Dear Readers,

Not a day goes by without a mention of the word “bubble”.

From experts to analysts, to the clerk who bags my groceries, the word bubble seems to have become synonymous with the market.

So much so that most people just shrug it off when the word is mentioned. There’s no twitch. There’s no worry. There’s no emotion.

But would you have shrugged off 2008, or the Dotcom Bubble, had you known what was to come when the word bubble was mentioned prior to those crashes?

Of course not.

Yet despite nearly everyone talking about a bubble, the market continues to climb at the most rapid pace in history.

The Dow continues its incredible stretch of hitting new highs, while overbought indicators for the S&P 500 are reaching its highest levels in…well…ever!

Does that mean we’re in a bubble?

Of course!

The real concern is not if we’re in a bubble, but when this bubble will pop.

In this Letter, I am going to show you the one indicator that hasn’t happened in 10 years, why I believe the market has more room to climb, and why President Trump may not be as bad as you think – especially if you’re an investor.

Before you stop reading because you’re anti-Trump, hear me out.

This is an investment newsletter, after all.

Double the Gum, Double the Size of Bubble

When we think of how overvalued the market is, or how frothy the market has become, we rarely consider what that truly means.

Sure, when compared to historical data, the market is higher and rising faster than ever.

But by today’s standards, is it really rising that fast?

Are stocks really that overbought?

The more gum we chew, the bigger the bubble…

The more money we create, the bigger the market.

A Different World

Many of the assets today aren’t expensive relative to one another, and especially not in relation to cash.

While we have seen global real estate and asset prices climb to all-time highs, we have also seen a record amount of cash put into the system.

Remember, more than US$15 trillion has been injected into the global economy by the central banks over the last decade, while both cash rates and interest rates are at record lows.

The Fed and the Bank of Japan quadrupled their balance sheets, while the People’s Bank of China and the European Central Bank more than doubled theirs.

Together, these central banks have tripled their balance sheets.

This liquidity has to go somewhere.

In past letters (here’s one from 2013), I talked about how this liquidity would go into stocks and other assets because leaving them in bonds during a low-interest rate environment simply means you’ll lose money as inflation outpaces the rate of return.

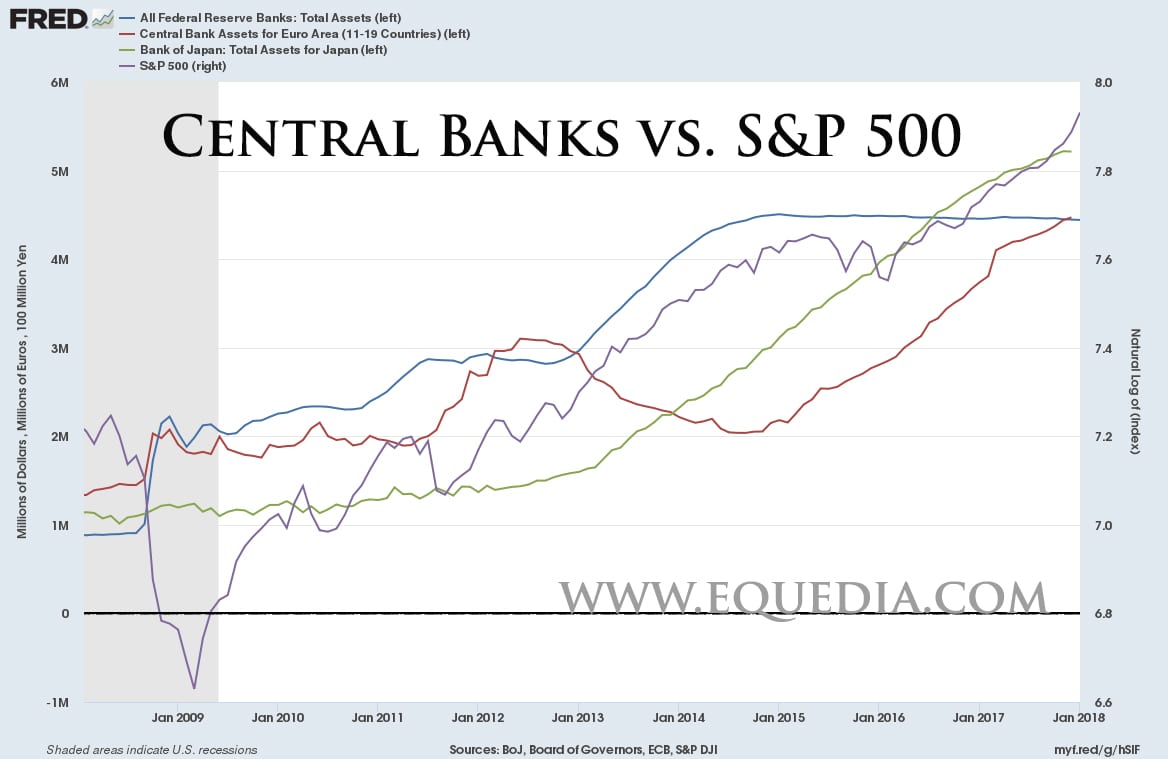

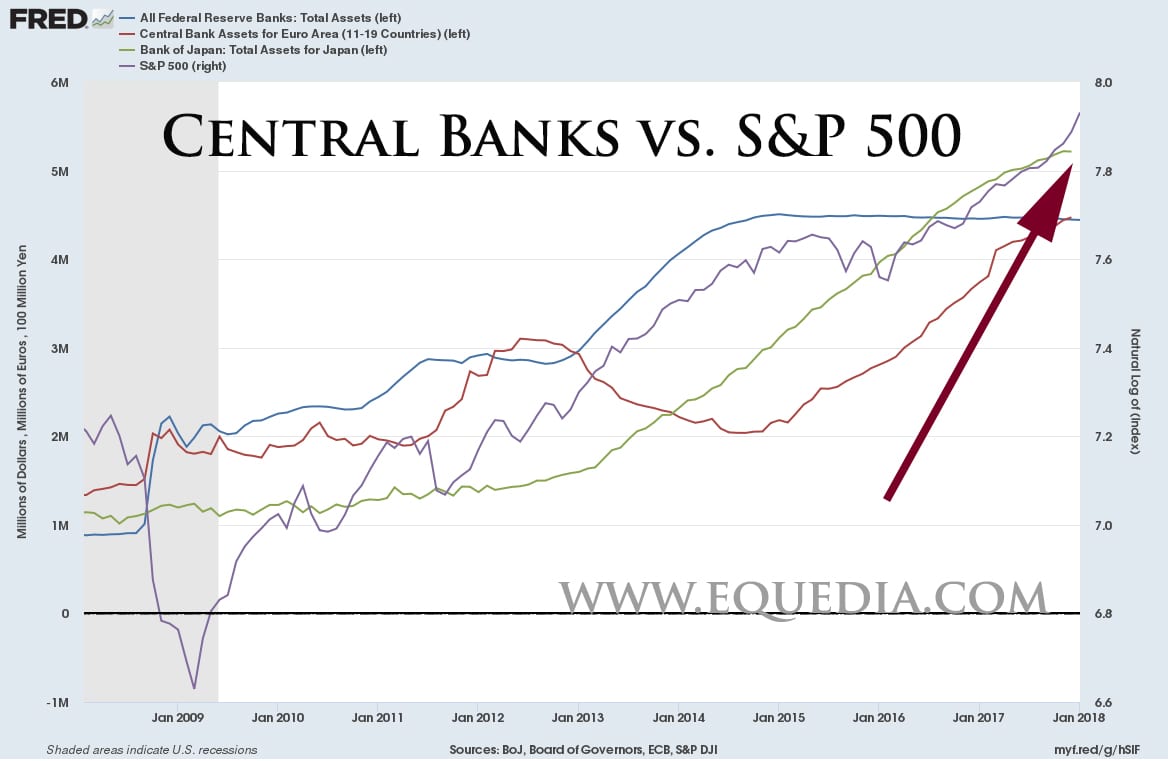

Just take a look at how the S&P 500 performed when graphed against the central bank purchases over the last decade.

Pretty lock step if you ask me.

This concept isn’t new, but I want to stress its relation to market values.

Sure, stock multiples are high. But that doesn’t mean stocks are a riskier asset class than financial assets that are tied to rates.

With interest rates still near all-time lows, stocks will have the upper hand because the cost of borrowing is so low.

Let’s simplify it even more.

If you borrowed $100,000 at 2% and invested it all in the S&P 500 last year, you would be up over 17% on the year (S&P 500 climbed 19.42% in 2017), netting you over $17,000.

That means you get an easy 17% carry without much thought – how much simpler can you get than investing in the S&P 500?

You can bet the banks and many other big corporations are doing this – just take a look at their financials.

Given the average yield in the US is roughly 3%, the stock market is clearly the better choice.

While the US is finally pulling back some liquidity, as long as corporate earnings continue to show strength and interest rates remain low, the market still has a lot of breathing room – especially considering that Europe and Japan have yet to taper and are still in buy-mode.

If you were to look at the equity market in a vacuum, its certainly at a historical high and deserving of a pullback.

But if you see it in the context of the all-time high liquidity environment we’re in, it’s actually not that high.

In fact, if you put our stock market in relation to our current and modern civilization, it’s really not that high at all.

Our civilization is advancing at the most rapid pace in history.

Technology growth is faster than ever. Data and computing speeds are doubling every year. We can communicate with someone across the world in the same amount of time that it takes for our brains to form a thought. Cars are getting faster. People are running faster.

In other words, everything – including the rise of the stock market – is getting faster.

More Gains to Come?

Every time stocks were as overbought as they are today, the market has experienced significant gains in the following months.

Via CNBC:

“In 1996, the RSI (Relative Strength Index) hit 87 in June – from there to the market peak, the S&P 500 rose 128 percent.

A decade earlier, the RSI reached similar levels and the S&P 500 proceeded to gain roughly 50 percent through to the bull market’s high.

Going further back, in 1955, the RSI peaked at 88 in July and gained around 15 percent through to the top of its bullish stretch.”

The S&P 500’s 14-month RSI is now over 87.

If we go by precedence, our market could be in store for at least another 15% gain from here.

But since things are moving faster than ever before, perhaps we could be in store for much more.

Just a thought for the analysts who continue to compare our current market to previous cycles…

Record Inflows Continue

In my last Letter from December, I said our market would continue to climb – especially in the first few months of the year – in part, because of the rapid rate of inflows from retail investors.

The S&P 500 is already up nearly 7.5% this month.

And those inflows?

According to BofA Merrill Lynch Global Research, inflows into equities funds over the last four weeks have hit the highest number on record with a total of over $58 billion.

In fact, through the week ending last Wednesday, investors poured a record $33.2 billion into stock-based funds.

One could argue this euphoria is the tipping point for the market since retail is always the last ones to participate in a bull market cycle.

While that is true, let’s keep it in context.

As long as the economy is perceived to be doing well, investors will continue to pour money into the market.

And why should investors feel good about the economy?

The Trump Effect

In the last edition of the Equedia Letter, I said that companies would begin to move the record amounts of cash they held abroad and invest in areas such as new production processes, new technologies, IT, and digital security.

Via The Equedia Letter, December 2017:

“The resulting rapid growth in technology will force disruption across many sectors, forcing many new acquisitions and mergers. If companies don’t invest now in new technologies and processes, they will be eaten alive by those who do.”

I then suggested that some of the largest US corporations in the world will not only be forced to bring money back onshore but they will have to spend it as a result of Trump’s tax policy:

“…The investment in capital expenditures will be further fueled by the repatriation tax holiday for US companies brought on by the Trump Administration, in which US companies could bring back hundreds of millions of dollars to avoid paying higher taxes in the future.

According to Goldman Sachs, S&P 500 companies hold US$920 billion in untaxed overseas cash, and it estimates that $250 billion of that would be repatriated.

But that’s just the beginning.

According to Citigroup, US-based companies have a whopping $2.5 trillion of capital stashed internationally.

The bulk of this money belongs to companies heavily concentrated in the tech and healthcare sectors and includes big names such as Cisco, Apple, GE, Qualcomm, Amgen, and Oracle.

Some of this money will come back to the US, and it will force one of two likely outcomes:

1. Corporate share buybacks

2. Capital expenditures/reinvestment

My guess is the latter will be the more likely outcome given the incentives by policymakers. Furthermore, with record-high valuations, it would make more sense for corporations to spend on Capex (Capital Expenditures) and acquisitions rather than the buyback of shares – especially since high share prices are often the best currency for buyouts.”

What’s happened since that Letter?

Just last Wednesday, Apple – who holds hundreds of billions overseas, said they would bring hundreds of billions of dollars back to the US.

Via CNBC:

“Apple just announced on Wednesday it will bring back hundreds of billions of dollars from overseas to fund investment in the U.S. and likely increase its capital returns.

“Apple, already the largest US taxpayer, anticipates repatriation tax payments of approximately $38 billion as required by recent changes to the tax law. A payment of that size would likely be the largest of its kind ever made,” the company said in the release.

Using the new 15.5 percent repatriation tax rate, the $38 billion tax payment disclosed by Apple means they are planning a $245 billion repatriation.”

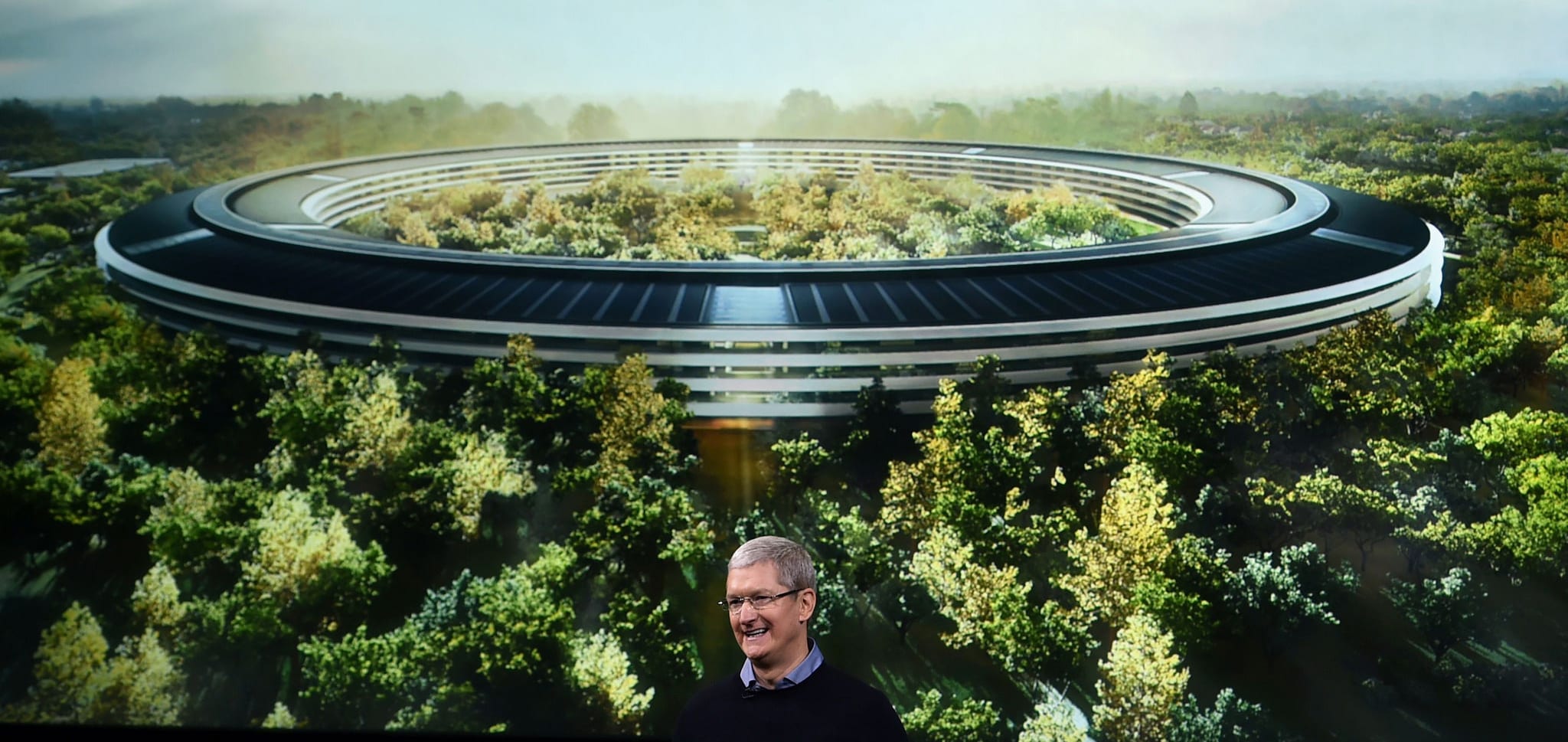

Not only will Apple bring back and invest billions in capital expenditures, including a brand new Apple campus (in addition to the one you see above), it will also create 20,000 new jobs.

That’s real jobs and real infrastructure creation – not a temporary government fix.

If anyone that tells you lower corporate tax rates only benefits the rich, tell that to the 20,000 new employees Apple will hire on US soil, who will pay US taxes.

My bet is we will see many of the other big name companies who hold money overseas do the same.

Especially if they want to compete and keep pace with China, who is expected to see its tech expenditure grow 8 percent to US$234 billion in 2018.

If you think China isn’t a threat, consider the following.

Via Reuters:

“China’s war for technology talent is intensifying.

…”Companies are well-funded and are in serious competition for talent,” said Thomas Liang, a former executive at Chinese search giant Baidu, who is now running an AI-focused fund. He said that startups in hot sectors like AI often have to offer 50-100 percent pay raises to attract employees away from established technology firms.

…Technology is certainly a major driver of growth in China. Output in China’s information technology and software sector expanded by 33.8 percent year-on-year in the fourth quarter, compared with 29 percent growth in the third quarter, according to data from the statistics bureau.

…In China, top graduates working on AI can command salaries of 300,000 yuan (US$47,066) to 600,000 yuan ($94,132) a year, according to tech recruitment website 100offer.com, while team leaders with three-to-five years of experience can make more than 1.5 million yuan ($235,33100) annually. Many of these jobs are in Beijing or Shenzhen.

Liang estimates salaries in the industry have roughly doubled since 2014.

By comparison, an AI researcher in San Francisco makes an average of $112,659 a year, and a machine learning engineer in the same city an average $150,815, according to job search site Indeed.com.

The money is still pouring in. More than $65 billion of venture capital investments were made in Greater China last year, up 35 percent from a year earlier, according to research firm Preqin, an all-time high and second only to North America, with $77 billion.”

We certainly haven’t seen that type of wage growth in the US…

Mergers and Acquisitions

What about the mergers and acquisitions that I said would take place as a result of the combination of the Trump tax policy and record corporate cash holdings?

Via Bloomberg:

“Just three weeks into the year, the value of mergers announced totals $152.5 billion.

That’s the highest since the $374 billion racked up in the same period during the technology deal frenzy in 2000, according to data compiled by Bloomberg.”

…North American companies, which fell out of favor among acquirers last year, are back on the shopping list in 2018, making up almost 60 percent of all announced transactions so far, the data show.”

I am not telling you to like Trump.

I am not telling you that I like him.

I am telling you that you don’t have to like him, but you can’t deny the immediate effects of his policy and its affects on your wallet.

And it’s not just your wallet…

Inflation to Finally Climb?

Despite the rise in asset prices over the past decade, we have witnessed little or low inflation growth.

Why?

First, the cost of labour has collapsed through globalization and technology.

In the past, our economies were relatively closed.

So when the Fed printed money, it would very quickly be passed down to the citizens of the US through job creation because that money went directly into the US economy. As more money was printed, wages rose very quickly and many factories experienced full capacity utilization.

That caused prices to go up very rapidly, leading to high rates of inflation.

Today, our economies are mostly wide open.

Countries trade very easily amongst one another. US citizens no longer have to buy a car built in Michigan – not when they have options to buy from all over the world. They could buy a Honda over a Ford.

Consider that we live in a world where two billion people live on less than three dollars a day.

Those people would love to work for a lot less than the people in the US.

This wage gap has led us to a big global economy with enormous excess capacity via a pool of extremely low-cost labour.

So despite all the money the Fed printed, inflation remains subdued because that money could be spent anywhere in the world.

As a result, we have experienced both low wage growth and job creation at home – another roadblock for inflation.

But under Trump, that may be about to change.

Via CNN:

“The U.S. Treasury and the IRS on Thursday put out new guidance and withholding tables for employers that incorporate changes from the new tax law.

Under those new tables, the Treasury estimates that 90% of people who get a paycheck are likely to see more in take-home pay, as soon as February. Employers will have until Feb. 15 to incorporate the changes in their payroll systems.”

A low minimum wage has been one of the major complaints from many low-to-middle class voters. Many of them even attacked Trump’s stance on minimum wage.

But Trump’s tax policy is already forcing companies to pass those benefits to its employees via bonuses and minimum wage hikes.

And these benefits don’t just go to the top earners.

Via USA Today:

“Home Depot is giving out bonuses of up to $1,000 to U.S. hourly workers, becoming the latest major national employer to hand out checks after President Trump’s corporate tax cut.

The home improvement chain said it would also continue to distribute “success sharing” payments tied to the company’s financial performance.

Workers with at least 20 years of experience will get the full $1,000 bonus, Home Depot spokesman Stephen Holmes said in an email. All hourly workers will get at least $200, he said.

At Walmart, bonuses of up to $1,000 were distributed to workers with at least 20 years of experience. Most workers were eligible for a few hundred dollars at most. Walmart also increased its minimum wage to $11.

Starbucks announced Wednesday that it would give hourly workers $500 bonuses and spend $120 million on wage hikes.

Dozens of other major national employers have also announced bonuses or wage increases, including JPMorgan Chase, the Walt Disney Co., and Wells Fargo.”

In other words, Trump’s tax policy is forcing big corporations to share the wealth with their employees.

And Trump’s cuts go a long way to helping families as well.

Via Daily Signal:

“…Wal-Mart also announced it will be expanding its paid maternal and parental leave by offering full-time hourly employees 10 weeks of paid maternity leave and six weeks of paid parental leave. Salaried workers will receive the same six weeks of paid parental leave that their hourly counterparts receive, too.

…Prior to these changes, paid maternity leave was eight weeks and paid parental leave was four weeks for full-time hourly workers.

Additionally, Wal-Mart will contribute $5,000 toward the cost of adoption, which on average ranges from about $34,000 to $40,000. The $5,000 can be used for adoption agency fees, translation fees, and legal or court costs.”

An increase in spending was one of the key missing ingredients for inflation growth. This “profit sharing” could change that.

Lowering of corporate taxes leads to a bigger US deficit, and the US dollar has been weakening as a result. But combine that with increased spending and low unemployment, and it could be the precursor for inflation to finally pick up.

This would pave the way for the increase in rates that has been announced.

While a rise in rates is the tipping point for what many experts believe will be the needle that pops the bubble, it doesn’t mean it’s going to pop tomorrow.

If we experienced little to no growth in the US, that may be the case.

But again, under Trump’s deregulation policy, the bubble could get bigger – and that’s not a bad thing, for now.

Business Deregulation

The US has always been a source of innovation and world-changing advances.

Business deregulation allows companies to take on more risk, which means more advances.

This could drive further foreign investments into the US, which would lead to even further job creation.

Big US companies sent money overseas because of high taxes here at home. But as these Big Corporates bring money back on home soil, the US will stride ahead.

There are a lot of smart people in the US and this rush of capital is going to fuel significant progress.

That means countries around the world will have to keep up and stay competitive.

That means China will have to increase its own spending or go backward on all of the progress they have made in the last ten years.

Its no wonder why China just announced that it’s building a new $2 billion tech complex specifically dedicated to Artificial Intelligence.

This competition will fuel the global economy.

Navigating Decisions

I am sure after reading this month’s edition you maybe led to believe I am a Trump supporter.

But I want to make it very clear: this letter isn’t about politics.

This Letter is about how to navigate your investment decisions based on macroeconomics.

Longtime readers of this Letter have witnessed many of my writings come true.

I gave you a few examples of predictions from last month that have just played out.

Here’s another one from just a few months ago.

Via the Equedia Letter, November 2017 Edition:

“Leading up to July 2018, I suspect that we’ll see a ton of M&A activity in the marijuana space.

That’s because the bigger players want market share but don’t currently have the production capacity to service all of Canada.

That’s why we could soon see them make a move on the smaller guys.

M&A is coming for sure and it could be the start of the next craze in retail come early 2018.”

Just last week, we witnessed the biggest deal yet in Canada’s marijuana sector when Aurora Cannabis Inc. struck a friendly deal valued at $1.1 billion to buy rival licensed producer CanniMed Therapeutics Inc., marking the biggest deal yet in Canada’s marijuana sector.

I suspect we’ll see billions of M&A activity in the marijuana space in 2018.

I sincerely hope that you don’t take what I write as a chance to boast about my insights. My hope is that you will take the research I provide and use it in your own due diligence when it comes to your wealth.

This sometimes means putting your political views aside.

Trump’s actions may be the beginning of another economic boom for the US.

But while my research points to further growth, it doesn’t mean we should lose sight of the dangers surrounding the market.

If interest rates go up – and I am confident that is the next path – stocks and real estate will eventually become less favourable – a normal occurrence as investors transfer their speculative capital into more secure investments based on higher rates.

And if you go back to the chart I posted earlier, you’ll notice that the growth in the S&P 500 has recently surpassed the growth of central bank bank assets – all units of measure being relative. This hasn’t happened in 10 years.

The question now becomes how our market will adjust based on the growth and security of job creation in the global economy. If rates rise too fast, it would most certainly halt growth and send the US and the world into another recession.

Perhaps the Fed and other central banks will be able to unwind their assets while raising rates in lockstep with the growth of the global economy.

Just remember that we’re in unchartered territory and historical numbers don’t directly correlate with our current situation.

If we use precedence alone to play this market, we would never make any money. There’s a reason why this credit cycle has shut down a record number of hedge funds over the past three years.

As I mentioned in my last Letter, my goal is to make as much money as I can in the stock market before the next major correction.

That doesn’t mean putting all of my profits from this current boom back into the market. It means reinvesting some profits, while also saving some for a rainy day. Hopefully I can pull out as much as possible before the next eventual market crash.

The Fear of Missing Out (FOMO) is real and there are just too many disruptions, innovations, and new sectors that are booming, to sit on the sidelines – especially during such a low-rate environment.

Don’t get left behind.

But save some for a rainy day.

Until next month.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will.

Good article but you lost considerable credibility imo when you appeared to worry (several times) that readers may think you as being pro-Trump. Are you actually that afraid of what people might think? Your worries of being perceived pro-Trump reminded me of typical Canadian sheeple who have been brain-washed by the anti-Trump left-wing media. Unfortunately, I now don’t have the great respect I once did for you.

Exactly what I was thinking but this guy is still really smart, even if he is afraid to admit that he likes Trump.

Frankly I thought this article was well thought out, very comprehensive, and a wholesome review of the many factors which contribute to our current “bubble”.

Thank you for that. It’s a good read.

CAN’T STUMP TRUMP.

All of your articles are very informative and well written. PLEASE KEEP IT UP….WE NEED YOUR WORK MORE OFTEN.

Just a suggestion….go to greaterfool.ca. Run by a former politician who you might be familiar with Gart Turner. He writes daily on his blog. Shorter articles make for easier reading and help people like myself with short attention spans.

Guess it’s time to place stop loss orders at some distant beneath all eguity positions

By time we have a President that loves America and wants to see americans do good.

The top in the market IMO will be Trump Impeachment if it happens.

Thank you for the sharing. Impressive analysis and information.

quote:”Lowering of corporate taxes leads to a bigger US deficit, and the US dollar has been weakening as a result. But combine that with increased spending and low unemployment, and it could be the precursor for inflation to finally pick up.”

If I might add in a one cent worth of thought, the deficit is probably caused by overspending of what the government has gotten and less so on how much tax collected. Most never pay any ways. A good country bestowed with a lot of natural resources in addition to profits from investing government funds and properties etc, might have a possibility not to tax the citizens, or no? There is a reference that I would like to make on how tax was started. Please refer to movie “Robbin Hoods” by Russel Crowe and Cate B. whenever you are free.

On the other hand, inflation occurs when the companies are making not enough money to cover what they are charging at the moment. They increase the prices to minimize the possibility of negative balance sheets or losses. Or, sometimes, in developing countries, it’s simply the fastest way to gain extra profits with the consent of the authority before they stall the economy and bankrupt the companies?? (People are spending much less due to expensive prices and may be high unemployment rate??)

In order to have a stronger USD, reduce deficits by e.g. barter trades; spend within the collections . It is understandable how the common sentiment sounds: “what is the use of the reserve if they are not to be spent”……….. Therefore, yearly budget spending of all the collections with the greatest mercy of one dollar (or may be $100) left to the national reserve is fine and acceptable worldwide………….. Tax, might not be the ultimate solution to deficits as commonly believed, nowadays. Or no?

Today’s announcement of of steel and aluminum import tariff’s could blow up the market’s gains. Do you think Canada,China etc. won’t retaliate?

Whenever someone starts a comment with “typical” this or that and then uses derogatory terms to put down others, well, they say it all about themselves. Too concerned with attacking, misses the topic as titled, “How trump policies affect your investments”. Good article, good info., don’t listen to the GG’s bullshit, he can’t be worth what little time it takes to delete his comments.