The world’s biggest players are loading up.

In fact, we haven’t seen buying like this since the 1970s.

Yet, you won’t hear about this in the media.

That’s because those who are buying don’t want YOU to know.

Nor do they want their competitors to know.

THEY want to accumulate as much as they can without making a peep.

The more they buy, the more leverage they have.

Most importantly, the more protected they are.

And with the current geopolitical environment, there is only one asset that countries trust.

Yes, I am talking about gold.

Gold does NOT depend on the creditworthiness of a country. It is globally liquid and accepted by every country and central bank in the world.

It can be sold or traded internationally with little counterparty risk, free from sanctions, tariffs, and other forms of fiat currency controls.

It’s no wonder that central banks have purchased over 1,000 tonnes of gold every year for three consecutive years. That’s the most central banks have bought since Nixon closed the gold window in the 70s.

While gold is now trading at an all-time high, we believe the real move has barely begun.

In fact, by this time next year, JP Morgan expects gold to hit $4,000.

Today, I am here to share with you how we can capitalize on this opportunity.

Leveraging Gold

I’m about to reveal a company led by a team that’s already delivered hundreds of millions in profits to investors by uncovering billions of dollars’ worth of gold.

But this isn’t just another speculative gold explorer hoping to get lucky.

And it’s not one of those drawn-out development stories that bleed capital for years before producing an ounce.

This is a company on track to produce more than US$2.6 billion worth of gold this year*!

*at current gold price of USD$3350.

That’s not a typo.

And that’s just a conservative estimate based on the lower end of their guidance.

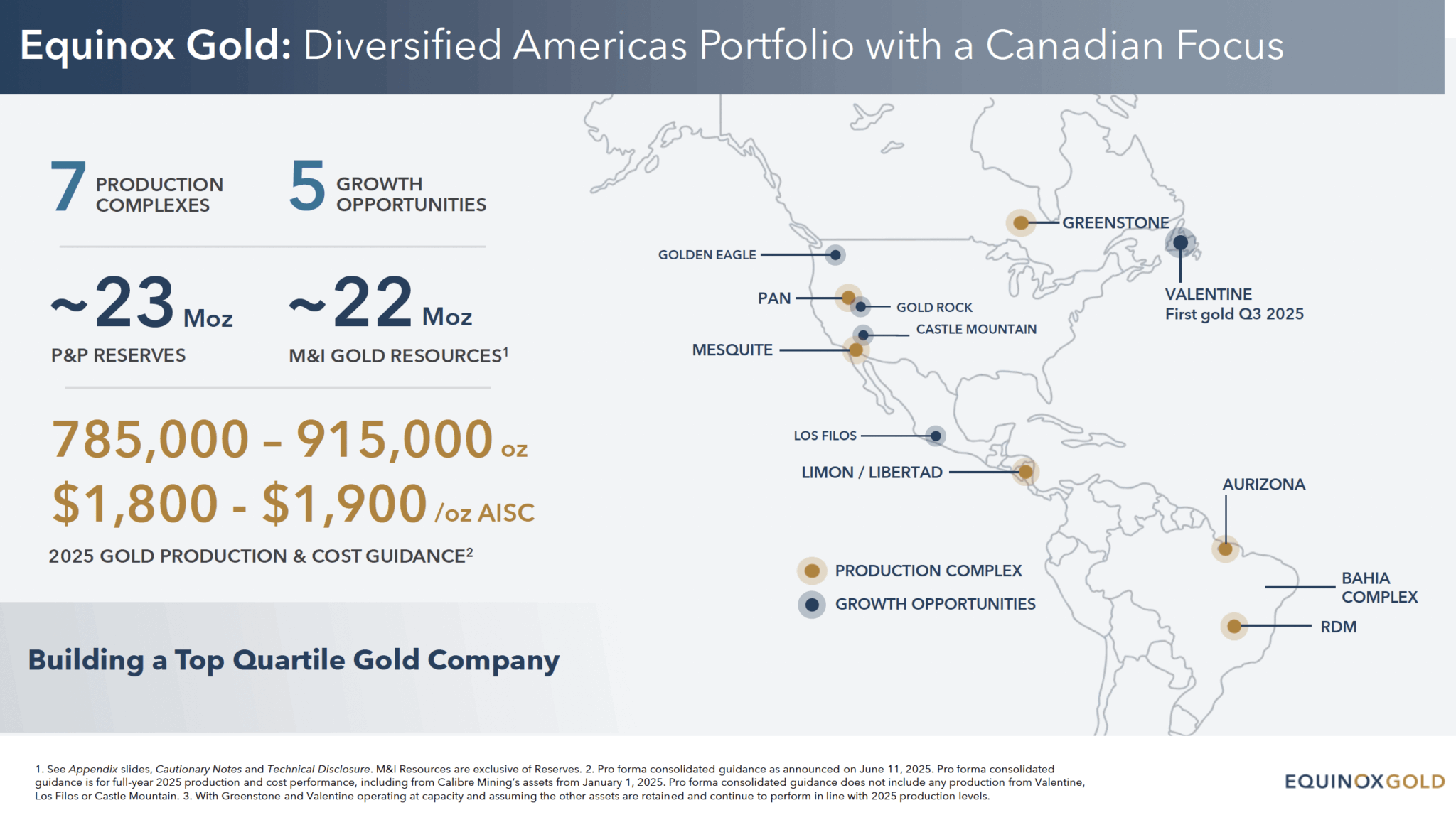

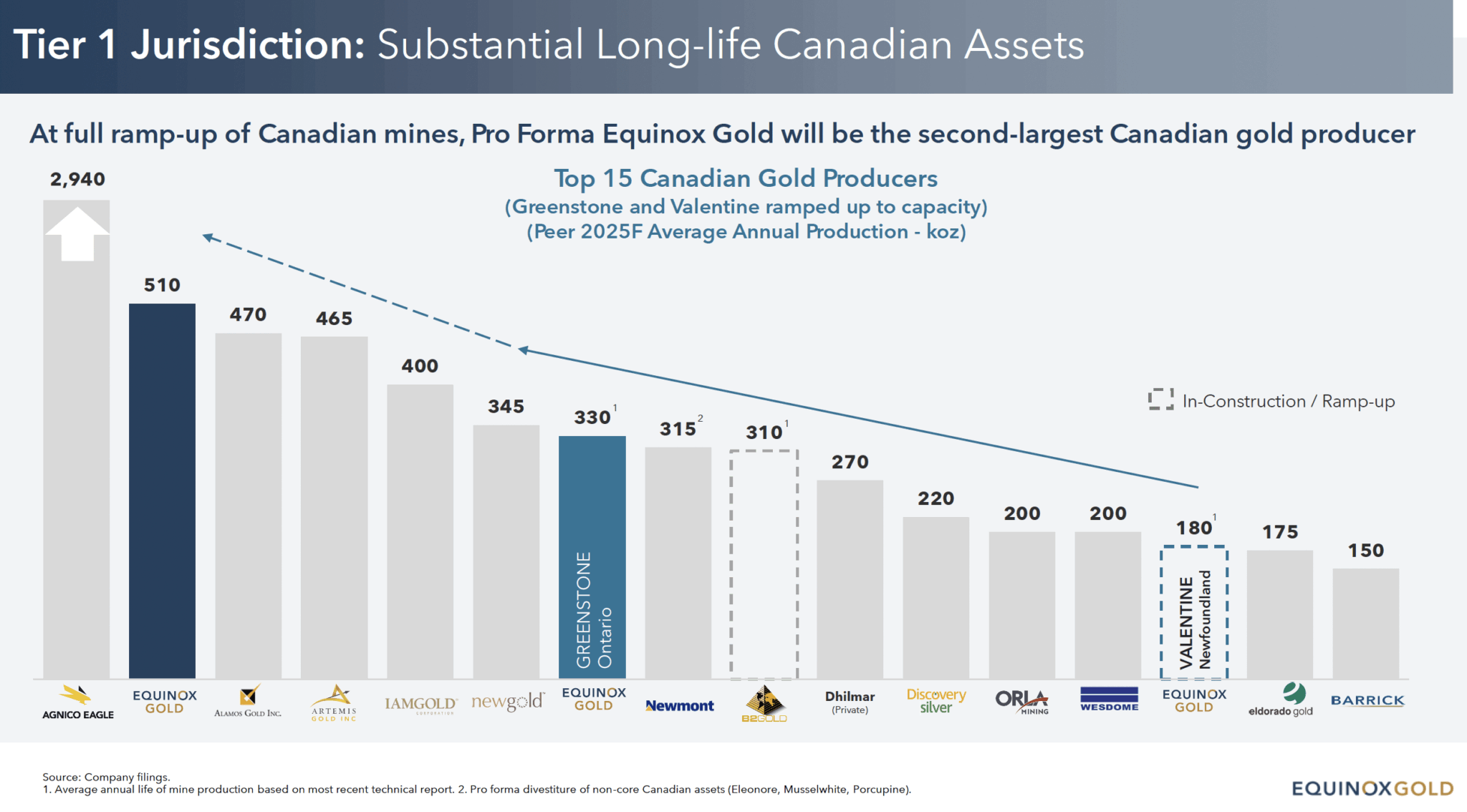

When this company reaches full ramp-up of its Canadian operations, it will become one of the largest gold producers in Canada – second only to Agnico Eagle, a company worth over US$60 billion.

But that’s not all.

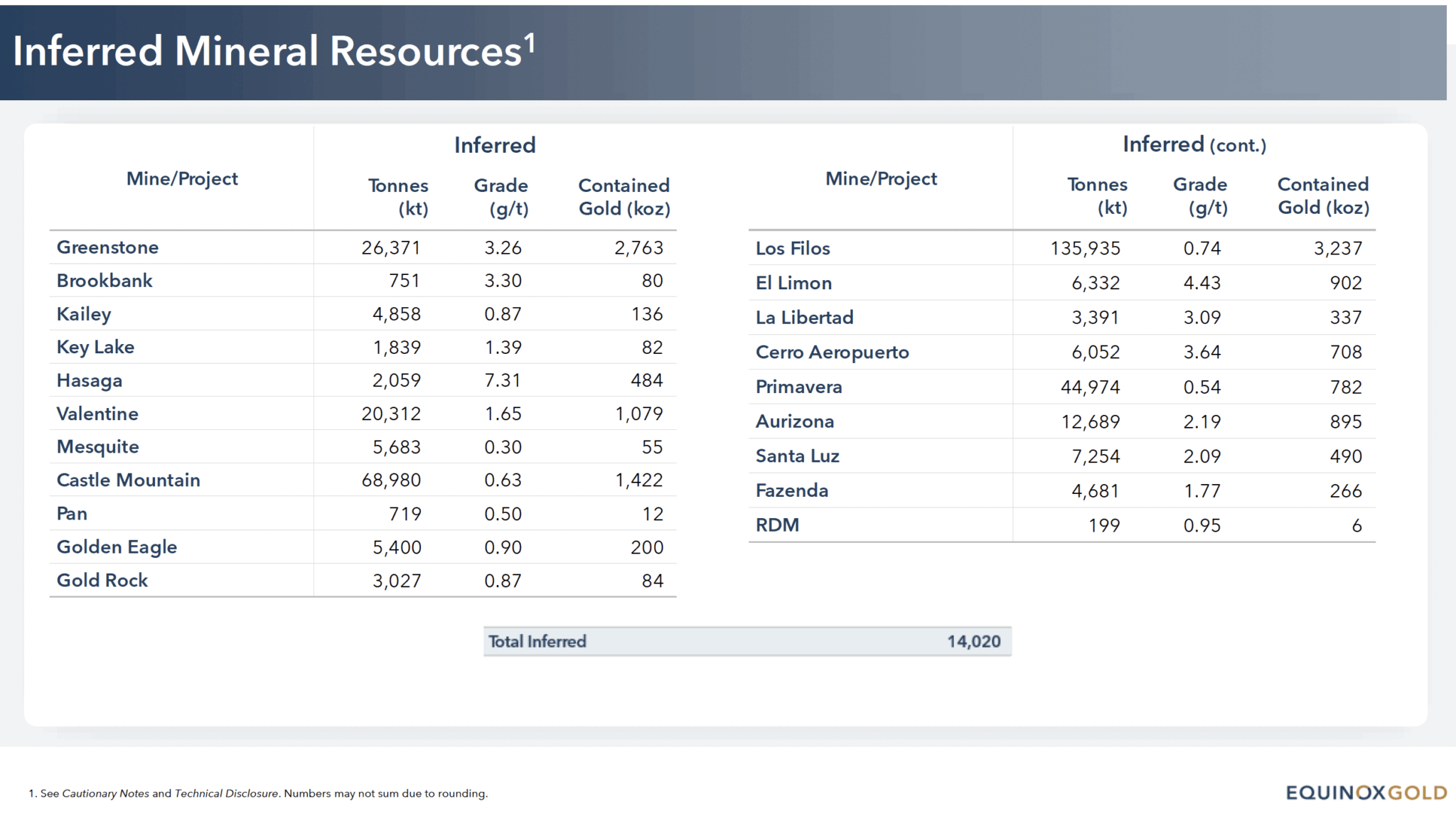

This company has 23 million ounces of gold in proven and probable reserves, 22 million ounces in measured and indicated resources, and another 14 million ounces in the inferred category.

Collectively, that could be over 59 million ounces of gold.

That’s nearly US$200 billion worth of gold*!

*at spot price of US$3350

And that doesn’t include the potential upside of exploration.

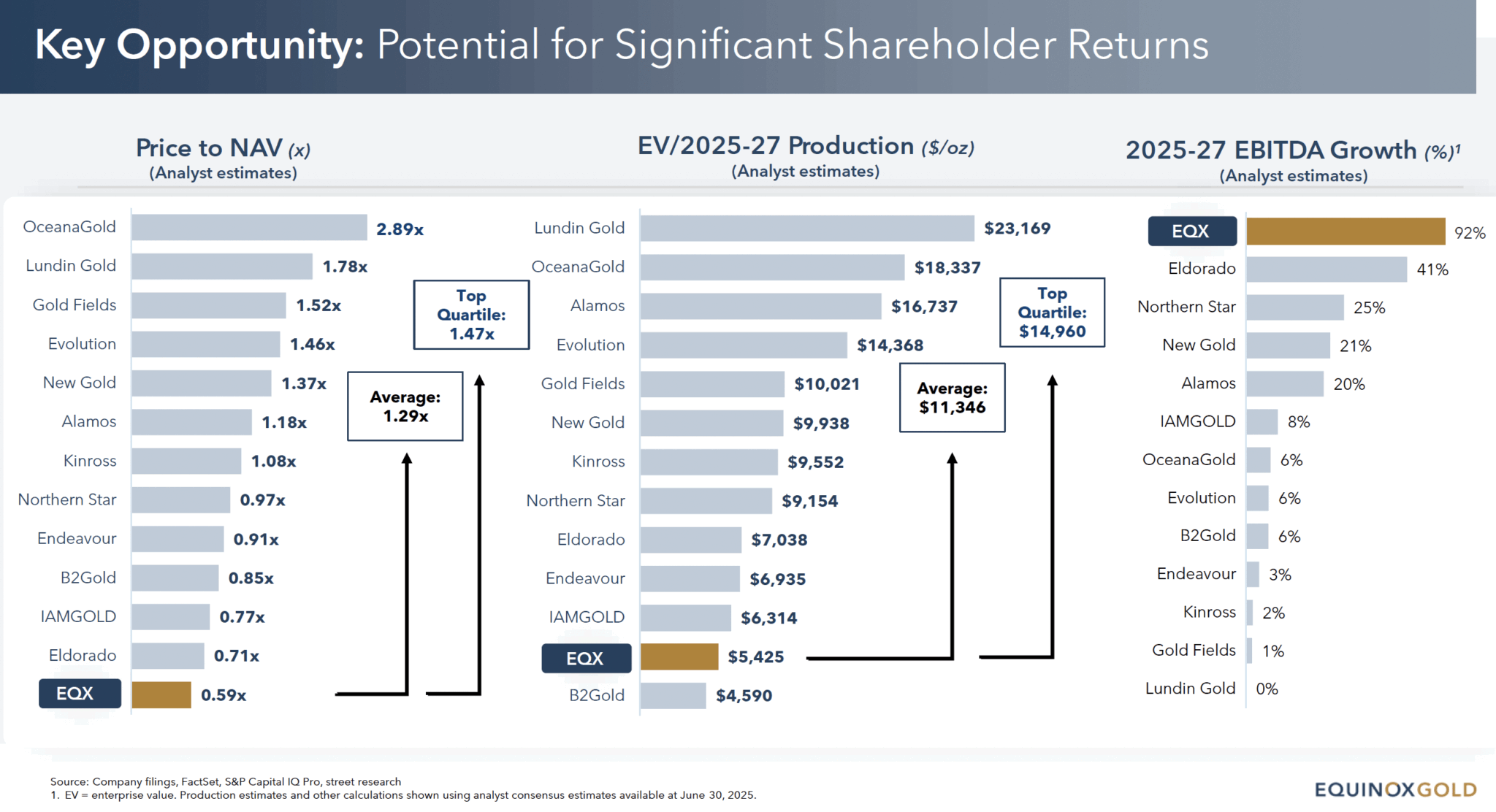

But here’s the best part: based on analyst reports, this company currently trades at less than half of its peer average price-to-NAV (net asset value) and enterprise value (EV) per forecast ounce of production between 2025 and 2027.

Yet it ranks at the top for 2025-27 EBITDA growth amongst those same peers, with analysts expecting 92% growth – that’s more than double its closest peer in the same category.

*Source: Company filings, FactSet, S&P Capital IQ Pro, street research 1. EV = enterprise value. Production estimates and other calculations shown using analyst consensus estimates available as of May 30, 2025.

In other words, we expect a re-rating is near.

Why?

Because we’ve seen this team do it time and time again.

They haven’t only made millions for investors, they have made millions for us.

10 Years in the Making

This opportunity began 10 years ago, when we introduced readers of this Letter to a powerhouse group of individuals who pulled off one of the most audacious deals in modern mining.

This team negotiated the merger of $7 billion worth of gold assets into a public shell company that had nothing more than the hope of raising C$25 million in capital.

At the time, the junior gold sector was imploding. Exploration companies were failing left and right. There were no exits for development-stage players, and without exits, there was no capital.

If you wanted even a shot at success in the gold space, you needed to do one thing: produce.

This team understood that.

After evaluating hundreds of assets and spending hundreds of thousands of their own dollars, they finally found their opportunity.

They identified a publicly traded company with three fully-owned, producing gold mines in Australia, churning out over 200,000 ounces annually.

The catch?

These assets had been so badly mismanaged by so many different operators that the market had completely written them off. No capital was flowing in. No one was even talking about them.

But the assets were solid. The operations had real potential. But as the saying goes, a bad barber with the sharpest scissors still gives a terrible haircut. The problem wasn’t the rocks—it was the management.

To make matters worse, 80% of the company was controlled by five New York hedge funds, turning what was technically a public company into something more like a semi-private holding. Liquidity was non-existent. Institutional interest? Virtually zero.

But this team saw it differently.

They saw a world-class gold platform buried under layers of mismanagement, with vast exploration upside and untapped value.

So they pounced.

They negotiated a deal to merge those assets into a new company—for just $25 million.

How?

Because of who they were.

This wasn’t just any group of executives. This was a team of proven mine builders and deal makers who, by that point, had collectively founded, grown, and sold mining companies worth nearly $30 billion.

They took the reins, overhauled operations, and unlocked the full potential of the Australian mines.

And then—just as they said they would—they made a massive discovery.

In under a year, they transformed that $25 million acquisition into a deal that saw the assets sold for over $1 billion.

It became one of the lowest-cost gold producers in the world.

That company was Newmarket Gold.

A Big Return

We first brought Newmarket Gold (Newmarket) to readers’ attention on July 26, 2015, when the stock was trading at just C$0.82.

Fast forward to September 2016, when Kirkland Lake Gold, one of Canada’s premier gold producers, announced it would acquire Newmarket in a deal valued at roughly C$1 billion — putting Newmarket’s share value at C$5.28.

That’s a gain of more than 540% in just over a year.

At the time, many thought the merger/acquisition didn’t make sense. But the team behind Newmarket saw synergies where most investors, including big funds, did not.

For them, this wasn’t a cash-out moment — it was a strategic merger designed to unlock even greater value for shareholders.

And they nailed it.

After the merger, Kirkland Lake Gold became one of the top-performing gold stocks in the entire sector.

By November 20, 2019, Kirkland Lake was trading above C$65 per share.

If you had held onto your Newmarket shares after the merger, your effective holdings could have been worth over C$30 per share (as a result of the 0.475:1 share consolidation).

That’s a staggering 3,558% return from the original C$0.82 entry price.

To put that into perspective:

- A $10,000 investment could have grown to $355,800.

- A $100,000 investment could have turned into $3,558,000.

500% plus gains in one year are hard to ignore. Unfortunately, like many, we sold too early.

But when this same team put together its next legacy deal, we promised ourselves we wouldn’t make the same mistake.

Five Years Later

About five years ago, the core founders put together a new deal following a similar blueprint: finding assets where their true value has yet to be unlocked.

We introduced this company to our readers when the company was trading at just C$0.75 per share.

While we’ve seen continued share price appreciation over the last few years, this same management was not about to settle for small and slow growth.

They wanted to unlock real value for shareholders, just as they did when they combined Newmarket with Kirkland Gold.

And so a deal was struck.

This time, they’ve teamed up with one of the most prominent mining executives of our generation.

Widely recognized as one of the top mining entrepreneurs, this man is a recipient of the following honors:

- The Canadian Institute of Mining Past President’s Memorial Medal

- The Association of Mineral Exploration of BC’s Colin Spence Award for excellence in global mineral exploration

- The Mining Person of the Year Award from the Mining Association of BC

- The Natural Resources & Energy Entrepreneur of the Year Award by Ernst & Young

- The prestigious Viola MacMillan Award from the Prospectors and Developers Association of Canada

- Selection as Mining Person of the Year for 2011 by The Northern Miner, a Canadian industry newspaper

- The CIM’s Vale Medal for Meritorious Contribution to Mining

- Appointment to the Order of Canada for his business contributions to the mining sector and his philanthropic efforts to preserve the environment

- Induction into the Canadian Mining Hall of Fame in recognition of his significant contributions to the Canadian mining industry

- The C.J. Westerman Memorial Award from Engineers and Geoscientists British Columbia

His name is Ross Beatty, and despite his long list of accolades, he believes that the company I am about to introduce will be his legacy deal.

So, what do you get when you combine multiple gold-producing mines with a proven team and one of the most prominent and successful mining executives of our time?

You get…

Equinox Gold

(NYSE-A: EQX) (TSX: EQX)

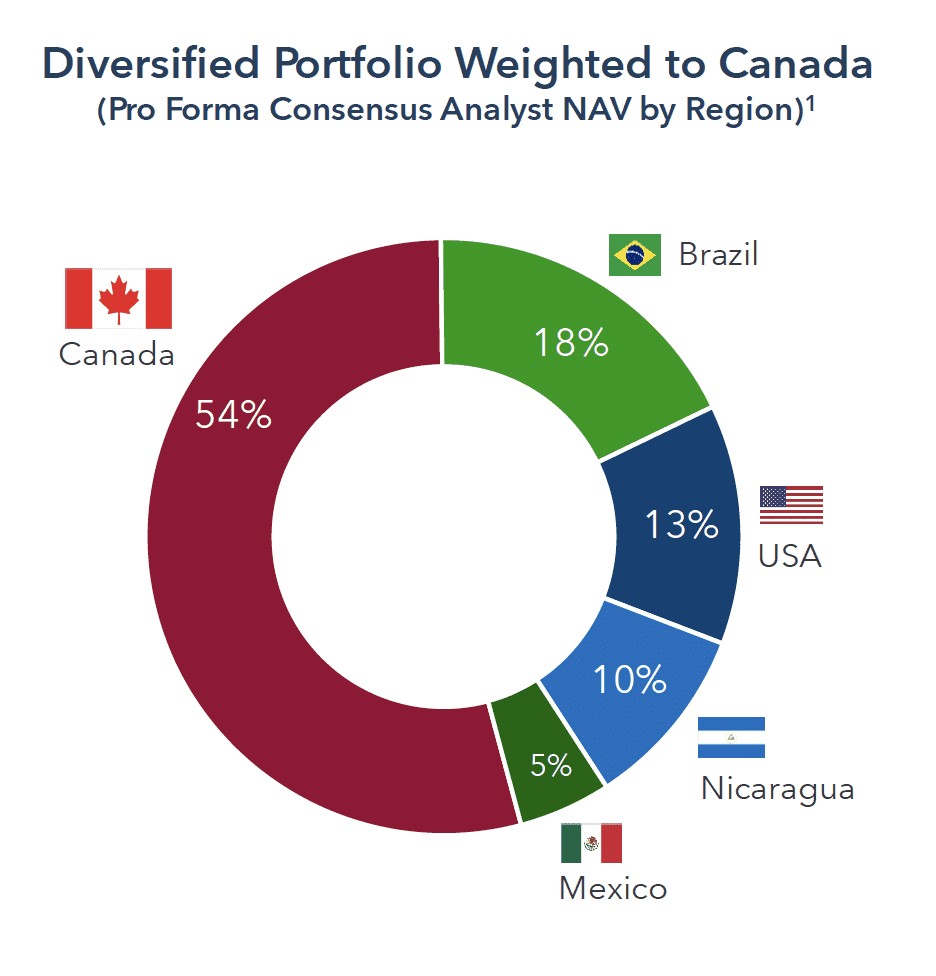

In June 2025, Equinox Gold and Calibre Mining completed a business combination to become Canada’s 2nd largest gold producer and are on track to produce nearly 1 million ounces of gold per year.

This is disseminated on behalf of Equinox Gold.

The merger of Equinox and Calibre Mining wasn’t just a consolidation—it was a calculated move to unlock latent value by bringing together two strong, complementary teams – and, of course, great assets.

The strategic intent was clear: harness the strengths of both organizations, align operations, and structure the business for long-term success. Together, they aim to create a gold producer capable of delivering consistent, top-quartile performance.

This newly combined entity now holds a significant amount of net asset value within its portfolio.

Just how significant are these assets, and what could they be worth?

Well, how about the potential of nearly US$200 billion worth of gold (at current gold price)?

Take a look:

Currently, Equinox sits on ~23 million ounces of proven and probable reserves, ~22 million ounces of measured and indicated resources, and another 14 million ounces of inferred resources.

As of today, all of this value remains largely unrecognized by the market.

But that may soon change.

A New Strategy

At the heart of their new strategy is share price performance.

The business operates as a financial instrument—backed not by speculation, but by the tangible discovery, development, and delivery of gold production. Every move is designed to maximize efficiency and effectiveness.

The deal with Calibre is more than just synergistic—it’s a strategic foundation for what comes next. The focus now shifts to building one of the industry’s most dependable and valuable gold producers.

However, the path forward isn’t without its challenges.

Equinox has historically underperformed against market expectations—a concern voiced by investors.

In contrast, Calibre earned market confidence with a stellar track record: delivering on expectations in 19 out of the last 20 quarters. That consistency became a major point of investor loyalty and, understandably, a source of hesitation for some regarding the merger with Equinox.

However, as you recall, with the Newmarket and Kirkland Lake Gold merger, investors also scratched their heads and couldn’t understand why it made sense. In fact, there were many disappointed Newmarket shareholders at the time. That is, until Kirkland Lake shares continued to rise in value year-over-year, reaching highs of nearly $70/share before eventually merging with gold powerhouse Agnico Eagle.

With the right execution, management believes it can do it again.

Calibre’s management saw an opportunity with Equinox that few people understand. And the team at Equinox, led by Ross Beaty, recognized the potential of that very discipline and operational rigour that Equinox now brings to its fold.

First Step

One of the first things that new Equinox has done is reset expectations for 2025 and moving forward.

Just as Calibre successfully met its guidance in 19 of the last 20 quarters, the newly combined team has collaborated to overhaul and strengthen its forward guidance to more accurately align with investor expectations.

This recalibration establishes a solid foundation from which the integrated company—its people and its assets—can begin consistently delivering on those expectations.

This discipline is not just important, but essential to unlocking greater value and driving long-term shareholder confidence.

As a result of the revised guidance announced in June, we believe that these expectations are already reflected in Equinox’s current share price.

That means, if the company can meet—or exceed—this updated guidance, it has the potential to drive meaningful share price appreciation, fueled by renewed investor confidence and greater clarity around future performance.

Why is this important?

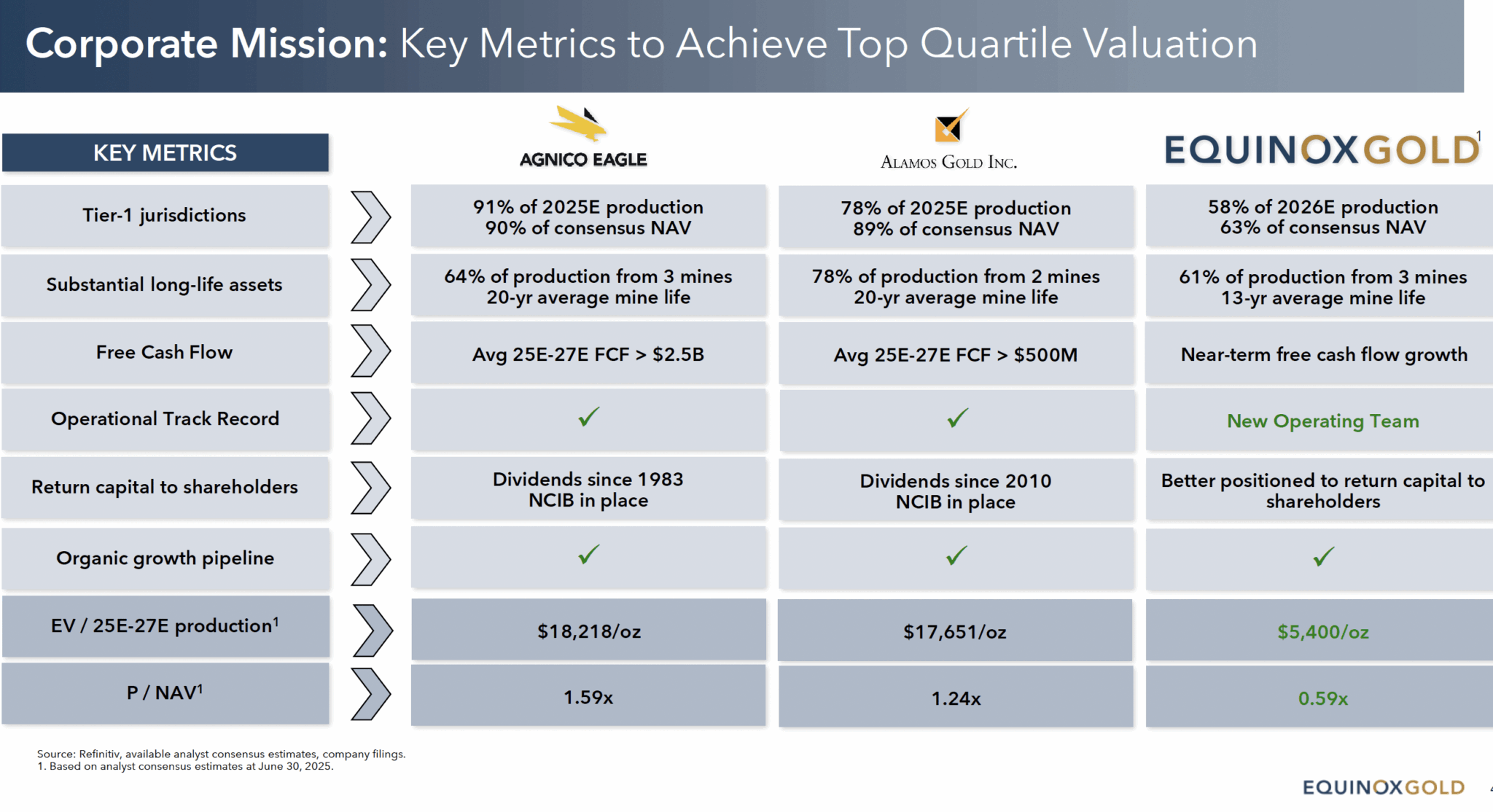

When evaluating the hallmarks of top-quartile gold producers, certain names stand out—Agnico Eagle, for instance, is a well-established, globally recognized leader. Alamos Gold, too, is quickly becoming a household name in the sector. These companies share a set of defining characteristics that investors consistently prioritize.

First, they operate in Tier 1 jurisdictions—locations known for political stability, regulatory clarity, and low-risk environments.

Does Equinox qualify here?

Check.

Second, they own substantial, long-life assets that provide strong production visibility for years to come.

Check.

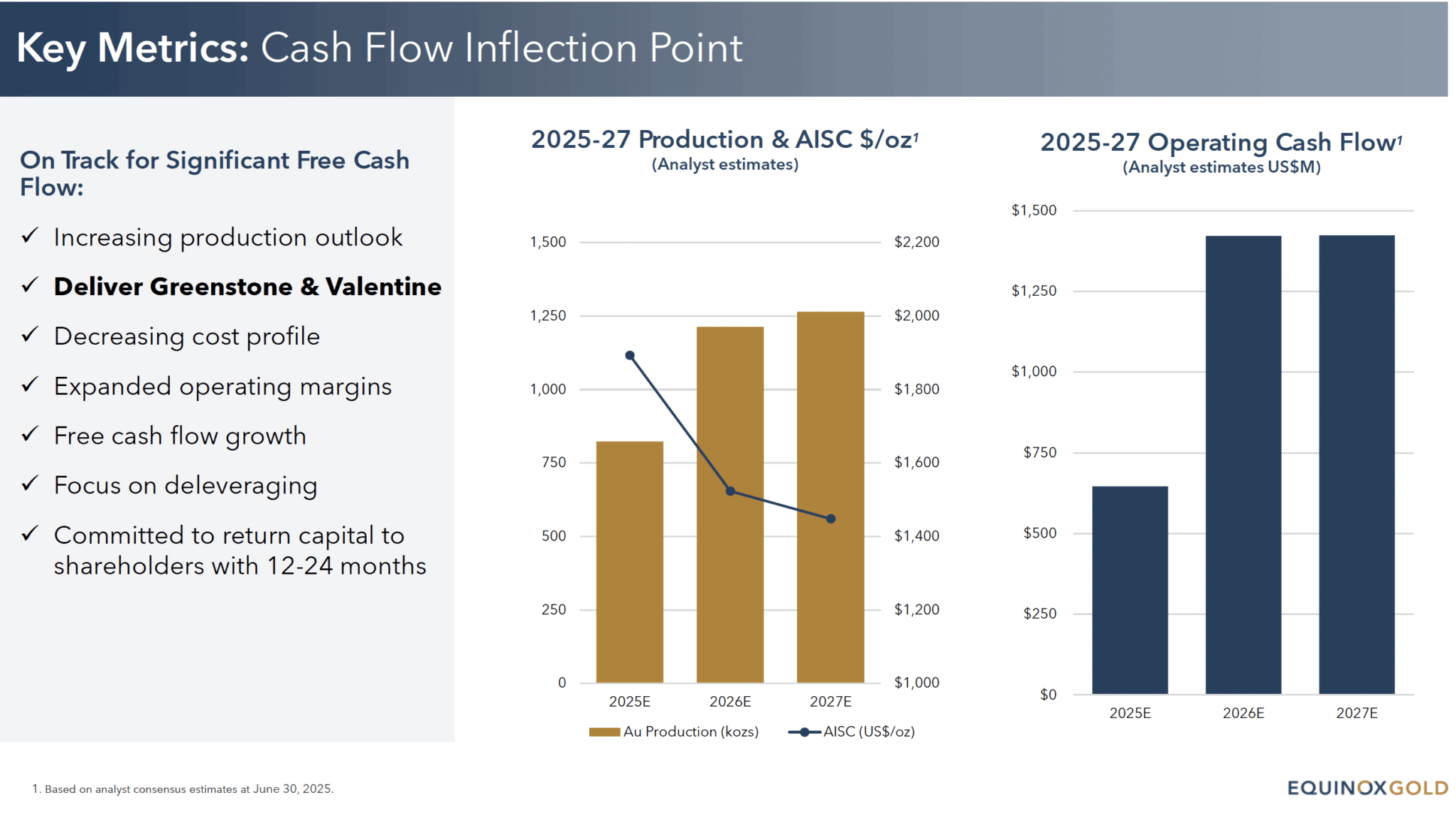

Third, they generate meaningful operating cash flow.

Can Equinox get there?

They’re not only on track to do just that, but on track to nearly double their operating cash flow.

Perhaps most crucially, Equinox now has the strong operational track record and a history of meeting or exceeding expectations with the Calibre team.

This is where Equinox has historically fallen short. The company hasn’t yet earned that reputation for reliability.

But that is now changing.

With the recent merger, Equinox has significantly strengthened its operating team and restructured its approach to guidance—laying the groundwork to begin delivering consistently against expectations.

It’s a pivotal shift: from underperformance to performance-driven execution.

Add to that a robust organic growth pipeline, and Equinox begins to look increasingly like a company on the cusp of Tier 1 status. While it hasn’t yet returned capital to shareholders, all the other key metrics—jurisdiction, asset quality, operational capability, and improved guidance—are now aligning.

This is what it looks like.

But when compared to peers, this is where Equinox stands today.

As you can see, Equinox has the potential for a significant re-rating.

It currently has one of the lowest Price-to-NAV and EV/2025-27 production value per ounce among its peers, yet its 2025-2027 EBITA growth, based on analyst estimates, is more than double that of its closest peer.

All Equinox has to do is deliver on results.

And we believe it can.

Ross Beaty’s Legacy Play—and the Calibre Catalyst

Spend five minutes with Ross Beaty, and you will hear the word “legacy” more than “gold.”

The Equinox deal with Calibre is not just another consolidation; it is how Mr. Beaty aims to cement a 40-year reputation for turning rocks into windfalls. He openly describes the Calibre merger as “a very clever strategic way to bring in quality expertise” and admits that Equinox on its own “doesn’t have that track record” of meeting or beating expectations.

Enter Calibre’s operations team, led by newly appointed CEO Darren Hall.

If you want a résumé to calm institutional nerves, Darren’s 30-plus-year run at Newmont, the largest gold company in the world—overseeing up to nine mines and 20,000 people—ticks every box. Combine that with the rest of the Calibre team, and Equinox has some of the best in the business.

Calibre’s culture of precision—19 hits on 20 quarterly guidance targets—gives Equinox instant credit. That credibility matters more than any new drill hole or scoping study, because nothing compounds like trust in mining.

Gaining Credibility

On June 11, 2025, the combined entity slashed 2025 expectations to 785,000–915,000 ounces at US$1,800–1,900/oz AISC. The new range excludes production from Valentine, Los Filos, and Castle Mountain and bakes in the lower output and learning curve costs of their Greenstone mine.

Was the reset painful? Absolutely—the stock fell from C$9.50 to C$8 even as peers rallied with the gold price.

But Ryan King, SVP of Capital Markets and Strategy, frames the decision as non-negotiable: “If we come out next year and hit Q1 against conservative guidance, it’s game on.”

In other words, Equinox is buying credibility one quarter at a time.

Now that you understand the story, let’s talk about the assets and the upside they bring.

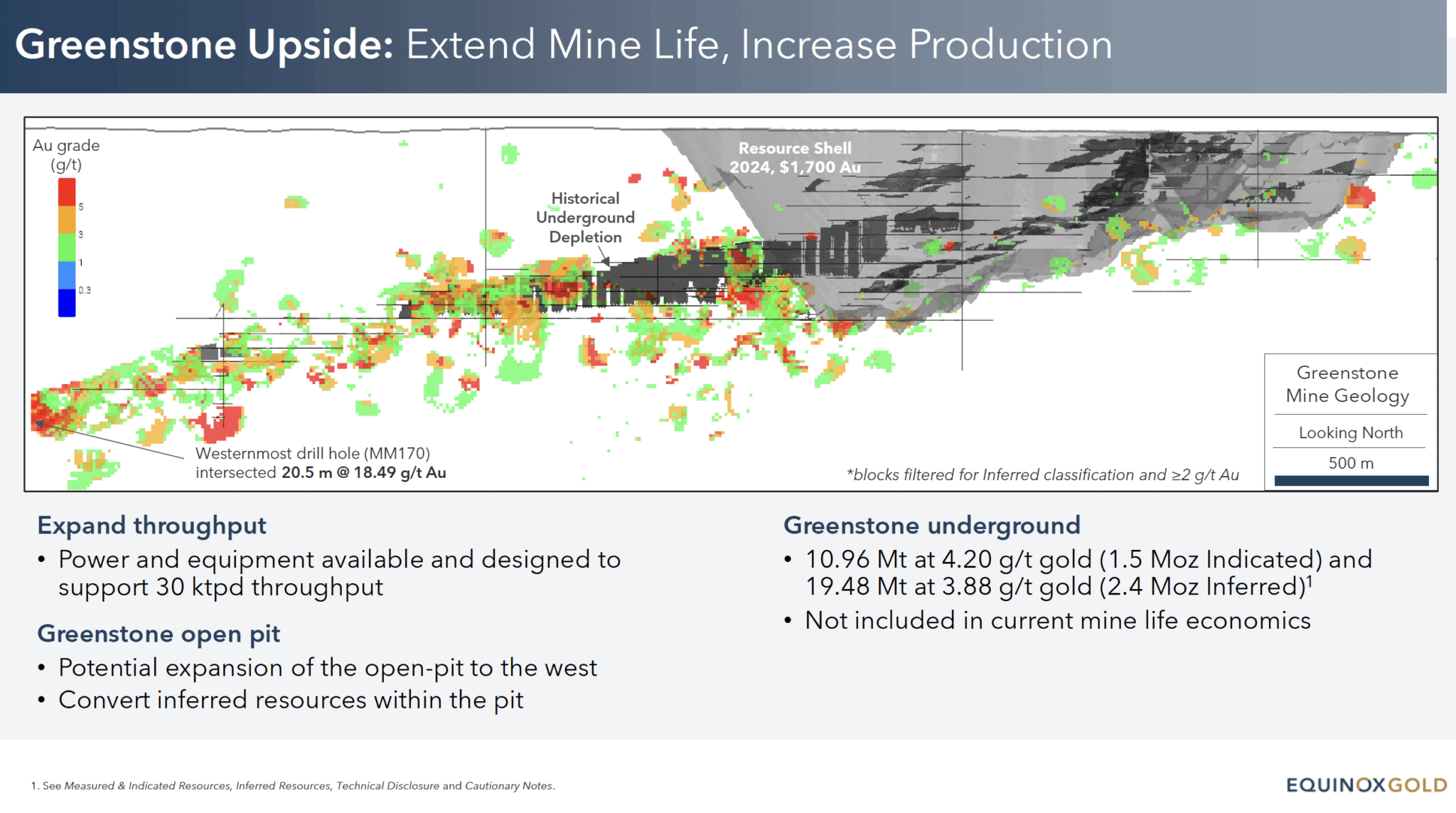

Greenstone: The Cornerstone Engine

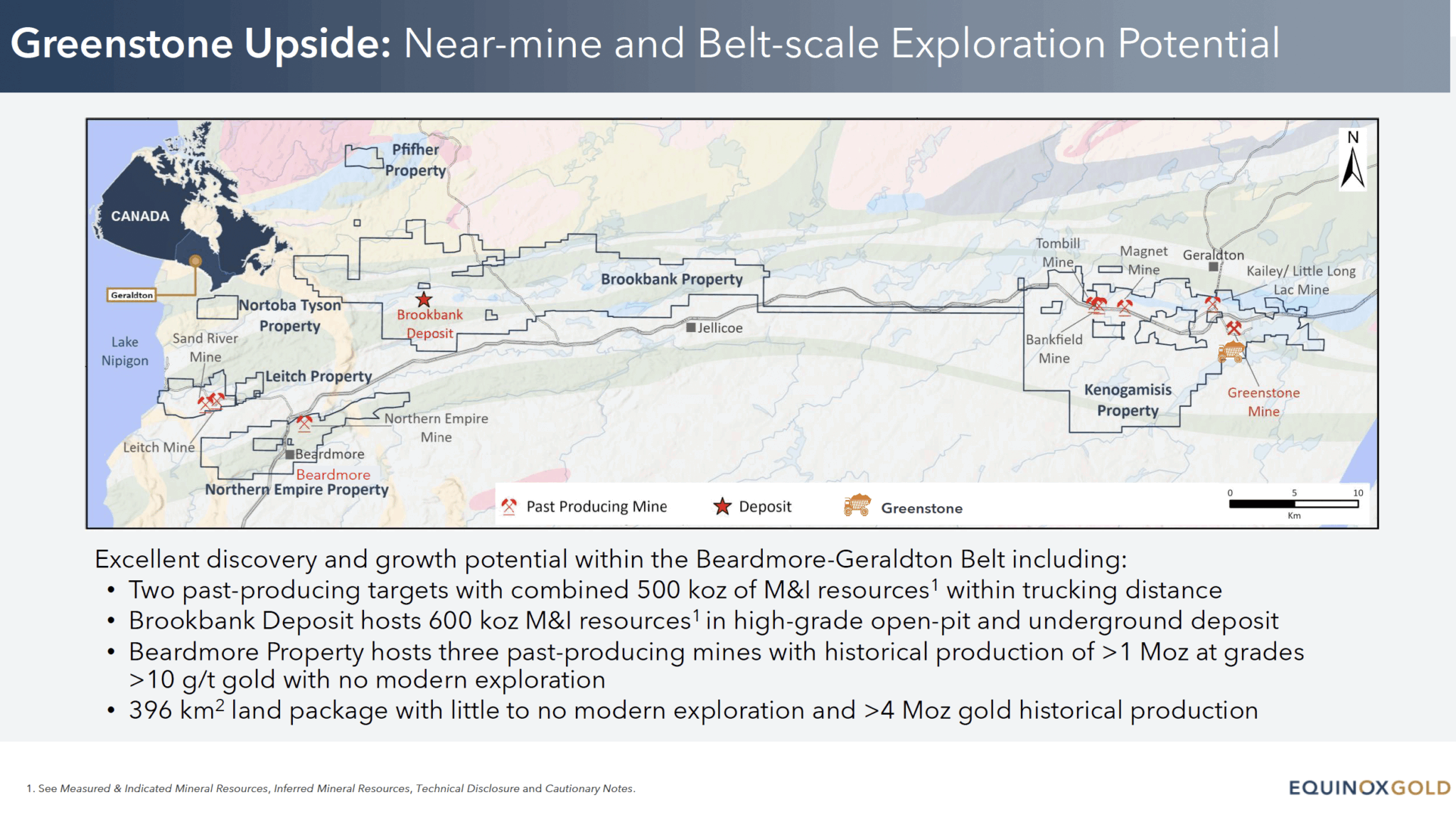

Drive north of Thunder Bay in Canada, and you reach Greenstone, a multi-million-ounce gold project located in the top-tier mining jurisdiction of Ontario, Canada, approximately 275 km northeast of Thunder Bay in Geraldton, Ontario.

With the expectation of producing on average 330,000 ounces of gold annually for its initial 15-year mine life, Greenstone will be a cornerstone asset in Equinox Gold’s portfolio as the Company’s largest, lowest-cost gold mine.

Ramp-up in mining is rarely smooth; early throughput missed design capacity, so Equinox adjusted its 2025 guidance to 220–260 Koz at around US$1,750 AISC. However, the plant was designed for 30,000 tons per day (ktpd), and its power lines, crushers, and grinding circuit can operate more efficiently without incurring new capital expenditures—a detail buried in the equipment specifications but critical for future margin expansion.

In other words, as operations become more efficient, there is strong potential to produce the anticipated 330,000 ounces per year, with over 15 years of mine life.

But upside doesn’t end at the mill fence.

As we mentioned earlier, the 59 million ounces of gold resources under Equinox’s grounds does include the upside of any exploration.

Yet, if you recall, the founding team at Calibre made a significant discovery with Newmarket Gold, which drove significant upside for investors.

And that same team believes that Equinox’s assets offers a significant amount of room for upside discovery.

Take a look:

The above highlights a shallow western extension, where hole MM170 resulted in 20.5 m of 18.5 g/t gold, indicating potential for expansion to the west. Under the pit lies an additional 3.9 Moz of high-grade underground measured, indicated, and inferred resources – none of which are included in today’s mine life economics.

With nearly 400 km2 and little to no modern exploration, Greenstone has significant belt-scale exploration potential.

Yet, Greenstone is just one of Equinox’s prized assets.

Valentine: First Gold by Q3—Plus the Frank Zone Surprise

Equinox’s Valentine project is almost a mirror image of Greenstone, albeit slightly smaller: 195,000 ounces per year for 14 years, with an all-in-sustaining cost (AISC) of just $1,007 per ounce, according to the 2022 feasibility study.

The Valentine Gold Mine is located in central Newfoundland and Labrador, one of the world’s top mining jurisdictions. When complete, Valentine will be the largest gold mine in Atlantic Canada and a significant economic driver for the province.

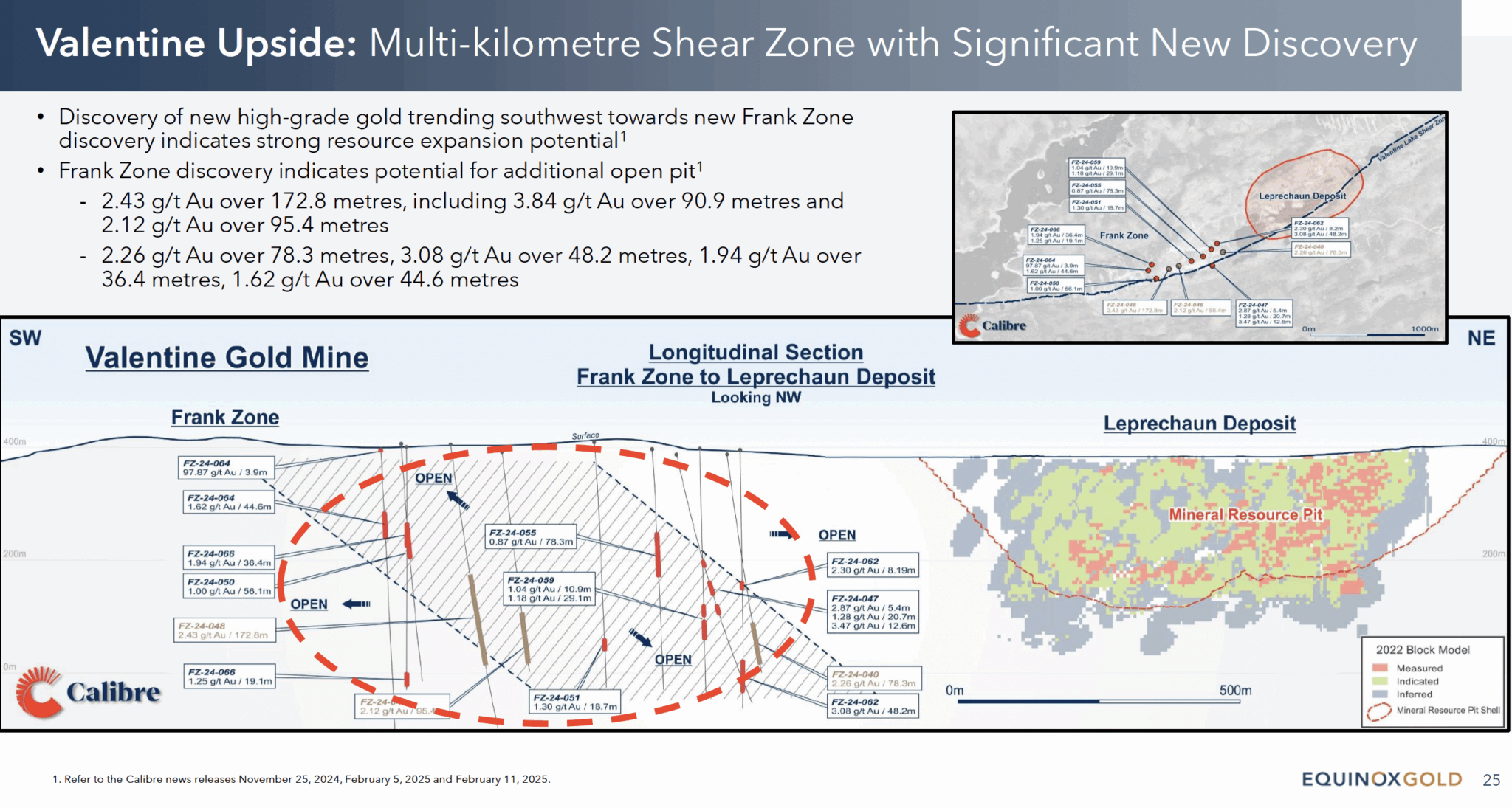

The project spans a 32-km mineralized trend with multiple deposits and strong exploration upside, including multi-kilometre shear zones southwest of the main pits.

Drills there recently hit 2.43 g/t Au over 172.8 metres, including 3.84 g/t Au over 90.9 metres and 2.12 g/t Au over 95.4 metres, and other holes that resulted in 2.26 g/t Au over 78.3 metres, 3.08 g/t Au over 48.2 metres, 1.94 g/t Au over 36.4 metres, and 1.62 g/t Au over 44.6 metres.

If those drill holes were announced by an exploration company, investors would go nuts. Those are simply amazing results.

Management calls it the Frank Zone—a discovery with intercepts that could morph into a third open pit over time.

With first gold scheduled for late‑Q3 and a full quarter of ramp-up in Q4, Valentine’s contribution will be modest this year but potentially game-changing in 2026 when it runs concurrently with Greenstone.

Combine that with the upside potential of the Frank Zone, Valentine could add significant value for shareholders.

More ounces of gold produced and more exploration upside.

Nicaragua: The Quiet Cash Machine

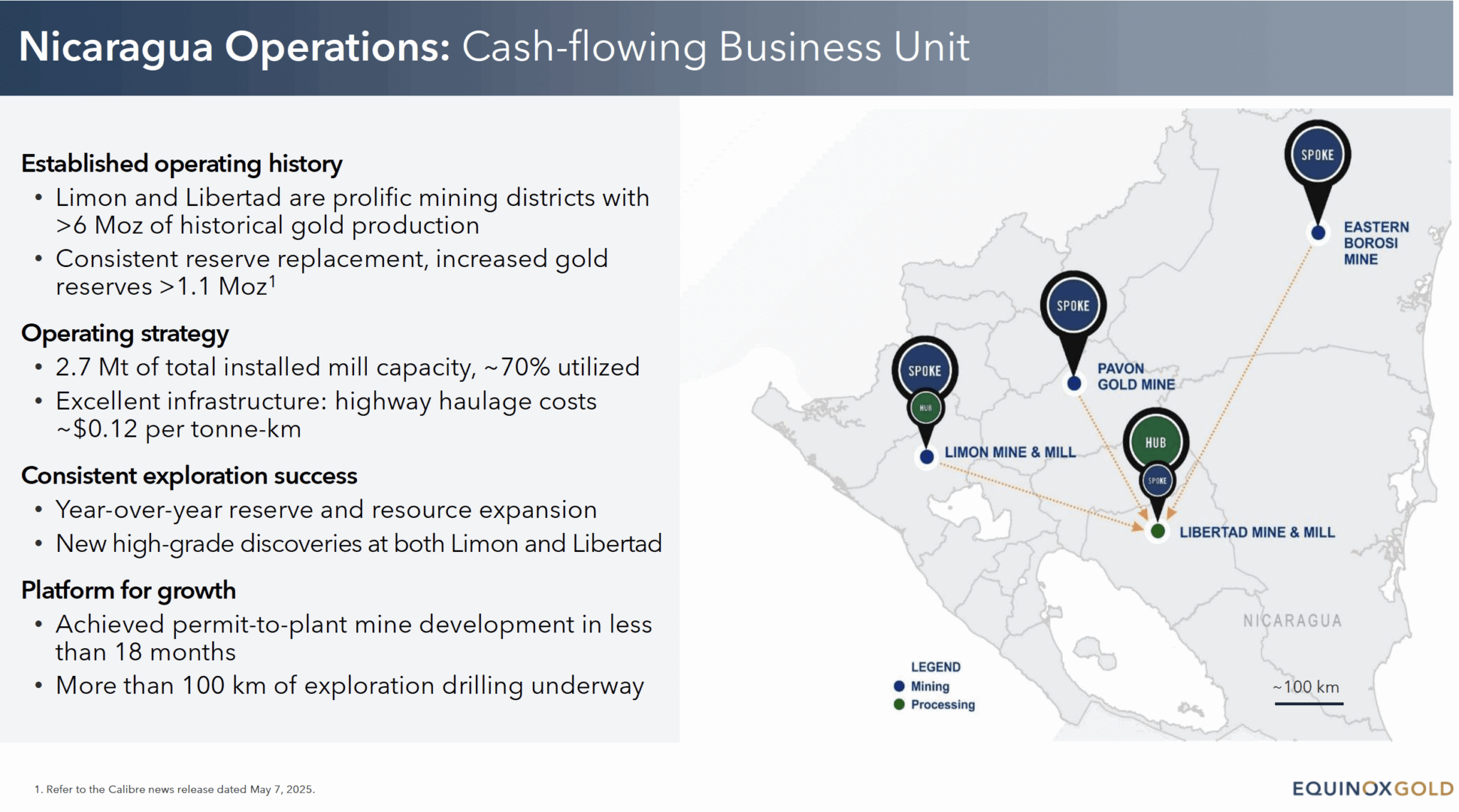

As many of you may already know from the Calibre side, the Limon-Libertad hub rarely makes headlines, but it churns out 200‑250 Koz at sub-US$1,500 AISC and has room in its mills to spare about 30% of installed capacity. Highway haulage costs run twelve cents per tonne‑kilometre—pocket change in hauling terms.

More than 100 km of drilling is budgeted for Nicaragua in 2025, and Equinox has proven it can permit pit-to-plant projects there in under 18 months. So while Wall Street obsesses over Canadian catalysts, the Nicaraguan unit quietly underwrites head‑office ambitions.

Brazil: Torque and Turnaround

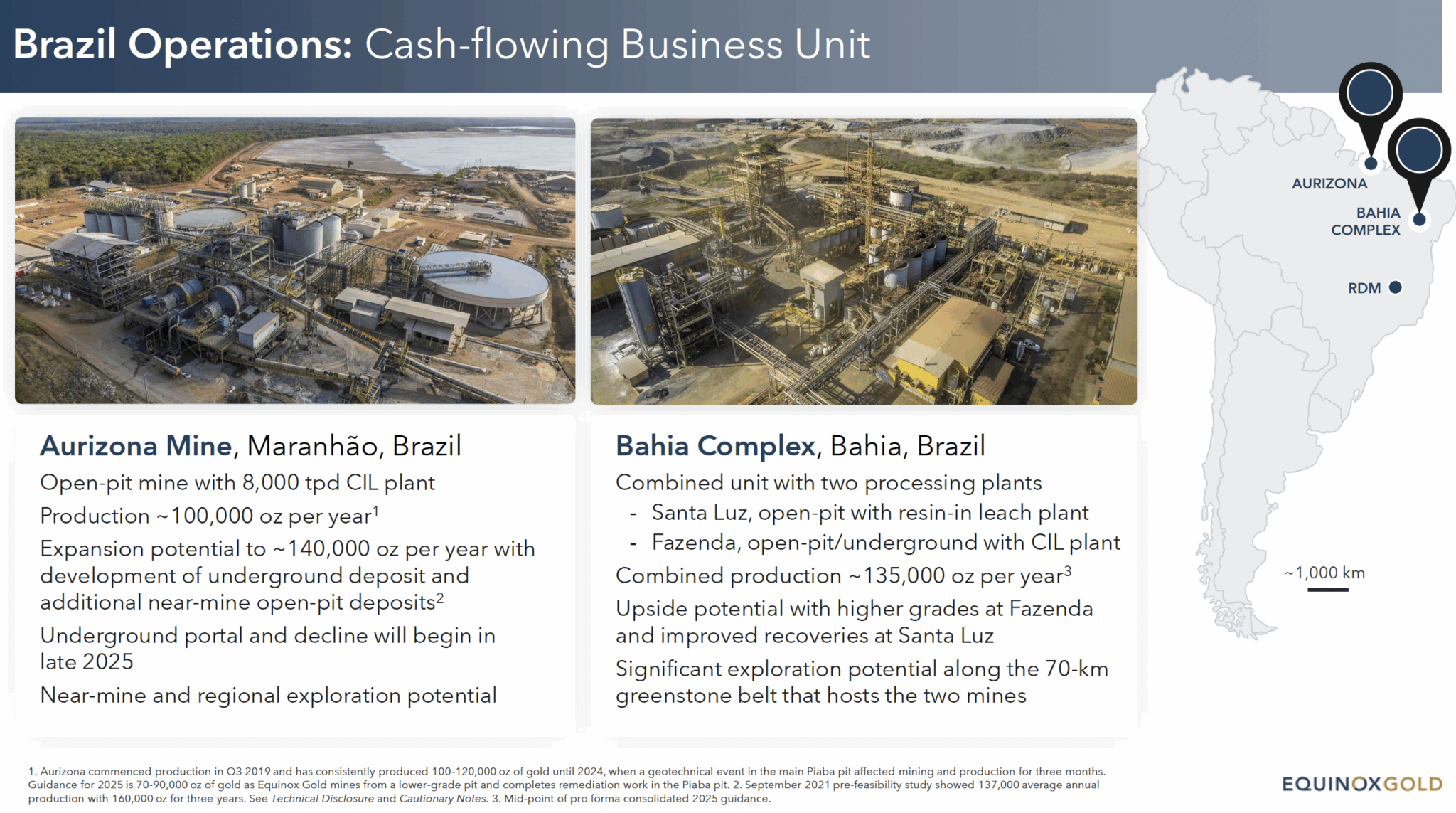

Brazil is Equinox’s “fixer-upper.” The Bahia Complex (Santa Luz and Fazenda) plus Aurizona should combine for roughly 260,000 ounces this year; however, costs are higher than those of its other assets at US$2,275–2,375 AISC.

While this makes Equinox’s overall AISC higher, don’t think that management doesn’t have a plan.

At Aurizona, the rescue plan is simple: go underground. Portal work begins later this year, unlocking higher-grade feed and pushing annual capacity toward 140,000 ounces by the late 2020s. In Bahia, improved recoveries at Santa Luz and higher grades at Fazenda can drag AISC back toward the peer average.

Equinox has assembled, invested in, and built these valuable assets over the last several years. With the current price of gold and the addition of operational talent, the time to rationalize and deliver on the assets is now. Based on discussions with management, they are evaluating the portfolio and reviewing asset divestitures to ‘high-grade’ their portfolio and deleverage the balance sheet.

Brazil could be a great opportunity for this.

Castle Mountain and Los Filos

Castle Mountain, situated on the driest stretch of the California desert, has struggled due to red tape permitting issues.

But today, its permit file is on Washington’s fastest train.

The asset is now part of the FAST-41 federal program that shaves red tape off critical metals projects. Phase 2 would lift output to ~220 Koz per year for 12 years.

Los Filos, once the pride of Guerrero, Mexico, is on care‑and‑maintenance after community standoffs. Yet two of the three communities have already ratified agreements. A switch from heap leach to a CIL mill could transform the asset into a 280–300 Koz, US$1,500 AISC producer, extending mine life by another decade or more.

In banker talk, these projects are deep out-of-the-money call options: they have virtually no value in consensus NAV models, yet they are massive if solved.

And it looks like the strategy for those solutions is underway.

A Nine-Figure Exploration Cheque

Many of Equinox’s assets have significant exploration potential. But just how serious is Equinox about discovery?

Well, how does a US$70–90 million exploration budget in 2025, spread across Greenstone, Valentine, Nicaragua, and Brazil, sound?

That budget ranks among the largest in the intermediate space, signalling management’s confidence in turning drill results into in-ground value – just as they did with Newmarket Gold.

Of course, despite all of the positives, there are risks.

The Elephant in the Room: Debt

On paper, Equinox owes US$1.8 billion, about half in a revolver, the rest in term loans and convertibles. Interest costs run US$150–200 million per year.

Now, this seems like a lot of money – and it is.

But remember, Equinox isn’t a small junior producer – it’s a near tier-one gold producer with nearly $200 billion of gold in the ground, and is expecting to produce nearly one million ounces of gold per year.

If you run the numbers using a conservative US$3,000 gold—yes, I know we’re around $3,350— producing one million ounces at $1,700 AISC still generates approximately US$1.3 billion in operating cash flow.

SVP Ryan King argues that even after taxes and interest, Equinox could retire US$500‑700 million against principal within 18 months.

Run the math at today’s gold spot price, and that’s more than $350 million extra of operating cash flow.

Add potential proceeds from a Brazilian or Mexican divestiture, and the elephant starts to look more like a house pet.

The other risk is operations.

This is true for every mine, which is why you need someone like Darren Hall. With the combined teams of Calibre and Equinox, we believe operations should outperform moving forward.

Lastly, gold price volatility cuts both ways – it can significantly enhance cash flows but also hurt value if it swings the other way.

But keep this in mind: every hundred-dollar move on one million ounces of gold produced is a US$100 million swing. If gold continues to climb higher (which is our belief), Equinox becomes an exceptional value proposition, especially given its current trading position among its peers.

On the other hand, if gold prices decline, you need the safety net of lower AISC.

For Equinox, even a pullback to US$2,700 per ounce (which we don’t see happening) still leaves headroom to service debt.

Conclusion

In mining, perception lags reality until an inflection forces them back into alignment.

Equinox stands right at that bend.

Two Canadian mines are about to swing the production pendulum; an operations team with a sniper’s aim now calls the shots; and the market is valuing each future ounce at one-third the peer average. That’s wild – especially if Equinox delivers.

Ross Beaty has bet his legacy that the discount won’t last.

And if Calibre’s playbook repeats, we don’t see how Equinox does not begin to trade closer to its peers.

We’ve seen this movie before: growth stories that finally pivot to cash flow can rise faster than retail investors update their watchlists. Heck, we experienced this with the Newmarket and Kirkland merger.

With gold looking stronger than ever and Equinox trading well below its peers, we believe there is more potential for upside than downside.

Central banks, hedge funds, and the smart money are aggressively positioning themselves for the next gold bull market.

Are you?

Equinox Gold

US Trading Symbol: NYSE: EQX

Canadian Trading Symbol: TSX: EQX

Seek the truth and be prepared,

Carlisle Kane

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Equinox Gold (EQX) because the Company is an advertiser on www.equedia.com. We currently own shares of EQX. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in EQX or trading in EQX securities. EQX and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from EQX, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

This newsletter (this “Newsletter”) is provided by Equedia Network Corporation (“Equedia”, “we” or “us”). Your access to and use of this Newsletter is subject to and governed by this disclaimer and Equedia’s Terms of Use, which is available at http://www.equedia.com/terms-of-use (the “Terms”). Please read this disclaimer and the Terms carefully. This Newsletter is not an offer to sell or a solicitation of an offer to buy any securities or commodities. To the extent that anything contained in this Newsletter may be deemed to be investment advice or a recommendation in connection with a particular company or security, such information is impersonal and is not tailored to the needs of any specific person. In addition to historical information, this Newsletter may contain forward-looking statements, including statements with respect to third parties regarding product plans, future growth, market opportunities, strategic initiatives, industry positioning, customer acquisition, the amount of recurring revenue and revenue growth. In addition, when used in this Newsletter, the words “will,” “expects,” “could,” “would,” “may,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “looks for,” “looks to,” “continues” and similar expressions, as well as statements regarding a third party’s focus for the future, are generally intended to identify forward-looking statements. Each of the forward-looking statements we make in this Newsletter involves risks and uncertainties that may cause actual results to differ materially from these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those disclosed by the parties referred to in this Newsletter in their public securities filings. You should carefully review the risks described therein. You should not place undue reliance on the forward looking statements in this Newsletter, which speak only as of the date such statement was published. Equedia undertakes no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of their publication, except as required by law. As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

As of the date of publication of this Newsletter, Equedia (on behalf of itself and any partner, director, officer or insider of Equedia) may have a financial or other interest in the party or parties featured in this Newsletter, within the meaning of National Instrument 31-103 – Registration Requirements, Exemptions, and Ongoing Registrant Obligations, published by the Canadian Securities Administrators. Equedia and its directors own shares of Equinox Gold (EQX) at the time of this writing. In July 2025, Equedia was paid C$350,000 for a six-month advertising contract for EQX, which includes expenses for advertisements on third party sites that we arranged for EQX. These services were paid for by EQX. For full details of our compensation, please visit https://www.equedia.com/terms-of-use/.

Wait i never sold market shares

Thank you for explanation about EQX holdings.

With good management future of a y company seems very promising.