Why are Gas Prices So High?

Dear Readers,

Yet, there isn’t a shortage of crude oil; actually, quite the opposite.

U.S. inventories hit a new weekly high last week, with monthly inventories rising to levels not seen since 1931. Canada, on the other hand, is already an oil-producing powerhouse but one that’s now experiencing a dramatic increase in natural gas production.

So why are we getting cheated at the pump and paying extravagant fees for heat?

I’ve read everything: from the spring time refinery turnover (where refineries shut down for maintenance in preparation for the busy summer driving season), to shrinking storage supplies in Cushing, Oklahoma, the delivery point for the delivery point for WTI futures, where inventories have fallen back to October 2009 lows.

While these reasons all add to the rationale behind high (er) gas prices, it’s by far not the whole truth.

Canada: An Oil Producing Powerhouse

When we hear complaints of high gas prices, we’re generally talking about the stuff we put in our cars: gasoline.

Gasoline is derived from crude oil. One barrel of oil generally produces around 19 gallons of gasoline, but there are also costs associated with refining it and transporting it back to market where you pump your gas.

For example, in 2011, refining costs made up about 11% of the total cost of gasoline.

Canada exports nearly three million barrels of oil per day. With this much production, you would expect we should all get a little break on prices at the pump.

But we don’t.

That’s because all of this oil needs be refined for commercial use.

Furthermore, there aren’t many refineries in Canada that can accommodate the amount of oil we produce.

As a result, most of the oil from Canada is shipped down to America for processing.

When you combine both transportation and refining costs, the profit margins for refiners using WCS is less than they would get from processing WTI.

That means if we want refiners to take our Canadian oil, we have to sell it to them for less – a lot less.

The spread between WTI and WCS has recently been in excess of $30 per barrel. Since Canada produces about three million barrels per day, it means we could be losing $90 million in revenue every day.

That’s why major campaigns backing the Northern Gateway and Keystone XL pipelines are taking place. These pipelines will alleviate the costs of getting Canadian oil more quickly and efficiently to export markets and refineries on the Pacific coast and the Gulf of Mexico.

What Do You Think Canadian Oil and Gas Prices? Do You Support the Pipelines?

CLICK HERE TO SHARE YOUR THOUGHTS

Why Do We Ship Oil to America?

The simple answer would be for Canada to build more refineries, instead of shipping it down south.

However, a recent report by the Conference Board of Canada showed that it would cost up to $7 billion to build a refinery capable of processing Canadian oil; yet, the returns are rather dismal – especially when you consider the lower Canadian Dollar.

Over the past decade, pre-tax returns in the refining industry have averaged only 11 per cent per year.

It’s no wonder why Canada has lost 50% of its refineries over the last 40 years. Even in oil-rich Alberta, oil refining accounts for only about 0.3 per cent of GDP.

With nearly 60 refineries practically sitting idle on the U.S. Gulf coast, it’s pretty hard for investment dollars to filter into Canadian refineries that are likely destined to have diminishing returns.

So while Canada remains an oil-producing powerhouse, most of our oil is sent down south for processing, before it’s sent back to us for use.

Since it’s easier and cheaper to pipeline product in from the U.S., most Canadian refiners have taken the position of exiting the market. As a result, much of the gasoline used in Eastern Canada isn’t even Canadian at all.

The added costs of transport and refining have all led to higher gas prices for Canadians.

What’s worse is that since we have to buy gasoline (refined oil) from America, even if it was ours to begin with, we have to pay for it in American dollars. That’s an immediate 10% premium given the recent decline of the Canadian dollar against the Greenback.

Canadians are getting hit both ways; the price of oil we import is going up, while the price we export is going down.

Furthermore, much of our oil requires natural gas to produce.

Oil sands companies need natural gas to heat water to create steam, which softens oil-rich bitumen deposits to the point where the bitumen can drain into wells from which it can be pumped to the surface.

So as natural gas prices rise (which they have), so do the costs associated with much of the oil produced.

How lucky are we to have significant amounts of crude and natural gas, yet also the highest natural gas and gasoline prices?

Here’s quick average look at the per litre gas prices across the country as of last week:

- Victoria – 142.9 cents

- Vancouver – 151.7 cents

- Calgary – 128.9 cents

- Edmonton – 125.9 cents

- Regina – 128.9 cents

- Saskatoon – 132.9 cents

- Winnipeg – 127.9 cents

- Toronto – 140.3 cents

- Ottawa – 139.3 cents

- Montreal – 151.4 cents

- Quebec City – 141.4 cents

- Fredericton – 140.5 cent

- Moncton – 140.5 cents

- Saint John, NB – 140.5 cents

- Charlottetown – 139.7 cents

- Halifax – 143.3 cents

- St. John’s – 147.3 cents

What’s the price at the pump in your city?

America: The World’s Largest Producer of Natural Gas and More

Canadians can blame the high costs of oil on the high costs of importing oil back into our country, but what about Americans?

How come Americans are also being hit with high oil and gas prices?

America’s oil production has risen nearly 50% since 2008 and domestic production is finally climbing after almost twenty years of decline.

Basic supply and demand fundamentals would suggest that since inventories are now back to all-time highs, oil prices should be much cheaper.

But it’s not.

Why hasn’t the cost of oil and gas come down for Americans?

Sure, drills are turning everywhere and fracking has made oil much more available domestically.

But much of America’s newly found production comes from shale formations or in deposits under the ocean floor, which is hard to access and thus, expensive. Places like Montana and North Dakota’s Bakken Shale may contain major oil deposits, but individual wells tend to produce little oil, so you have to drill many wells and that takes a lot of investment dollars.

So yes, it costs much more to produce oil now than it used to – just as it is for mining.

Still, the increased costs of oil production are far from the main reasons why oil and gas prices remain so high.

Who Sets the Price?

Violence didn’t drive the price of oil up, as many media sources will tell you – speculative traders did.

A couple of years ago, there was a great article from New York Times talking about this exact scenario. It explained how traders were the primary reason for increased oil prices:

“…By 2008, eight investment banks accounted for 32 percent of the total oil futures market. According to a recent analysis by McClatchy, only about 30 percent of oil futures traders are actual oil industry participants.”

That means speculative trading exceeded actual supply and demand fundamentals.

Furthermore:

“According to Congressional testimony by the commodities specialist Michael W. Masters in 2009, the oil futures markets routinely trade more than one billion barrels of oil per day. Given that the entire world produces only around 85 million actual “wet” barrels a day, this means that more than 90 percent of trading involves speculators’ exchanging “paper” barrels with one another.

Because of speculation, today’s oil prices of about $100 a barrel have become disconnected from the costs of extraction, which average $11 a barrel worldwide. Pure speculators account for as much as 40 percent of that high price, according to testimony that Rex Tillerson, the chief executive of ExxonMobil, gave to Congress last year.”

The upstream price* (total costs) of oil production in America currently averages $33.76.

(includes lifting and finding costs. Lifting costs are the costs to operate and maintain oil and gas wells and related equipment and facilities to bring oil and gas to the surface. Finding costs are the costs of exploring for and developing reserves of oil and gas and the costs to purchase properties or acquire leases that might contain oil and gas reserves.)

Yet, oil prices remain above $100 per barrel. Go figure.

Natural Gas Prices Rising

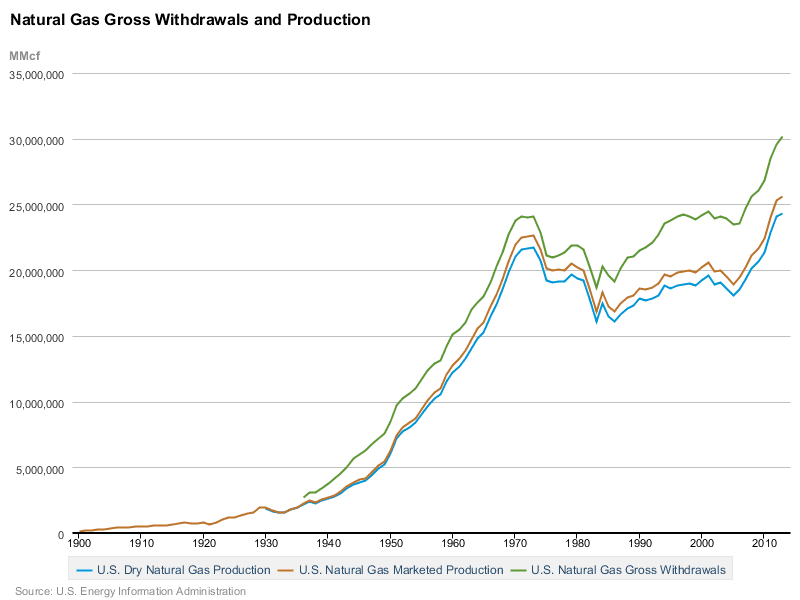

Canada and the U.S. are producing more natural gas than ever.

Canada is the world’s third largest producer of dry natural gas with production of 13.9 billion cubic feet per day.

America’s is now the world’s largest producer of natural gas, surpassing Russia last year:

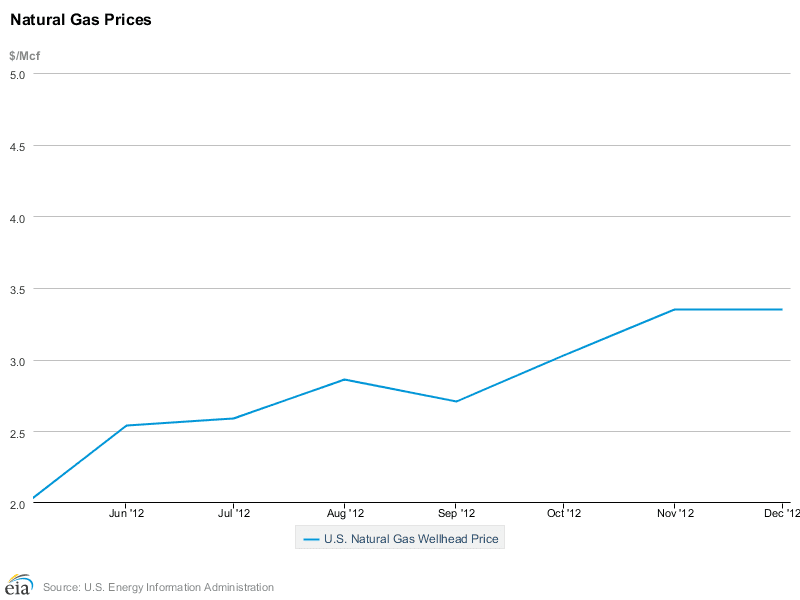

While natural gas prices have fallen dramatically over the last decade because of rising production, it doesn’t explain why prices have doubled in the two years since May 2012 from $1.94 to today’s price of $4.65.

Yes, we had a harsh winter and used more gas, but that doesn’t account for the rise in price prior to the summer:

The real reason is quiet simple: profit.

Making Money at Our Expense

The U.S. is a net exporter of natural gas. It is estimated that over 60% of all natural gas production leaves the country. Take a look at the dramatic increase in natural gas exports:

Canada is no different.

Canadian gas supplies earmarked for LNG exports continue to rise. The total export license volume for LNG is now up to 238.33 Tcf (trillion cubic feet), while reserves sit at 68 Tcf. Annual allowed volumes for LNG export is now at 9.48 Tcf, while Canada currently produces just over 5 Tcf per year and consuming around 3 Tcf per year.

You can do the math.

Battling Russia

As I mentioned in my letter, “Will America Save Europe?” LNG is part of Obama’s plan to pay for all of the massive deficit spending that has taken, and continues to take, place in America. This strategy is essentially mirroring Russia’s, who has been exploiting its natural gas resources for many years and succeeding.

If the price of gas drops, America wouldn’t make much money exporting gas supplies to Europe via LNG, since it has to compete Russia, whose gas can be sent to Europe at a much lower cost via pipeline.

The added revenue from exploiting oil and gas could prevent America from its financial destruction.

Oil and natural gas companies pay a lot of taxes. In 2012, the effective tax rate for the industry averaged 44.0 percent, compared to 26.6 percent for other S&P Industrial companies.

That is the highest tax rate in the US for any sector.

In addition, oil and gas companies also pay the federal government significant rents, royalties and lease payments for production access.

Overall, America’s oil and natural gas industry supplies over $85 million a day to the U.S. Treasury in the form of income taxes, rents, royalties and other fees. That adds up to more than $30 billion a year.

With pro-energy development policies taking place, the oil and gas sector could produce at least $800 billion in additional cumulative revenue to the government by 2030, according to a study by Wood Mackenzie.

Without proceeds from LNG exports, America is doomed to financial failure.

A New Energy Partner?

The battle in Ukraine, Syria, or simply Russia vs. the West, all stems from energy (see The Real Reason for War in Syria).

This is where Russia has been sticking it to America. Not only does Russia already control the flow of gas into Europe, it’s about to strike a deal with one of the largest consumers of energy on the planet: China.

After a 10-year series of talks, Russian President Vladimir Putin is expected to meet with China in May to finalize the agreement. I told you about this last month and we will soon see what happens.

If Russia can negotiate a gas agreement with China next month, it will have an upper hand in the battle for energy dominance.

Pipelines are already being built through Mongolia, which likely means it’s only a matter of time before gas starts piping through.

This could also affect anticipated LNG shipments from Canada, as LNG costs more than pipeline gas.

Aggression Rising

America is feeling desperate and has finally persuaded other Western nations to follow.

Within the past few days, there have been rumours of Washington sending additional troops to Poland and the Baltics for NATO exercises; this is the front line of the former Soviet periphery.

Meanwhile, American financial services company Standard & Poor’s downgraded Russia’s credit rating from BBB to BBB -, which is considered the lowest investment grade by market participants. This was clearly a political blow to Russia.

But more importantly, the G7 have agreed to intensify sanctions against Russia over the Ukraine crisis, with a US official warning some punitive measures could be imposed as early as Monday.

As a result of the intensifying aggression between both sides, Russian presidential adviser Sergei Glazyev proposed a rather radical plan of 15 actions to protect Russia’s economy if sanctions were to be applied:

- Translation of state assets and accounts in dollars and euros from NATO countries to neutral ones.

- Returning all state-owned assets (precious metals, works of art, etc.) to Russia.

- Begin selling NATO member sovereign bonds before sanctions are imposed.

- Termination of export of gold, precious and rare earth metals.

- Monetary swap with China to finance critical imports and transition to settlements in national currencies.

- Creating own system of exchange of information for interbank payments and settlements

- Creating a payment settlement system of bankcards like Visa and MasterCard.

- Limiting foreign exchange position of banks, the introduction of preliminary declaration of major non-trading foreign exchange. Introduction to future tax on capital outflows and financial speculation.

- Russia should use national currencies in trade with customs Union members, other non-dollar, non-euro partners and conclude new contracts for the export of hydrocarbons in rubles.

- Monetary swaps with countries to finance trade.

- Rapidly decline reserves dollar instruments and debt obligations to the countries supporting sanctions.

- Substitution of state corporations and state banks loans in dollars and euros ruble.

- Advocate citizens of to expedite the transfer of euro and dollar deposits into rubles, just in assets of state banks in the U.S. and the EU are frozen.

- In response to the trade embargo – the implementation of critical operations through Belarusian and Kazakh enterprises.

- Converting offshore ownership of strategic enterprises, subsurface objects and properties to national jurisdiction.

Many of these points, while radical, make a lot of sense.

Despite sanctions, there will be many nations who will accept the ruble in payment, which is why monetary swaps with countries can combat much of the sanctions imposed. Think China, for example.

The battle between Russia and the West continues to heat up and it’s not going away anytime soon. I’ve mentioned this over the past year and it is very real and not something to take likely.

Just over a year ago, I received a letter from a reader saying that I was a fear-monger for explaining the situation with Russia and the current financial/energy battles around the world.

Today, it’s slowly unfolding.

As I write this, Ukrainian Prime Minister Arseniy Yatsenyuk just told the world that Russian military aircraft had crossed the country’s airspace seven times “to provoke Ukraine to start a war”.

NATO estimates that 40,000 Russian troops are massed on the Ukraine border, and appear to be in a state of readiness to invade.

I can say with confidence that this won’t end well. Something drastic will happen out of this battle that will significantly affect our money and our portfolios.

Look for traders to create big swings in the market in the coming months on the progressive aggression overseas.

The Equedia Letter

$1.529 per litre in South Surrey, BC

Wow. Sucks to be you.

I guess voting for that carbon tax in Vancouver was a good idea.

How much is the provincial sales tax in BC? 8%?

Why British Columbians put up with the theft from right and left parties is beyond me.

Politicians spend money to get elected, then tax everyone to pay for it. In the end we all get shafted with higher prices in gas and oil, because it has to pay for the spending the politicians do.

EXCEPT MEMBERS OF PUBLIC ARE NOT WILLING TO DO ANYTHING ABOUT IT. IN B.C WHINING AND BITCHING IS AS FAR AS IT GOES….AFTER THAT, BACK TO THE SAME OLD, SAME OLD….YOU GET WHAT YOU ELECT.

What is the single largest component of the price of gas?

Taxes…provincial, federal and carbon taxes. The locations with the highest prices have the highest taxes. Consumers voted these taxes upon themselves and are getting what the asked for.

Someone should list a CDN Gasoline ETF and then everyone can shut up and hedge themselves. I am tired of this topic each year. We vote taxes on ourselves, close refineries and bail out auto companies so they can offer 0% financing (ie more cars on the roads) and then whine about high prices?

For the amount of time that the XL-Keystone has been bantered about (years), Alberta could have completed two refineries capable of converting the WTC into gasoline and other products. Then Canadians would have cheaper gasoline but I’m sure the industry would come up with yet another excuse.

Sorry, the WCS.

You may be right, but a few refineries is not enough to keep up with the demand. You would need billions of dollars to put up a few of these and still that won’t be enough for refine all the gas that Canada produces. That’s why the pipelines are key.

Let’s also remember that we produce far more oil than we need, as this article mentions. Adding more refineries and then shipping it elsewhere would be a waste of money. It might save Canadians 10-11% on costs, but it would be minimal profit for refineries.

If you’re a Company doing business, why would sell gas for cheap when you can sell it for more? Duh…

As a Canadian, why would I sell oil cheap to the US and then buy it back for a lot more. Also, the price of the XL rivals a new gas plant

or two not to mention they could have been online by now.

So you’re saying that for the next 40 to 50 years (or however long oil is produced in Canada and shipped to the USA for processing) that the Canadian government will continue to lose that revenue. And that is acceptable to the government? The oil companies will use any excuse that they can get away with while they continue to screw Canadians at the pump and loot the wealth of the country. They are willing to spend tens of billions of dollars to build the pipeline but they won’t spend the seven billion dollars to build a refinery! How long would it take to recover the cost of building a refinery in Canada? Is there a political party in Canada that is willing to stop this looting of Canadian resources?

This was considered in the article. It should be do-able if only for strategic resource purposes. Hard to see it being economically viable with existing refineries sitting idle, all costs paid.

Finally someone who reads the whole article before commenting. Agreed.

Canadian government royally screwed due to the Trade Agreements established since the Maroney times 1974.PC government.

This is a major Monopoly by the big guns. Its a bad deal for us the people. Does it make sense to ship things down then ship them up .

Who is benefiting.. The tax collector and a few parties not to be mentioned here. We know who you are.

Politicians work for a corporation called the government. They cannot serve totally the public who actually suppose to be the government. They give us a little bid here and there to keep us quiet. Even if we give them the power to implement policies there are forces behind the curtains that control all aspects of what we experience ((believe me there are ways to change this)) Therefore Politicians end up working for the corporation and mind as well acquire what they can for themselves. Now some politicians will try to stand up for what is right but soon find out that very few un-elected make the decision making. Any understanding of economics will show their trace of influence all over the world. The more people get to understand how things are done then eventually with a majority changes may be initiated. Till then very little changes to the current status quo..

This thing about refineries is nothing more than ways of hiding the tax dollar we all pay etc.

THINGS MUST BE MADE CONFUSING FOR THE MASSES NOT TO GRASP THE ACTUALLITES OF EVENTS. THE ENFORCEMENT OF THE MOST POWERFULL ASSET….THE LABOR OF OUR PHYSICAL BODIES.. has been done and will continue to be the plan , including WARS.

So much we can accomplish , only if the majority would stand up and said NO…WE,VE HAD ENOUGH of these economics.

Peace….

If the lefties and greenies in BC would only realize that they are being “had” by rich US funds who want to make sure that we can only sell our oil to them and stop blocking Kinder Morgan and the northern Gateway, the better off we will be.

Keystone Pipeline – Yes

Kinder Morgan Trans-mtn – No

Northern Gateway-No

two thumbs way up!

Could you quantify how America is currently exporting that amount of Natural Gas please? As far as I knew Cheniere was the only export facility and it is not ramped up yet.

I believe that a global economy is one of the worse happenings we have had to endure.

I believe that speculation should be outlawed.

I believe that governments should take a lesson from a well organised, self sufficient, debit free home owner. “take care of your family first, and sell your excess to your nearest neighbor”

I believe banking should be “simple savings and loans”. I believe that patent and intellectual property rites should be abolished, and education should be open learning favouring individual interest within ethical and moral standards.

This would allow more innovation, greater employment, and less disparity between rich and poor, ie; a happier more prosperous country.

The Keystone pipeline, or anything like it, is INSANE. What sense does it make to pump oil (via pipeline) all the way down to the Gulf of Mexico, where the refineries are not only old & in need of constant repair (100% capacity is actually about 86% because there’s always maintenance work going on), they have to shut down every time there’s the threat of a hurricane in the Gulf. When you could BUILD new refineries where the oil is? Last I looked, southern Canada, North & South Dakota & Wyoming don’t ever have hurricanes & refining technology has improved so much that new facilities would be VASTLY superior to the old ones near the Gulf of Mexico. A pipeline from the Canadian oil fields to new refineries in the northern States like North Dakota would make sense, but not all the way down to the Gulf, or even Cushing, Oklahoma.

Keystone gives Canada a pipeline to refineries that have access to the Gulf. Couple that with the Panama Canal project to allow larger ships through and you have access to markets around the world from a single location. The Gulf is the ultimate central distribution hub.

What is the reason that no one, other than Ivanhoe Energy itself, is using their HTL procedure to convert Canadian Oil Sands and bitumen to a state roughly equivalent to WTI? The process is supposedly energy producing and does not require diluents for sending through pipelines. I was invested in IVAN, but, sold my shares, after many years of waiting.

Likely because of the geology; what works in certain places might not work elsewhere. It’s like drilling wells in the oil sands.

CANADA SHOULD BUILD MORE OIL PROCESSING PLANTS PERIOD-ITS CRAZY NOT TO.

Superb piece of finance journalism.

There are multiple refineries in Alberta. Suncor, Syncrude, CNRL, Shell and several others refine this oil within the province. Why are Albertans still paying so much for gas?

I believe its as Ivan said in this article: It’s all about profits. All of these refineries belong to public companies. They refine their own oil.

Shareholders want to see profits rise. Why would these companies sell oil to Albertans for cheaper? People in Alberta already get a significant discount to the rest of Canada as a result of the tax break.

Imprudent planning is the main cause for not having enough refineries. If Canada wants to be an exporter as well as self sufficient it needs refineries, pipelines and ports to handle exports. We should not rely on the United States for those services they have their own priorities and Canada is not one of them. Oil refineries were shut down in the Montreal region years ago, I suppose other regions have experienced the same. Lets get Canada energy self sufficient and build what is missing.

I cannot emphasize how much I am for petroleum pipelines. “Oil by pipe” is much, much safer than “oil by rail” and more economical than the present “truck oil to rail tankers and then back to truck” to refinery.

Alberta has suffered deaths, endangerment to lives and property, contamination of lakes and ground water, and evacuations due to train derailments. Another “Lac-Megantic” disaster in Canada and/or the U.S.is inevitable. High volume transport of oil by rail must be stopped and pipelines built as soon as possible.

We will all be dependent upon oil for 30+ years. It is so unfortunate that there are those people (especially from Hollywood)that cannot be realistic and realize this. As much as we would like to be “green”, alternate practical energy for affordable vehicles for the “John Does” just isn’t here and won’t be here for a long time.

you have covered much more than just the price if oil and gas. On refineries, if it is so lucrative to refine, where are the companies and businessmen to take this opportunity? Or is there more to it?

Political situations USA/RUSSIA/CHINA etc are worrisome and appear inevitable. Has Canada taken precautions?

Extremely high taxes at the three levels of Canadian government Federal, Provincial and Municipal are the main reason for unreasonable gasoline prices in Canada.

Very Comprehensive Analysis. The truth is Canadians always pay more. Sanctioned by our government? (government defined = politicians who are elected by the people, then their focus turns to their own personal future, their best future will most likely keep Canadian power / rich elite happy and not us – i.e. eventually most politician’s will work for a major Canadian company which are 55% owned by some 20 odd families per Paul Hellier’s book some 20 yrs ago, per public records).

Some 55 years ago, gas was 25% cheaper in Buffalo NY than Ontario, still is. Why wouldn’t Canada by now have enough refineries? Would Irving Oil be powerful enough to block competition? Have the backing of Politicians? I don’t know. I think it ridiculous to think Canada does not have enough refineries without it being ON PURPOSE! … Ron K.

Refineries. Hmm. Why don’t we build and operate our own. Seems like a no brainer to me. If we are paying such high shipping costs both to and from U.S. refineries, doesn’t it make sense for us to produce our own fuels, hire our own people and keep it in Canada. The Americans don’t give a s–t about us not for one minute so why do we think they do by allowing them to HELP us out an produce our oils. Obama recently put a stop on the pipeline addition. There is a reason for that. He doesn’t need our oil anymore. Harper, throw some money into our own country for once.

I’d love to see the petro dollar demolished. I think it’s appropriate that the cultural and economic identity of Ukraine with Russia be maintained. The U S needs to realize their greed is not always in someone else’s best interest. The psychos in power won’t be satisfied till they spill blood on another useless exercise in their goal to dominate the world. Russia, China and Iran will be a formidable foe but the U S can’t see beyond profit and control.

Petro Dollar in the USA? I think not, a very few benefit from oil, exactly like in Canada. However, most of the Trillions and trillions of dollars have gone to the Middle East. Why do you think most of the Emirates and Arab “royality” i.e. 90% of everyone does not work at all. Min. moron there gets around $60K a year stipend and 99% of “workers” are foreign. THAT is what and where “Petro” dollars are. Plus a very few in North America. OK now I am bored also with our Canadian stupidity and acceptance of our leaders who are nothing but snivelling arrogant thieves. e.g. Brian Mulrooney is not in jail, but even his butler testified how he and they did many midnight deposits of CASH to their bank accounts and it took Brian 7 yrs to admit / file those monies to CRA – pefect example of Canadian apathy. At least the USA (misguided admittedly) puffs up and makes some noice in the world re injustice. Oh well….have a good one, fill up and support more stupidity.

If there are 60 mothballed refineries in Texas, why not just buy a few and move them to Canada? Gotta be cheaper than $7b. Hey Ivan, great idea, no? Can you get something started for us to invest in? TIA.

I think you may be wrong with the US import of gasoline contention – Canada makes all its gasoline internally, not re-imported from the US. All this is from a quick internet search so it must be correct! Canada’s current refinery inlet capacity is 2,135,000 bbl/day excuding that of upgraders that need further refining. https://en.wikipedia.org/wiki/List_of_oil_refineries#Canada

Canada’s refineries average 35.7% gasoline from inlet so 762,000 bbl/day of gasoline is produced. Lost that link which was specific to Canada’s current heavier crude mix but this one gives a generic product range http://wiki.answers.com/Q/How_much_gasoline_can_be_made_from_one_barrel_of_crude_oilDisregarding diesel for the moment. Stats Canada’s last data says total Canada gasoline consumption for 2012 as 40,444,101 m3 or 695,000 bbl/day. http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/trade37c-eng.htm

Assuming imports/exports net out then Canada has more than enough internal refining capacity to produce our internal gasoline demands. Supply/market locations may mess this up a bit but should net out.

Willing to pay more for gas if it means less pollution. Not sure how much pollution would occur pipeline vs other transport, but I’m sure the oil would pollute sensitive areas in the wild with a pipeline. More concerned with Monsanto’s threat to the planet than oil and gas.

Art

people complain about the cost fuel and other products and then say “what does it matter what l say”? of nobody speaks up, it will never matter and so we must speak our minds and maybe it might have some effect. we pay far too much for gas because those in control can show an excu7se as to why the prices are up there. what excuse can they give for the price rising 6-7 cents on wed. or thur. every week and dropping back a few cents on mon. only to rise again on wed.-thur. this is totally unacceptable but we can do so little abou8t it. government has to step in but they will not. it’s all about the dollar. PLEASE,PLEASE help me out here people. we must stand together.

Sin1 = using clean easy-to-tranport natgas to ‘create’ dirty hard-to-transport tar-oil.

Sin2 – Thou shalt not label things dishonestly. The stuff is tarsands (solid at room temperature) not oilsands (liquid at room temperature). The fact that tar is a less nice word than oil is irrelevant. Call things (like dishonest HEALTHCARE) by wrong words and you end up making bad decisions (hospital is honest even if ‘old fashioned’ and better describes what we actually have). The sales pitch sells a rocky siren song. At least Ulysses had the sense to tie himself to the mast and plug his comrades ears.

Canadians are so tangled up with FREE Trade agreements that even if we wish to change the economics of the Land we will have plenty of opposition from the US mainly. we are a country so plentiful. Why are we feeding on the crumbs that fall off the table instead of eating a full meal. We have capability of being self-sufficient in every means.

Why we are being imposed on economics that have little benefits to the population and mainly serve the ego side of elite’s. WE KEEP PLAYING THeIR GAME..We could be working 4-5 days week and still have a lot more, and take the extra days in educating and evolving ourselves. Instead of being strangled daily with the burden of debt.

WHY POLITICIANS DON’T DARE TO EVEN GO THERE. either they don’t know HOW TO accomplish this or are to comfortable in the STATUS QUO of the CORPORATION..most likely the latter..

we should build our own Canadian refineries and learn to discover alternatives to make it cheaper.Then we can have cheaper then now gasoline prices and enter into a non-free trading agreements with other countries.

THE USA HAS OIL . Foreign policies dictate for the survival of their own and to be the LAST MAN STANDING, they will extract everything and anything from others. Foreign policies are mostly implemented by the “US” and not the “USA”

Its time to crumble these so called corporations and let the people free, its 2014//////

What I see happening is a beginning of how economics are to be. Sooner than later war will be again which will have an opposite affect who what US intended.( Energy of Mass Destruction )

The Standard US dollar currency may vanish sooner than anticipated as good number of countries are already implementing ways to avoid the Standard US $ currency.

Canadians with a much better overall economics have to loose about 10% of the difference of US $.

Don’t make sense to me . Why not equal to the US $ due to the imports etc.???

The whole economic mandate as of now soon will be of the past.

Good buy Kings and Queens and Popes and the rest of the other 3%..

There are better ways and more peaceful ways that intelligent humanity can dwell and enjoy, this passage of life

I support the Northern Gateway pipeline, but not Keystone XL. If the Keystone pipeline goes through, it will have the same result as with every other export we send to the U.S. They will dictate the price and Canada won’t get fair market value for our oil. The U.S. will simply close the valve and Canadian producers will have to bow down to the U.S. We need a pipeline to other international markets, that is why I think the Northern Gateway is best. I just wish the people that are causing all the delays, would think more about having their hand out for money from the government, and remember where it comes from. Something has to supply the money they receive! Taxpayers alone can not continue to afford that bill. The environment is important, and there are regulations to ensure things will be done properly. Stop with the protests, and listening to idiots like Neil Young, and start thinking about what this country needs. Yes, we need to move away from oil, but it takes money and time. Until something better is found, we are stuck with what we have, let’s just do it right, and do it soon. This will provide the money it takes to develop something else.

In Leyland Lancashire England £5.72 pence = c$3.50 cents roughly not sure about exchange rate.

Hmm it seems like your blog ate my first comment (it was

extremely long) so I guess I’ll just sum it up what I

submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to everything.

Do you have any tips and hints for rookie blog writers?

I’d certainly appreciate it.

All you say is true and said well. In addition, the Fed and many other countries print money which is nothing but counterfeiting so the buying power of the dollar is so much less. In addition, Canada has a choice whether or not to use the petro dollar. The Canadian government chooses to do so which is counter productive for it’s citizenry.

The U S has it’s tits in a wringer over Russia, the petro dollar will soon be history as Russia and China and so many others eventually eliminate it. American greed has no limit and I will be ecstatic to see it all fall apart. They take what they want no matter where it is and slaughter any who get in the way.

The most depressing book I ever read is “The Tyranny of Oil”. It goes back to the beginning and tells the story of the Rothchilds who owned Standard oil. He/they are zionist jews and this 2% of the U S population run everything from the Fed, media, lobby groups supreme court etc. etc.. The money changers of old are with us today and will eventually destroy what is left of this country if the other 98% of the population do not rise up to make the changes necessary.

It boggles my mind that most of the mindless masses are instead, glued to the TV, cell phones or looking for hand outs from the government while the psychopaths in power continue their relentless theft for control..

good comments all. How about going next step, at least with your voting. Stop voting for the same old system (Libs, PC, NDP/Green). Check out independent candidates/ new parties or start something in your area. Things gotta change.

Doesn’t matter who gets in; they are all the same; just look at the past. Power does strange things to people.

Understand your cynicism but there are answers, ya know. Hava look at my latest post (bobgreeninnes.net) and then DO something instead of giving yourself excuses to become part of the problem. Please.

calories in carton of strawberries

after reading about the cost of fuel in other parts of the world, we are a lot less but we also have more than we can use and export a lot of it, so there is no excuse for our high costs. it boils down to the greed of the producers and also the governments of our country. l guess the companies say “sell to the highest bidder” and to hell with the people who work for them and all the people who end up backing them. same old story—it’s all about the dollar. fuel will never be cheap unless there ends up being an alternative source such as sun power, hydrogen, water, oxygen, etc. of course, then the inventor will be bought out by big business or even “disappear” or be stopped by the governments. we do not really pay a lot more for gas. the dollar keeps getting devalued. what a neat way for all of us to be deceived. if an honest person gets into power, it seems they are soon corrupted. it is a lose, lose situation. about all we can do is try to make the best of it.

We stumbled over here by a different website and thought I may as well check

things out. I like what I see so i am just following you.

Look forward to exploring your web page for a second time.

l think we are getting “hosed” by the oil companies and there is damn little we can do about it because the government wants all they can get from us also. if our provinces were run like they run Alaska, we would have no debt, pay very little taxes, and get a monthly check from our government as a rebate. we, like Alaska, have more natural resources to be self sufficient but instead we export most of them and then buy back the refined products (at an exorbitant price)after being told we do not have the facilities in Canada to do this. meanwhile, the liberals just finished scrapping the funds for building a new refinery in Ontario, costing us taxpayers a loss of over a billion dollars AND THEN HAVE THE NERVE TO SAY THAT ‘IT IS WATER UNDER THE BRIDGE’ AND TIME TO MOVE ON. talk about nerve of our politicians. maybe someday there will be a change. unfortunately, not in my time. s.romanko

minecraft wiki

best protein powder and supplements are usually marketed as nutritional supplements.

There a wide range of types and brands of protein supplements around, but you can be sure that the Dymatize Iso 100 can be a safe bet.

Protein powder blueberry muffins This could be the protein to possess

before bed being a snack or part of your main meal.

The Palladio natural rice powder is normally found inside

a few colors, which are natural, warm beige, nude and translucent.

Protein drinks are perfect for athletes who require instant nourishment right after the exercise.

Nice post. I learn something new and challenging on websites I stumbleupon everyday.

It will always be interesting to read content from

other writers and use something from their websites.