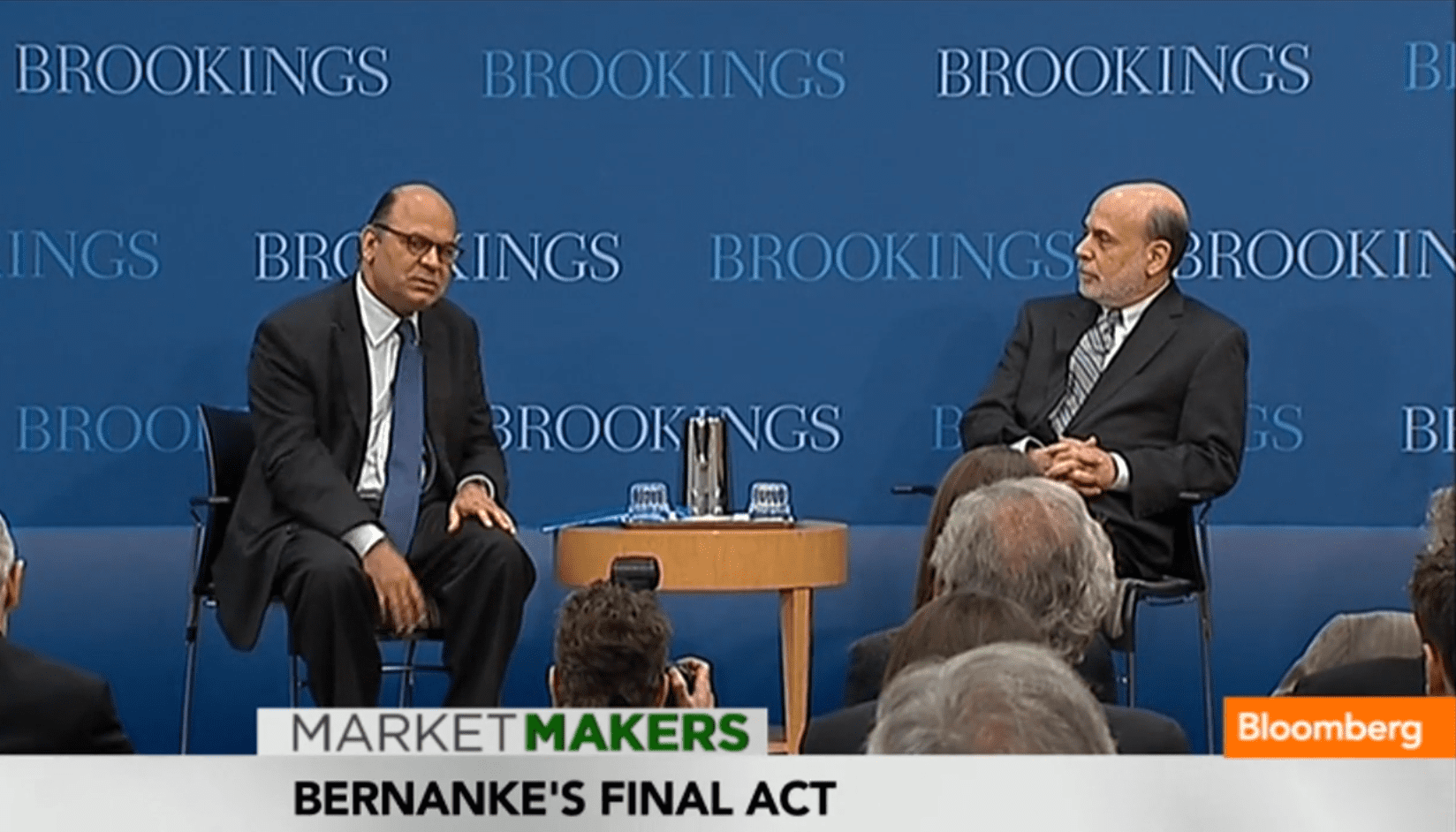

No one is sure where our market is going. Not even Federal Reserve Chairman Ben Bernanke.

This Friday, Bernanke gave a small boost to the market by vowing to do whatever it takes to revive the shaky economy. He reassured Wall Street that the central bank will act if “unexpected developments” cause the recovery to falter. This brought the Dow back above 10,000.

You can find the full speech by clicking HERE.

Bernanke confirmed again that the deep economic contraction had ended, and that we are seeing broad stabilization in global economic activity and the beginnings of a recovery.

Although the markets took a sigh of relief, albeit a very small sigh, this isn’t the first time Bernanke has made reassuring statements about the economy. So while he sees no double dip, let’s not forget that he also didn’t see a housing bubble before it popped.

But we can’t blame him. We have to remember that his words play an extremely powerful role in the reactions of the market. If his talks are overly negative and pessimistic, his words alone have the ability to cause another economic collapse. And no one wants that.

So let’s cut the guy some slack. Bernanke is a genius. While we can all talk about how to make things better, let’s be real. The majority of us are not as smart as he is (this guy scored 1590 out of 1600 on his SAT.) Despite his smarts, being the Federal Reserve Chairman is not an easy task. He has to find a way to tell the truth, without telling the truth.

But the truth is simple: We are still very close and playing a very tough balancing act to another market downturn.

The Double Take

Just days before Bernanke’s speech, gold climbed once again while our favourite precious metal, silver, ended the week climbing over 5%. But what’s interesting is the fact that gold started to retreat after Bernanke’ s statement about the economy.

Investors’ perception of gold relies heavily on the economic outlook of the US. While, for the most part, a strong economy should mean that gold prices should falter, that may no longer be the case.

We are in a completely different world now.

Gold and precious metals, such as silver, have been a safe haven for investors during times of economic uncertainty. It has been a preserver of wealth for thousands of years. But wealth is about how much money someone has. It’s about how much Dollar, Yuan, Euro, or Rupees you own. Ultimately, it’s about how much it’s all worth.

So even if a slow recovery has begun, as Bernanke has mentioned, that doesn’t mean gold should fall and the Dollar should rise. Even if the US Dollar eventually strengthens, it should only strengthen amongst other currencies (see the Human Metal).

You see, the US still has a lot of debt. More than it ever has. Just take a look at the rising US debt by keeping track of the US Debt Clock like we have over the past year (see the Human Metal, Another Shot at Glory, and It’s Bigger Than Ever)

With that kind of debt, gold should have an even stronger place in preserving wealth. Even if the economy roars over the next five years, the US will still be busy paying back the trillions of dollars they borrowed from the Fed and from countries around the world.

That’s why gold, and other precious metals, shouldn’t really fall that sharply on strong US economic numbers. Not this soon into the so-called “recovery” anyway.

In fact, if you look into Bernanke’s recent statement, he insured that:

“Regardless of the risks of deflation, the FOMC (Federal Open Market Committee) will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally.”

In short, Bernanke said that the central banks will act if “unexpected developments” cause the recovery to falter. That means the spending of even more dollars. More borrowed dollars, that is.

Either way, we are confident that the US economy is being held together through generous spending of borrowed money. So if we don’t go into a double dip, its more than likely that this spending of borrowed money played a big role in preventing another downturn.

At the pace interest accrues on these trillion dollar loans, precious metals should move even higher when pegged against the US Dollar.

Now, if we do go into a double-dip, we already know that means precious metals will continue to climb. So either way, there is strong evidence to support that precious metals will continue their run, regardless of the economic outlook.

So the next time your parent’s tell you that money doesn’t grow on trees, you can tell them they’re wrong. The US does it everyday…

Until next time,

Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies.Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Equedia.com has been compensated to perform research on specific companies and therefore information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received. Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid six thousand four hundred and thirty Canadian dollars plus gst/hst per month for 7 months which totals forty five thousand dollars plus gst/hst of advertisement coverage on Minco Silver Corporation. The company (Minco Silver Corporation) has paid for this service. Equedia.com currently owns shares of Minco Silver Corporation and may purchase shares without notice. We intend to sell every share we own for our own profit. We may sell shares in Minco Silver Corporation without notice to our subscribers. Equedia Network Corporation is a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.