Dear Readers,

Two of the biggest names in the entertainment world just joined this Company.

Just a couple of years ago, Forbes named one of them as the highest-paid actor – beating out Matt Damon, Tom Cruise, Robert Downey Jr. and even the Rock, Dwayne Johnson.

In that same year, the other was named the richest hip hop mogul in the world.

Together, they’re about to take the world by storm with this massive announcement.

And it could send this Company to new heights.

But before I tell you about what they’re up to and how you can ride their wave, let me explain a few very important things.

You’ve Heard it All

You’ve heard how celebrities and athletes have made hundreds of millions investing in deals no one else has access to.

Just ask Kobe Bryant.

Last year, he was reported to have turned his US$6 million investment in sports drink BodyArmor – yes, the drink you see at every UFC event – into a $200 million-dollar score.

You’ve seen big-name rappers make more money from these investments than they have in their entire music career.

Just ask 50 Cent who reportedly made $100 million from his Vitaminwater investment.

Truth be told, most of the wealthiest rappers and athletes aren’t as rich as they are because of their music or respective sports.

They’re THAT rich because of the investments they make.

Take Dr. Dre.

He made upwards of $350 million on just one deal!

According to Forbes, Dr. Dre’s Beats headphones deal with Apple made him the third richest person in hip-hop.

The two richest hip hop artists ahead of Dr. Dre?

Jay-Z and P. Diddy – both have made a killing on their investments.

Jay Z has made hundreds of millions from fashion, entertainment, and music.

But his biggest score?

His Armand de Brignac champagne – which, according to Forbes, is his “single most lucrative investment.”

It’s made him $310 million.

He’s made five times more money from booze than music.

Of course, it’s not just smart investing that helped these celebrities take their money to the top.

It’s the power of their brand and their endorsement skills that allow them to influence their investments into ridiculous profits.

For example, when Jay Z heard the negative comments directed at the hip hop community by the guys at Cristal Champagne, he immediately boycotted them.

But he didn’t do it just because he could. He did it to make money.

He then purchased the champagne brand Armand de Brignac…

…rapped about it.

…put them in his music videos.

…and talked about it everywhere.

His endorsement led to soaring sales, and hundreds of millions of dollars for himself.

What about P. Diddy?

According to Forbes, Diddy makes the bulk of his cash – somewhere in the “low-to-mid nine-figures” – from his massive 50/50 profit split on the Ciroc Vodka deal with Diageo.

Every month, Diddy collects eight-figures from that deal. Every. Single. Month.

You may be wondering: “Why am I telling you this?”

I promise you; it isn’t because I am trying to teach you a lesson about celebrity endorsement – this is an investment newsletter, after all.

In just a bit, I am going to share with you something massive.

It’s something that I believe could send shares of this one Company soaring.

It’s an investment idea that not only includes some of the biggest names in the entertainment world but is in a space that is easily one of the biggest new health trends on the planet.

And best of all, it includes one of the celebrities I just mentioned. And two other massive ones that I haven’t even talked about.

When word gets out about this announcement, the media outlets will be clamoring to talk about it.

And we know what can happen to stocks when they draw that kind of attention.

Hang tight.

The Massive Beverage Market

You may have noticed a common theme.

Outside of Dr. Dre, the biggest winners for most of these celebrity moguls came from something you can drink.

The beverage sector is by far one of the most profitable money makers for celebrity-fuelled investments because consumable products are easily accessible by the masses and turnover constantly.

Just ask George Clooney, who became the highest-paid actor last year without making a single movie. How? He made $239 million on tequila.

The only problem for regular investors is that access to investments in the beverage category is mostly non-existent.

That’s because most beverage companies are private, and investments into high-growth beverage companies mostly belong to elite celebrities and sports stars – ones who can help take these products to the next level with their stardom.

So unless you’re one of the best basketball players ever, a big-name rapper like 50 Cent, or a famous actor like George Clooney – the chances of participating in the lucrative beverage space are slim-to-none.

Until today.

What if you can invest alongside two of the biggest names in the entertainment world – both of whom have individually invested more than $20 million each?

What if you can invest in a health craze that is not only sweeping the nation but is endorsed by one of the biggest celebrities in the health industry?

Today, I am going to introduce you to just that.

It’s a Company that already has its products in almost every major supermarket in the United States, including Walmart, Kroger, Albertsons, Costco, and even Whole Foods.

It’s a Company that’s ranked as the fastest-growing U.S. brand in its category.

In fact, it just announced yet another record quarter of sales – up nearly 30% year-over-year.

But that’s not all.

It’s about to take its brand into one of the biggest new health trends of this decade.

It’s no wonder analysts at H.C. Wainwright & Co. have put a price target on this Company much higher than where it trades today – one that even it thinks is conservative:

“…Our…price target appears conservative across a selection of valuation vectors including historical merger and acquisition prices, comparable company multiple analysis, and a conservative take on discounted cash flow.”

Meanwhile, analysts at Canaccord Genuity have an even higher price target. They believe this Company is trading at one of the lowest multiples amongst its peers – even though they expect this Company to be growing at a faster pace.

But here’s the biggest kicker: neither of the analysts’ targets reflects what I am about to tell you.

That’s because this Company just announced something BIG.

It’s something that not only involves two of the wealthiest and most well-known celebrities in the world but also one of the biggest health and fitness names.

And it’s about to transform this Company into one of the biggest companies in its category.

In fact, it will be even bigger than Kobe’s BodyArmor – which is crazy when you consider that this Company is trading less than what Kobe’s investment in BodyArmor is worth.

Here we go.

About to Become One of the Biggest

The Alkaline Water Company

NASDAQ: WTER – TSX-V: WTER

Over the past year, I published multiple reports on why I believed the Alkaline Water Company (NASDAQ: WTER) (TSX-V: WTER) was undervalued and why it was a potential takeover target by the Big Beverage companies.

If you missed the first report, I strongly suggest catching up by: CLICKING HERE

For some of you, what you’re about to read may sound familiar.

But I urge you to hang tight because what I am about to share is bigger than ever expected.

First, a quick overview.

In short, The Alkaline Water Company Inc. is a leading producer of premium bottled alkaline drinking water produced using the Company’s proprietary Electrochemically Activated Water (ECA) system, and sold under the brand name Alkaline88®.

Alkaline88® is now sold in nearly 50,000 retail locations nationwide in all 50 states, with a distribution that spans more than 150,000 stores.

These include 9 of the top 10 largest retailers in the entire U.S. and two of the largest retailers in the entire world.

Take a look:

The Company has become both the fastest-growing alkaline water company and the fastest growing premium water brand in the U.S.

The Company has become both the fastest-growing alkaline water company and the fastest growing premium water brand in the U.S.

It’s also the number one bulk water brand, according to Neilson.

And those are bold statements considering the alkaline water category is the fastest growing premium water category in the U.S.

According to Canaccord:

“From 2014, alkaline water industry sales in the U.S. increased from $48M to $246M in 2016 and are expected to grow to $676M by 2020.

The growth rate is being supported by strong endorsements from athletes and celebrities such as Kawhi Leonard and Tom Brady, among others.”

And, according to Zenith Global, global sales of alkaline water rose to $631 million in 2017 and is rapidly heading toward the $1 billion milestone.

Zenith even labeled alkaline water as an “international growth phenomenon.”

Sales from the Alkaline Water Company certainly support that.

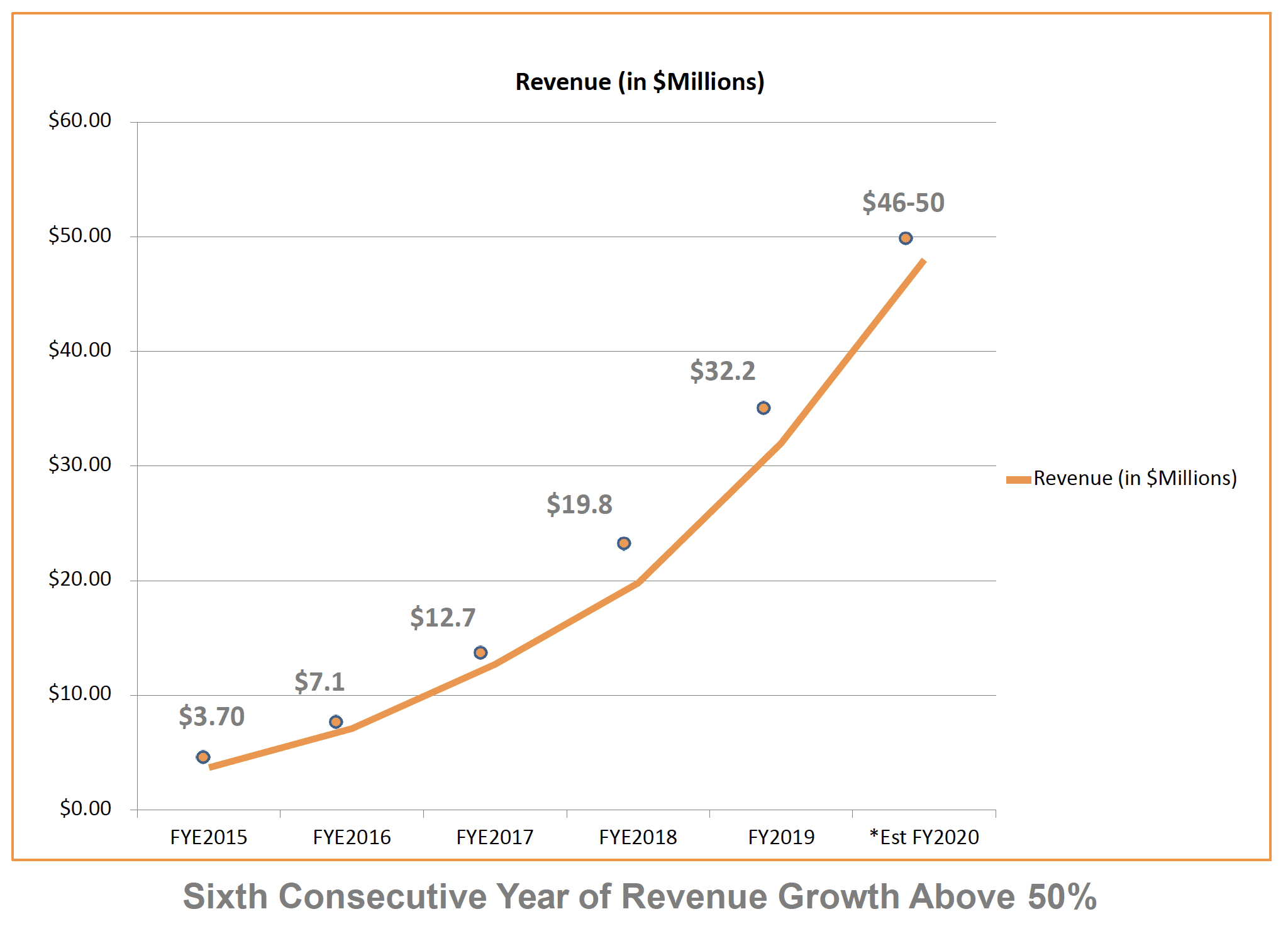

Just take a look at the Company’s sales growth:

Not only is the Alkaline Water Company growing at a pace faster than any of its peers, but it has single-handedly beat the growth rate of the entire category – year after year.

Not only is the Alkaline Water Company growing at a pace faster than any of its peers, but it has single-handedly beat the growth rate of the entire category – year after year.

It’s why I believed that they were not only undervalued at the time of my first report but why they were a prime takeover target.

I listed many of those reasons in my original report, which you can find HERE.

Since then, the Company has continued to grow at a rapid pace.

It just recorded sales of US$10.2 million for their first fiscal quarter of 2020, up nearly 30% compared to their first fiscal quarter 2019.

And, just a couple of months ago, it reported its highest monthly sales in company history.

But here’s the best part.

All of what I just told you might be overshadowed with what the Company just announced…

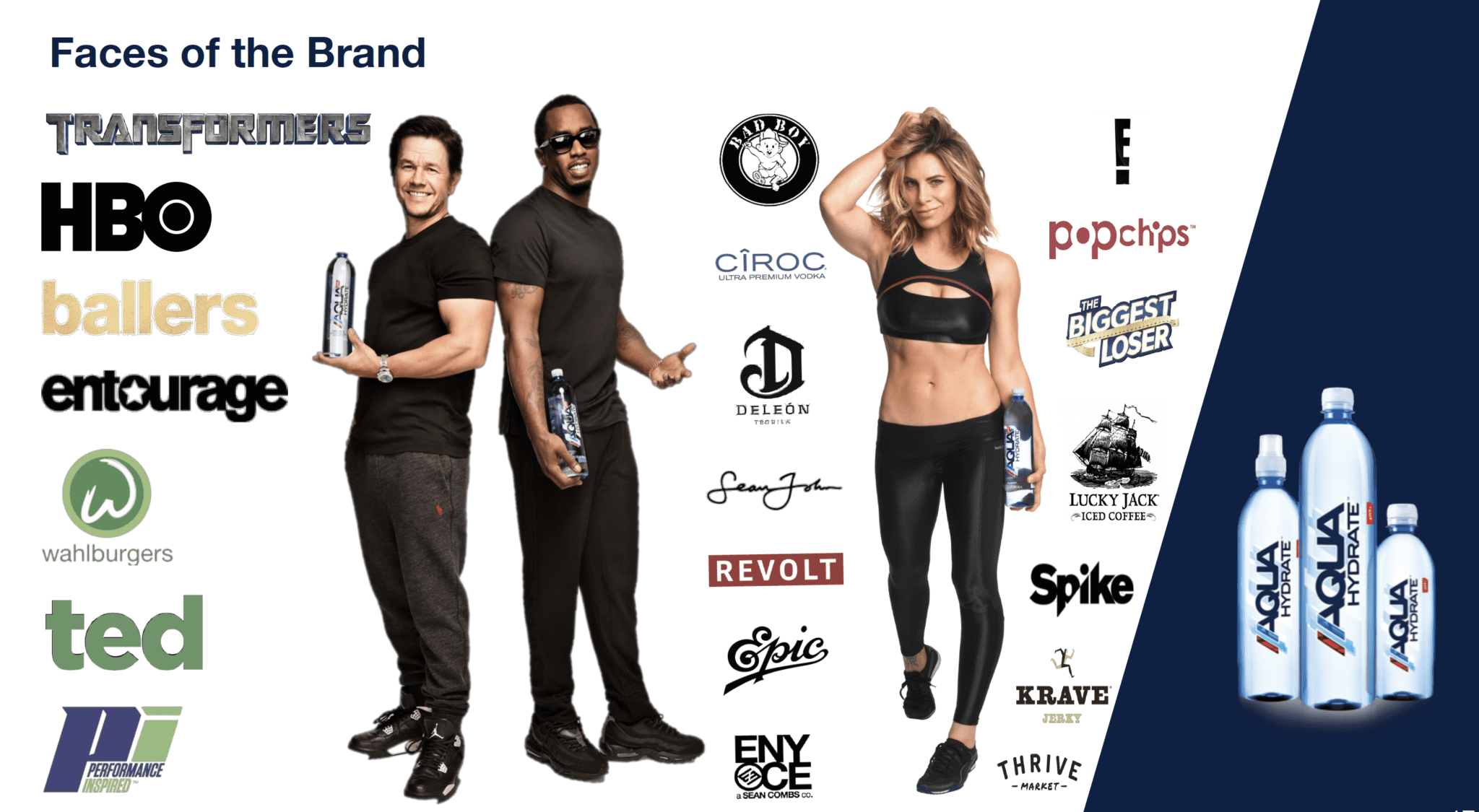

The Alkaline Water Company to Acquire AQUAhydrate

Today, the Alkaline Water Company Inc. (NASDAQ and TSXV: WTER) announced that it has entered into a definitive agreement and plan of merger under which Alkaline will acquire all of the issued and outstanding shares of common stock and preferred stock of AQUAhydrate Inc., a private Los Angeles-based performance lifestyle company that manufactures and distributes premium bottled water, in an all-stock transaction.

AQUAhyrdate is the high-PH water brand created by none other than Mark Wahlberg – 2017’s highest-paid actor, according to Forbes.

I am sure you have seen the bottles of AQUAhyrdate in many of Mark’s movies, including one of his latest heart-warming movies about adoption, Instant Family.

Mark has put in over $20 million into the deal.

But that’s not all.

Investing right alongside of Mark Wahlberg is 2017’s richest hip-hip mogul, P. Diddy – who also put in over $20 million.

Together, they have built a powerhouse of a brand in AQUAhyrdate and are about to take it to the next level.

The two companies combined immediately catapults sales of The Alkaline Water Company from the expected $46-50 million in annual sales this year to an estimated $65 million, and then upwards of $85 million the next year.

And it will cement the Company as one of the leading independent hydration companies – one that will be more than twice as big as Kobe’s BodyArmor!

A Great Deal

Mark and P. Diddy have poured in a ton of money and time into AquaHydrate.

But here’s a chance for new investors to invest right alongside them.

You see, the deal was signed at a share price of US$2.30 – exactly where the Company trades at the time of this writing.

And all of those shares are restricted for at least six months from the time of closing.

That means investors today in The Alkaline Water Company are not only buying shares at the same price as where the deal was struck, but get to exit before Mark and P. Diddy!

With more than $40 million invested between the two superstars, I am betting they’re going to do their best to make it a success.

Here’s what P. Diddy had to say about the deal:

“Today, I am confident that we are creating a powerhouse by combining AquaHyrdate with one of the largest, fastest growing alkaline water companies in the world. I look forward to this next stage of growth as we build one of the most recognizable brands for premium water.”

Remember earlier, when I told you how celebrities use their influence to make hundreds of millions of dollars?

Both Mark and P. Diddy have officially committed to new endorsement agreements with

AQUAhydrate when the transaction closes.

In other words, they’re committed to making the Company an absolute monster.

But it’s not just the two of them.

You see, the Alkaline Water Company is taking on the health and fitness category. And while Mark is well-known for his health and fitness, what better endorsement can a Company’s product receive than having one of the most famous health and fitness celebrities in the world on board?

Alongside Mark and P. Diddy, is none other than Jillian Michaels – who has also committed to staying on with a new endorsement deal.

Collectively, the three of them have an estimated social media reach of over 74 million followers across Facebook (NASDAQ: FB), Twitter (NASDAQ: TWTR), and Instagram!

Not to mention that every media outlet will be eager to have them on their shows.

Mark has created one of my favorite shows of all time in Entourage and has starred in some of the biggest movies of this generation.

Diddy turned a failing vodka into one of the top vodka brands in the world.

And Jillian Michaels has become one of the most well-known fitness personalities.

Together, I believe they are going to catapult the Alkaline Water Company to the next level.

But again, that’s not all.

The Biggest Health Trend in the World

While the beverage sector represents an incredibly lucrative opportunity, there is one that is growing at an even faster pace.

In fact, companies within this particular category are trading at multiples unheard of since the dotcom boom.

Yes, I am talking about CBD.

If you recall from a previous letter, the Alkaline Water is already beginning to introduce its CBD-waters into the beverage market.

And just a month ago, on August 9, 2019, the Company announced three all-natural flavored Cannabidiol (“CBD”) infused waters.

And just a month ago, on August 9, 2019, the Company announced three all-natural flavored Cannabidiol (“CBD”) infused waters.

But the biggest news of all came just a few weeks ago.

On August 28, 2019, the Alkaline Water Company Inc. (NASDAQ and TSXV: WTER) announced the expansion of its Cannabidiol “CBD” product portfolio with the launch of CBD-shots, tinctures, capsules, and powder packs.

These include:

-

- 25mg Hemp-derived CBD Infused Beverage Shots

- Energy Shot – Blood Orange Flavored

- Recovery Shot – Peach Mango Flavored

- Relax Shot – Watermelon Cucumber Flavored

- Sleep Shot – Lemon Honey Flavored

- 150mg Hemp-derived CBD Tinctures

- 25mg Hemp-derived CBD Capsules

- 25mg Hemp-derived CBD Powder Packs

- 25mg Hemp-derived CBD Infused Beverage Shots

To develop and bring these new products to market, the Company entered into a Supply Agreement with Centuria Foods Inc. whereby Centuria will be the Company’s exclusive supplier of water-soluble phytocannabinoid-rich hemp oil.

To develop and bring these new products to market, the Company entered into a Supply Agreement with Centuria Foods Inc. whereby Centuria will be the Company’s exclusive supplier of water-soluble phytocannabinoid-rich hemp oil.

And that exclusivity is a massive deal.

Centuria Foods Inc. is the largest and fastest-growing hemp-based CBD manufacturer in the U.S.

Before the legalization of Hemp and CBD production via the industry-changing 2018 Farm Bill, Centuria Foods was the only legal CBD producer in the U.S., having approvals from Department of Homeland Security and Customs and Border Protection.

That means the Alkaline Water Company isn’t just another Company adding CBD to its portfolio in hopes of chasing the CBD craze.

With their products in over 50,000 retail locations nationwide in all 50 states and a distribution that spans more than 150,000 stores, it’s easy to understand why the Alkaline Water Company chose Centuria to be the exclusive supplier.

And that alone could send shares much higher.

Why?

Cannabis Multiples

As you have already seen, shares of those in the CBD and cannabis space are trading at insane multiples.

Just a few weeks ago, we saw Charlotte’s Web soar when they inked a deal with Krogers that put their product into 1,350 Krogers (NYSE: K.R.).

What happens when the Alkaline Water starts selling their product through their already-cemented distribution chain of more than 50,000 retail locations in over 150,000 stores – including Krogers!? Even more when you consider the AquaHydrate acquisition!

Via Forbes:

“Beyond social media strength and celebrity backers, the new company will boast one of the largest distribution networks for a CBD-related brand in America.

The new products are expected to be distributed via Walmart, Target, Safeway, Rite Aid, GNC Meijer, QT, Albertsons, CVS, Albertson, Kroger, Schnucks, Smart & Final, Jewel-Osco, Sprouts, Bashas’, Stater Bros. Markets, Unified Grocers, Bristol Farms, Vallarta, Superior Foods, Ingles, HEB Brookshire’s, Publix, Shaw’s, Raley’s, Food Lion, Harris Teeter, and Festival Foods.”

These potential sales aren’t even included in the Company’s sales forecast.

But that’s not even the crazy part.

When the Alkaline Water begins to roll out these CBD products, and analysts begin to see these products being sold, the Company could shift from the beverage category to a cannabis one.

And that likely means a re-rating of their stock.

According to FTI Consulting in June 2019, Canada’s top largest cannabis companies were trading at an average multiple of a whopping 55.8x multiple to their LTM (last twelve months) revenue.

If the Alkaline Water Company even comes close to that multiple, it would be worth over $2 billion today! That implies a share price north of $40!

It trades at just over $2 today.

Of course, I am not saying it’s going to $40 – especially since I believe cannabis multiples are too high, and the fact that all of the Alkaline Water Company’s sale right now are water.

But what we do know is that the Alkaline Water is aggressively pursuing the CBD path, cemented by inking an exclusive deal with one of the biggest CBD companies in the U.S.

Furthermore, I don’t know of one CBD company that currently has a bigger distribution network than that of the Alkaline Water Company.

And with the acquisition of AquaHydrate, which brings endorsement from some of the biggest celebrities in the world, we could soon see Alkaline CBD products flying off the shelves.

And that’s a big deal.

I think Mark Wahlberg feels the same way:

“When Sean and I first got involved in the business, our vision was to build a lifestyle company focused on health and wellness, and that’s what we’ve done.

The AquaHydrate and Alkaline 88 brands align well and will support exciting innovations in flavors, sparkling, and CBD products.“

The Growth of the Alkaline Water Company

Five years ago, the Alkaline Water Company entered into one of the hottest beverage markets: alkaline water.

Today, the Company has transformed into the fastest-growing and one of the largest alkaline water brands in the world.

The Company is already considered by many to be a prime takeover target by Big Beverage.

And with the acquisition of Aquahydrate, that target just got even bigger.

Barely Scratching the Surface

As we know, many companies in the marijuana space are commanding insane valuations of over 100 times revenue – some even over 250!

I am not saying that we should expect to see those types of valuations for the CBD/hemp space, but what I am saying is that those in the space will likely command high valuations also.

And why shouldn’t they?

The CBD market could reach US$22 billion by 2022.

What will happen to CBD/hemp-infused beverage stocks, like the Alkaline Water Company, if Coca-Cola or Pepsi Co. officially announce their foray into the space?

It could be mind-blowing.

But let’s not jump so far ahead yet and look at it from a more conservative perspective.

Canaccord believes that as “WTER’s growth continues to ramp up, it will become an attractive takeout target for larger beverage companies.”

Using two recent comparable transactions, Vitaminwater and CORE Nutrition, Canaccord believes that “it is reasonable that WTER gets taken out at ~5.0x sales. Based on their 2021 sales estimate, that would imply a share price of US$6.50 – more than triple where the Company trades today.

And again, this doesn’t include the acquisition of AquaHydrate, nor does it imply any sales from their new line of CBD products.

Conclusion

The beverage space is always dying for innovation and new products.

We have witnessed multi-billion-dollar deals that have made investors in the beverage space hundreds of millions of dollars.

But those investments were mostly reserved for the rich and famous.

The Alkaline Water Company changes all of that.

It is the only publicly-traded water company on a major stock exchange that I know has announced a foray into CBD consumables.

That means almost any investor can get involved in the CBD consumables space.

Furthermore, the acquisition of Aquahyrdate presents a unique opportunity for the investment community.

The combination of Alkaline 88 and AquaHydrate, and all of the respective professionals from both organizations, will allow the Alkaline Water Company to attract institutional investor interest and analyst coverage from across North America and ignite the retail investor community.

I firmly believe that with Mark and P. Diddy on board, the Alkaline Water will become so much bigger.

Not only does the Alkaline Water Company have a strong foundation as one of the best brands in the premium water category, supported by strong and growing sales, but the Company is now using its vast distribution network – and celebrity endorsement – to enter a market that is one of the biggest health trends in the world: CBD.

Take another look at the picture below.

Can you not imagine those products flying off the shelves, the same way 5-hour energy drink did many years ago and still does today?

Can you not imagine those products flying off the shelves, the same way 5-hour energy drink did many years ago and still does today?

With just one product alone, 5-hour energy shots sell nearly $1 billion worth of product a year, in a category that’s dying for innovation.

And that’s precisely the innovation that the Alkaline Water Company, along with Mark Wahlberg and P. Diddy, are looking to provide.

Two of the fastest-growing premium water brands are joining forces.

And I think their combination will take the Alkaline Water Company to the next level.

The Alkaline Water Company

US Trading Symbol: NASDAQ: WTER

CA Trading Symbol: TSX-V: WTER

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure:

We are biased towards the Alkaline Water Company (WTER) because the Company is an advertiser on www.equedia.com. We currently own shares of WTER. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in WTER or trading in WTER securities. Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. WTER and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from WTER, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

Important Information For Investors And Stockholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

In connection with the proposed transaction between The Alkaline Water Company Inc. (“Alkaline”) and AQUAhydrate, Inc. (“AQUAhydrate”), Alkaline will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 of Alkaline that will include a joint proxy statement of Alkaline and AQUAhydrate that also constitutes a prospectus of Alkaline, and a definitive joint proxy statement/prospectus will be mailed to stockholders of Alkaline and AQUAhydrate. INVESTORS AND SECURITY HOLDERS OF ALKALINE AND AQUAHYDRATE ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Alkaline through the website maintained by the SEC at http://www.sec.gov.

Certain Information Regarding Participants

Alkaline, AQUAhydrate, and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Alkaline is set forth in its Annual Report on Form 10-K for the year ended March 31, 2019, which was filed with the SEC on July 1, 2019. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at http://www.sec.gov.

Notice Regarding Forward-Looking Statements

This report contains “forward-looking statements.” Statements in this news release that are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Such forward-looking statements include, among other things, the following: that the Transaction will be completed on the terms and conditions of the Agreement, or at all; delivery of shareholder value with clear synergies in operations, R&D, distribution, and sales; that the combined company’s expectation is to generate revenue of at least $65 million in fiscal 2020; the strategic and financial benefits of the Transaction to Alkaline, including any benefits related to the high profile board members and investors of AQUAhydrate, the unique positioning of Alkaline and AQUAhydrate in the capital markets following the Closing, attracting institutional investor interest and analyst coverage from across North America and ignite the retail investor community, brand extension, cross selling and potential expanded shelf space, ability to initiate a more aggressive rollout strategy leveraging distribution platforms of Alkaline and AQUAhydrate, retail buyer synergies, production and logistical advantages afforded to AQUAhydrate; the focus on CBD-infused products for upcoming product launches and the statement that Alkaline’s CBD infused health drinks will make Alkaline a strong competitor for the $22 billion category by 2021; the acquisition of AQUAhydrate is an unprecedented opportunity that allows Alkaline to cement itself as a leader in various multi-billion dollar segments which include premium water, functional & wellness, and the CBD market; the belief that post-acquisition, the combined companies will attract a more diverse consumer base, offer product differentiation and innovative brand extensions to become a major independent force in the beverage sector; the business synergies associated with the merger that Alkaline identified will immediately impact and reduce costs associated with operations and allow the combined companies to accelerate their sales channels through cross-promotion of both brands based on their distinct consumer bases and distribution channels; the number and percentage of Alkaline Shares to be owned by certain persons; the combined company’s trailing twelve months revenue in financial periods following the Closing; the satisfaction of the conditions to closing, including AQUAhydrate maintaining endorsements agreements with certain persons, Alkaline and AQUAhydrate receiving the requisite approvals, the number of AQUAhydrate Shares being subject to the exercise of dissent rights, the conversion of preferred stock of AQUAhydrate into AQUAhydrate Shares, and the conversion or termination of all AQUAhydrate’s convertible securities; the capital reorganization of AQUAhydrate; and the constitution of the Board and the appointment of officers of Alkaline following the Closing.

The material assumptions supporting these forward-looking statements include, among others, that the demand for Alkaline’s and AQUAhydrate’s products will continue to significantly grow; that the past production capacity of Alkaline’s and AQUAhydrate’s co-packing facilities can be maintained or increased; that Alkaline will receive all necessary regulatory approvals for the production and sale of CBD infused products; the popularity of AQUAhydrate’s high profile investors and board members will be maintained or continue to grow; that there will be an increase in number of products available for sale to retailers and consumers; that institutional and retail investors and media organizations will be attracted to a pure play water company; that there will be an expansion in geographical areas by national retailers carrying Alkaline’s and AQUAhydrate’s products; that there will be continued expansion into new national and regional grocery retailers; that there will be an expansion into new e-commerce, home delivery, convenience, and healthy food channels; that there will not be interruptions on production of Alkaline’s or AQUAhydrate’s products; that there will not be a recall of products due to unintended contamination or other adverse events relating to Alkaline’s products; and that Alkaline and AQUAhydrate will be able to obtain additional capital to meet Alkaline’s and AQUAhydrate’s growing demand and satisfy the capital expenditure requirements needed to increase production and support sales activity. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, governmental regulations being implemented regarding the production and sale of alkaline water or any other products, including products containing CBD; the fact that consumers may not embrace and purchase any of Alkaline’s CBD infused products; the fact that Alkaline may not be permitted by the FDA or other regulatory authority to market or sell any of its CBD infused products; Alkaline and AQUAhydrate being unable to realize the anticipated synergies from the Transaction; Alkaline or AQUAhydrate not receiving the requisite approvals for the Transaction; the fact that consumers may not embrace and purchase any of Alkaline’s or AQUAhydrate’s infused water products; additional competitors selling alkaline water and enhanced water products in bulk containers, reducing Alkaline’s and AQUAhydrate’s sales; the fact that Alkaline and AQUAhydrate do not own or operate any of their production facilities and that co-packers may not renew current agreements and/or not satisfy increased production quotas; the fact that Alkaline and AQUAhydrate have a limited number of suppliers of its unique bulk bottles; the potential for supply-chain interruption due to factors beyond Alkaline’s and AQUAhydrate’s control; the fact that there may be a recall of products due to unintended contamination; the inherent uncertainties associated with operating as an early-stage company; the inherent uncertainties with mergers, acquisitions and other business combinations; changes in customer demand and the fact that consumers may not embrace enhanced water products as expected or at all; the extent to which Alkaline and AQUAhydrate are successful in gaining new long-term relationships with new retailers and retaining existing relationships with retailers; the unexpected illness or other incapacity of any of AQUAhydrate’s high profile investors subject to endorsement agreements with AQUAhydrate or Alkaline; Alkaline’s and AQUAhydrate’s ability to raise the additional funding that they will need to continue to pursue their business, planned capital expansion and sales activity; competition in the industry in which Alkaline and AQUAhydrate operate; and market conditions. These forward-looking statements are made as of the date of this news release, and Alkaline assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although Alkaline believes that any beliefs, plans, expectations and intentions contained in this news release are reasonable, there can be no assurance that any such beliefs, plans, expectations or intentions will prove to be accurate. Readers should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents Alkaline files with the SEC, available at www.sec.gov, and on the SEDAR, available at www.sedar.com.

This news release contains future-oriented financial information and financial outlook information (collectively, “FOFI”) about the combined company’s pro forma results of operations, including revenue, all of which are subject to the same assumptions, risk factors, limitations, and qualifications as set forth in the above paragraphs. FOFI contained in this news release was made as of the date of this news release and was provided for the purpose of providing further information about Alkaline’s future business operations. Alkaline and AQUAhydrate disclaim any intention or obligation to update or revise any FOFI contained in this news release, whether as a result of new information, future events or otherwise, except as required by law. Investors are cautioned that the FOFI contained in this news release should not be used for purposes other than for which it is disclosed herein.

Footnotes:

- Estimation of pro forma revenues associated with the combined company after the closing of the Transaction are estimates based on previous performance and have been used for illustrative purposes only. AQUAhydrate had gross sales over $15 million in each of 2017 and 2018. The combined company will begin to record AQUAhydrate revenues once the Transaction closes and is expected to add $5 to $7 million ofrevenues in fiscal 2020. Alkaline’s forecasted pro forma revenues of $65 million for the combined company is based on its expectation that revenue growth will remain consistent for fiscal year 2020, significant sales growth will continue in Southern California, and significant orders will be received from the national-retailers and east coast grocery chains, which have only recently started selling its products. In addition, Alkaline assumes that it will continue to be able to add co-packing plants and production capacity to satisfy customer demand. As its sale cycle is an average of 14 days, a slowdown of the growth in any of the areas set forth above during fiscal 2020 or other events could cause actual results to vary materially from this forecast. In addition, sales growth, which may have a significant impact on quarterly and annual revenue, is difficult to predict. Furthermore, AQUAhydrate assumes that it will continue to be able to sell through convenient store channels, recently added mass retailer and drug store chains, and that production and procurement will be able to meet sales projection demands. As its sale cycle is an average of 10 days, a slowdown of the growth in any of the areas set forth above during fiscal 2020 or other events could cause actual results to vary materially from this forecast. In addition, sales growth, which may have a significant impact on quarterly and annual revenue, is difficult to predict.

Dear Mr Lo,

Before I followed your recomendation on investing in NexOptic technology.

What is your opinion on that Company now?

I’ve been drinking this water myself I live in new you’re Long Island and we have two place we can go fill our self I think this is the best water and to see two great guys and I would love to join myself and if needed I’ll drive a car around with logos if they want I’m in Florida now so I’ll do slot of drive for them with free hand outs to pass off the great water as I put on miles

I would love to be apart of A business thats striving and growing bigger then ever.

Yes I want this free letter

How do I invest with Mark Wahlberg’s water company

How can I join

I’m interested

This is the second time you have promoted WTER and the stock has gone south. Where are you getting your information ? If those two celebs put money into this company I bet they are unhappy now.