In just a bit, I am going tell you how a specific event last week just put a massive target on this Company’s back.

But before I do that, a little background is in order.

Blockbuster is dead. Hotels are struggling. And taxis are on the brink of failure.

With the power of digital and mobile technologies, new players have quickly disrupted the traditional kingpins who were too slow to adapt.

Even traditional newspaper outlets and media are struggling to find ways to survive in this digital world.

In fact, it is precisely this digital disruption that has allowed the Equedia Letter to become one of the most widely read financial publications across Canada.

But streaming movies, taxis, and hotels are peanuts compared to what I am about to share with you.

You see, the disruption in this one industry alone isn’t worth just billions.

It’s worth trillions upon trillions of dollars.

In fact, Forbes called it “The $15 Trillion Gold Rush.”

In fact, Forbes called it “The $15 Trillion Gold Rush.”

And I believe that’s an understatement – especially considering that this $15 trillion gold rush is just a niche within an even bigger market – a dramatic revolution in the biggest industry in the world: Money.

In this report, I am going to show you:

- Why cash is no longer king

- How financial technology companies, or Fintechs, are changing the way you manage your money, pay your bills, pay for coffee – and how this could make a number of investors rich

- and the ONE Canadian Company that’s not only taking part in the digital disruption of money, but now has a big target slapped on its back because of a specific event that took place just last week. (This event has already propelled shares of this Company by 30% in the last few days, but I believe there’s more to come. Make sure you read on!)

The King is Dead, Long Live the King

How you pay your bills…How you plan your savings…How you buy a home…

Right down to how you buy your next cup of coffee…it’s all changing.

That’s because cash is no longer king.

Last week, I talked about:

- How everything you do in the near future will be done without the use of cash (when was the last time you used cash?)

- How countries around the world have become mainly cashless

- How governments are abandoning paper bills faster than ever, including India which just wiped out a whopping 86% of its paper money last year

- Why our children may probably never go to a bank when they’re adults

You may not know this, but the majority of our monetary transactions are already done without the use of cash.

According to the Federal Reserve Bank of San Francisco:

“In 2015, 32 percent of consumer transactions were made with cash, compared with 40 percent in 2012. Growing consumer comfort with payment cards and the growth of online commerce, among other factors, contribute to this trend.”

The Move to Digital

What may appear to be a simple change is actually a drastic step in the world’s evolution.

And in the near future, most transactions will simply be done using your phone, watch, or other digital devices.

In Denmark, the Danes are already moving away from paper and metal money. Almost a third of their population use an official Danske Bank app called MobilePay that links their mobile phone to other users’ phones or to a sensor at the till allowing them to confirm payments with a simple swipe on their smartphone’s screen.

In the UK, technologies like Paym allow users to transfer money to others by entering their mobile number.

Here at home, Google Wallet and Apple Pay turn smartphones into a contactless card, allowing you to tap your device against readers to transfer money.

Wealth and Power Through Transactions

Now imagine being able to take a small profit of every transaction someone does.

That’s serious power.

It’s no wonder companies like Visa and Mastercard – depsite some early hiccups – have done nothing but climb in share price since their IPO.

Take a look:

But even with their massive profits, they’re just a small piece of the pie.

Imagine what happens when everything you do – banking, bill payments, taking out a mortgage – goes mobile and digital.

Massive Investments into Fintech

It’s no wonder a record amount of money has been poured into Fintechs over the last few years.

Venture capital funding of the Fintech revolution has been staggering, with worldwide investment reaching close to $25 billion in 2015 alone.

And the space is heating up in Canada.

Via Globe and Mail:

“Venture capital-backed investment in Canadian financial-technology companies hit its highest level in almost two decades last year…”

And with good reason.

According to Mastercard, Canada ranked Number One when it comes to how ready we are to become cashless, and Number Two (after Singapore) in the speed with which we are abandoning cash for plastic or digital wallets.

This massive influx into Fintech investments is creating a new generation of companies disrupting everything from money management and payments to loans and even financial planning.

In fact, it is believed that Fintech disruption could take as much as 10 to 40% of bank revenue and eliminate 1.7 million banking jobs within the next 10 years!

But that’s not all.

Customers are embracing new FinTech providers, with 50.2% globally saying they do business with at least one non-traditional firm.

Combine the nearly 75% of Millennials who prefer to get their banking services from a non-financial services company with the 90% plus Generation X and Y kids who may never step in a bank, and the legacy big banks could be in serious trouble.

No wonder Scotiabank paid a whopping $3 billion for ING Canada just a few years ago.

Big Banks Need to Change

The Big Banks know their massive profits are in trouble.

But they have largely struggled because their legacy systems can’t keep up with the rapid shift in technology.

In fact, in order to keep up, the Big Banks applied layers upon layers of technological bandages – bandages built by third party groups!

According to IDC, via Bloomberg:

“…Canadian banks must transition from brick-and-mortar institutions into digitally driven businesses using global networks, software and servers to survive, IDC said in the report.

Currently, the country’s lenders are focused on sticking digital channels on top of existing operations…”a clear indication of a culture that is placing lipstick on legacy system pigs.”

“Canadian banks are at a threshold of deciding how to continue to support their legacy systems,” said Robert Smythe, who wrote the report along with Jason Bremner, said in a telephone interview.

“The banks have no option but to continue to focus on fintech investments, and they have to find a way to reduce the costs to maintain their legacy systems.”

Its no wonder 25 percent of the big banks see FinTech firms as potential acquisitions, according to IDC.

And aside from that 25 percent, another 35 percent said they would not mind collaborating with Fintechs.

That means more than 60 percent of all banks in the world see FinTech as a collaborator.

And the proof of that study has been evidenced by the mass acquisition and financings of Fintechs over the last few years.

Takeover is Ripe

Fintechs are being either gobbled up, or raising serious dough from big names.

Here are just some examples:

- Ant Financial To Acquire US Payment Firm MoneyGram For $880M

- Klarna to acquire German payments company BillPay for £60 million

- Daimler Financial Services acquires PayCash Europe SA

- BBVA buys Openpay, a Mexican online payments startup

- Singapore-based fintech investor Senjō Group acquires UK payments company Kalixa

- Vantiv Announces Agreement to Acquire Moneris Solutions USA

- Go-Jek acquires Indonesian e-payment startup MVCommerce

- Finance giant ICAP acquires FinTech company Abide Financial

- PayGate acquired by East African payments firm

- PayU Acquires CitrusPay For $130M, India’s Biggest Fintech Deal

- TerraPay expands footprint in 32 countries through acquisition of Pay2Global

- Mobile payment app PaidEasy buys Happy

Okay, you get the point. But, if you think this isn’t happening close to home, think again.

Just last week, Paypal offered $304 million to buyout Vancover-based fintech TIO Networks.

And that buyout just a massive target on the Company I am going to introduce in this report.

Better Timing

In the investment world, quite often it’s the big money guys who get in early and reap the rewards.

But what if I told you that you could invest in a Company at a massive discount to what the “smart” money – including Fidelity, Fortress, Telus Ventures, and even Michael Wekerle of Dragon’s Den fame – paid?

To make it more interesting, if you were to give a valuation equal to the average multiple based on Bank of Montreal’s EV/2018E revenue for Canadian fintechs to the Company I am about to introduce, it’s shares would climb by over 650%!

Not only that, what if I told you that the Company could be in store for its biggest year ever – so big, in fact, that it could challenge an industry worth billions of dollars and completely change the Company altogether?

Let me introduce you to…

Mogo Finance Technology Corp.

(TSX: MOGO)(OTC: MOGOF)

Mogo Finance Technology Corp. (TSX: MOGO)(OTC: MOGOF) is a Canadian financial technology company focused on building the best digital banking experience in Canada, with innovative products designed to help consumers get in control of their financial health.

Mogo Finance Technology Corp. (Mogo) represents a Company that is on the cusp of something amazing.

Many years ago, Mogo started off as an unsecured consumer lender with brick and mortar storefronts.

Seeing the massive shift from brick and mortar to digital taking place, its management transformed itself into an online lender in 2006, slowly replacing all of its brick and mortar storefronts.

But over the last couple of years, being digital wasn’t enough – you had to be mobile.

That’s precisely why Mogo and its management team spent over $120 million developing a mobile digital banking platform to take advantage of this massively disruptive opportunity.

And their perseverance is paying off.

In Q3 of last year, Mogo’s member base grew to nearly 300,000 members – an 85% increase from the year before.

Today, it has more than 350,000 members and growing.

With over 275 employees including 100 in technology, Mogo has one of the largest and most experienced fintech teams in Canada.

And unlike many of the startup Fintech firms with much higher valuations but little to no revenue, Mogo has a $50 million revenue run rate (based on Q3 2016).

So let’s talk about their platform and why I believe that they’re undervalued when compared to others in the space.

Leading Digital Banking Platform in Canada

Built mobile first, users can sign up for a free MogoAccount in only three minutes and get access to free credit score monitoring, a free spending account, mortgages and personal loans.

It’s a beautiful platform and all you have to do is download it onto your phone.

Like many other industries, banking is facing digital disruption because consumers, led by Millennials who are looking for convenient digital access to products that make it easier for them to manage and control their financial lives.

No one wants to stand and wait in line.

Unlike a typical bank account opening experience where you have to go to a branch and then wait in line, opening a MogoAccount happens in just a few minutes right from the convenience of wherever you are – 24 hours a day.

Of course, it’s a lot of work switching bank accounts – I’ve been there. But that’s not what Mogo is about.

In fact, the MogoAccount is designed to work alongside your current bank account, providing value and utility you aren’t getting from your bank or credit union.

It’s free to use and takes just minutes to link up to all of the major Canadian banks. Best of all, it’s extremely easy to setup.

And that’s extremely important in today’s world.

According to a report by Dealsunny, 44 percent of those who have adopted modern FinTech solutions, do so simply because of how easy it is to get started.

It’s no wonder why Mogo members are growing so rapidly – it takes only three minutes to open a Mogo account.

And once you do, you’re introduced to a suite of financial products – all integrated into one simple mobile platform.

A Suite of Innovative Products

Right now, Mogo offers 4 innovate products: Mogomoney (loans), Mogomortage (housing), Mogo Credit Score, and it just officially launched the Mogocard (spending).

Let’s start by taking a look at what I believe is not only driving members to sign up, but Mogo’s gateway to the next generation of banking consumers.

The Mogocredit Score

The Mogocredit Score

Mogo is currently the only free credit score check across Canada, and the only free mobile credit check in Canada, period.

Now, this may not sound important at first, but let me tell you why you should be paying attention.

Consider that both Equifax and Transunion charges roughly $16-20/month to give and monitor your credit score. That’s more than $200 per year.

Users of Mogo, on the other hand, can essentially get it all for free.

Not only that, the Mogo App will send you notifications and tell you every month how your credit is doing – all with no monthly fees and no hidden charges.

And it won’t affect your credit score.

But what appears to be a simple credit score check is actually much more.

The credit check works without affecting your credit score and allows Mogo to gain insight on its members and even prequalify them for a loan.

By giving away free credit scores, Mogo unlocks incredible value and potential – especially in our modern age of debt.

It is ingenious and powerful. Here’s why.

Imagine a recent graduate mired in student loan debt.

She needs a car for work, and in order to buy that car, she needs a loan.

When she applies for a loan, her credit score drops.

And since she has barely built up enough credit and has a massive student loan, she’ll likely be declined, which in turn, lowers her credit score.

But if she were to sign up for a Mogo account, she would know her credit score immediately and lenders (Mogo) could potentially offer a range of products to her – all without going through a credit score-lowering credit check.

In other words, once a member is tied into the Mogo system, the platform could eventually anticipate and provide everything they need, from loans to mortgages.

A Proven Model

In the U.S., Credit Karma has used this simple business model of attracting users with free credit scores and turned it into a $200 million+/year business (based on 2014 number) by offering those who check their credit scores a buffet of other financial products.

In fact, less than a couple of years ago, Credit Karma raised $175 million at a massive $3.5 billion valuation.

Here’s why this is important for Mogo…

As of 2014, it is estimated that Credit Karma had 40 million users, which means they generated an average of $5/user.

In Canada, there are 26 million people who have credit scores, and it’s estimated that less than 10% keep track of it.

Mogo is dominating the free credit score market in Canada because it is theonly Canadian company providing an all-mobile experience when it comes to free credit score checks and has the largest consumer base of members for that product.

If executed properly, Mogo’s free credit check alone could turn Mogo into a massive Company.

But I believe Mogo has an advantage over Credit Karma.

It has its own built-in financial products…

Mogomoney (Loans)

Imagine receiving a loan without going through the hassles of visiting a bunch of banks, then waiting weeks just to see if you’ll even qualify.

With Mogo, that is no longer the case.

Since Mogo “knows” its member’s credit score, it can offer them loans between $500-$35,000 with a wide range of rates.

Best of all, it takes only a few minutes for to see what they qualify for and it won’t hurt their credit score.

But that’s not all.

Mogoloans will remind them about payments, send a monthly account snapshot, and other important info about their financial health.

It will even turn borrowing money into playing a game

When was the last time your bank or credit card company lowered your interest rate? Unless you specifically ask for it, I would say close to never.

With Mogo’s unique Level Up program, members could earn lower rates simply by making their payments on time. Think of it like a game that gets you out of debt faster.

This is all part of the next shift and disruption in banking: an interactive digital banking platform.

But let’s say you don’t need a small loan.

How else can Mogo benefit from knowing your credit score?

The MogoMortgage

Just last month, Mogo entered the $1.3 trillion Canadian mortgage market – not as a lender, but as a broker.

In other words, Mogo takes no credit or funding risk but gets a high margin broker fee. When you consider that the average mortgage in Canada is approx. $300k with avg. origination fees around 1%, Mogo could generate $3k for every mortgage it originates.

With over $100 Billion in annual mortgage originations done through brokers, this represents a very big opportunity for Mogo.

How does it work?

Mogo has simplified the process and made it more engaging in a number of ways for consumers including:

An online and mobile process, from pre-approval until the mortgage is renewed or fully paid-off.

Experienced mortgage specialists available via online chat, email, and phone to walk through the process and help get the right mortgage for them.

Transparent advertised rates that are not only the actual rates, but are also market-leading.

The only mortgage experience that provides free monthly credit score monitoring to help track financial health.

A custom, interactive dashboard-the only one in Canada-that gamifies the experience of getting mortgage free, including rewarding members with perks like dinner on Mogo, to celebrate payment milestones annually.

Champagne on closing: members also get celebratory champagne sent to them on the closing of their mortgage.

Mogo just launched their mortgage offering last month, so I assume it will take some time before it catches on and we see how its members convert.

But I believe that the future of banking, including mortgages, will soon be integrated into a mobile platform with the type of interactivity Mogo already provides.

Right now, Mogo has obtained a mortgage broker license in the provinces of BC, AB, and ON, with plans to expand throughout Canada.

If Mogo is successful in converting its massive audience to their mortgage platform, it could be a major turning point for the Company.

But let’s say you aren’t ready to borrow money from a mobile platform just yet.

Mogo has something for that, too.

The Mogocard (Digital spending account)

This is the fourth product in Mogo’s line-up.

Mogo isn’t a bank, but it’s building all of the necessary platforms that traditional banks will soon need to adopt.

When you sign up for a Mogo Spending Account, it comes with a Mogo Platinum Visa® Card.

Like everything on Mogo, the digital spending account can be opened for free in less than three minutes through Mogo’s iOS mobile app or from a desktop.

The Platinum Prepaid Visa card is Chip/PIN and Paywave enabled, and funds can be transferred instantly from an existing bank account into the Mogo Spending Account through the mobile app.

This allows consumers to separate their spending money from their traditional chequing or savings account and is designed to help consumers monitor and control their spending in a convenient and engaging way, through features such as instant push notifications for real-time tracking of transactions and account balances.

There are no monthly account fees and, unlike a regular credit card, using the prepaid Visa means there is no risk of overdraft fees or interest charges.

It’s clear that Mogo is leveraging the power of their technology platform to deliver a digital banking product that is not only much more convenient but also gives consumers real-time data to help them manage and control their spending.

And unlike traditional bank debit cards, which charges you about $15 per month for unlimited transactions or require that you have a minimum balance, the MogoCard is free with unlimited transactions and no monthly or annual fee.

This consumer first mentality – no fees, interactivity, ease-of-use – is precisely what has been driving consumers to Fintech.

On the business side, the Mogocard can prove to be very profitable for Mogo.

Mogo earns a 2% interchange fee on the value of each transaction with a gross margin of about 50%, and 45% when it reaches scale.

The end user will never notice because these fees are collected from the merchants.

In other words, if Mogo is successful with its Mogocard, it could make millions taking a cut of every transaction its members make – just like Google or ApplePay.

Valuation

If we compare Mogo to its peers, it’s clear that Mogo is significantly undervalued.

Mogo currently has a market cap of just over CDN$60 million.

They have raised around $100M of equity and up to $400M total if you include available credit facilities – that’s more than any other Fintech in Canada as far as I am aware.

And for the first time since the IPO, Mogo now has two Fintech analysts covering them.

BMO just picked up coverage in January (picking Mogo as one of the outperforms alongside Paypal) and Canaccord joined last week.

According to BMO’s January coverage, the median multiple for Canadian Fintechs is 5.9x EV/2018E revenue and the average multiple is 7.5x EV/2018E revenue.

If Mogo were to get a rerate on its stock based on those numbers, its shares would be valued at over $18, and over $24 respectively.

It currently trades at just over $3.

But that’s not all.

When you start comparing Mogo to other Fintechs, you begin to see how undervalued Mogo really is.

So let’s talk about that.

The Comps

Paypal just bought Vancouver-based fintech company TIO Networks for over $300 million last week. This buyout sparked an immediate transition into Mogo, as we have now seen Mogo’s share price rise since that transaction.

Since there are numerous metrics when comparing companies, I’ll keep it simple and use basic back-of-the-napkin calculations.

TIO Networks had $74.7 million of revenue in its most recent fiscal year ended July 31

and was bought out for over $300M.

Mogo is expected to have around $50 million of revenue last year, and it has a market cap of barely over $60 million.

On the other side of the world, British app-only bank Atom is set to announce an equity investment of close to £100 million (CDN$163 million) in the next few weeks with support from its existing investors.

In late 2015, Atom was valued at £150 million (CDN$245 million).

I am not sure what the current valuation is, but considering that Atom Bank lost £22.5 million (CDN41.7 million) last year on income of just £46,000 (CDN$75,000), I’d say Mogo certainly has better metrics.

Next in line is Monzo, another digital-only banking platform in the U.K.

As it exists today, Monzo has more than 100,000 users who get access to a pre-paid MasterCard and accompanying iOS and Android apps – much like the Mogo offering.

However, Mogo has more than three times the member base, with over 350,000 members.

Like Mogo, Monzo offers the ability to do things like track your spending in real time. Based on its recent financing, Monzo is valued at £50 million (CDN$81.7 million) – again, higher than Mogo’s current market cap.

The Turnaround

Mogo went public in June 2015 during a hot IPO market.

And while the IPO raised the Company C$50 million at $10/share, it was priced just below the marketed range of $11-$13 in order to make room for a big time strategic investor of size.

Pricing the deal below its marketed range immediately put negative selling pressure on to the stock.

Then the Greek credit crisis hit and being in the financial space, Mogo’s share price continued to fall.

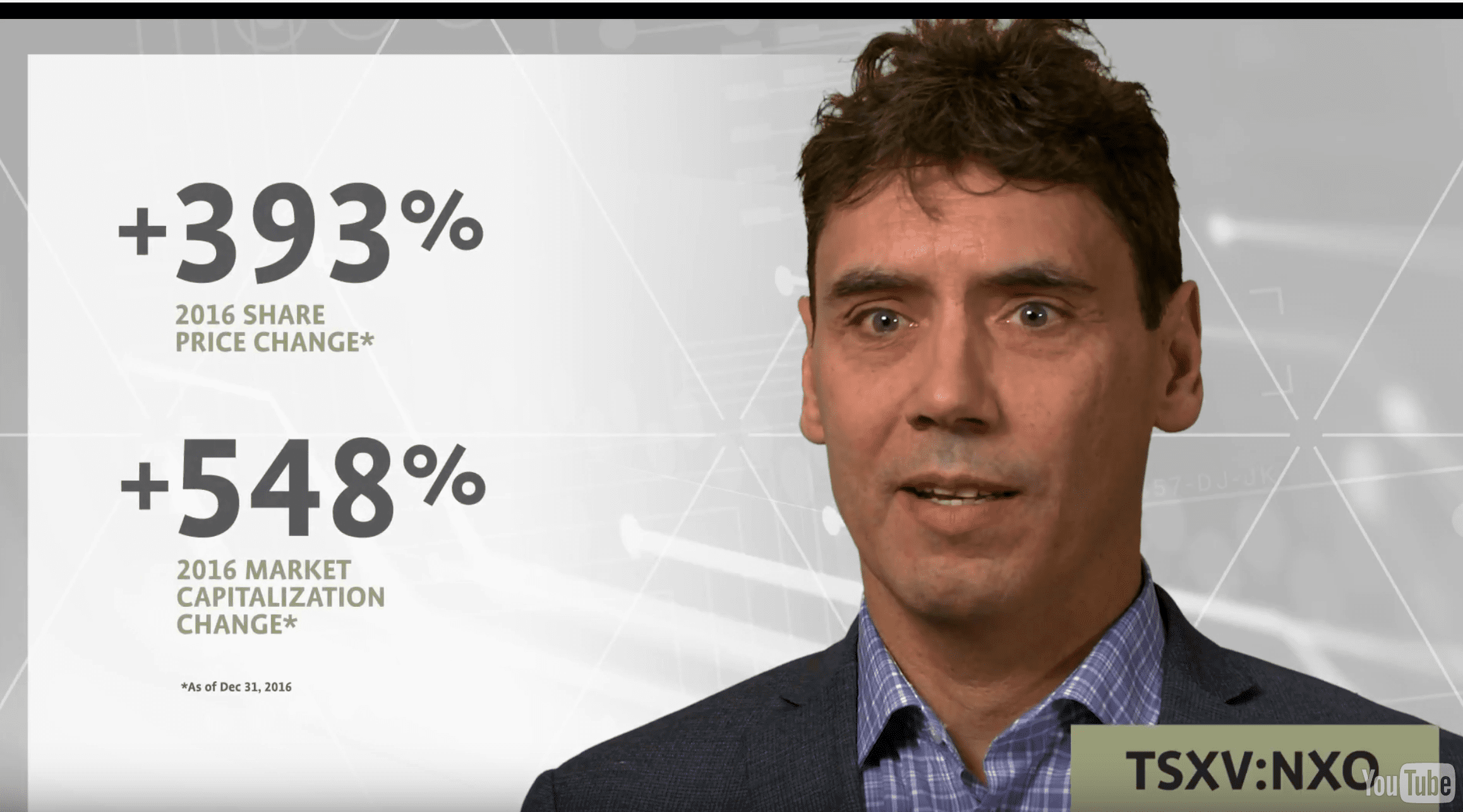

Yet, despite all of that, Mogo has grown organic revenue 86% year-over-year in 2015 and was the 2nd fastest growing company on the TSX behind Shopify.

But as a result of the rapidly shifting market in 2015, Mogo turned attention from the loan book to fee-based products last year.

In other words, 2016 was an investment year in building out the digital banking platform to position Mogo to launch products and continue to grow market share in the digital mobile financial space.

In fact, a number of milestones in 2016 went unnoticed by the market:

- Postmedia partnership (more in a bit)

- Launch of new digital banking platform and iOS app

- Hit positive adjusted EBITDA in Q3 – a quarter earlier than had been communicated to the market (actually the only public guidance given last year was EBITDA positive in Q4 which was achieved a quarter early)

All of last year’s milestones were achieved while significantly lowering their Cost Per Acquisition (from $135 in Q1 to $18 in Q4) and growing its member base from 186k at the end of 2015 to 350k in Jan 2017.

I believe Mogo is now positioned this year to reap the benefits from the investments made in 2016.

More importantly, investors now have a chance to participate in Mogo at a much cheaper price than some of the big players that invested in Mogo in earlier financing rounds.

Take a look:

- Mogo Raised $40m privately @ $5 and$9 per share led by Fidelity, Fortress, and Telus ventures.

- Mogo IPO’d on the TSX @ $10 per share, with top banks in Canada leading the transaction: BMO, CIBC, National Bank, Canaccord, and Cormark.

Today, the largest institutional investors in Mogo are Fidelity and Fortress (which was just acquired by Softbank, the largest Fintech investor on the planet.)

Lastly, insiders own over 40% – and are still buying!

A Strategic Marketing Partnership

Mogo has signed a 3-year partnership with Canada’s largest newspaper network, Postmedia.

Through this partnership, Mogo receives a minimum marketing spend of $50 million over three years – that’s close to Mogo’s entire market cap!

In return, Mogo pays just $2M/year, gives up 1.2M warrants @ $3 per share that vest over 3 years, plus a revenue share during the period of the agreement.

All of this means Mogo has a marketing budget that rivals what the big banks might have, but at a much lower cost.

No Risk, No Reward

As I always say, there are risks involved when investing in any company – big or small.

The most obvious risk in my view is execution: Can Mogo execute and convert its massive audience into consumers of their product? Their business model is sound and has already been proven out by companies like Credit Karma in the U.S.

Given what management has been able to do, I believe they can.

Access to capital is another risk. Mogo currently has over $20 million in the bank but Mogo is an advanced digital platform which costs a lot to maintain and develop. If they can’t raise money in the future, it would certainly slow down their momentum.

However, we should note that Mogo currently has up to $250M in credit facilities available from Fortress, but is currently only using <$50M.

There is also the risk that large banks try and attempt to enter the space more aggressively. Almost every major bank has ramped up spending with Toronto-Dominion Bank bringing some 2,000 people into its technology group last year, with plans to add another 1,000 in 2017. But again, these big banks are handcuffed by legacy systems and a cobweb of decision makers.

Then, of course, there are economic risks. Many believe that Canada is on the verge of a housing bubble that could pop at any time. This could affect Mogo’s new mortgage business.

Furthermore, there is nervousness surrounding the overall stock market given that it continues to hit new highs. Can this momentum be sustained?

Of course, no one can truly time or predict how those outside forces will play out.

And as I always say, we should focus on what we know rather than speculate on what we don’t.

In the end, I believe Mogo is at a turning point not only in their business but in the price of their stock.

Take a look:

If Mogo shows that it can execute in the coming quarters, it could become the next big digital banking platform in Canada.

If Mogo shows that it can execute in the coming quarters, it could become the next big digital banking platform in Canada.

With a market cap of barely over $60 million, the upside, in my opinion, outweighs the risk. I am certainly an investor at these levels.

Lastly, we should consider that the Company has an extremely tight capital structure.

It currently has just over 18 million shares outstanding, with a large chunk of it in the hands of insiders (who are buying).

This is both good and bad.

The bad news is that it could be hard to snap up stock at current prices since it appears there aren’t many sellers at these levels.

The good news is it if investors can get in early, it won’t take much buying for the stock to move higher, evidenced by how fast the stock has climbed since the TIO Networks (a Mogo comp) offer by Paypal just this past Tuesday.

Of course, if Mogo executes and begins to trade anywhere near the average Fintech in Canada, its share price should be much, much higher than where it is today.

Conclusion

If I had more time, I could give you a plethora of examples and comparables as to why Mogo’s share price should be higher.

But you get the point.

The Big Banks need to start transforming themselves from inflexible, analog monoliths to delivering highly personalized digital experiences in order to be relevant to the next generation of banking consumers.

That’s precisely why Mogo has a clear advantage and could be in line to even disrupt the Canadian banks should it execute on its business model. But the best part is, it doesn’t have to disrupt them in order to succeed.

In an industry where the executives believe digital disruption will drive 40% of companies out of the top 10 in the next five years, the potential exists for some massive wins for early investors in the space.

Over the next decade, Millennials will be the largest consumer of financial services products.

They have grown up in a mobile digital world and have grown accustomed to a mobile-first mentality.

When it comes to financial services, they will opt for the same easy-to-use digital experiences in banking that they get in all other aspects of their lives, just like they do with Netflix, Uber, Air BnB, Amazon, and Paypal.

This change is already happening.

CNBC said bank branches are evolving…and shrinking:

“JPMorgan Chase reduced its number of branches by more than three percent year-over-year in 2015, and trimmed even more to start 2016. Over the last three years, a representative for the bank said JPMorgan Chase teller transactions fell by more than 100 million as consumers have increasingly adapted to digital payment options.”

Global News said Canada’s Small Town Bank Braches are Doomed:

“…Falling foot traffic to branches has been a measurable trend at U.S. bank branches for some time, with institutions shrinking their retail networks accordingly. For its part, Scotiabank said last fall it was shuttering 120 international branches as it centralizes and automates some processes.”

And Commercial Observer said that, “A significant decline in branch foot traffic has become an industry-wide trend.”

Banking has been digitalizing rapidly, and the large Canadian banks are doing whatever they can by focusing and spending millions on digital banking,while removing a legacy workforce.

As I have said before, unimaginable wealth and power will go to those companies who take over from traditional currencies.

In Canada, Mogo could take advantage of this shift.

As CNBC put it, “Could Mogo be the Uber of Finance?”

We shall see.

Mogo Finance Technology

US Trading Symbol: MOGOF

Canadian Trading Symbol: MOGO

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure: We’re biased towards Mogo because they are an advertiser. We currently own both shares of the Company and options. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Mogo. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Mogo and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Wow everything is positive………how much were you paid to pump this baby???

Call me old fashion but how about the HACKING of all these accounts…….security anyone???

I cut up my Target and Home Depot cards when they were hacked.

Has any hacker been caught or sent to jail or prison??? Internet wireless hacking is very rewarding!!

What about the companies own Tech. employees hacking or passing customer info to hackers???

So this fintech will kill millions of bank jobs. I guess they can become Internet Hackers.

For now, I like my brick and mortar bank. They have names and addresses.

When I start seeing public executions of Hackers, I may be more likely to get on-board.

I may buy some stock, knowing the stupidity of Millenniums who go “Gaa-Gaa Goo-Goo” over unproven

Tech stuff. Example: UBER So just how many women have been driven away to be RAPED!!??

Enjoy your news letters.

Nobody