how Trump’s BBB is highly favourable to traditional energy producers.

And you’ll most certainly have read articles stating that this could lead to higher oil and gas prices as a result of renewables losing their incentives and thus relying more on fossil fuels, such as coal and nuclear.

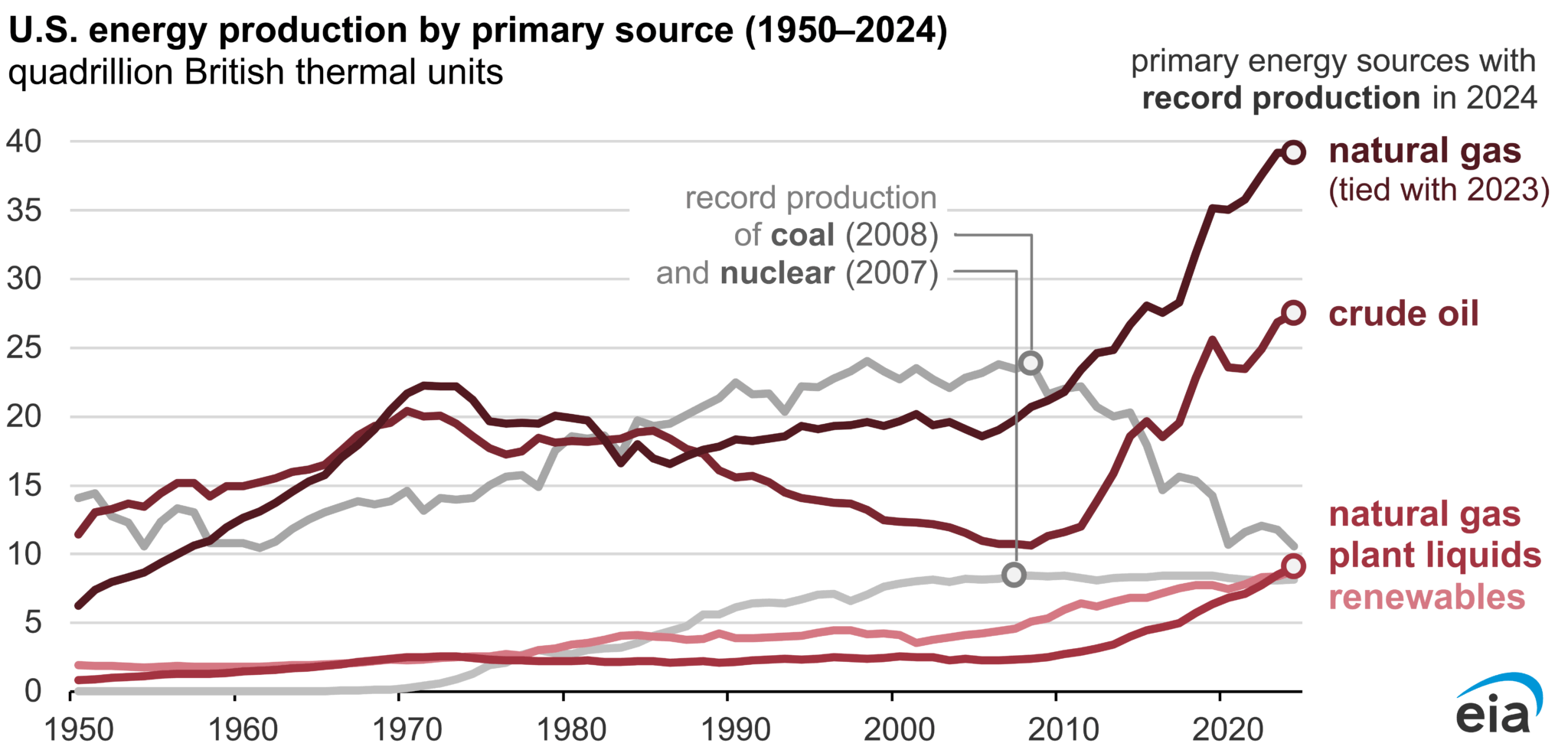

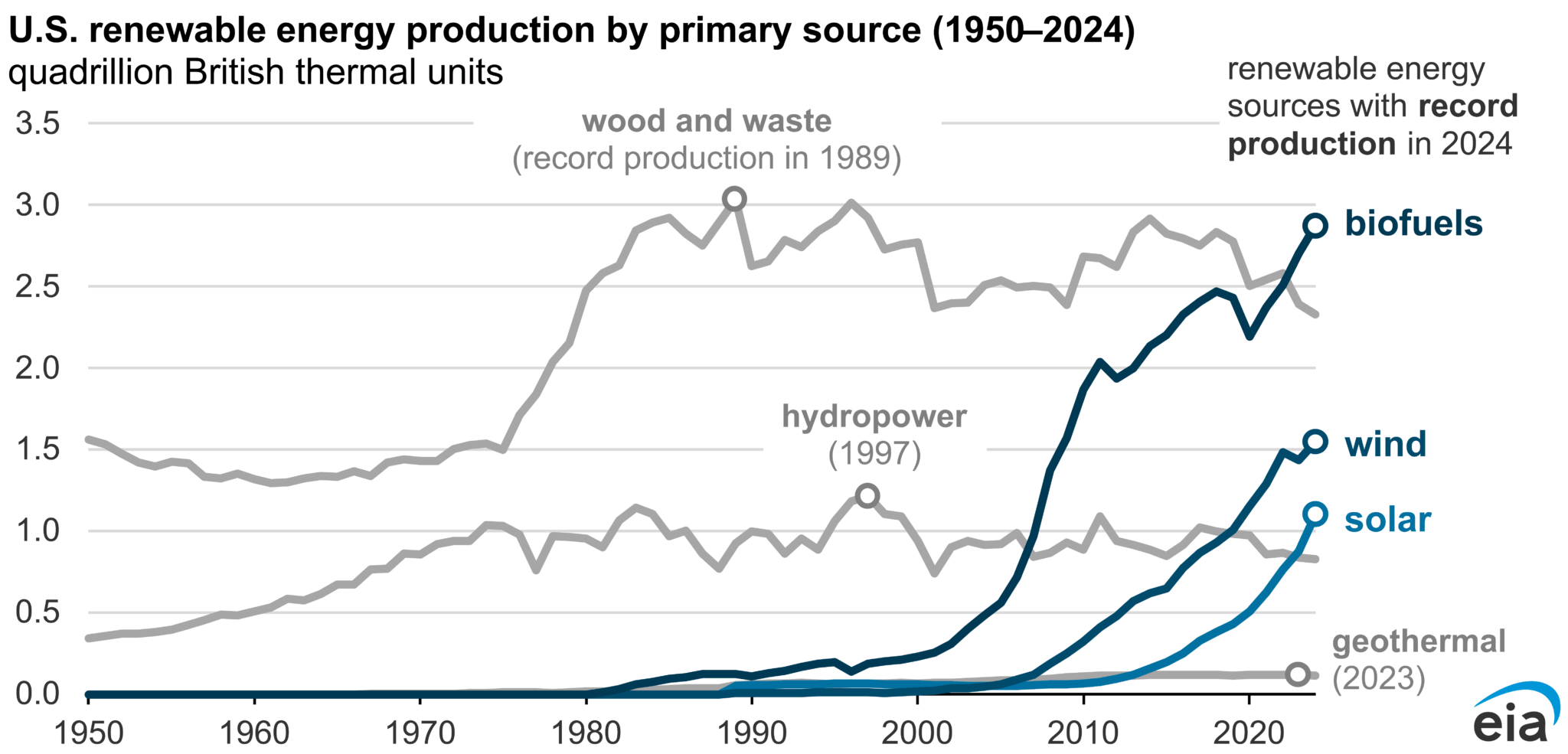

While this will drive demand for fossil fuels, these media outlets have overlooked (or intentionally overlooked, as a way to attack Trump) one important factor: fossil fuels, coal, and nuclear have historically accounted for nearly all of the US’s energy production.

Take a look:

But the BBB removes incentives for wind and solar, which will drive energy prices higher, the media says.

Oh, really?

Let’s look at the facts.

Wind and solar combine to produce a total of just over 2.5 quadrillion British thermal units (Btu).

While this sounds like a big number, it’s a drop in the bucket compared to every other source.

Despite the decline over the last decade, coal and nuclear production still represent over 20 quadrillion Btu – nearly 10 times more than what Wind and Solar produce.

Last year, U.S. solar and wind production increased by 25% and 8%, respectively, as new generators came online.

That means solar output climbed by about 0.3 quadrillion Btu, while wind output rose by roughly 0.074 quadrillion Btu.

Do you know how much coal production has to increase to match that?

Coal represented 10% of the United States’ total production of 103 quadrillion Btu, so 13 quadrillion Btu.

In order to replace the “significant” gains of wind and solar last year, coal production needs to increase just 2.9%.

So, forget oil and gas – the incentives for coal should be more than enough to balance the scales, offsetting the loss of removed incentives for wind and solar.

In other words, unless there are further tensions in the Middle East, the BBB is unlikely to raise the price of oil and gas.

Now, when you combine lower energy prices with reckless government spending, you have a recipe for one group of stocks to outperform.

Hang tight, we’re almost there.

The Interest-Rate Trap: The Fed’s Limited Options

The Federal Reserve now finds itself cornered. Raise rates too high, and debt payments spiral out of control. Lower rates and inflation surges again, reducing real yields.

Given the U.S.’s precarious fiscal position, significant hikes seem improbable – this would be a disaster for the US as interest payments skyrocket.

The United States must refinance over $9 trillion of maturing debt in the next twelve months before funding new deficits from the Big Beautiful Bill.

Every quarter-point Fed hike now adds on the order of $70 – 80 billion to the Treasury’s yearly interest tab once fully absorbed, and roughly $20 billion in the very first year, not including spending from the BBB.

That means if Fed chair Jerome Powell raises rates now, it would be financial suicide for Americans, especially given the spending outlined in the BBB.

And while Powell has held off on rate cuts, it seems that a small cut is likely in the near term.

If history is any indication, the one asset class politicians can’t destroy with reckless spending and currency wars is about to climb even higher.

Yes, I am talking about gold.

Central Banks Accumulating, Again and Again

While publicly dismissing gold, central banks globally have quietly become its largest buyers.

Central bank net purchases have topped over 1,000 tonnes in back-to-back-to-back years, marking it the most buying in the post-Bretton Woods era.

As a result, gold is experiencing severe supply constraints. Mining production has plateaued due to declining ore grades and stringent environmental regulations. ESG requirements have further slowed the development of new mines.

Yet, global demand—driven by central banks and investors—is accelerating.

When demand surges against a constrained supply, prices inevitably rise.

Add in a period of steady or declining rates, and we have a recipe for even higher prices.

When you combine all of this with the BBB’s focus on lowering energy prices, you have an even better recipe for bigger gains.

Mining Stocks: Leverage to Gold’s Rise

Historically, mining stocks offer tremendous leverage to rising gold prices. As gold climbs, profit margins for miners expand dramatically.

With gold hovering over $3,300/oz, miners with all-in sustaining costs of $2,000 per ounce enjoy extraordinary profitability.

And if energy prices DO lower as a result of the BBB, these margins could climb even higher.

Conclusion: Preparing for What Comes Next

Gold isn’t just an investment—it’s insurance against financial and political recklessness.

With trillions more in debt flooding the system, competitive devaluation spiralling globally, and the dollar’s status under siege, gold’s rise seems inevitable.

You have now met it in full: an immutable asset with no counterparty risk, hoarded by the very institutions that publicly dismiss it, and newly empowered by a world rejecting the dollar’s monopoly.

If gold continues the current trend, the capital now hiding in money market funds will scramble for the tiny market cap of precious metal equities. The bid will not fit through the door at once. Early positions—thoughtful, selective, and sized for volatility—may be the only rational response.

If gold merely keeps pace with the expanding global money supply, we believe a $3,500/oz gold price is a conservative estimate. Should confidence break outright, even optimists will look small. In either case, gold mining stocks—leveraged to every tick—are primed to outperform.

Remember: the U.S. must refinance over $9 trillion of maturing Treasuries in the next twelve months, plus the new supply baked into the “Big Beautiful Bill.”

To keep borrowing costs low, the Federal Reserve might secretly start buying lots of these bonds itself, pretending it’s just a small tweak. This yield curve control will be disguised as “balance sheet flexibility,” but it’s really just printing money under the table.

If that happens, the smart money will see right through it and rush to buy gold to protect their money. This will undoubtedly lead to higher gold prices.

Secure your wealth accordingly.

Seek the truth and be prepared,

Carlisle Kane

The Equedia Letter

is it not 2024 and not 2014

As we wrote in 2014:

The US Dollar will become worthless during the next 25 years

Good write-up, however, nothing said about the near Trillion dollars wasted in the expense of removing the millions of illegal immigrants that the Communist Democrats allowed to flood this country with diseases and illegal drugs killing real American taxpayers. Also, not one word about SILVER and its value or other rare metals. Most Americans cannot afford to buy GOLD.

How about Powell?? Another Brain-Dead Democrat who is getting paid big bucks for doing nothing!!

What about silver instead of gold?

So what about a yielding ETF that optimizers with calls/puts like TSLY, NVDY, PLTY? but focused on proven gold winners?

Hey… trumpee is Water-Boarding Wall Street and so is Water-Boarding the Citizens of U.S. The Bully, Bully repubs are actually the Laughing Stock of the World. Nobody should believe or trust King ding-a-ling.