Dear Readers,

US markets continued their climb into Friday’s close with the S&P 500 capping its longest streak of gains since late 2010, closing up to 1405.87.

The Dow Jones Industrial average rose 42.76 points to 13207.95.

As I mentioned on April 1st, I am still calling for the S&P to climb above 1500 – despite the worries and negativity from the media:

My call continues: I expect the S&P 500 to be trading above 1,500. While this would still be below its all-time high of 1,565 set in October 2007 (a key psychological number), it would be just enough to take the Dow to around 14,300, beating its high in October 2007 high by a couple of hundred points.

Keep in mind I am basing these numbers on a lot of technical and historical data. While I have no doubt that the US is recovering, I just don’t believe it’s recovering from a true fundamental growth standpoint – and not nearly as fast as the market tells us. Of course, the market is forward thinking historically by 6-12 months…”

Before we get ahead of ourselves, I need to make one thing clear: This is temporary. While I believe it will continue due to further stimulus, reality will eventually kick in. We are without a doubt in a great secular bear market; within it we will have cyclical bull and bear markets.

Because GDP growth has been artificially stimulated through cheap credit, most of the growth in the US is a result of borrowed money that may never be paid back. As Bill Gross, PIMCO CEO, recently mentioned, “accounting acts of magic aside, this and other developed countries have for too long made promises they can’t keep, especially if asset markets fail or respond as they have, historically.”

A couple of weeks ago I mentioned that, “in Q2 America added $2.33 in debt for every $1 in GDP…Never have I studied a scenario like this that hasn’t ended in disaster.”

GDP growth, earnings, and quarterly statements have been the biggest focus for stock market participants. Thus far things haven’t been too bad. But the biggest problem facing our market is not poor GDP growth, poor earnings, or poor quarterly statements; it’s our debt crisis.

The Debt Crisis

The facts are simple. There is a lot of money that will never be paid back and the only way to prevent further disaster is to print more money.

I mentioned that there are only two choices to deal with this fiscal mess:

- Let the world’s financial system collapse (defaults)

- Print more money/expand credit, destroy currency

Obviously option one is politically intolerable for rich, developed nations and would lead to ultimate disaster. As a result, debt-to-GDP ratio for the world’s largest economy and world reserve status superpower has already exceeded the 100% mark.

According to world renowned Carmen Reinhart and Kenneth Rogoff of Harvard University, a threshold of 90% debt-to-GDP is the trigger of a debt crisis. In other words, the US is in the middle of one right now.

The Solution?

In a 2011 NBER working paper, Carmen Reinhart and Belen Sbrancia noted that throughout history, high debt-to-GDP ratios have been reduced by:

- economic growth

- a substantive fiscal adjustment/austerity plans;

- explicit default or restructuring of private and/or public debt;

- a sudden surprise burst in inflation; and

- a steady dosage of financial repression that is accompanied by an equally steady dosage of inflation.

It’s clear that both options 1 and 2 are not working. Option 3, as I already mentioned, is politically unacceptable for rich, developed nations. Option 4 is also out of the question, given that in a normal bond market investors demand a higher interest rate to fight off inflationary risk. Let’s not forget that we’re already experiencing negative real interest rates in the US.

That leaves option 5 as the only logical progression.

In their paper, they define financial repression as:

- Explicit or indirect caps or ceilings on interest rates, particularly (but not exclusively) those on government debts.

- Creation and maintenance of a captive domestic audience that facilitated directed credit to the government.

- Direct ownership (China or India) of banks or extensive management of banks and other financial institutions (i.e. Japan) and restrictions of entry to the financial industry and directing credit to certain industries

By their definition, we are going through a financial repression right now:

- Interest rates amongst most of the rich nations are already at all-time lows and there are commitments to keep them low for an extended period of time, resulting in negative real interest rates.

- The biggest purchasers of government bonds have been the central banks. As mentioned in my letter, A Shocking 2011 Cover-Up:

“The Fed is in effect subsidizing U.S. government spending and borrowing via expansion of its balance sheet and massive purchases of Treasury bonds. This keeps Treasury interest rates abnormally low, camouflaging the true size of the budget deficit. Similarly, the Fed is providing preferential credit to the U.S. government and covering a rapidly widening gap between Treasury’s need to borrow and a more limited willingness among market participants to supply Treasury with credit.”

- New Basel III liquidity rules will force banks to hold even more government debt. Countries around the world have already begun to drastically increase their holdings of government debt and this will continue – especially with a European-wide banking supervisor (see New Rules for Banks that Will Change the World)

When you add it all up you can see that this goes back to the only two options available:

- Let the world’s financial system collapse (defaults)

- Print more money/expand credit, destroy currency

Option 1 is clearly out of the picture. That means option 2 is inevitable. With option 2 comes the steady rise in inflation. The more noticeable effects of inflation will eventually show up and the few percentage gains you make on your stocks (see Everything has Changed) will be overshadowed by the rate of inflation. The world’s largest money manager, Bill Gross, calls it the death of equities.

Beyond Our Reach

What the governments do once we elect them into power is beyond our control. As a result we will see gold continue its climb. The sentiment amongst many of the big money managers I speak with has grown more bullish towards gold and gold stocks in the past week. It seems that from both a technical and sentiment standpoint, gold stocks have finally found their support.

Many gold stocks broke out last week. The Market Vectors Gold Miners ETF (GDX) climbed nearly 4% and the Market Vectors Junior Gold Miners ETF GDXJ nearly 3.5%. While that doesn’t seem like much, there were certain gold stocks that had more significant breakouts.

One was Detour Gold which climbed nearly 9% in just four short trading days.

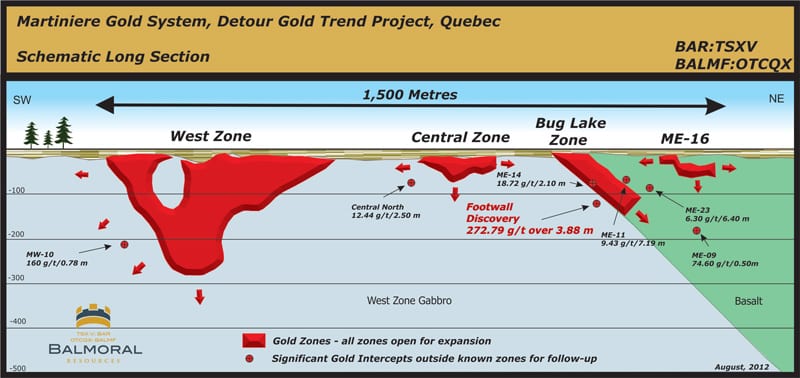

Detour Gold is set to become Canada’s largest gold mine next year. As a result of Detour’s climb, one of my favourite explorations play right now, Balmoral Resources Ltd. (TSX.V: BAR) climbed nearly 25% – that means readers of this letter are doing well.

While my current focus is not on exploration plays, Balmoral is a clear exception. Their flagship property is sitting right beside what will become Canada’s largest gold mine and management continues to hit high grades everywhere. In short, they are a prime takeover target. M&A activity is heating up in this sector and I have no doubt Balmoral will be high on the list of takeover candidates. I love the management team led by Darin Wagner; these guys have done it before and I expect them to do it again.

You can see my original Balmoral Resources report, A Recipe for Success, by CLICKING HERE.

The Primary Focus

In this enviroment it’s important to focus on the cash flow of producing gold companies because that is where the big money will go first. When the big money reaps the rewards of these companies, they will take their profits and pour money into the more speculative side of the gold market.

A few weeks ago I mentioned that an easy way to start filtering good gold stocks is to look for the ones that have already bounced from their 52-week lows on good volume.

What I am Buying

I stress that while gold stocks are undervalued, there are many of them that are much higher on my radar than others.

Barkerville Gold was one of them and it has already climbed more than 100% since my mention of them in my interview with the Gold Report (see here). I have taken them off my radar as a result and I am now focusing on a new gold producer that is making lots of cash and is expected to decrease cost and increase production within the next few months – exactly what you want from a producer.

This company has broke from its bottom last week and I believe it has much more room to climb. I will have a chat with management next week. If it all checks out, I’ll let you know what I am buying next.

If you believe in gold stocks as I do, August may be one of your last chances for bargain hunting.

Until next week,

Ivan Lo

Equedia Weekly

Disclosure: I am long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies. Balmoral was an advertiser, but is no longer at the time of this report. However, we do own shares in Balmoral. That means I am biased. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will.

Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Companies do pay us to advertise on our website and we often distribute our reports on featured companies. While we are never paid to write a rosy and positive report on any company, we do market our reports using the advertising fees paid for by our featured companies.

This process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. Our revenue is generated by sponsor companies and we grow our readership by using the advertising fees we charge to distribute our reports. This helps both Equedia and our client companies gain exposure and allows us to provide you with our research at no cost.

Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. We own shares in Balmoral Resources which was purchased after our initial report.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

Hi to all, it’s genuinely a good for me to pay a visit this web site, it includes precious Information.