The Currency War Continues

Inflation vs Deflation & the Growing Currency Wars

Dear Readers,

It’s been over a year since my series of letters on the growing currency war.

But over the past few months, the topic has once again been brought back to light as central banks around the world continue to intervene on the global currency market.

My viewpoint has not changed and many things I talked about in those letters have played out as those letters described.

Which is why it is important to go back and review what has happened…because the war is heating up and it will affect you.

Let’s go back to my letter, America’s Gold Wiped Out:

“We’re at war. But not one that’s fought with guns and missiles; one that is fought with currency.

Currency wars are fought globally in all major financial centers by bankers, traders, politicians and automated systems – and the fate of the economies and their affected citizens hang in the balance.

A “currency war” is a fight between countries to achieve a lower exchange rate for their own currency. In other words, its competitive devaluation.

In short, the cheaper your currency, the more money you attract from foreign entities; this leads to increased exports, growth, and job creation.

…However, devaluation and currency wars never produce either the growth or the jobs that are promised, but they reliably produce inflation.”

From “Currency in a Financial War“:

“Currency is the heart of a nation; without it, it cannot survive. Its value is its Achilles heel. Collapse its value and everything goes with it.

Stocks, bonds, derivatives, and other investments are all linked through a complex network. If one sector is failing, another might be winning. For example, if stocks and bonds are failing, one could turn to commodities to pick up the pieces.

However, all of these investment vehicles are priced in a nation’s currency. Destroy the currency and you destroy all of the markets within the nation. Destroy the markets, and you destroy the nation.

That is why currency is the target in any financial war.”

Then in my letter from September 2012, “The Assassination: The Effects of US Money Printing on World Currencies“:

“In my first letter this year (2012), I said that QE3 for 2012 was inevitable:

“Hopeful numbers will come out of the US but the economic decay in 2012 will eventually accelerate enough to overshadow any signs of hope. In order to avoid an outright economic collapse, the governments of the world, in particular the US, will once again be forced to initiate massive amounts of Quantitative Easing (QE)” – January 8, 2012

The massive initiation has begun.

The Fed, like the ECB, just announced its own unlimited bond buying program; buying $40 billion a month of mortgage-backed securities bonds that would be open ended until labor conditions improve.

That means they’ll keep printing until things get better, and beyond.”

Fast-forward a year later, and where are we?

After years of injecting all kinds of stimulus, central banks continue to offer even more assurances of cheap money and asset purchases.

This has resulted in an inflated stock market; a market which should technically be an indicator of how well the economy is doing.

Instead, the stock market has become an indicator for the amount of money being put into the system and monetary policies by central banks around the world.

The “general” concept behind QE and stimulus measures by central banks is to inflate an economy into growth during times of distress.

If the headlines are correct and we are experiencing real growth as the stock market suggests, why would central banks need to continue their intervention?

The Truth About Central Bank Policy: Inflation vs Deflation

The reality is that central banks don’t need to intervene.

They want you to believe that we absolutely need inflation because the opposite – deflation – is a terrible thing. They want you to believe deflation represents a lack of economic growth.

But historically, deflation under normal circumstances has never been the cause of poor growth – as a matter of fact, it was quite the opposite.

Deflation occurred in the U.S. during most of the 19th century (the most important exception was during the Civil War).

But this deflation was caused by technological progress that created significant economic growth.

This was also a period before the establishment of the US Federal Reserve System’s role in active management of monetary matters.

So “they” may tell you that deflation is a very bad thing.

But what deflation really means is a lack of growth in “their” banking system.

The Fed is a bank. Its growth – like all banks – relies on lending.

If people stop borrowing, banks wouldn’t make money.

The more they lend, the bigger they become.

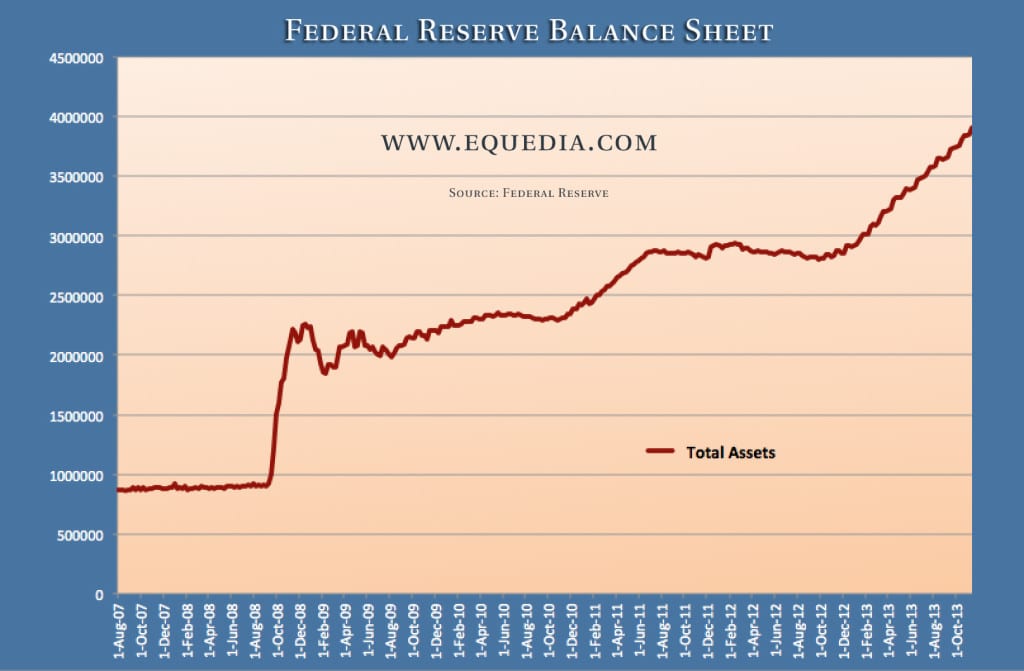

And the Fed has lent more money since 2007 than it ever has in its history.

Here’s a look:

Share Your Thoughts on the Fed by CLICKING HERE

What Inflation Means for the Fed

The Fed’s policy is to prevent inflation from falling too low.

What that really means is that their policy is to prevent the cost of living from…well…staying the same.

Inflation is good for those who are heavily indebted, but punishes those who have been financially responsible.

The scary part is that people have fallen for the “we need inflation”

mentality because they have been so heavily brainwashed by the media that inflation is a great thing and deflation is really bad

Inflation vs. Deflation

Inflation means prices for goods and services are rising, which means you have to pay more for something.

Deflation means the opposite, which means you pay less.

The less we pay, the less likely we need to borrow to pay for the things we buy.

We’re all bargain hunters. If we could buy a new iPad for $500 instead of $1000, we would.

So why then would we want inflation? Why would we want to pay more for something, when we can pay less?

Why wouldn’t we want deflation instead?

Deflation: Good or Bad?

If our society never fell into this debt crisis, we would want deflation.

But since our world has fallen for the idea of cheap money via the central bank system, deflation can be scary.

Deflation increases the real value of debt.

In other words, deflation makes it harder to pay back money that you have borrowed.

Let’s use housing as a simple example.

If housing prices drop by 10% (deflation), a homeowner with a large mortgage could see the real value of his debt rise by 10% because he now owes 10% more than what his home is worth (assuming he borrowed all the money for his house to keep the math simple.)

Since deflation means lower prices, which can eventually lead to wage declines, that same homeowner would now have a higher ratio of monthly mortgage payments to wage income.

Deflation would mean higher loan-to-value ratios for homeowners, leading to increased mortgage defaults (which we saw in 2007) and ultimately a crash in the banking system.

Banks need people to borrow to keep their system alive and they have done a great job of making everyone pay more for everything as a result.

The more expensive things get, the more we have to borrow – and that’s good for the banks.

Housing prices haven’t gone up because the real estate market is hot; they’ve gone up because credit has been cheap.

The next time you’re buying a condo in Vancouver for $1 million, or a condo in Toronto for $750k, don’t thank a great real estate market for that – thank the central banks.

Inflation vs. Deflation: What’s Better? CLICK HERE to Share Your Thoughts

Deflation: The Bigger Picture

Deflation causes a country’s debt-to-GDP ratio to rise.

As prices fall GDP is lowered, which then leads to a country’s inability to service its debt – the same debt accumulated as a result of easy money.

In other words, if deflation occurs, many countries could default…or print more money to prevent that from happening – which is exactly what the US is doing.

The central bankers’ blueprint is very simple: If they can make you believe that inflation is low, then they can print as much money as they want, further entangling the world in a central bank credit system.

While there have been talks of the Fed scaling back, the chances of QE stopping anytime soon is slim to none.

Here’s where the topic of currency wars come back into play.

The US has allowed the Fed to increase the monetary base and devalue the dollar for more than two years.

Ever since QE was initiated, they have told us they will slow it down – yet, the only thing they’ve done is increase the amount of QE.

As I mentioned before, as the world’s most powerful country prints, other countries have to do the same to keep up or risk a major decline in their economies.

Worldwide Competitive Devaluation

Countries all over the world have been cutting rates in the past years in

But the problem is that the scale eventually needs to be rebalanced to bring equilibrium back to society. When one country prints, another must follow suit or suffer the consequences of economic decline.

Over the past few months, countries all around the world are attempting this rebalancing act.

Last week, the Czech National Bank began to intervene in currency markets to weaken the koruna by selling its own currency, targeting a lower exchange rate as part of its battle to avoid deflation. The koruna fell by more than 4 per cent against the euro as a result.

But shortly after that, the ECB reduced the benchmark interest rate by a quarter point, bringing it to a record low of 0.25 per cent because of disinflation (slow down of inflation) fears. One more cut and money will be lent out for free.

For the first time in four years, Peru’s central bank also joined in the rate cuts on Nov. 4, because of slow export growth; once again, as a result of its currency being higher relative to the countries it exports to.

And despite the massive increase in job growth for New Zealand, its central bank has delayed expected rate hikes while Australia’s Reserve Bank chairman says its currency is overvalued and it may also be forced to cut rates.

Meanwhile, Japan has already been cutting rates and printing more money (relative to GDP) than any other country, but is still struggling to meet its inflation target of 2%.

As rates remain at record lows all over the world, more borrowing will take place, further engulfing every society into the central bank monetary system.

While a country can impose import duties, capital controls and other techniques to fight the currency war, the most “tolerated” act is to print and inflate.

At the end of the day, it ALL bodes well for the central banks as countries battle for a cheaper currency via direct currency manipulation.

Inflation vs. Stocks

As I mentioned many times before, if you’re worried about inflation, investing in stocks shouldn’t keep you up at night:

“The impact of inflation on your portfolio depends on the type of securities you hold. If you invest only in stocks, worrying about inflation shouldn’t keep you up at night. Over the long run, a company’s revenue and earnings should increase at the same pace as inflation. I think we’re already seeing that in our markets. As the money supply increases, so have the prices of everything else – including stocks.”

As a matter of fact, you should embrace it.

The Fastest Growing Stock Exchange in the World

Inflation in Venezuela has now surged above 50 percent as a result of massive government spending and currency controls by their government.

On the other hand, their stock market is up over 392 per cent on the year, and over 505 per cent over the last 52 weeks.

Stocks generally do very well during times of inflation because higher prices generally lead to higher price-earnings (PE) ratios.

The Fed tells us there’s no inflation but the stock charts and everything else tell us otherwise.

Here’s a look at the S&P 500 against its earnings growth since 1960:

Stocks have risen not only because of the massive amounts of money put into the financial system, but it has also climbed because of rising prices.

Since 2008, worldwide economies – including the US – have been struggling to regain their economic growth; jobs have been lost and many countries are on the verge of heading back into a recession.

Yet, corporate revenues are soaring? Welcome to inflationary cues.

The Next Step

Retail investors are starting to come back into the market (even though the market is at an all-time high.)

I sense that the euro could move back up in relation to the US dollar and would not be surprised to see the ECB step into the market next year using the same tactics as Japan and the US.

This could set off yet another wave of currency devaluation.

My prediction that the S&P 500 will reach 1800 before the year is over remains.

The Equedia Letter

Prices have gone up everywhere, from stamps to gas, to food. everything. How can they say there’s no inflation? Its all one big banking scam.

Prices are going up far faster than wages and that’s killing the economy.

deflation is clearly better if we lived before 1970. but since we are in a central bank system, we need a little inflation to keep us in check.

Its not ideal, but society has borrowed so much money that we cant go backwards. We’re stuck

Let the money rain! Don’t save! Spend! When you can’t spend anymore, borrow!

Thank you Fed for letting me spend far more than I could ever make.

Dear Ivan Lo

Were you at the recent Agora Symposium in Vancouver where this was laid out almost word for word – a friend let me listen to his set of audio CD from this conf.

this set of facts was presented so clearly on the Agora Symposium CD that for the first time in my life i actually understood what the heck is going on —

regards

Who really gives a hoot over what happens to the S & P 500. The ted is not the only liar in the ball game. Those “expert” who claim that an INDEX of AMERICAN stocks is of vital importance to investers must join the ranks of those who can be believed at one’s peril.

bobi

Thank you for this easy to read, rather thorough summary.

I’ve shared it with my children wo need to “listen up!”. In my view I choose deflation BECAUSE I believe it will be the only way we can buy time to save the planet. Too many people view money as something that is just THERE – like water and oxygen. I believe that deflation is the only way we can slow down enough for people to learn what they need to start putting the horse back in front of the cart, the planet before the economy.

This is so true Brian. Kids these days want everything given to them. Entitlements are overblown and every one votes for the guy who will give them the easy way out.

Let businesses grow

Thomas Jefferson said in 1802:

“I believe that banking institutions are more

dangerous to our liberties than standing armies.

If the American people ever allow private banks

to control the issue of their currency, first by

inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property – until their children wake-up homeless on

the continent their fathers conquered.”

Speaking of investing in stocks, how are you feeling about Balmoral and Uranerz? Still confident in their future?

Please let me know if you’re looking for a content writer for your current weblog. You have some really good posts and I’m I would be a good tool. If a person ever desire to take a few of the load away, I’d like to write a few material for the blog in exchange for a link back for you to mine. Please blast me an e-mail in case interested. Thanks!

Don’t we need inflation in any economy for there to be spending?

One of the reasons against Bitcoin functioning well as an economy is its high appreciation rates.

With an appreciating currency, people would have higher purchasing power but would rather save then spend or invest. Lower spending and investment results in fewer jobs being created and lower GDP on a perpetual basis.

For the modern economic system to operate, there needs to be a healthy amount of inflation.

as a currency*

Abdul: that is exactly what they want you to believe. Think about it from a simper perspective. Lets say the new PS4 costs $500, people either save up to buy it or they go on credit. if they go on credit, more people can easily buy and sony can charge more and more knowing this. However, if they save up to buy it, no one is buying or spending. Credit makes purchasing expensive things easy.

But lets say the pS4 drops there price to $250. Then everyone rushes to buy it and no one needs credit because its cheaper. Deflation actually creates more spending, but less borrowing. and banks can’t have that because then they don’t make interest.

We have to start looking from the simple concepts. If things are cheap, people buy and don’t need to borrow. Just like Ivan said, deflation in the early 19th century caused strong economic growth because things were cheaper.

It is not my first time to visit this site, i

am visiting this website dailly and get good data from here every day.

Seriously, I like this post! I read your blog

fairly often and you’re always coming out with some Amazing stuff.

I share this on my social media and followers loved it!

Keep up the good work 😀