More Stunning Results: MAG Silver

Over the past few years, I have made some pretty bold calls regarding the price of gold and silver.

I am about to make another call: Gold and silver are about to break out. Gold is headed back above $1800 and silver back near $40 very soon – I am talking as early as the next few weeks.

Once gold breaks $1800, it will easily meet its old highs. While shorters may try and force gold down, it has strong support at $1715. Silver is back above its 65-week moving average, staying strong above $34.

Every week, I emphasize that there will be a continual need for more liquidity in the financial system. The euro needs to be stablized and many countries around the world will need new cash to pay their bills.

The latest Greek rescue package (yes, another one) is another prime example of newly printed money going to waste to service the debt of old printed money.

A recent Bloomberg article tells us that the Euro-area banks may tap the European Central Bank next week for $470 billion euros of three-year cash – that’s almost as much as they did in December and it’s been less than a few months. Last week, I already showed you how many of the central banks around the world have been unloading a massive wave of liquidity right under our noses.

This recent massive wave of liquidity is just the beginning. If you delve deeper into the way the world’s financial system works, you will see that the amount of leverage through derivatives and paper trading are at astronomical levels. You will see that more value of this trading exists than the world’s overall GDP combined – by more than 10 times. You will see there is not enough money to keep things moving forward and not enough money to pay the bills. You will see that the tools required by the governments to prevent financial collapse, are the same tools that are digging us deeper into a hole.

Soon big funds around the world will begin to allocate a bigger portion of their holdings into gold and related investments as a result of fear; fear of diluting their weatlh and fear of the tools used by the governments to prevent a total collapse of the world’s financial system.

As a result, not only will gold and silver climb higher, but many of the gold and silver stocks are about to as well – in particular, the juniors.

For example, MAG Silver (TSX: MAG)(NYSE.A: MVG), a company I just wrote up on Feb 12, 2012 is already up nearly 20%. It looks like some strong players are buying up the stock in anticipation of their upcoming PEA on Juanicipio.

For those who haven’t read the report, you can find it here: The Most Important Silver Project in the World

The report sums up many of the reasons why I invested in MAG. But I am about to show you some more reasons why MAG is one of my favourite stocks right now.

I won’t get into specifics – I’ll just let the numbers speak for themselves.

Take a look at some of these past monster drill holes:

Hole 16: 1,798 grams per tonne Silver (57.8 ounces), 2.91 grams per tonne Gold, 3.43% Lead and 5.51% Zinc over 6.35 metres.

This includes 2.95 metres (9.6 feet) of 2,807 grams per tonne Silver (90.3 ounces), 3.27 grams per tonne Gold, 5.94% Lead and 9.14% Zinc and a significant gold zone returning 1.80 metres (5.9 feet) averaging 9.24 grams per tonne Gold, 1,222 grams per tonne silver (39.3 ounces), 2.16 % Lead and 3.15% Zinc.

Hole 02: 2,358 grams per tonne silver (75.8 ounces per ton) over 1.70 meters .

Hole 17: 1,347 grams silver and 0.50 grams gold over 8.05 metres.

Hole GC: 1,634 grams per tonne (g/t) silver (47.7 ounces per ton), 0.52 g/t gold, 3.02% lead and 4.75% zinc over 6.45 metres.

Hole GD: 1,343 g/t silver, 3.76 g/t gold, 7.73% lead and 5.73% zinc over 21.25 metres.

Hole GA: 562 grams per tonne (g/t) silver (16.4 ounces per ton), 0.55 g/t gold, 0.80% lead and 1.92% zinc over 7.35 metres.

This includes a 3.0 metre section grading 1,048 g/t (30.6 opt) silver, 1.18 g/t gold, 1.75% lead and 2.23% zinc.

Hole HE: 10,000 + grams per tonne (g/t) (291 ounces per ton) silver, 9.69 g/t gold, 0.13% lead and 0.23% zinc over 0.21 metres (true width).

The lower vein reported 624 g/t (18.2 opt) silver, 0.27 g/t gold, 1.69% lead and 0.33% zinc over 1.40 metres (true width)

Hole GE: 123 g/t (3.6 opt) silver, 4.89 g/t gold, 1.24% lead and 4.92% zinc over 7.38 metres.

This includes a higher grade intercept of 166 g/t (4.8 opt) silver, 5.89 g/t gold, 1.42% lead and 6.42% zinc over 3.0 metres. The lower silver rich vein has returned 1,179 g/t (34.4 opt) silver, 1.98 g/t gold, 3.01% lead and 2.21% zinc over 4.71 metres.

This also includes a high grade gold and silver intercept of 6,310 g/t (183.9 opt) silver, 10.05 g/t gold, 7.63% lead and 5.23% zinc over 1.0 metres.

Hole QE: 1,198 g/t (34.9 opt) silver, 0.24 g/t gold, 2.75% lead and 5.15% zinc over 4.70 metres. This includes a higher grade intercept of 1,820 g/t (53.1 opt) silver, 0.16 g/t gold, 4.01% lead and 6.74% zinc over 2.82 metres.

Hole JI-08-LE2: 1,068 grams per tonne (g/t) (31.1 ounces per ton) silver, 1.25 g/t gold, 0.69% lead and 3.53% zinc over 10.2 metres.

This includes an internal high grade gold and silver zone with a true width of 3.06 metres running 2,268 g/t (66.1 opt) silver, 2.27 g/t gold, 0.97% lead and 4.19% zinc.

Hole JC: 828 g/t (24.1 ounces per ton (opt)) silver, 17.12 g/t gold, 1.13% lead and 1.87% zinc over 2.71 metres.

The Footwall vein was also intersected with good silver values and reported 677 g/t (19.7 opt) silver and 0.44 g/t gold, 1.23% lead and 5.34% zinc over a true width of 3.03 metres.

Hole ND: 1,052 g/t (30.7 opt) silver, 0.63 g/t gold, 3.68% lead and 6.86% zinc over 5.11 metres.

This includes a higher grade section of 1,324 g/t (38.6 opt) silver, 0.64 g/t gold, 3.11% lead and 8.16% zinc over 3.21 metres.

Hole IE: 1,843 grams per tonne silver (53.75 ounces per ton), 4.43 grams per tonne gold, 3.54% lead and 5.96% zinc over 5.30 metres.

This includes a 3.10 metre section of 3,045 grams per tonne silver (88.81 ounces per ton), 7.44 grams per tonne gold, 5.89% lead and 9.84% zinc.

Not enough? Take a look at these tables:

|

| click to enlarge |

|

| click to enlarge |

|

| click to enlarge |

|

| click to enlarge |

|

| click to enlarge |

If you’re into gold and silver stocks, you’re probably already drooling over the numbers I just showed you – including the 0.60 of more than 10,000 g/t of silver and 9.69 g/t gold shown in the above chart.

If you’re a silver bug, you’re probably calling the guys over at MAG right now.

Strong drill holes are not uncommon amongst explorers. But multiple strong drill holes – especially above 1000 g/t silver are extremely rare. In the case of MAG, these constant hgih grade results, year-over-year, translate into something really special.

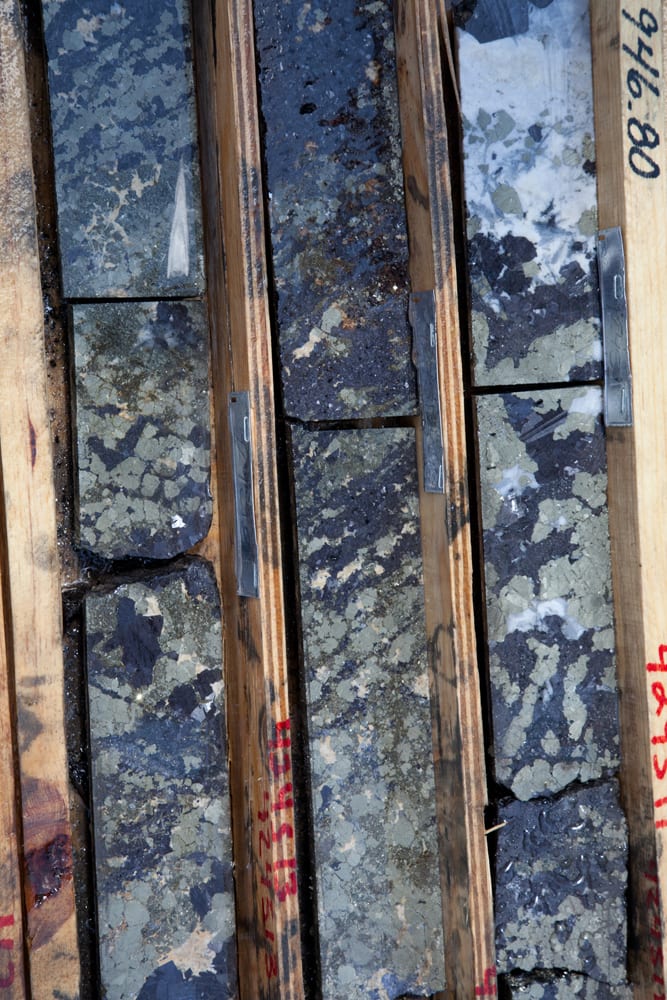

It’s no wonder why every geologist I speak with (and I speak with many world renowned geologists), say MAG’s results and cores are among the best they have ever seen – if not, the best.

As it stands, MAG is already undervalued.

The Juanicipio project boasts an incredible indicated resource of 146 million ounces of silver grading 728 g/t, 384,000 ounces of gold grading 1.9 g/t, 267 million lbs of lead at 1.9%, and 539 million lbs of zinc at 3.9%. It has an inferred resource of 85 million ounces of silver grading 373 g/t, 370,000 ounces of gold grading 1.6 g/t, 267 million lbs of lead at 1.5%, and 539 million lbs of zinc at 2.6%

While the Juanicipio project is already one of the highest grade silver deposits on the planet, much of this deposit has yet to be further explored.

That means the exploration upside for one of the world’s highest grade silver deposits has yet to be unleashed.

With an increased exploration budget for this year at Juanicipo, along with MAG’s other significant high grade silver projects, I think there is a strong opportunity that MAG is going to continue with more amazing drill results based on what we have seen.

Next week will be the PDAC – one of the biggest mining conferences in the world. MAG will no doubt be one of the main attractions – silver or not – for many of the funds.

The miners and explorers are beginning to light up – get your shopping bags ready.

Until next week,

Ivan Lo

Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

Disclosure: We’re biased towards MAG Silver because they are an advertiser and we now own shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including MAG Silver. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. I am also long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies.

Until next week,

Ivan Lo

Equedia Weekly

Questions?

Call Us Toll Free: 1-888-EQUEDIA (378-3342)

Disclosure: We’re biased towards MAG Silver because they are an advertiser and we now own shares. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Reports, including MAG Silver. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. I am also long gold and silver through ETF’s and bullion, as well as long both major and junior gold and silver companies. Disclaimer and Disclosure

Disclaimer and Disclosure Equedia.com & Equedia Network Corporation bears no liability for losses and/or damages arising from the use of this newsletter or any third party content provided herein. Equedia.com is an online financial newsletter owned by Equedia Network Corporation. We are focused on researching small-cap and large-cap public companies. Our past performance does not guarantee future results. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. This material is not an offer to sell or a solicitation of an offer to buy any securities or commodities.

Furthermore, to keep our reports and newsletters FREE, from time to time we may publish paid advertisements from third parties and sponsored companies. We are also compensated to perform research on specific companies and often act as consultants to many of the companies mentioned in this letter and on our website at equedia.com. We also make direct investments into many of these companies and own shares and/or options in them. Therefore, information should not be construed as unbiased. Each contract varies in duration, services performed and compensation received.

Equedia.com is not responsible for any claims made by any of the mentioned companies or third party content providers. You should independently investigate and fully understand all risks before investing. We are not a registered broker-dealer or financial advisor. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report OR ON Equedia.com will be the full responsibility of the person authorizing such transaction.

Again, this process allows us to continue publishing high-quality investment ideas at no cost to you whatsoever. If you ever have any questions or concerns about our business or publications, we encourage you to contact us at the email or phone number below.

Please view our privacy policy and disclaimer to view our full disclosure at http://equedia.com/cms.php/terms. Our views and opinions regarding the companies within Equedia.com are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect. Equedia.com is paid editorial fees for its writing and the dissemination of material and the companies featured do not have to meet any specific financial criteria. The companies represented by Equedia.com are typically development-stage companies that pose a much higher risk to investors. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time. Statements included in this newsletter may contain forward looking statements, including the Company’s intentions, forecasts, plans or other matters that haven’t yet occurred. Such statements involve a number of risks and uncertainties. Further information on potential factors that may affect, delay or prevent such forward looking statements from coming to fruition can be found in their specific Financial reports. Equedia Network Corporation., owner of Equedia.com has been paid $5833.33 plus HST per month for 6 months which totals $35,000 plus hst of media coverage on MAG Silver Corp. MAG Silver Corp. has paid for this service. Equedia.com may purchase shares of MAG Silver without notice and intend to sell every share we purchase for our own profit. We may sell shares in MAG Silver Corp without notice to our subscribers.

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.